Skift Take

Viator leads in online tours and activities, as Skift Research's new analysis shows, but being in first also puts a target on its back. Rivals are working hard to close the gap and the race is far from over.

The tours and activities space still remains fragmented and dominated by numerous small operators located in their individual destinations. Many of these operators manage their businesses and bookings manually, using pen and paper or rudimentary databases to keep track of reservations.

Aggregators have faced significant challenges in tapping into the market’s full potential, owing to the category’s lower online penetration rates and booking values. Nevertheless, the market is starting to change and online distributors now see the segment as a previously untapped source of commissions.

Similarly, for tour operators, offering a variety of booking options is important to target as many travelers as possible. Distribution via online travel agencies is likely to make that easier and result in more bookings overall.

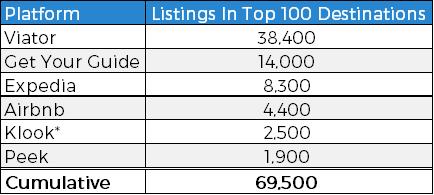

As a part of our latest report investigating the tours and activities market, Skift Research analyzed the inventories of six major online tours and activities distribution platforms. We found that Viator leads in the online arena based on total number of listings and number of listings in the top 100 tourist destinations.

Our analysis also shows that this lead is not yet set in stone. Some sites are growing their inventory in an attempt to match Viator’s scale. Yet others are building specialists platforms that offer a more curated selection of tours focused on specific region.

With online travel agencies accounting for only approximately 4 percent of global tours and activities revenues, it’s clear that online distribution has a long way to go. What is becoming increasingly apparent, however, is that there is considerable untapped potential for the online travel agency players, as tours and activities bookings shift online and mobile.

Last week we launched the latest report in our Skift Research service, The State of Tours and Activities 2018.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

Skift Research conducted a proprietary analysis of tours and activities inventory on six major online distribution platforms, Viator, Expedia, Airbnb, GetYourGuide, Klook, and Peek, to gain a general sense of regional listings and approximate current market shares. For all six sites, we compared how many listings were offered to U.S. consumers across 100 of the most popular tourist destinations worldwide.

To make valid comparisons, the same set of cities was used on each site. We collected information for publicly available, English-language listings as of February 2018. For sites that required a date range, we searched for inventory available in August 2018. Skift collected data on nearly 70,000 activities. Although not a complete sample, we believe our dataset represents almost 40 percent of all tours available on these six sites.

Viator had the highest number of listings for the cities we tracked.

Source: Skift Research, Company Websites

*For Klook, we are tracking unique suppliers of activities on its US-language webpage. This means that activities with multiple package options are only counted once. Please note that individual providers will vary on how they display activities with multiple package options but we believe our sampled data is broadly comparable and generally only tracks top-level activity options.

Preview and Buy the Full Report

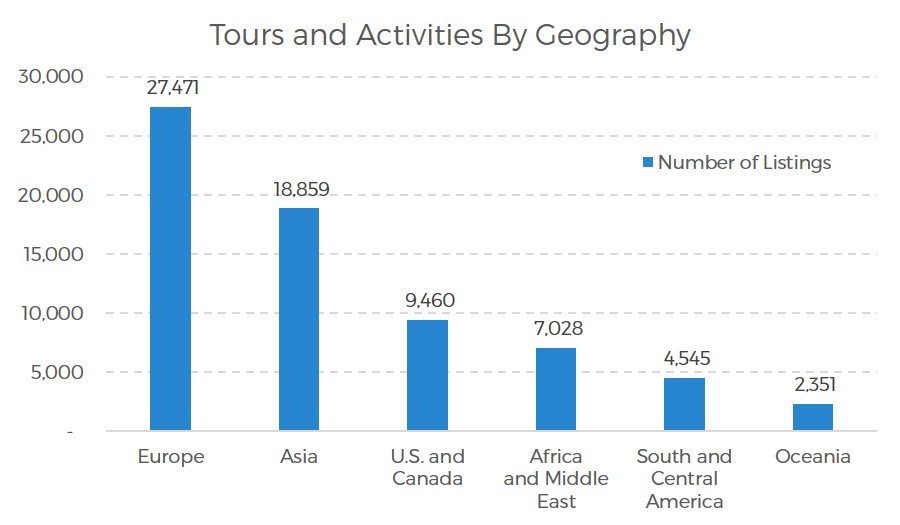

Europe has made the most progress in offering online booking of tours and activities, with over 27,000 listings available across all five platforms in the cities we surveyed. This makes sense given Europe’s position as the leading tourist destination worldwide, with 671 million visitors. Asia has the next most cumulative activities offered.

Europe had the highest number of total listings, followed by Asia.

Source: Skift Research, Company Websites

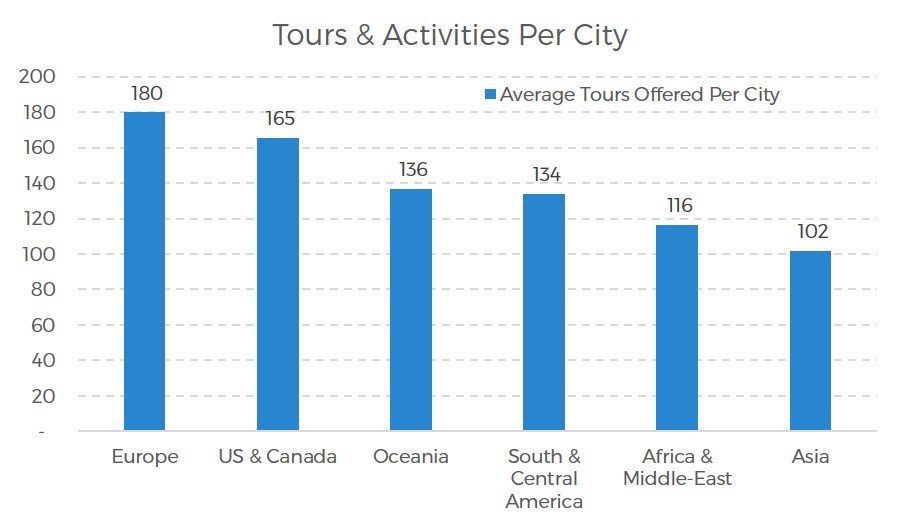

Because of Europe’s position as the leading tourist destination in the world, we analyzed more cities in Europe than in any other region. We adjusted for that bias by looking at tours and activities offered on a per-city basis. With this adjustment, Europe remains in the lead in terms of average number of activities offered per city, but now North America and Oceania rate considerably higher, likely reflecting the technical sophistication of tour operators in cities such as New York and Sydney relative to other regions.

Europe has the highest average number of activities offered by city.

Source: Skift Research, Company Websites

Preview and Buy the Full Report

On a single country basis, the United States leads in terms of number of activities, followed by Italy and China, respectively.

The United States, followed by Italy and China, have the most activities.

Source: Skift Research, Company Websites

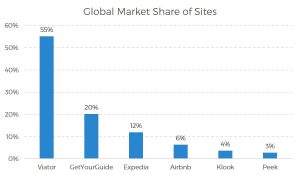

Further, our analysis largely corroborates Skift’s previous reports that Viator/TripAdvisor is in pole position when it comes to online attractions. It has the largest number of tour listings, more than twice as many as its next closest competitor. We estimate that Viator has nearly 55 percent market share worldwide for the 70,000 online listings that Skift Research collected. Our analysis does not account for overlapping inventory on multiple platforms.

Viator had the highest number of online listings globally that we collected.

Source: Skift Research, Company Websites

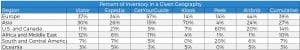

That doesn’t mean the game is over yet. Viator will have have to fight to stay in the lead, as our data also shows. For instance, many platforms see an opening to compete by being regional specialists. Klook is clearly positioned as an Asia expert, for example. It has 70 percent of its listings on that continent. GetYourGuide is tilted heavily towards Europe, which accounts for 57 percent of its inventory. Peek has a similar concentration in North America.

Other than Viator and Expedia, online travel agencies kew toward a specific geography.

Source: Skift Research, Company Websites

These regional specialist sites are also more likely to put a vetting process in place so that their platforms offer only higher quality tours. We recognize that one of the main limitations of our analysis is that it evaluates quantity over quality. The smaller platforms are more likely to offer a curated selection of tours, and so our analysis cannot fully take some of their advantages into account.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst calls, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst calls, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Have a confidential tip for Skift? Get in touch

Tags: activities, airbnb, digital, expedia, experiences, getyourguide, peek, rezdy, skift research, tours and activities, tripadvisor, viator

Photo credit: Many tours can be booked online on a double decker bus, such as this one in London. Various online platforms are competing to market share in the tours and activities sector. Aron Van de Pol / Unsplash