Skift Take

Will the experiences sector ever be fully online? Industry analysis paints a doubtful picture, but there's considerable room to scale and grow, with the current volume at some 30% and key industry players owning marginal stakes.

Ongoing demand for experiences points to a potential market worth hundreds of millions of dollars. With 70% of tours and activities still offline, companies are investing in tech that reduces booking friction and also enhancing the in-person experience.

This fragmentation of the tours and activities sector and the opportunity for online travel agencies and travel businesses to increase their market share will be a big discussion at the Skift Global Forum in New York on September 26-28. We’ll be hearing from industry leaders Airbnb, American Express Travel, Expedia, GetYourGuide, Google, and Intrepid.

1. Experiences Need to Deliver Unique Value

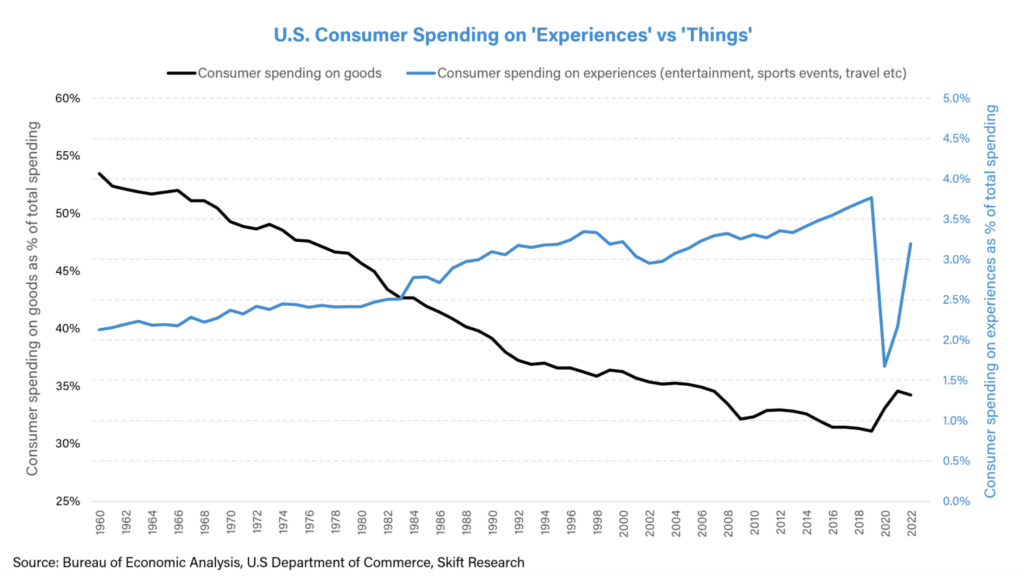

Skift Research analysis shows travelers’ appetite for immersive experiences remains strong, with travelers caring more about “creating a travel experience that meets their expectations than about the cost.” We spotlighted the Rise of the Experiential Traveler at Skift’s Global Travel Forum in 2015.

This year, we’ll be digging into how travel companies are trying to tap into this vastly under-served tours and activities segment. Curating branded experiences, such as TUI’s plan to further invest in its Collection Experiences and the relaunch of Originals by GetYourGuide earlier this year, are just some of the examples we’ve seen.

GetYourGuide’s Originals launch with ‘Turning the Lights On at the Vatican Museums‘ saw 15,000 people applying for the initial one of the seven limited tours in 2022. TUI Collections, as an example, offers a full-day Majorca tour in Spain, including a vintage train ride and catamaran cruise to Sa Calobra beach, guided by TUI staff, and including TUI transfers. Hospitality brands have also gotten into crafting more unique experiences, such as Marriott Bonvoy’s Moments.

While Airbnb has halted the intake of new experiences to “perfect its core services”, Airbnb CEO Brian Chesky’s vision for the platform is a closely anticipated discussion at this year’s Skift Global Forum.

2. Turning the Unit Economics of Experiences into a Profit

Online marketplaces or distribution platforms account for less than 30% of the booking landscape, with no single business owning more than 5% to 6% of the market for experiences, forecast to be $300 billion by 2025.

With its two-branded experiences strategy enhanced through Viator, Tripadvisor now sees experiences account for half of its earnings. However, meeting the demand through paid search and performance marketing means sacrificing profitability for growth. As the only other public experiences platform, TUI moved a third more bookings in its last quarter. Still, it reports low single-digit EBITDA growth.

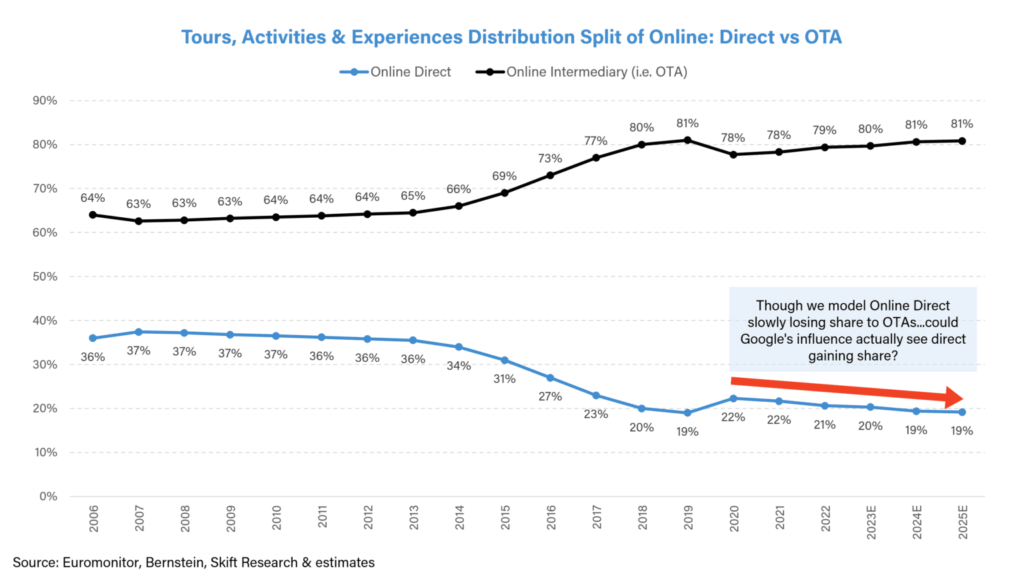

“The tours, activities & experiences market is a lucrative and under-explored opportunity in the travel industry. Its high fragmentation, influx of small suppliers, and rapid shift from offline to online makes it a goldmine for online intermediaries to gain market share from traditional offline players,” said Senior Research Analyst Pranavi Agarwal, as detailed in her deep dive report into the tours and activities sector.

3. Who has the Most Influence to Drive Bookings?

The market is fiercely competitive among the big players at the top of the funnel. And expensive. This means the travel industry will continue to weigh whether experiences are a viable path to profitability or a means to grow the lifetime value of loyal customer bases.

We’ll look to unpack this competitive race to be the best vertical search engine for discovering and booking travel experiences, even as tech giants like Google recognize the sector’s potential.

The display of Google’s Things to Do listings allows smaller platforms to bubble up their search presence and improve direct bookings.

But Google remains a search engine, with paid search revenue streams. Pitting smaller tour operators against major platforms with big marketing budgets further amplifies the competition between the various platforms, and the need to find the right display to win new customers.

These are just some of the themes we’ll discuss at the Skift Global Forum in New York on September 26-28.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, amex, experiences, getyourguide, sgf2023, skift global forum, tours and activities, viator

Photo credit: Person making an online credit card purchase. Unsplash / Unsplash