Skift Take

This is in essence a hostile takeover, and the acquisition may not go through. But if it does, it will create the largest budget hotel player in North America.

Choice Hotels on Tuesday made a hostile bid to acquire all the outstanding shares of competitor Wyndham Hotels & Resorts at a price of $90 a share, assuming a $7.8 billion valuation. Wyndham publicly turned down the unsolicited offer from Choice Hotels.

The potential deal would create the largest franchisor of budget hotels in North America. Together, they would run about 16,360 properties from budget to luxury.

Under the proposal, Wyndham shareholders would receive $49.50 in cash per share and 0.324 shares of Choice common stock per share.

Wyndham responded on Tuesday that Choice Hotel’s hostile offer undervalued Wyndham’s growth potential and involved risks. Choice Hotels probably doesn’t have much room to bid higher without upsetting its own shareholders, said analysts at Truist in a flash report.

The Case for a Merger of Hotel Groups

Choice Hotels president and CEO Patrick Pacious made a concise argument on CNBC on Tuesday:

“Costs for our franchisees are rising,” he said. “By bringing the two companies together, we believe that through direct bookings, lower operating costs, and a much more robust rewards program, we have an opportunity to help the owners — our franchisees — really improve the value of their assets and the return on investment.”

Having a greater scale bolsters the effectiveness of loyalty programs and brand marketing, which can help hotel companies drive more customers to book directly and lower the costs of distribution by reducing exposure to third-party commissions paid to online travel agencies.

Patrick Scholes, an analyst at Truist Securities, and his colleague Gregory Miller liked the proposed offer in a flash report: “This is an attractive offer for Wyndham shareholders, though we note its chairman (and former long-time CEO) is very well-versed in M&A [mergers and acquisitions] and may be strategically holding out for a somewhat better offer from Choice or from someone else.”

Wyndham’s Hesitation

Wyndham’s management and board are less convinced of the merits of the proposed deal, believing it undervalued Wyndham’s growth potential and involved risks.

On August 22, Wyndham’s board responded to a revised Choice proposal by saying the offer undervalued Wyndham’s growth potential.

Wyndham asked Choice to sign a mutual confidentiality agreement so it could receive more insight into that company’s performance, helping ease its worries about potential business and execution risks for a deal. Choice refused then and in later conversations, Wyndham said.

“During the course of September 2023, Wyndham’s counsel held multiple conversations with Choice’s counsel to discuss regulatory and execution considerations,” according to a Wyndham statement. “But Choice was unwilling to propose any mitigations to address Wyndham’s concerns about these risks and was unable to provide any convincing evidence of a pathway to resolve concerns raised by Wyndham.”

Valuing the Hotel Companies

The deal Choice proposed on Tuesday, which it spelled out on a website, represents approximately a 30% premium to Wyndham’s latest closing price.

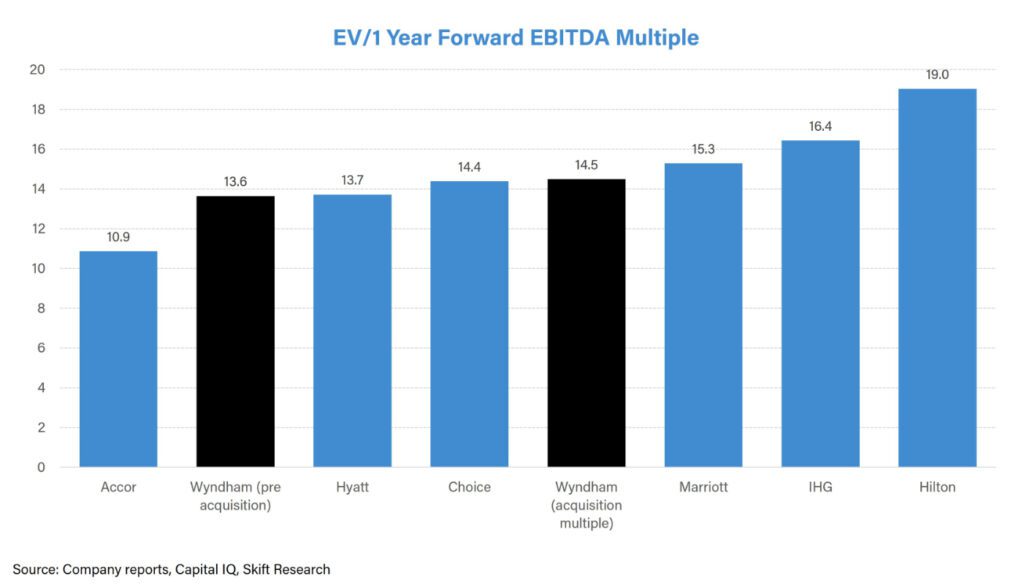

“Wyndham currently trades at an enterprise value/1-year forward EBITDA [earnings before interest, taxes, depreciation, and amortization] multiple of 13.6x, trailing U.S. peers,” said Pranavi Agarwal, Senior Research Analyst at Skift Research.

“With the assumption of Wyndham’s net debt, the proposed transaction is valued at approximately $9.8 billion,” said a company statement.

“Using that $9.8 billion figure and a 1-year forward consensus EBITDA number means that a potential merger would value Wyndham at a multiple of 14.5x — in line with Choice and above more luxury-skewed Accor and Hyatt,” Agarwal said.

Scholes and Miller at Truist pointed out that Wyndham had never traded at 14.4 times its earnings outside of the pandemic’s unusual disruptions.

“This premium is respectable to us,” the Truist analysts wrote.

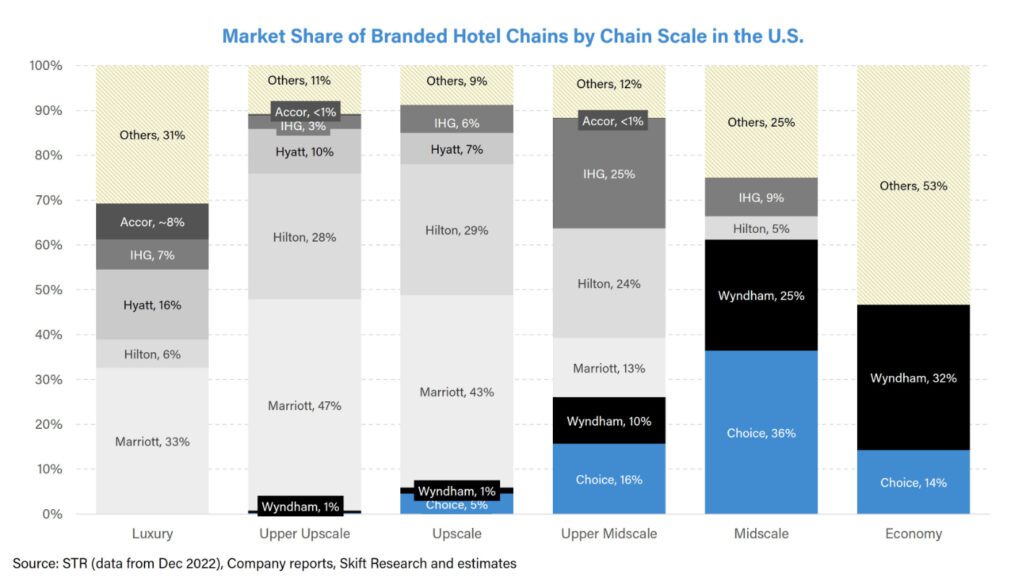

“Of any company that would acquire Wyndham, we view Choice as the most natural candidate given a fairly similar portfolio makeup in the U.S,” they added.

A chart from Skift Research noting the similarities underscored this point:

Months of Merger Talks

Skift had reported earlier this year on rumors of a possible merger, as well as why some analysts were skeptical.

But formal talks began in recent months. Choice and Wyndham were in a negotiable range on price and consideration,” Choice said Tuesday. But Wyndham walked away.

“We remain convinced of both the many benefits of the combination and our ability to complete it,” said Pacious.

Different Companies, Different Strengths

Both companies have big positions in the mid-tier market, which has become increasingly interesting to hotel groups, as noted by Skift Research’s recent report: Battle of the Midscales: Wyndham vs Choice in 20 Charts.

Choice Hotels is the Rockville, Maryland-based operator of nearly 7,500 hotels spanning 22 brands, including its flagship upper-midscale brand Comfort and roadside midscale brand Quality Inn.

Wyndham, a Parsippany, New Jersey-based hotel operator with approximately 9,100 hotels and 842,500 rooms, is best known for its budget brands, such as Super 8 and Ramada. But its 24 brands also include higher-end properties, such as Dolce, Wyndham, and Wyndham Grand.

Choice has repeatedly said its strategy consists of expanding its portfolio with hotels that generate higher royalties per unit, meaning higher-end properties.

Stock Price Gyrations

“While a hostile takeover attempt is never something that the industry looks forward to, and there are plenty of unanswered questions on the chain of events that Choice disclosed, this is a way to get the sector and lodging stocks back in the spotlight, right before the start of earnings season,” said Alan Woinski, editor of Daily Lodging Report.

Wyndham was up 15% pre-market. Choice was down 2%. Since the market opened, Wyndham has pared gains and for about 90 minutes stopped trading, while Choice has remained down.

“Choice has in recent history traded at a premium to Wyndham, despite Wyndham reporting higher EBITDA margins post-Covid and faster EPS (Earnings per share) growth through 2019-2022,” Agarwal said.

Have a confidential tip for Skift? Get in touch

Tags: choice, choice hotels, choice hotels international, future of lodging, mergers and acquisitions, wyndham

Photo credit: The Wyndham Orlando Conference Center Celebration, owned by AD1 Global, in Florida. Source: Wyndham.