Download a high-resolution PDF version of the Short-Term Rental Top 250.

Skift Research launched a seminal report on the short-term rental ecosystem back in 2019. The report was well received, and we have seen, and heard of, many cases where the industry has used our industry framework and Top 100 landscape to understand and explain the space of short-term rental companies.

Now, we are revisiting those 2019 efforts, with the past four years bringing some of the biggest disruption as well as boom times. As the space has grown considerably, we have been forced to expand our efforts, and so we are now presenting 250 companies that are at the forefront of shaping the short-term rental industry.

Download a high-resolution PDF version of the Short-Term Rental Top 250.

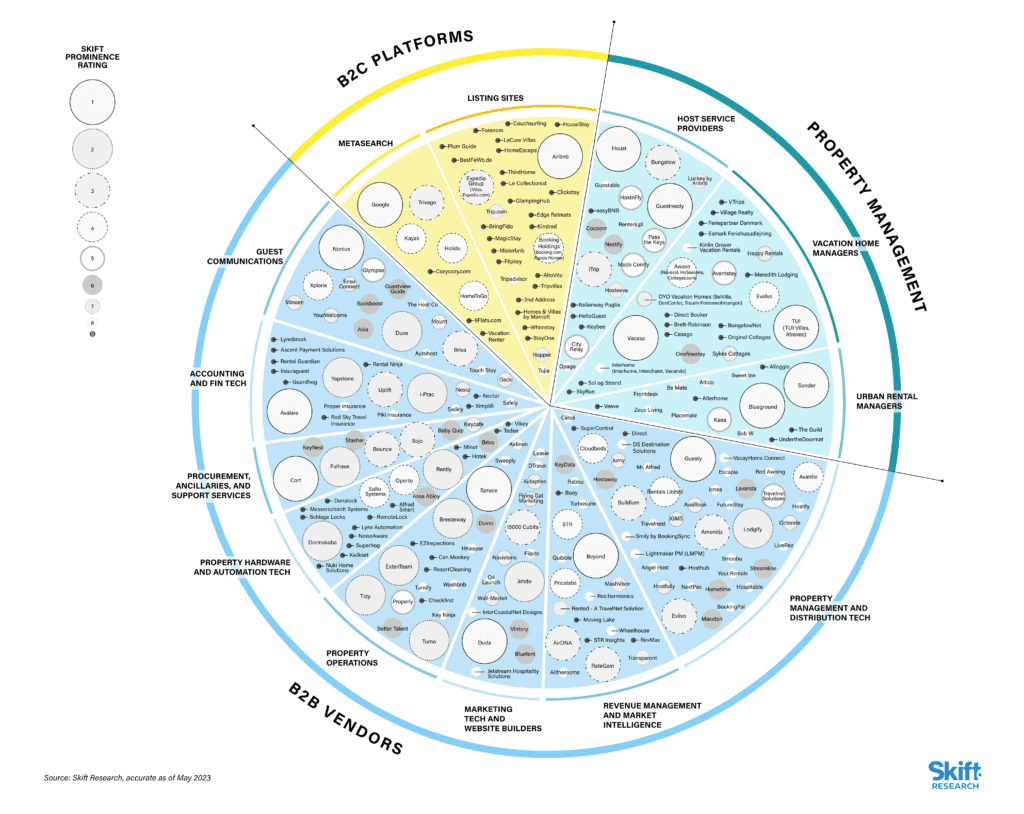

To find the 250 most influential companies, we compiled a list of ~430 companies operating in the short-term rental industry. As these short-term rental companies range from large, multinational, publicly listed companies, all the way down to one-(wo)man, bootstrapped startups, we had to find some common denominators to compare companies.

We decided to use LinkedIn to track followers and employees as a way to find the most prominent 250 companies. With the majority of these companies working with other businesses, rather than consumers, LinkedIn is the best platform to track prominence. We understand that not every company is able to be active on LinkedIn, but the vast majority of companies are on the platform, and LinkedIn allows us to track two interesting metrics: followers and employees.

A higher number of followers can be seen as a stamp of approval from business partners and people interested in the space. The number of employees provides an indication of the size of these companies, and while this is again not a perfectly comparable measure, larger companies are likely to have more clients and therefore a larger impact.

To ensure we are not comparing a consumer-facing multinational company like Airbnb with a specialized business-facing tech vendor, we compared companies in their own sectors, and picked the top performers from each sector.

Each vendor is represented by a bubble, and the size of the bubble is an indication of its followers and employees. We should stress that the size of the bubbles is not an indication of revenues or operational size. The bubbles are comparable within each sector, but not between them.

We determined how many players from each sector should be included in our 250 list, based on the number of companies operating in the space, and our own estimation of the impact each sector has on the overall sector. This resulted in the breakdown you see in the table.

| Sector | Category | Top 250 vendors |

|---|---|---|

| B2C Platforms | Listing Sites | 30 |

| Metasearch | 8 | |

| Property Management | Host Service Providers | 19 |

| Vacation Home Managers | 23 | |

| Urban Rental Managers | 15 | |

| B2B Vendors | Property Management and Distribution Tech | 41 |

| Revenue Management and Market Intelligence | 19 | |

| Marketing Tech and Website Builders | 15 | |

| Accounting and Fin Tech | 18 | |

| Property Operations | 18 | |

| Property Hardware and Automation Tech | 20 | |

| Guest Communications | 16 | |

| Procurement, Ancillaries and Support Services | 8 |

We have made every effort to include as many short-term rental companies as possible, but we realize that this map is not perfect: we may have missed some companies, and many companies in the sector operate across multiple distinct categories, or in some cases also outside the short-term rental space. For the latter this may account for more followers and employees, and so, when this was apparent, we have made adjustments to their score.

Please get in touch with any feedback, so we can continue to improve this ecosystem.

The 250 companies that are at the forefront of shaping the short-term rental industry come in all shapes and sizes. We categorize these companies in three subsectors: Business-to-Consumer Platforms, Property Managers, and Business-to-Business Vendors. Each subsector is further split into a total of 14 different categories, as visualized in the framework below.

Airbnb is probably the most successful travel company of the last decade. A startup that went from a crazy idea to a verb. One of the keys to Airbnb’s success is its gold-plated brand. Airbnb’s image and platform help drive a powerful flywheel that is difficult to replicate.

But that’s not to say that there is no competition, and there is room for more specialized platforms to attract travelers with specific needs. This is shown in our 250 list, with luxury or ultra-luxury platforms like Le Collectionist, Plum Guide, and LaCure, business travel-oriented platforms like AltoVita, 2nd Address, and MagicStay, homeswapping platforms like Kindred and ThirdHome, or a last-minute booking site like Whimstay.

When we talk metasearch in travel, we talk Google.

A Skift Research report on Google, using data from Similarweb, showed that in January and February of 2020, Google Travel (only the metasearch modules, not search results) owned 52% of web traffic between itself and four other prominent metasearch sites. We believe that this stands as a good benchmark for pre-pandemic trends. We found that the Google Travel website saw a dramatic increase in web traffic share as a result of the pandemic. Revisiting the numbers for the same timeframe in 2022, Google had gained 11 points of share to average 62% of all traffic.

Now, the story is slightly different in the short-term rental space. Google metasearch in vacation rental has not succeeded as well as its efforts in hotels and flights, despite many similarities between these two segments.

The online travel agencies, having been burnt by Google, have refused to participate in Google meta for this category. Most notable are Airbnb and Vrbo. And unlike hotels, vacation rental properties are tightly integrated into their respective OTA platforms for calendars, bookings, and distribution. That makes this boycott more effective than it might have been in another sector.

As the STR space further develops its own brands (e.g. Sonder) that want to pursue first party distribution, we see the potential for cracks to form in the OTA boycott of Google vacation rentals. But for now, vacation rental brands remain a small part of the marketplace; alternative booking sites hold most of the cards and they are not playing them on Google.

| Platform | Jan/Feb 2020 Average Share | Jan/Feb 2022 Average Share | Change |

|---|---|---|---|

| Google Travel | 52% | 62% | 11% |

| Kayak | 20% | 18% | -2% |

| Tripadvisor | 18% | 14% | -4% |

| Skyscanner | 6% | 4% | -2% |

| Trivago | 5% | 2% | -3% |

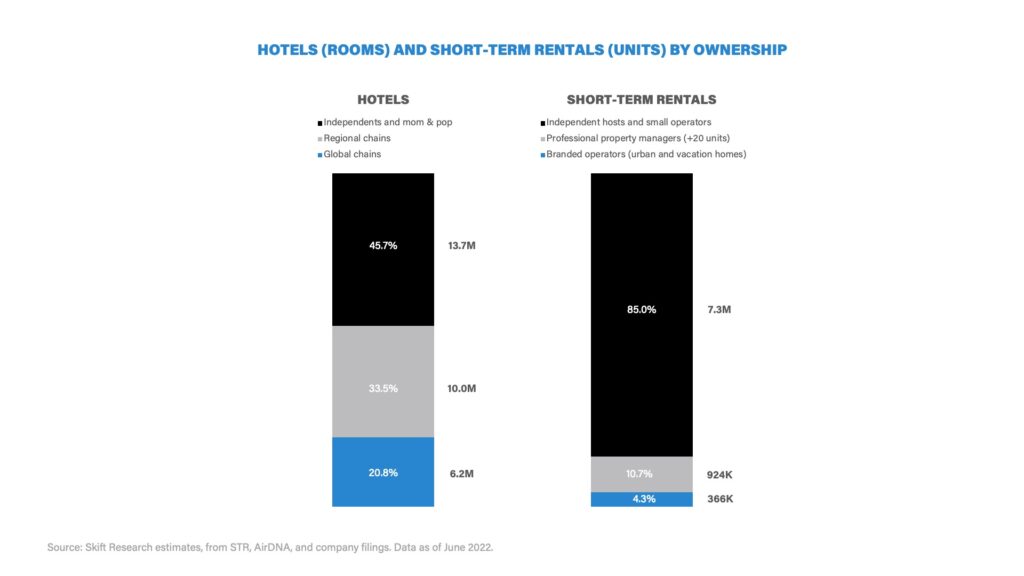

The short-term rental space is extremely fragmented. Skift Research, using data from STR and AirDNA, estimates that just over half of global hotels are affiliated to a global or regional brand (see below). In the short-term rental industry we estimate that this is less than 5%. Another 10% or so are operated by large property managers. The “long tail” of small, independent operators makes up the remaining 85%.

This has an impact on how these properties are run, especially when it comes to the use of third-party vendors. Many of the small operators and individual hosts making up the long tail “view Airbnb and Vrbo as their property management system, they are effectively their reservation management system,” Jeremy Gall of Breezeway told Skift Research. On top of that, many will use these platforms as their primary or only distribution channel, and use the pricing tools provided by Airbnb and Vrbo as their de facto revenue management systems.

Vendors have a hard time convincing these hosts to start using additional software. But there is no lack of trying. Companies like Futurestay, Lodgify, Smily by BookingSync, or Guesty for Hosts focus on these small property owners.

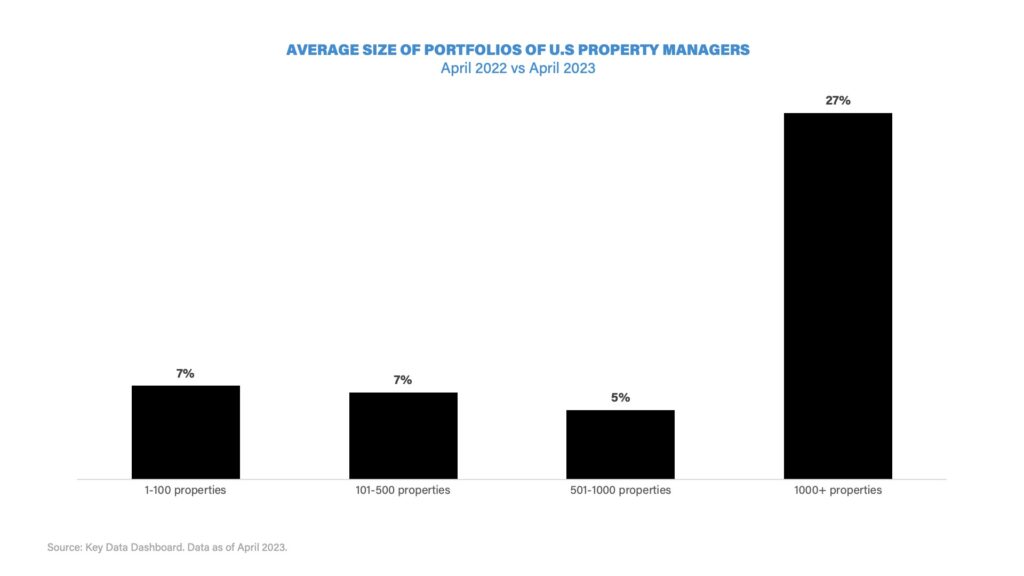

Data from Key Data Dashboard shows that large property management firms (with a portfolio of over 1,000 managed properties) have been growing their portfolios at the fastest rate.

Another data provider, AirDNA, shows that overall U.S. available listings owned by these large property management companies have actually declined on websites like Airbnb, but it is clear that more and more properties are managed by professional managers.

According to AirDNA, 79% of available U.S. listings were managed by operators with fewer than 20 properties in April 2019, but this decreased to 73% by April 2023. Medium-sized operators with between 20 and 100 properties grew the most, from an 8% share to 11% of total listings.

In the property management space there are some interesting differences in business models that we should point out. Next to independent hosts we identify three different types of property managers:

We have seen professionalization in all these segments, with companies consolidating or growing more organically. The pandemic has, however, also brought some to their knees, with especially the masterlease model, which was taking many headlines in 2018 and 2019, seeing casualties. Companies working on purpose-built multi-family real estate for the short-term rental market also have seen their value shrink considerably.

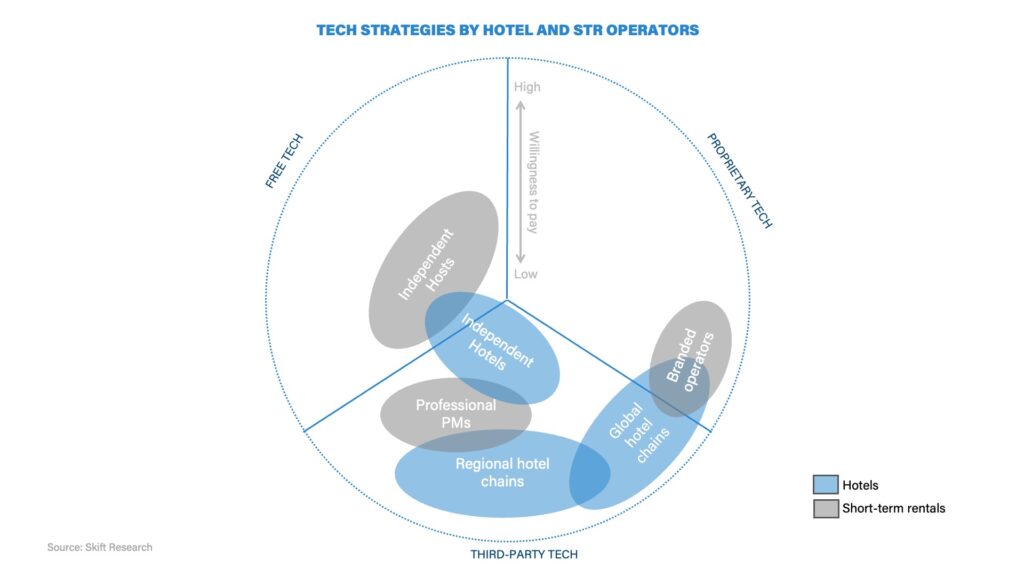

The business-to-business landscape is a very diverse mix of technology and operational vendors, and over the past years this diversity has only increased. As the lines between short-term rental companies and other accommodations like hotels have blurred, so too has the short-term rental vendor space converged with the hotel tech vendor space.

Hotel vendors are starting to offer short-term rental solutions, while short-term rental vendors are increasingly seeing demand from hotel operators which are looking to build a more diverse and mixed-use portfolio. It is no longer an easy distinction between hotels and short-term rentals, which offers many opportunities for b2b vendors.

The acquisition of short-term rental data aggregator Transparent by hotel data aggregator OTA Insight in March 2022 is a clear indicator of this increasing overlap. It also highlights that after a bit of a lull during the pandemic, mergers and acquisitions are back on the table.

Guesty has been very active in acquiring smaller tech vendors, but most of these acquisitions do little to move the needle. The B2B vendor space remains extremely fragmented.

The need for consolidation, however, will likely grow. For one, the increasing brand standards and professionalization in the short-term rental space will grow the demands on technology. It is a fact of life that large companies tend to partner with large tech vendors, leaving smaller players with a shrinking market share. And with uncertain times, we have seen unprofitable companies falter or shrink over the past years.

That is not to say that there is no space for smaller players, though. Some of the best innovation tends to come from hyper-focused startups tackling a specific pain point. The latest innovations around generative AI will likely bring a whole new host of tech vendors into the space. Startups like Jurny and Guest Guru, or more established players like Breezeway, have already implemented large language models to improve customer and staff interactions, and more solutions will come.

Download a high-resolution PDF version of the Short-Term Rental Top 250.

Online platforms for hosts to list their properties and guests to book short or longer-term stays.

| Vendor | Country |

|---|---|

| Airbnb | U.S. |

| Expedia Group (Vrbo, Expedia.com) | U.S. |

| Booking Holdings (Booking.com, Agoda Homes) | U.S. |

| Hopper | Canada |

| Trip.com | Singapore |

| Tujia | China |

| Tripadvisor | U.S. |

| Le Collectionist | France |

| Plum Guide | UK |

| Forenom | Finland |

| Couchsurfing | U.S. |

| AltoVita | UK |

| ThirdHome | U.S. |

| Kindred | U.S. |

| LaCure Villas | Canada |

| Flipkey | U.S. |

| Misterbnb | France |

| HouseStay | U.S. |

| GlampingHub | Vietnam |

| Whimstay | U.S. |

| StayOne | Hong Kong |

| BringFido | U.S. |

| Edge Retreats | UK |

| Homes & Villas by Marriott | U.S. |

| MagicStay | France |

| 2nd Address | U.S. |

| HomeEscape | U.S. |

| Tripvillas | Singapore |

| BestFeWo.de | Germany |

| Clickstay | UK |

Aggregators of short-term rentals from multiple listing sites.

| Vendor | Country |

|---|---|

| U.S. | |

| Trivago | Germany |

| Kayak | U.S. |

| Holidu | Germany |

| HomeToGo | Germany |

| VacationRenter | U.S. |

| Cozycozy.com | France |

| 9Flats.com | Singapore |

Operators providing ‘white label’ services for hosts, taking care of distribution and revenue management, operations, and guest communications. Many offer these services as modules which can be purchased as a package or individually. These service providers distribute the rental on third-party platforms, with the host often remaining the ‘face’ of the rental for short-term rental companies.

| Vendor | Country |

|---|---|

| Guestready | UK |

| Houst | UK |

| Bungalow | U.S. |

| iTrip | U.S. |

| Pass the Keys | UK |

| City Relay | UK |

| HostnFly | France |

| Made Comfy | Australia |

| Nestify | UK |

| Cocoonr | France |

| Luckey by Airbnb | France |

| Hosteeva | U.S. |

| Opago | UK |

| Renters.pl | Poland |

| Guestable | U.S. |

| Keybee | U.S. |

| easyBNB | Czech Republic |

| HelloGuest | UK |

| Italianway Puglia | Italy |

Operate second homes; most prevalent in traditional rental destinations in North America and Europe. These managers have historically used proprietary technology, but are increasingly moving to third-party technology. Extremely fragmented at the local level, although some major players exist.

| Vendor | Country |

|---|---|

| Vacasa | U.S. |

| TUI (TUI Villas, Atraveo) | Germany |

| Awaze (Novasol, HoSeasons, Cottages.com) | UK |

| Evolve | U.S. |

| Avantstay | U.S. |

| Sykes Cottages | UK |

| Interhome (Interhome, Interchalet, Vacando) | Switzerland |

| Kinlin Grover Vacation Rentals | U.S. |

| Onefinestay | UK |

| OYO Vacation Homes (BelVilla, DanCenter, Traum-Ferienwohnungen) | Switzerland |

| Happy.Rentals | Switzerland |

| Brett-Robinson | U.S. |

| Village Realty | U.S. |

| Sol og Strand | Denmark |

| VTrips | U.S. |

| Feriepartner Danmark | Denmark |

| Esmark Feriehusudlejning | Denmark |

| Casago | U.S. |

| Original Cottages | UK |

| SkyRun | U.S. |

| BungalowNet | Netherlands |

| Direct Booker | Croatia |

| Meredith Lodging | U.S. |

Younger management companies which focus on urban rentals, on the back of Airbnb’s success. They differentiate themselves through proprietary technology. Many push their brand through their own booking website, and branding on third-party platforms.

| Vendor | Country |

|---|---|

| Sonder | U.S. |

| Blueground | U.S. |

| Kasa | U.S. |

| Be Mate | Spain |

| Placemakr | U.S. |

| Sweet Inn | UK |

| Zeus Living | U.S. |

| Bob W | Finland |

| Altido | UK |

| Frontdesk | U.S. |

| Alterhome | Spain |

| The Guild | U.S. |

| Veeve | UK |

| Alloggio | Australia |

| UnderTheDoormat | UK |

Technology that helps hosts and managers run and distribute their short-term rental properties.

| Vendor | Country |

|---|---|

| Guesty (MyVR, Kigo) | U.S. |

| Lodgify | Spain |

| Buildium | U.S. |

| Eviivo | UK |

| Amenitiz | Spain |

| Rentals United | Spain |

| Avantio | Spain |

| Cloudbeds | U.S. |

| Travelnet Solutions | U.S. |

| Streamline | U.S. |

| Hostaway | U.S. |

| Hometime | Australia |

| Lavanda | UK |

| Maxxton | Netherlands |

| AvaiBook | Spain |

| Hostfully | U.S. |

| iGMS | Canada |

| Jurny | U.S. |

| Red Awning | U.S. |

| Octorate | Italy |

| NextPax | Netherlands |

| Your.Rentals | Sweden |

| Travelnest | UK |

| Smoobu | Germany |

| Hostify | U.S. |

| Hospitable | U.S. |

| Lightmaker PM (LMPM) | Canada |

| LiveRez | U.S. |

| Angel Host | Canada |

| BookingPal | U.S. |

| Smily by BookingSync | France |

| DS Destination Solutions | Germany |

| Mr Alfred | UAE |

| Ciirus | U.S. |

| VacayHome Connect | U.S. |

| Escapia | U.S. |

| Icnea | Spain |

| FutureStay | U.S. |

| SuperControl | Ireland |

| Hosthub | Greece |

| Direct | U.S. |

Technology to help hosts and managers understand demand and price their short-term rental properties

| Vendor | Country |

|---|---|

| Beyond | U.S. |

| AirDNA | U.S. |

| RateGain | India |

| STR | U.S. |

| Pricelabs | U.S. |

| Keydata | U.S. |

| Rented – A TravelNet Solution | U.S. |

| Transparent | Spain |

| Mashvisor | U.S. |

| Wheelhouse | U.S. |

| Turbosuite | Spain |

| Rabbu | U.S. |

| Alltherooms | U.S. |

| Quibble | U.S. |

| Res:harmonics | UK |

| RevMax | U.S. |

| Buoy | U.S. |

| Moving Lake | U.S. |

| STR Insights | U.S. |

Technology to market short-term rental properties and build direct booking tools and websites.

| Vendor | Country |

|---|---|

| Duda | U.S. |

| Jimdo | Germany |

| 15000 Cubits | U.S. |

| Bluetent | U.S. |

| Vintory | U.S. |

| Wall-Market | France |

| Navistone | U.S. |

| Aidaptive | U.S. |

| Flying Cat Marketing | Spain |

| InterCoastal Net Designs | U.S. |

| Flip.to | U.S. |

| Laasie | U.S. |

| Jetstream Hospitality Solutions | Canada |

| Q4 Launch | U.S. |

| DTravel | Cayman Islands |

Technology to support any accounting, financial, and payment needs from hosts and property managers.

| Vendor | Country |

|---|---|

| Avalara | U.S. |

| Uplift | U.S. |

| Yapstone | U.S. |

| i-Prac | UK |

| Nexio | U.S. |

| Proper Insurance | U.S. |

| Safely | U.S. |

| Pikl Insurance | UK |

| Swikly | France |

| Ximplifi | U.S. |

| Guardhog | UK |

| Ascent Payment Solutions | U.S. |

| Lynnbrook | U.S. |

| Nectar | U.S. |

| Rental Guardian | U.S. |

| Insuraguest | U.S. |

| Rental Ninja | Spain |

| Red Sky Travel Insurance | U.S. |

Vendors that help make the operational side of running short-term rental operations more efficiently, by offering cleaning and linen services.

| Vendor | Country |

|---|---|

| Spruce | U.S. |

| Turno | U.S. |

| ExtenTeam | U.S. |

| Breezeway | U.S. |

| Tidy | U.S. |

| Properly | U.S. |

| Better Talent | U.S. |

| Doinn | Portugal |

| HKeeper | U.S. |

| Key Ninja | Australia |

| Turnify | U.S. |

| Sweeply | Iceland |

| Washbnb | U.S. |

| Airlinen | UK |

| Checkfirst | Portugal |

| EZInspections | U.S. |

| Can Monkey | U.S. |

| ResortCleaning | U.S. |

Vendors providing hardware like door locks and relevant technology including digital keys, noise monitors, energy monitors etc.

| Vendor | Country |

|---|---|

| Salto Systems | Spain |

| Assa Abloy (Global Solutions, Hospitality) | Sweden |

| Rently | U.S. |

| Dormakaba | Switzerland |

| Brivo | U.S. |

| Schlage Locks | India |

| Operto | Canada |

| Nuki Home Solutions | Austria |

| Minut | Sweden |

| RemoteLock | U.S. |

| Hotek | Netherlands |

| Alfred Smart | Spain |

| Messerschmitt Systems | Germany |

| Vikey | Italy |

| Kwikset | U.S. |

| NoiseAware | U.S. |

| Superhog | UK |

| Tedee | Poland |

| Lynx Automation | U.S. |

| Danalock | Denmark |

Technology which allows for better communication between hosts and guests, especially for large property managers with many listings.

| Vendor | Country |

|---|---|

| Nonius | Portugal |

| Duve | Israel |

| Brisa | Brazil |

| Xplorie | U.S. |

| Glympse | U.S. |

| Guestview Guide | U.S. |

| Bookboost | Sweden |

| Akia | U.S. |

| Dack | U.S. |

| Minoan | U.S. |

| Mount | U.S. |

| Enso Connect | Canada |

| YourWelcome | UK |

| Autohost | Canada |

| Touch Stay | UK |

| The Host Co | U.S. |

Catch-all category which includes vendors that provide supplies to short-term rental hosts and managers, as well as ancillary or peripheral services like luggage storage. Furniture rental and design agencies are included here too.

| Vendor | Country |

|---|---|

| Cort | U.S. |

| Baby Quip | U.S. |

| Bounce | U.S. |

| Fulhaus | Canada |

| Sojo | U.S. |

| Keycafe | Canada |

| KeyNest | UK |

| Stasher | UK |

To identify the top 250 companies, we included 430 short-term rental companies in our initial research. For a full list of companies included, see the embedded sheet.

View on desktop to search and sort list.

Download a high-resolution PDF version of the Short-Term Rental Top 250.