Skift Take

Wyndham execs and board members more forcefully rejected Choice Hotels' current terms for a merger on Thursday. But they explicitly left the door open to a more generous offer from a market player.

Wyndham’s executives talked at length Thursday about why they wouldn’t accept the unsolicited bid from Choice Hotels – a $9.8 billion buyout offer after assuming debt.

“With no organic growth, a less vibrant loyalty program, and virtually no international capabilities in Choice’s platform, we are, frankly, not surprised [Choice made a hostile bid to merge],” said Stephen Holmes, chairman of Wyndham’s board. “Our business offers a medicine cabinet full of remedies.”

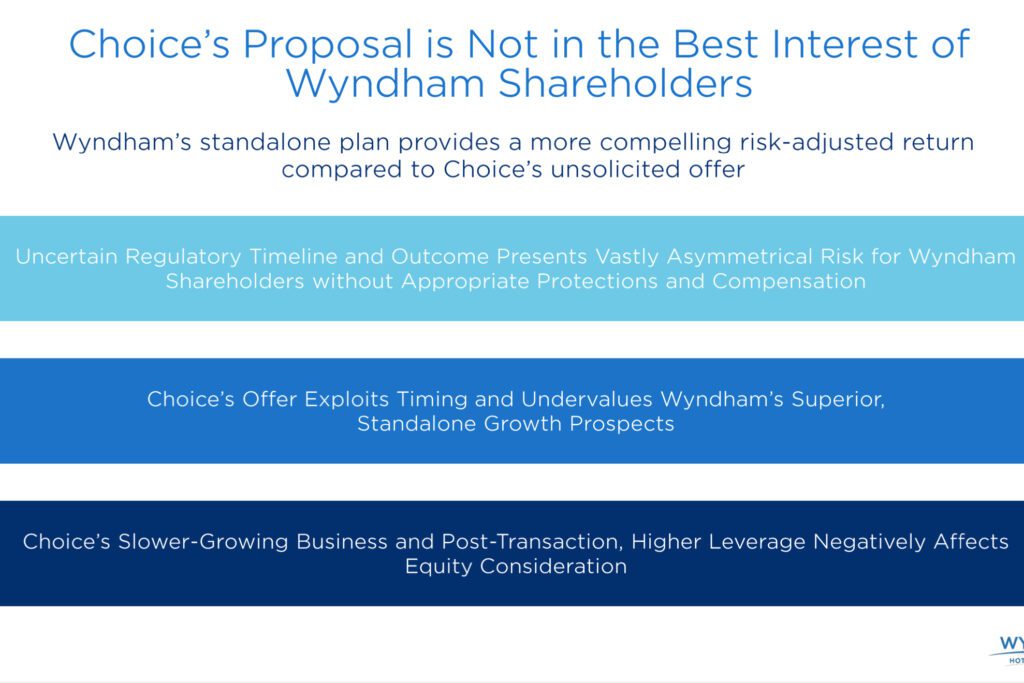

Wyndham released a presentation outlining why it believes it would be smarter to go it alone. (Embedded below.)

But Wyndham execs didn’t slam the door shut. “The ball is really in their court,” Holmes said.

Choice Hotels on Wednesday called on Wyndham to return to merger talks.

“Their plan seems to be to put out repetitive press releases and see if they can turn the water enough to make it interesting for us,” Wyndham’s Holmes said. “That’s a bit of a desperate plan.”

Wyndham’s Top Objections

Wyndham executives highlighted “execution risk,” a lack of cash up-front, and Choice’s alleged weaker performance as its top hesitations about a deal.

“Asymmetrical” risks, including antitrust review

- Wyndham noted that U.S. antitrust investigations are “at historic highs” and that a “combination between direct competitors” would likely be “subject to rigorous regulatory review.”

- Wyndham’s Holmes claimed that Choice Hotel execs first claimed in talks that deal approval might only “take three months.” But they eventually agreed that a deal might be “subject to Federal Trade Commission second round review, which typically takes 12 to 18 months,” in Wyndham’s words.

- “If this uncertainty were to persist for an extended period of time, some portion of our development and openings may not materialize, which compounds over time,” said Wyndham CEO Geoffrey Ballotti.

- “God only knows how they can get a deal through the FTC [Federal Trade Commission] where we are not a willing participant,” Holmes said.

Wanting more cash upfront

- Choice’s offer relies on a mix of 55% cash and 45% stock.

- “The fixed value of the cash portion offered to our shareholders would not be realized until the

conclusion of an extended regulatory process, which our advisers estimate could take 12 to 18 months,” Ballotti said. - “While the offer may have had an initial headline of $90 per share, the proposal is currently worth less and may continue to fluctuate in value over time as it includes a significant amount of stock consideration,” Ballotti said.

But Wyndham is open to a transaction with the right partner

- “This is less about the industrial logic and way more about the risks that we discussed,” Ballotti said. “There are 9,500 branded economy hotels. There are 22,000 nonbranded hotels in the U.S. economy space. And certainly, there are synergies in scale and size and scope.”

Choice Wyndham Merger Has Been Floated for Two Decades

In surprising candor, Wyndham’s Holmes — who was chairman and CEO from the company’s birth in 2006 until 2018 — admitted that overtures for a merger with Choice had been floated for nearly the entire life of Wyndham as a hotel group.

- “Twenty years ago, I negotiated a deal to buy Choice,” Holmes said. “And I never talked about it because it’s not appropriate, but we negotiated a deal. The capital markets turned on us, and the credit was not available to make an all-cash offer, which is what was desired from the other side.”

- “Choice has contacted us multiple times over the years, and we’ve told them, we’ve looked at it, we’ve decided what’s in the best interest of our shareholders, and nothing has been done about it,” Holmes said.

Talk Getting Harsher

Wyndham has begun responding with tactics that will make it tougher to get a deal done.

- The company said some of its franchisees (without giving a percentage estimate) were “concerned about losing Wyndham’s owner-first philosophy.”

- “I don’t think our Days Inn or Super 8 owners on any street corner in America would want to share their guests with a Choice, Econolodge, or a Roadway owner across the street who they compete with,” Ballotti said.

- “I was ecstatic when I saw Wyndham rejected the bid,” said Swapnil Shah, President, MIC Hotel Corp, owner of Ramada Plaza Resort International Drive, in a quote Wyndham publicized. “I don’t believe Choice has the talent or the desire to instill an owner-first philosophy into their organization.”

- “They have some serious issues within their organization,” Holmes said. “It seems like a desperate grab to try to solve problems that the company has.”

- Choice Hotels has had “seven consecutive quarters of negative organic growth, combined with its declining pipeline,” Ballotti said. “This challenging growth profile will only be exacerbated should Choice be required to operate within the proposed excessive leverage profile that this transaction would require.”

- “Choice has used M&A [mergers and acquisitions] to mask its lack of organic growth through the $675 million acquisition of the rights to use the Radisson brand in the Americas, which has accounted for the entirety of their reported system growth since the transaction closed of August of 2022,” Ballotti said.

- In contrast, Wyndham forecasted for 2024 “a 7% to 8%” organic annualized EBITDA (earnings before interest, taxes, depreciation, and amortization) growth for 2024.

- “We saw growth in our mid-scale, great growth in our international direct franchising business,” Ballotti said of its third quarter results. “And our pipeline is sitting at a record level of 13 consecutive quarters.”

- “Franchisees are choosing us more so than they’re choosing Choice, as you’ve seen over the last few years,” Ballotti said.

- “Retention rates, we feel, are really the best measure of franchisee engagement,” he said. “Our economy retention rates are several hundred basis points ahead of Choice’s.”

- “We know that the other side is out there saying a lot of things that are not attractive to us and that make it more difficult to transact business,” Holmes said.

Harsher talk may encourage Wyndham franchisees and stockholders to reject any offer — even a more generous one.

“It’s hard for us to say no more than we’ve already said no,” Holmes said.

Already, investors are skeptical a deal will happen given how they are pricing the two companies’ stocks, as Skift Research has explained.

However, perhaps another player, like Blackstone or IHG, may make a move.

“When I first heard from the other side, their question was, ‘Are you prepared to transact?'” Holmes said. “And I said, “Well, I’m always prepared to transact if it’s in the best interest of our shareholders.'”

Daily Lodging Report

Essential industry news for hospitality and lodging executives in North America and Asia-Pacific. Delivered daily to your inbox.

Have a confidential tip for Skift? Get in touch

Tags: earnings, future of lodging, hotel earnings, wyndham, wyndham hotel group

Photo credit: The Wyndham Orlando Conference Center Celebration, owned by AD1 Global, in Florida. Source: Wyndham.