Skift Take

Google’s Things To Do tool has been met with both trepidation and excitement. In the tours and activities space, unlike other travel verticals, we expect that Google will benefit the online intermediaries, giving prominence to online travel agencies.

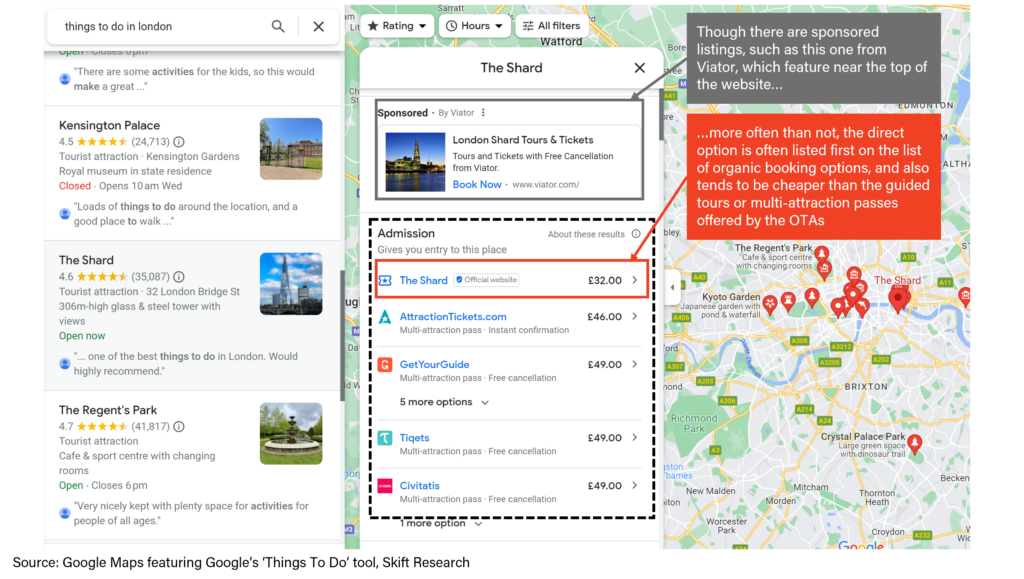

In September 2021, Google launched an advertising product called Google Things To Do, which lists not only the top attractions in a city but also options to book tickets via direct sites or online travel agencies. As we show in the screenshot below, though Google displays paid sponsored listings near the top of the site, its main organic booking list prioritizes the direct website over the sites of aggregators such as Viator, GetYourGuide and Musement, to name a few.

As an exercise to test how often the direct site does appear top of the list, and also to understand which online travel agencies are listing on Google’s Things To Do tool, we ran a web scraping analysis across 40 cities in each global region, looking at the top 10 booking options listed for the top 20 attractions in each city.

As we show in the chart below, the direct site appeared on a 100% of attractions, followed by a long tail of online travel agencies, with the top 4-5 positions below the direct option primarily being the large players such as Trip.com, GetYourGuide, Klook, Tiqets etc. Though there are regional leaders, such as GetYourGuide in Europe and Trip.com and Klook in Asia, there is no one dominant player – with even the current leaders only listing on ~50% of attractions. This goes to show how fragmented the booking landscape is today.

The first option was always the direct website, with the 2nd-5th options getting progressively more fragmented as more niche players attempt to (organically) bid on a booking.

Google is very clear on its ranking system with its website noting that: “tickets are ranked based on several factors, but mainly by price. Official tickets are given preference in the ranking. Ticket suppliers don’t pay Google to appear in these search results and can’t pay to influence their ranking.”

It is perhaps of no surprise to see Trip.com often come top of the booking list, being well known to discount prices (by giving up a share of their take rate) as a way to undercut competitors. We also note that neither Booking.com nor Expedia featured in any of the booking options.

Google’s entrance into the space has been met with both trepidation and excitement. While Google Hotels and its practice to prioritize direct bookings over the online travel agencies has proved to be a formidable competitor to the likes of Booking and Expedia in the hotels industry, in the experiences market we expect Google to be more friend than foe.

This is inherently due to the vastly fragmented nature of tours, activities & experiences which demands a strong aggregator, with direct options less likely to gain traction.

For example, we interviewed Laurens Leurink, CEO of Tiqets, who commented: “I think Google is still hugely challenged in finding the right interface. Because if you want to compete with every provider on a whole diverse range of experience through one user interface, that’s quite challenging.”

Though still in early phases of developing Things To Do to the same scale as Google Hotels or Google Flights, the fragmented nature of the experiences market means that Google is likely to focus primarily on the large headline attractions for which there will be a direct website in addition to several OTA booking options.

However a vast portion of the experiences market doesn’t have its own website, and instead relies on reservation technology providers or the online travel agencies as a predominant distribution channel. Therefore small operators who do wish to list directly on Google will have to partner with a booking site or reservation technology company in order to integrate with Google’s systems.

Therefore, while Google is certainly aiding in the shift from offline to online, we ultimately expect the online intermediaries to continue gaining share of bookings.

Read the full deep dive report for a comprehensive overview of the tours, activities & experiences industry and to understand why it is such an opportunistic segment for online intermediaries within the online travel landscape.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: experiences, google, online travel, online travel agencies, skift research, tours and activities

Photo credit: AI generated image showing a tour of an art museum. Image created on Midjourney.