Skift Take

Google is constantly tweaking its hotels platform and we see its latest iteration contributing directly to the democratization of the online travel industry.

Skift Research has conducted an extensive data-scraping of the Google Hotels platform to understand Google’s role in the hotel distribution landscape.

We wanted to understand the following: how hotels are listed on Google, which OTAs are bidding for bookings, and whether Google is aiding direct bookings to compete more head-on with online intermediaries.

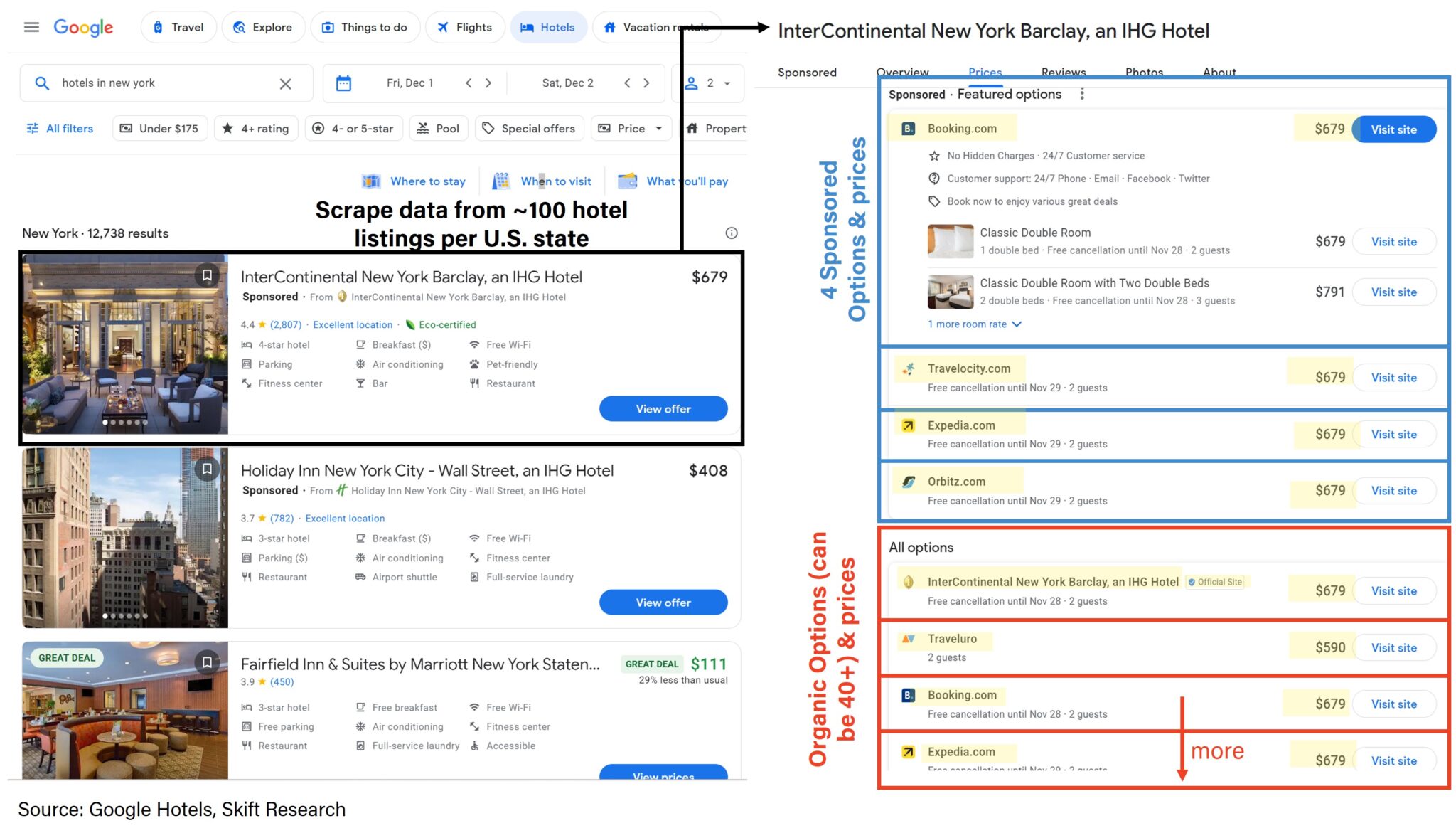

We scraped data from over 5,000 hotel listings across the U.S. (roughly 100 hotels per U.S. state). For each hotel listing, we scraped the booking options and their corresponding prices across both the sponsored (paid) box and the organic (free) box.

In total, we analyzed more than 130,000 data points: 40,000 from the sponsored options and more than 90,000 from the organic options.

Why Did We Do It?

As we wrote last year in A Deep Dive Into Google’s Impact on Travel 2022, “Google is the single most impactful advertising partner for the travel industry,” with travel companies likely spending more than $10 billion on Google’s performance ads in 2022.

Google has seen a big rise to the top of the booking funnel. While it is generally agreed that Google Hotels has outcompeted other metasearch engines, such as Tripadvisor and Trivago, a key question is whether it has disrupted the legacy OTAs.

Recent changes to Google’s display of hotel listings could put the duopolistic power long-held by Booking and Expedia at risk.

In March 2021, Google Hotels launched free organic listings in addition to paid ads, with Google Travel’s VP of product management at the time saying: “This is an opportunity for us to show that we have a full range of pricing” and to “drive more traffic for the ecosystem as a whole.”

The introduction of organic results has led to increased fragmentation and price competition within the underlying market. For a metasearch engine such as Google, this is good for business – but for Booking and Expedia, a cause for concern.

A Deep Dive into Google Travel Part I: U.S. Hotel Distribution

What Did We Learn? 3 Key Insights

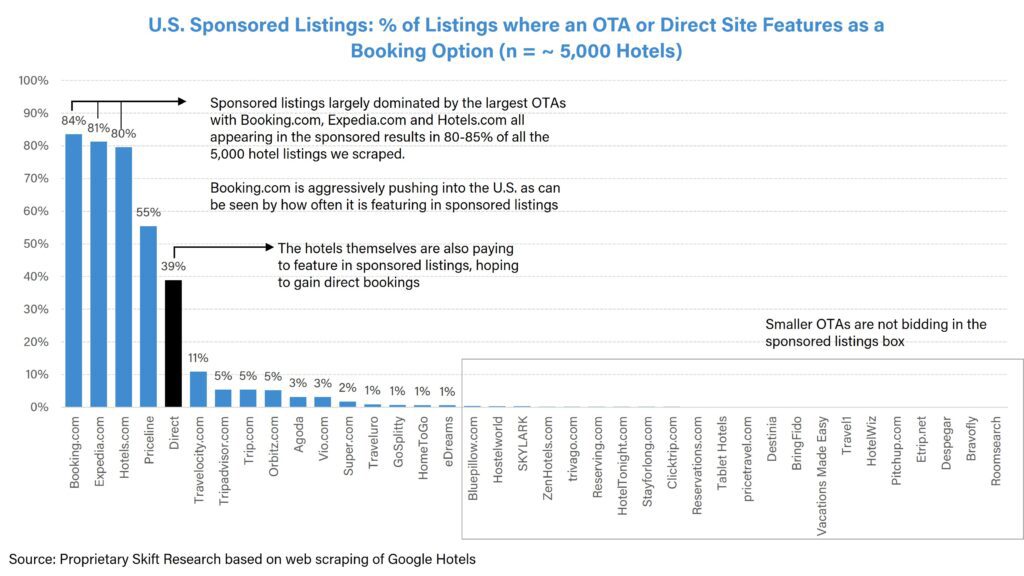

Key Insight 1. Paid sponsored listings are dominated by the largest online travel agencies (OTAs), whereas smaller OTAs are less likely to bid in the sponsored results box. There are also clear signs that Booking.com is targeting market share in the U.S., with it being the most likely to feature in the sponsored results, followed by U.S. incumbent Expedia.com.

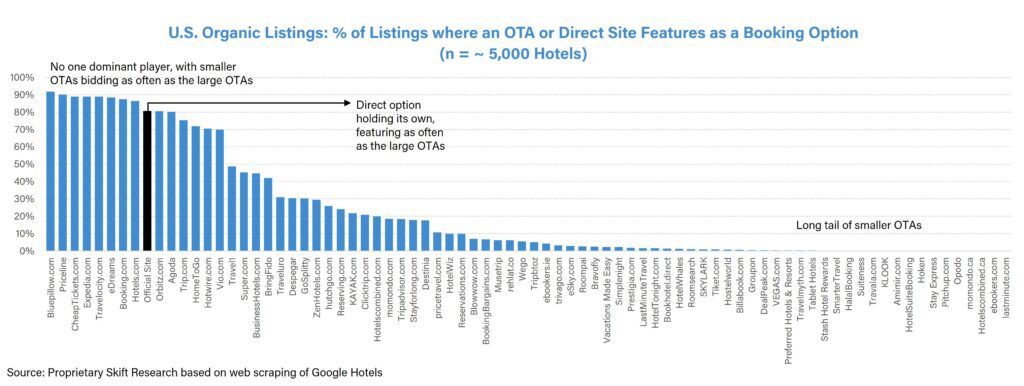

Key Insight 2. The introduction of organic results is leveling the distribution playing field – allowing the direct site and smaller OTAs opportunity to compete head-on with Booking and Expedia.

Whilst the largest OTAs dominate the paid sponsored listings, in the free organic results, there is no one commanding player, with Expedia.com and Booking.com as likely to appear as the official direct site and OTAs such as cheaptickets.com and bluepillow.com.

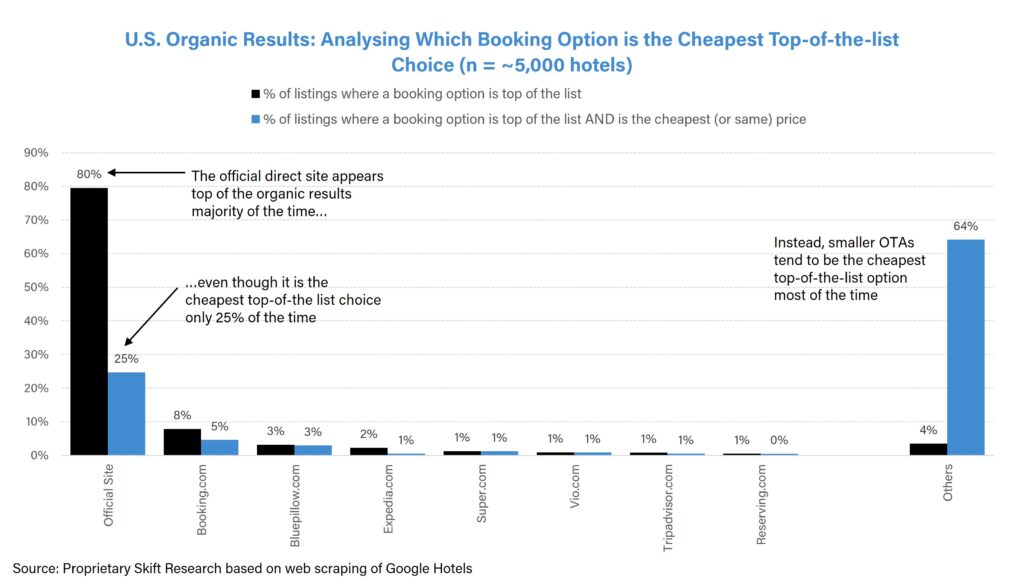

Key Insight 3. Google Hotels actively prioritizes the direct site in its organic results, with the official site most likely to appear top of the organic list, even when it is not the cheapest option. Google is playing an increasingly important role in the dis-intermediation and disruption of the legacy OTAs by aiding the shift to direct bookings.

Read the full report for more analysis of Google’s role in the evolving distribution landscape.

This report focussed on U.S. hotel distribution and is Part I of our web scraping series on Google Travel. In Part II of the series, we will consider a global perspective by comparing key metrics and attributes of U.S. hotel distribution across other regions of the world, such as Europe, Asia Pacific and the Middle East. Stay tuned for more.

Additionally, if any of our readers have ideas and suggestions for further analysis of this rich dataset, please get in touch with author Pranavi Agarwal at [email protected].

We would like to acknowledge that this report was inspired by work done by Bernstein’s Global Hotels & OTAs team led by Richard Clarke.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: advertising, booking, direct booking, expedia, future of lodging, google, Google Hotels, hotel ads, hotel distribution, online travel newsletter, otas