Volotea: The Biggest Low-Cost Airline You’ve Never Heard Of

Skift Take

Leaders of Travel: Skift C-Suite Series

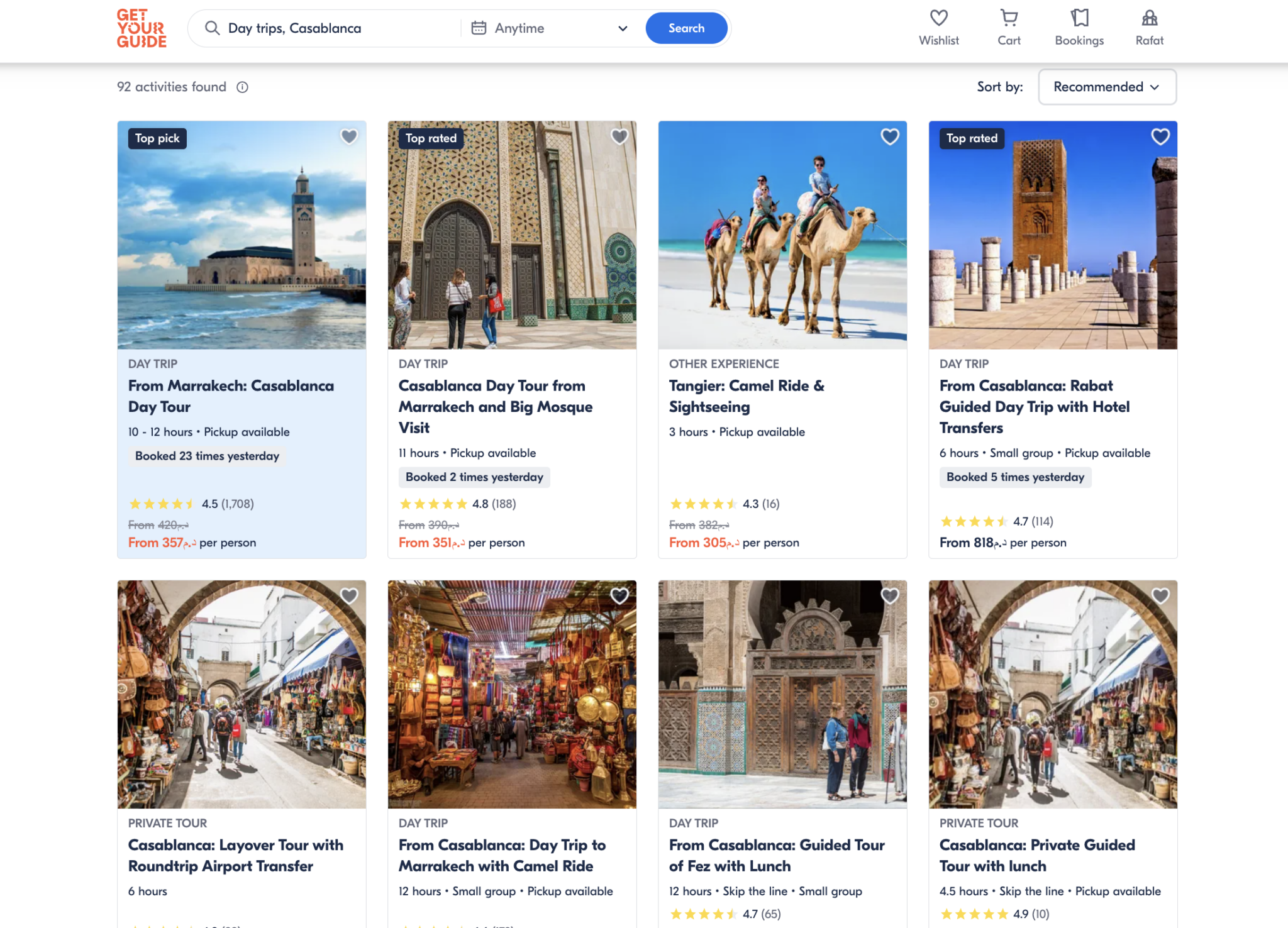

What are the top trends impacting hotels, airlines, and online bookings? We speak to the executives shaping the future of travel.There’s a fairly high chance that you’ve never heard of Volotea. But it’s one of the quirkiest budget airlines anywhere on the planet. It’s also (usually) pretty profitable.

Think of European low-cost carriers and the big boys probably come to mind. Ryanair, easyJet, and Wizz Air are the most prominent players continent-wide, with the likes of Vueling, Norwegian, and Eurowings also enjoying a high profile, especially in their home regions.

But how does Volotea, a privately owned and financed airline, survive in Europe’s hyper-competitive market?

The Barcelona-based company leaves the trunk routes for the big names. Instead, it has carved out a niche serving smaller cities overlooked or ignored by others.

Volotea’s Secret Sauce

Volotea was founded in 2011 by Carlos Muñoz (pictured above) and Lázaro Ros, but this wasn’t their first foray into aviation. The duo also founded the aforementioned Vueling, which is now owned by IAG, the parent firm of British Airways and Iberia.

While you’ll find Volotea’s distinctive red and white airplane tails at airports in Paris, Rome, and Madrid, the core of the Volotea network lies in secondary and tertiary European cities. The airline has almost 450 routes, with more than half of these being exclusively served by Volotea.

The airline reaches 110 airports, stretching from Portugal to Greece and most countries in between. It is strongest in France, Italy, and Spain, where it has the bulk of its 21 network bases. Earlier this year, the all-Airbus operator carried its 60-millionth passenger.

In the latest of our Leaders of Travel: Skift C-Suite Series, we sit down with Muñoz.

Shaking Off Pandemic Problems

Skift: You had a fairly tough time during the pandemic. Can you give us some context on how 2024 is looking compared to recent years?

Carlos Muñoz: In 2020, from memory, we lost €66 million, and in 2021 we reduced that to €38 million. Remember, this is a company that had been profitable in the previous six years. We thought 2022 was going to be the turnaround year, and then in February Russia invaded Ukraine. That was a tragedy for Ukraine, for Europe, and for the world. Fuel prices go up. We have always hedged, but Covid-19 killed the hedging possibility. So 2022 was actually our worst year.

But things have picked up more recently?

What went right in 2023 is that there was no big pandemic and no big war starting, although [the Russia-Ukraine war] did unfortunately continue. Demand was super strong and it remains so into 2024. You read figures published by the public airline companies, I can tell you that as a private company, I see the same, if not more. We’re seeing a strong pricing environment.

Fueling IPO Speculation

With a strong performance last year and momentum continuing into 2024, there has been a lot of speculation that an IPO might be on the cards. What’s the latest thinking around that?

We are IPO-ready, but this is not just a statement. It’s a lot of work behind the scenes with a lot of banks and lawyers. But for the IPO, or IPOs in general to happen, we need the markets to be ‘IPO open’. That’s starting to happen, but it depends on a lot of factors that are obviously outside of our control. However, if things in capital markets remain well and specifically if large IPOs are happening and they perform well in the market, then smaller IPOs including Volotea will take place.

What do you think makes Volotea such an attractive proposition?

We’ve had a lot of interaction from people that say they like Volotea’s strategy – its uniqueness, and growth potential. It’s a very differentiated company from the others; it’s the only low-cost airline dedicated to small cities. It has way less competition than anybody else. Volotea has this beautiful cost trajectory and we keep on winning at The World Travel Awards and at Skytrax. We connect cities like nobody else, at a pretty decent price and provide a good experience.

You’ve mentioned the things that make Volotea an attractive proposition from a customer and IPO investor perspective. What about somebody just buying you outright? As an independent, privately owned airline you must have had some interesting discussions?

I’d say just like with an IPO, it always takes two. Of course, it isn’t only my decision, but as CEO and co-founder, I think I influence things a little bit. Our preferred path is definitely the IPO. We’ve always said this as it will help pay the bill for Covid-19 when we really took on a lot of debt. We want to strengthen the balance sheet, that’s really what the IPO is about, it’s essentially new money.

It’s also important to note that – not in the sense that you’re asking about direct ownership – but we’re already very complimentary with other airlines. We look at them as cooperation opportunities and I think as the years go by, and we keep on growing, there will be more of those.

There’s Life After Boeing

You were Europe’s last major operator of the Boeing 717. How transformational has your fleet renewal program been?

Although Covid-19 was very negative, one huge thing that came with it was a structural fleet change. We got rid of the 717s. They were a good plane and reliable, but cost-wise it went from being decent to being outrageous. They were quite costly – a big drag. If the pandemic brought one good thing it is that we agreed with Boeing the early transitioning out of the aircraft.

You now have an all-Airbus fleet, however some of the A319s are getting pretty old. What is the strategy for life after the A319?

That’s a very good question, and we have an answer. I cannot tell you all of it, but we are very long-term planning. For around three-quarters of our markets, the perfect seat capacity is 180. We won’t jump higher because that’d be a change in strategy. If I was competing with Ryanair or Wizz Air or any of those guys on the bigger routes I think probably the A321 would be the better equipment.

Our average route size at Volotea is 28,000 seats per year. That compares to my first airline Vueling, which is now at 150,000 seats, which is almost six times our amount. EasyJet is around 100k, Ryanair is 75 to 80k. So you can see our strategy is not just a slogan or whatever, it’s data.

What about the Volotea routes that cannot sustain an A320?

If you look at our network there are different markets where the 150-seater size works better. So, yes, we want to keep some A319s and when those expire, when they become non-fuel efficient, we’ll be looking for aircraft in that gauge, as that’s the sweet spot for about a quarter of my markets. Obviously, you have the Airbus A220, the Embraer E2 – we’re talking in that sort of space.

The Biggest Challenge?

By co-founding Vueling and now Volotea, you’ve proved your aviation credentials. Do you ever wake up in the morning and ask where your next challenge lies?

I still need to come out of Covid. My challenge is to fix the balance sheet and put Volotea back in a strong financial position like it was in 2019. Don’t get me wrong, we weren’t Microsoft – we didn’t have $40 billion in cash – but we had zero debt. If you look at the industry globally, we’ve gone from $450 billion debt to $650bn [post-pandemic]. So I need to be sure that we go back to a solid balance sheet. That’s my biggest challenge. Then after that, I intend to work for many years as I love this industry.

This interview was edited for clarity and length.

Airlines Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of airline sector stocks within the ST200. The index includes companies publicly traded across global markets including network carriers, low-cost carriers, and other related companies.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more airlines sector financial performance.