Skift Take

Airbnb is trying to win on brand with a reduced reliance on Google while the smaller Vrbo embraced YouTube big-time, and will spend, spend, spend to advantage.

Vacation rental brand Vrbo has seemingly made significant gains, even over the larger Airbnb, in recent months, but it was steep advertising spend that bolstered those gains as Vrbo outspent Airbnb 10-fold in U.S. advertising during the first two months of 2021.

In other words, Vrbo bought a lot of traffic, overwhelmingly through online video, including Google’s YouTube, raising the question whether Vrbo’s boost is sustainable.

In the chart below, you’ll see that Vrbo spent an estimated $91 million — with $82.6 million of that for online video — in U.S. advertising in January and February, the latest statistics available, according to Kantar Media.

Join Us at the Skift Short-Term Rental and Outdoor Summit on May 19

Airbnb, on the other hand, spent merely one-tenth of Vrbo’s level, namely $9 million during that timespan. Airbnb’s advertising outlays tilted toward television, with $4.8 million in spend, and the short-term rental brand shelled out $3.9 million for search engine marketing, likely mostly with Google.

Online Travel U.S. Advertising Spend January-February 2021

| Brand | Total Brand Spend |

|---|---|

| Jan-Feb 2021 | |

| Vrbo | $90.8M |

| Online Video | $82.6M |

| TV | $3.5M |

| Search | $3.3M |

| Display | $1.3M |

| Booking.com | $48.8M |

| Search | $48.2M |

| Expedia | $38.1M |

| Search | $33.2M |

| TV | $4.6M |

| Tripadvisor | $34.9M |

| Search | $34.3M |

| Hotels.com | $23.5M |

| Search | $23.3M |

| Trivago | $18.8M |

| Search | $18.3M |

| Airbnb | $8.9M |

| Search | $3.9M |

| TV | $4.8M |

| Total Spend | $225.7M |

Source: Kantar Media

Asked about Vrbo’s marketing strategy, an Expedia Group spokesperson said: “Our marketing strategies are specific to the brand and geography, and while we can’t share specifics, we are seeing positive growth across all of our alternative accommodation brands in our top performing markets. In the coming weeks, we’re launching new marketing initiatives aimed at continuing to attract hosts to our platforms. These initiatives will roll out across a variety of mediums.”

Airbnb declined to comment on these advertising trends.

These advertising trends may have shifted in the interim. Airbnb launched its largest global advertising campaign in the last handful of years in late February. Expedia.com — not sister brand Vrbo — likewise is debuting its biggest advertising campaign in five years.

The backdrop to Vrbo’s advertising blitz is the gains it has made starting last year following the advent of the coronavirus pandemic when travelers avoided hotels in cities, and checked into vacation rentals and other short-term rentals in non-urban locales.

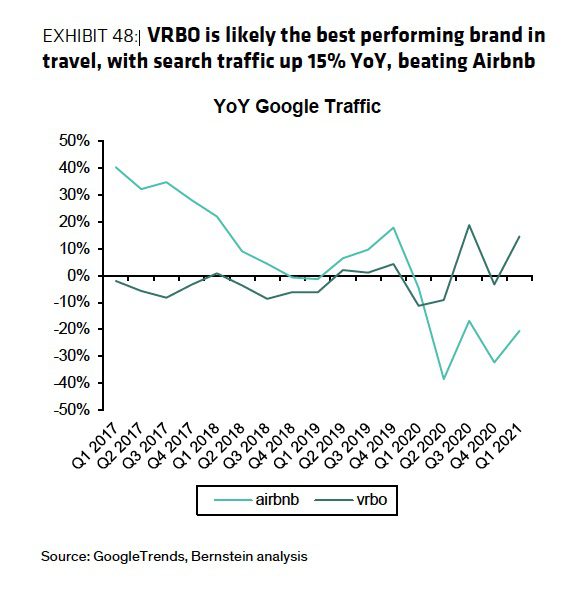

“Vrbo is likely the best performing brand in travel, with search traffic up

15 percent year over year, outperforming the more global Airbnb,” an April 20 AB Bernstein research note stated.

The chart shows that Vrbo’s free search traffic in Google increased 15 percent year over year in the first quarter of 2021 while Airbnb’s organic traffic was down double digits.

But during this period, or for at least for the first two months of the quarter, Vrbo’s advertising budget was 10 times larger than Airbnb’s. Although Bernstein’s numbers were for organic traffic, advertising spend certainly boosts brand awareness and can often spur more queries of the free variety.

Richard Clarke, AB Bernstein managing director, told Skift Vrbo is making gains because it has the right mix, including its focus on the U.S., where it gets more than 65 percent of its revenue, whole homes, and more rural locations.

“However, they (Vrbo) are clearly investing behind this — trying to get the brand engrained,” Clarke said. “It shows that likely they don’t expect the same flywheel, if Airbnb does really have a flywheel.”

The competition between global short-term rental market leader Airbnb and the smaller and U.S.-oriented Vrbo is certainly picking up.

Marketing spend levels among Airbnb, Expedia Group, and Booking.com are a flash point. Airbnb has vowed to downsize its paid marketing through Google, arguing, as it did before becoming a public company last year, that the strength of its global brand would spur direct traffic, and be a key advantage over rivals.

Vrbo launched a campaign last month to woo Airbnb super hosts, and the two have engaged in a tit for tat on which company’s hosts earn more money on their respective platforms.

Asked in March about Airbnb’s new global advertising campaign and whether Vrbo would mimic for its new host recruitment plan, in which it is trying to steal Airbnb super hosts, Cyril Ranque, president of Expedia’s Travel Partner Group, said Vrbo wouldn’t launch such an advertising blitz. “For us, it is not so much marketing but actual fact,” Ranque said.

Skift pointed out at the time in a news story that Vrbo had indeed been spending substantial amounts on U.S. TV commercials in early January. It turned out that Vrbo indeed spent nearly $91 million on advertising during the first two months of 2021 — although the advertising blitz was not tied to host recruitment.

It is interesting to note that Vrbo, according to Kantar Media, spent more than any other online travel brand in the United States during the first couple of months of the year. Vrbo’s $91.8 million in U.S. advertising spend dwarfed the budgets of Europe-heavy Booking.com ($48.8 million), Vrbo sister brand Expedia.com ($38.1 million), and Tripadvisor ($34.9 million).

Lean Away From Google? Nope

Major travel brands, including Expedia, Booking.com, and Tripadvisor have all been talking about reducing their dependence on Google advertising before and during the pandemic, but the Kantar Media numbers showed those inclinations have been tossed aside during the current crisis. They’ve all been relying overwhelmingly on paid search engine marketing, presumably most of it with Google.

The big exception to the search engine marketing trend in the U.S. during the first two months of the year was Vrbo, which went big in online video — but Google’s YouTube got a major chunk of those dollars.

Some would say that keeping Google advertising at arm’s length will have to await a post-crisis period.

Register Now for the Skift Short-Term Rental and Outdoor Summit on May 19

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, booking.com, expedia, search engine marketing, tripadvisor, vrbo, youtube

Photo credit: Vrbo spent big time in early 2020, reaching consumers through YouTube advertising, in many, cases seen on mobile phones. Luis Alvarez / Getty