Asia-Pacific Tourism Rebound: Late to the Party, But Now Leading the Pack

Skift Take

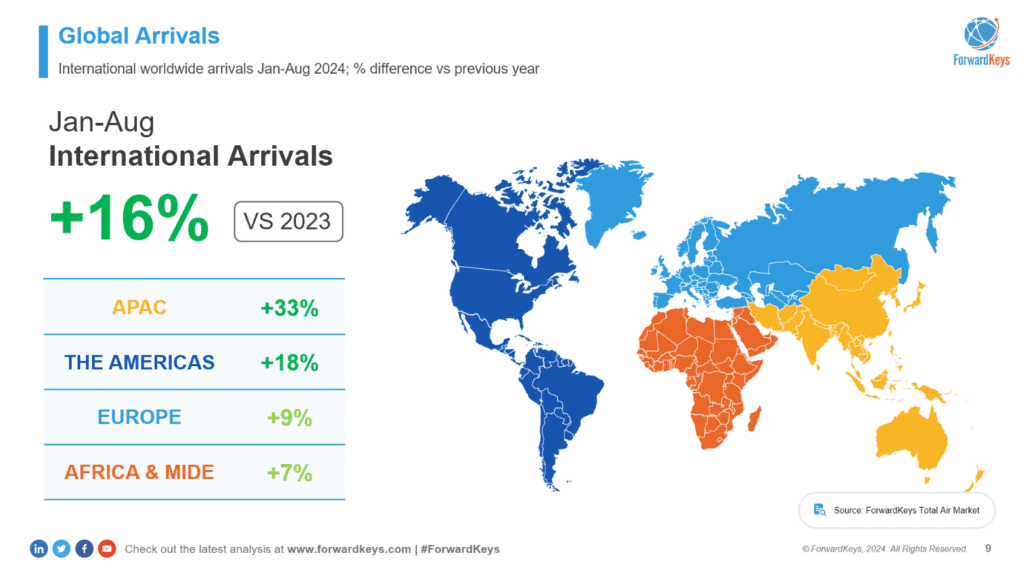

The global tourism industry is bouncing back in 2024. International arrivals increased 16% between January and August, compared to 2023, according to travel intelligence firm ForwardKeys. The company's insights, presented at the World Travel and Tourism Council's (WTTC) Global Summit in Perth, highlighted the pivotal role of the Asia-Pacific region in driving this resurgence.

Despite ongoing challenges, pent-up demand is leading to rapid growth across several key markets.

Travel is surging globally, however, Asia-Pacific (APAC) has emerged as a key engine of growth. The region's recovery was slower compared to other parts of the world, largely due to delayed reopening after the pandemic. But the catch-up phase is in full swing.

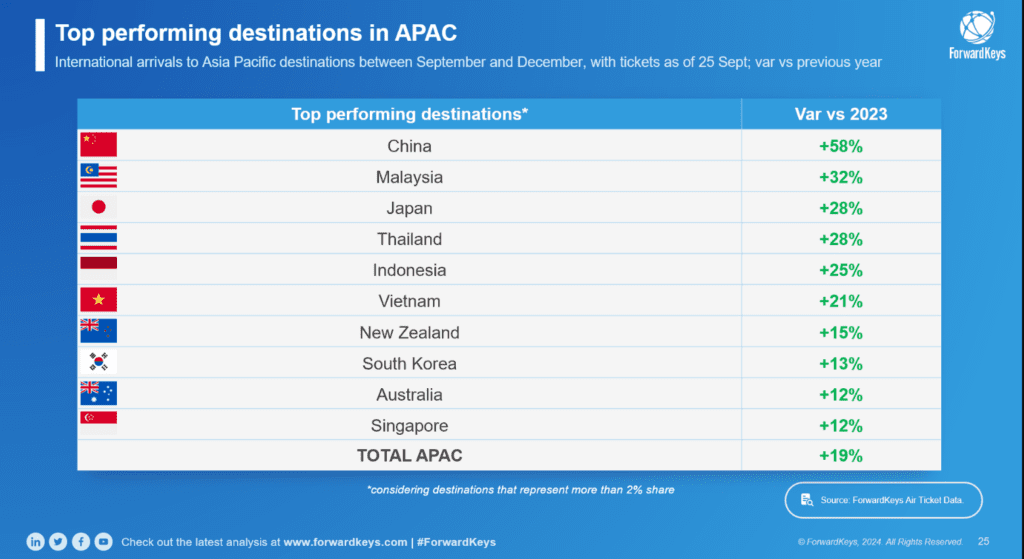

In 2024, APAC is experiencing double-digit growth, with international arrivals projected to rise by 19% overall. China, Japan, Malaysia, Thailand, and Indonesia are leading the charge, each showing significant year-on-year growth in visitor numbers.

Asia-Pacific’s Comeback Story: Gradual But Steady Recovery

"Asia is still in a recovery phase, catching up with its 2019 levels," Olivier Ponti, director of intelligence and marketing at ForwardKeys, said on Wednesday. "But we are seeing consistent progress, especially in countries like China, which still has space to grow. Malaysia, Japan, Indonesia and Vietnam are also growing strong.”

This recovery trajectory, though promising, indicates a gap between current performance and pre-pandemic benchmarks. However, the year’s upward trend has industry stakeholders optimistic that the region will continue to close the gap through the end of 2024 and beyond.

Within Asia-Pacific, different markets are recovering at varying speeds. Southeast Asia and South Asia have shown robust growth, especially when compared to last year. However, when benchmarking against 2019 levels, South Asia is the strongest performer, thanks to countries like India, which initiated recovery efforts early in 2023.

Oceania has seen a 10% increase in arrivals, driven largely by New Zealand and Australia.

Source Markets: Spotlight on China and Japan

The resurgence of international tourism is not just about where people are going, but where they’re coming from. ForwardKeys highlighted that the U.S. and European markets are already in growth mode, while China and Japan’s outbound travel are still recovering, albeit with strong year-on-year improvements.

“China and Japan are both showing substantial growth compared with last year, but they still haven’t reached 2019 levels,” said Ponti. This trend offers destinations opportunities to focus on re-engaging these critical markets as they return to international travel.

A key takeaway for destinations aiming to attract Chinese travelers is the need for targeted strategies. The Golden Week travel period in October saw Chinese visitors surpassing 2019 levels in Asian markets like Macau, Singapore and Hong Kong , reflecting the potential for a swift rebound if destinations adapt their marketing and engagement efforts.

Beyond Asia, Chinese outbound travel to destinations like Istanbul, London, Moscow, Milan and Dubai during the October Golden week also exceeded pre pandemic levels, Ponti noted.

Emerging Travel Trends: Sustainability and Seasonality

In addition to recovery numbers, sustainability emerged as a major theme during the ForwardKeys’ presentation. The aviation industry is taking steps toward a greener future, with airlines investing in new-generation, fuel-efficient aircraft. However, destinations still grapple with integrating sustainable practices into their tourism models, Ponti said.

The shift towards sustainable practices is not only driven by regulatory pressures but also by changing traveler preferences.

Another challenge highlighted was managing tourism growth through better seasonality planning. Unlike pre-pandemic times, travel demand today is more evenly spread across the year, offering destinations a chance to balance visitor numbers and reduce peak-season strains. Japan, for example, has made progress in extending its tourist season by promoting lesser-known attractions during off-peak months.

As travel continues to rebound, the challenge for many destinations is to manage growth without overwhelming their existing infrastructure. This requires a strategic focus on spreading visitor traffic throughout the year and optimizing tourism assets during traditionally low-demand periods.

Ponti emphasized the need for smarter planning to handle the surge in travelers: “The key challenge is to flatten the peaks of seasonality and ensure tourism infrastructure is used efficiently year-round. Identifying off-season opportunities can unlock new potential.”

Skift’s in-depth reporting on climate issues is made possible through the financial support of Intrepid Travel. This backing allows Skift to bring you high-quality journalism on one of the most important topics facing our planet today. Intrepid is not involved in any decisions made by Skift’s editorial team.