Choice Hotels, a U.S.-based franchisor, said on Tuesday it had opened an average of more than four hotels a week in the first half of 2023 — a 39% jump year-over-year. The steady onboarding of properties was one reason it reaffirmed its profit forecast for the year despite some industry concerns about leisure demand patterns in the U.S. going into reverse.

Choice Hotels opened 107 hotels in the first half of the year, with an increase in conversion hotel openings of 45% and a rise in new construction hotel openings of 24%. The gains were impressive in a hotel sector where interest rate uncertainty had raised concerns about the willingness of banks to endorse hotel development.

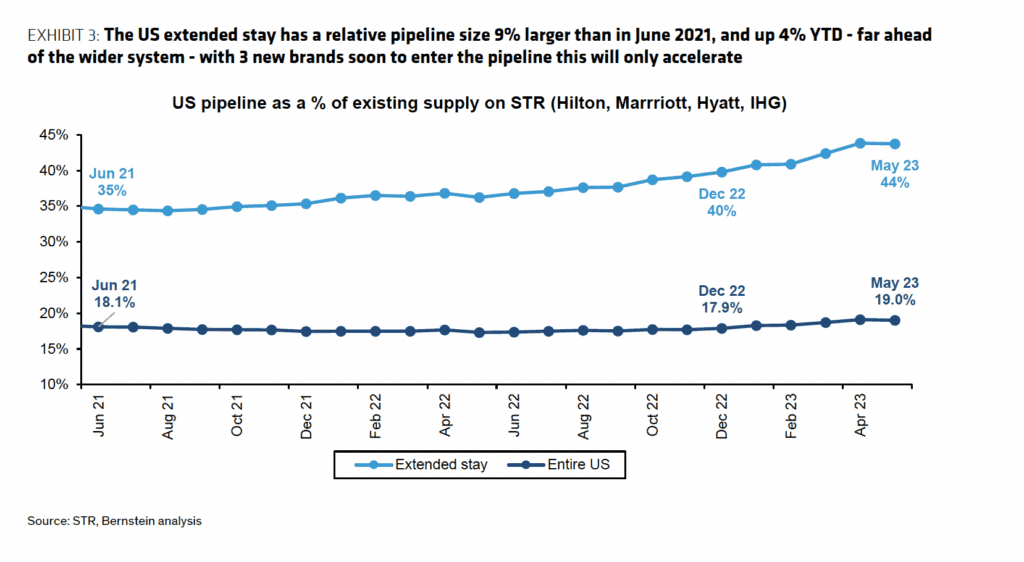

The first-half openings growth was across all segments. Openings in the upscale segment were by 83%, the midscale segment by 42%, the extended stay segment by 50%, and the economy segment by 11%.

“The company remains optimistic about extended stay franchise business growth and expects the number of its extended stay units to increase at an average annual growth rate of more than 15% over the next five years,” it said in a statement.

The positive news helped the company re-commit to its previously provided financial guidance for full-year 2023, where it forecasts net income — a measure of profit — of between $255 and $265 million.

The news is positive at a time when analysts have become more cautious about the hotel sector. For more context, see “Analysts Pare Back Enthusiasm for Hotel Companies.”

Investors closely watch trends in another metric, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). The news on that front was also positive relative to its peers.

“In 2024, Choice Hotels expects to generate more than 10% adjusted EBITDA growth at the midpoint, year-over-year, driven by approximately $20 million in incremental contribution from [the merger with] Radisson Hotels Americas as well as organic growth in more revenue intense segments and markets, strong effective royalty rate growth, and other factors.”

For more, see “Choice Hotels’ Brands, Explained.”

These are the most relevant articles I found:

Morgan Stanley Flags Headwinds for Hotel Companies – 06/30/2023

Choice Hotels Explores Buying Wyndham: Report – 05/23/2023

The Wyndham-Choice Merger Skeptics – 05/25/2023