News this week that Marriott will make resort fees more fully transparent upfront in the search results of its website and mobile app drew focus once again to the topic of resort fees. Yet research analysts at Truist suggest U.S. hotel groups haven’t expanded the practice since 2019.

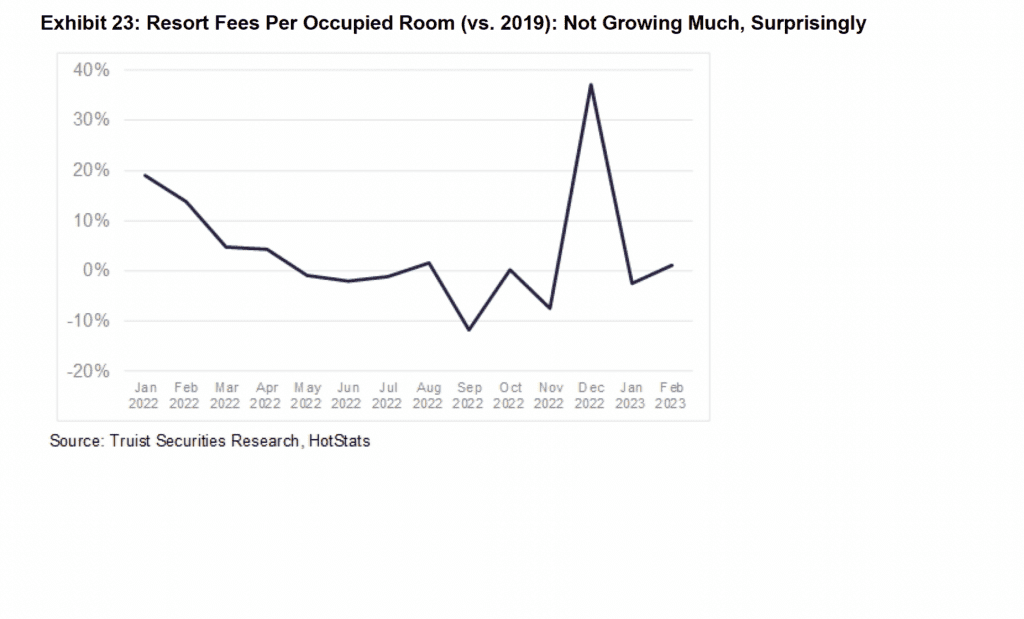

“We see no clear evidence that the actual resort fees/guest have grown materially since 2019,” wrote analysts Greg Miller and Patrick Scholes in a report. “Frankly, this was very surprising to us.”

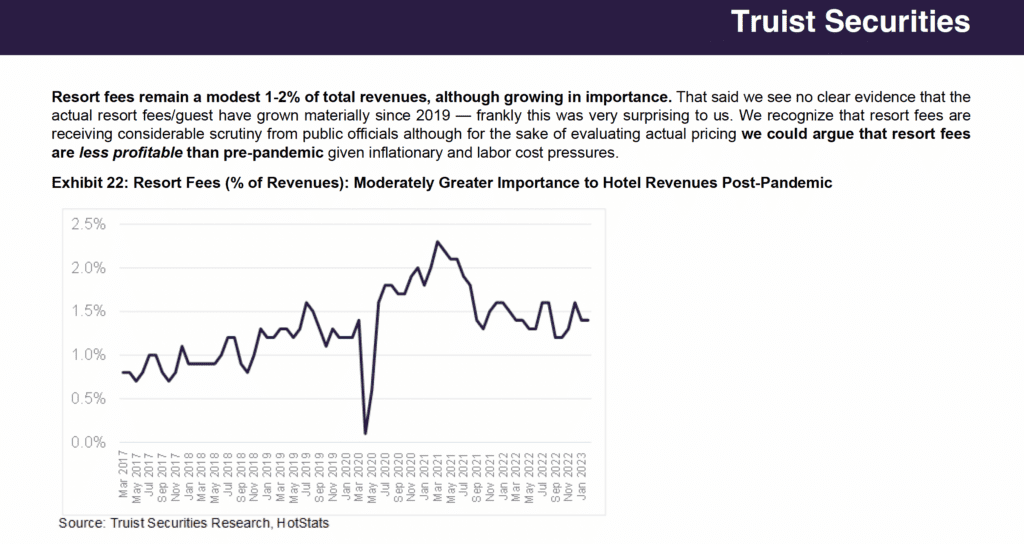

The analysts estimate that resort fees remain “a modest” amount of total revenues, between 1 and 2 percent, based on data from HotStats, a benchmarking service.

One possible reason may be that resort fees may have become “less profitable than pre-pandemic given inflationary and labor cost pressures,” the analysts speculated.

Marriott is the first of the global hotel groups to boost pricing transparency. It alone made at least $206 million off the practice just from its self-managed resorts since 2012, according to depositions from the Washington, D.C., Attorney General’s ongoing lawsuit, which Skift reported on. But all of the major hotel groups engage in the practice.

So-called “drip pricing” continues to be a popular sales technique in travel, where a seller gets a consumer psychologically invested in an offering and then adds little additional costs without prompting the buyer to abandon the purchase.

Yet many consumers seem to take it in stride. One study found that guests dropped their online ratings by only a small percentage after they encountered fee surprises yet booked anyway.

Gary Leff's One Mile at a Time blog was the first to report on Marriott's changed policy.Tags: future of lodging, Marriott International, news blog, resort fees, truist