The U.S. leisure and hospitality sector in February continued its recovery from the pandemic, according to a report from the U.S. Labor Department on Friday.

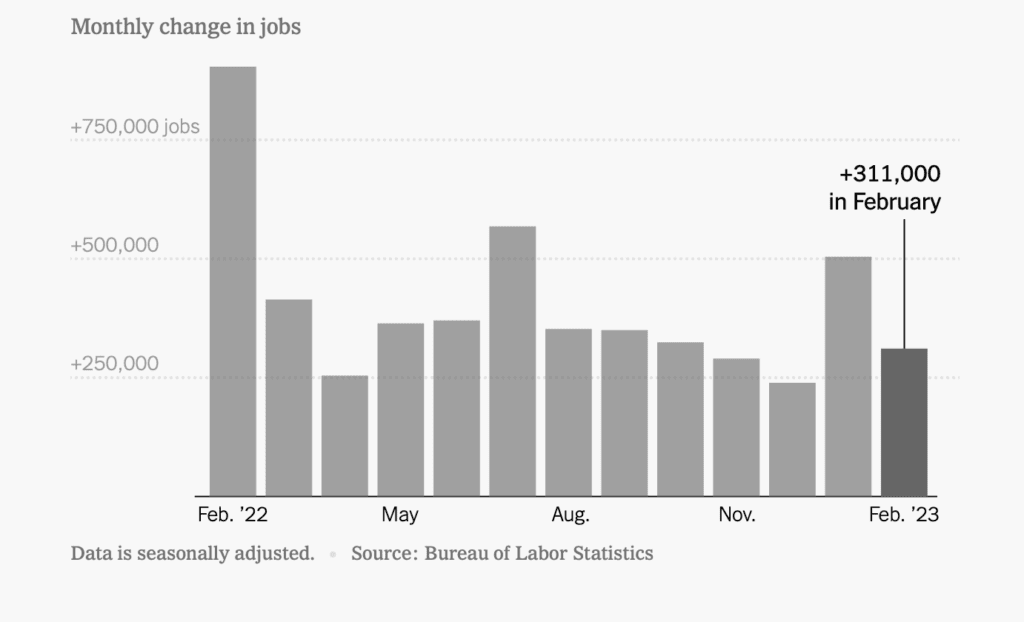

Government surveyors estimated that U.S. businesses created 311,000 jobs in February. About 14,000 of those jobs were in travel accommodation, mainly hotels. That was down slightly from a 15,000 reported gain for hotels last month.

On the one hand, many U.S.-based hotel groups reported in February hotel earnings calls that they feel broadly back at their full labor quotas, with labor gaps no longer a pressing issue.

On the other hand, 1.7 million leisure and hospitality jobs are open.

The remaining 91,000 added jobs were in restaurants and leisure and hospitality broadly. Employment in the broader leisure and hospitality was only below its pre-pandemic February 2020 level by 2.4 percent, suggesting a full recovery is in the offing.

“One way the federal government should address our workforce shortage is to increase the allotment of H-2B visas, which is at least 100,000 short of demand, to provide the industry with the temporary workers it so desperately needs,” said U.S. Travel Association president and CEO Geoff Freeman.

The national unemployment rate was estimated at 3.6 percent. On the plus side, low unemployment can fuel travel spending.

“There is still a much room for further services spending, greatly benefitting travel,” said Dan Roberts, vice president of research at Visit Virgina, a destination marketing organization. “Rotation of consumer spending from goods back into services, as has been the case for months now, is the story.”

On the downside, many commentators suspect the robust jobs report may embolden the U.S. central bank to boost interest rates. Such a move by the Federal Reserve risks overshooting economic trends, accelerating a contraction beyond what’s necessary to tamp down inflation and thus reducing economic growth in the second half of the year.

CLARIFICATION: A typo in the original version gave the wrong year for the pre-pandemic February 2020 level.