American Airlines Hits Smaller Hubs With Steeper Airfares Through Legacy Channels

Skift Take

It's been a fortnight since the American Airlines' airfare shakeup, and travel agencies continue to report fairly large discrepancies and some confusion — including a twist involving the carrier's smaller hubs.

Business travel platform AmTrav said its corporate customers pay more when not going through American's New Distribution Capability platform on at least 34 percent of bookings, with the difference averaging $128. However, one agency told Skift a gap of more than 400 percent recently appeared.

To recap: American Airlines told travel agencies and online booking tools they need to start using New Distribution Capability connections to continue to access its full range of fares, as the airline pulled some 40 percent of the fares from what the airline calls third-party legacy technology platforms (that use decades-old Edifact technology.)

This includes the global distribution systems Amadeus, Travelport and Sabre. But these three tech companies also offer New Distribution Capability channels with similar capabilities to American's own platform.

The issue at hand? Many agencies still book through these so-called third-party legacy technology platforms. They argue there are better workflow issues, and it's harder to amend tickets directly with airlines. There are also technology and commerical issues at play, as not all agencies can easily adopt the technology needed (although American and countless other airlines will argue they, alongside the booking tools, have had time to prepare.)

“We are definitely seeing huge differences in fares,” said Olga Ramudo, president and CEO of Express Travel, located in Coral Gables, Florida.

She cited one consultant who looked at a Miami-New York LaGuardia round-trip. They found $1,529.80 for a first-class regular "legacy" fare through Sabre. The New Distribution Capability equivalent for that first-class fare was considerably lower at $1,029.80.

“Another market, Miami-Atlanta, where Delta is a big competitor, the difference was $120.00," she added.

Smaller Hubs

According to AmTrav, American Airlines has raised non-New Distribution Capability fares more in its smaller hubs like Miami, Phoenix and Chicago compared to larger hubs like Dallas, Charlotte and Philadelphia.

Experts argue this could be because there's less competition in these smaller hubs, so the airline can afford to do so. It also acts as an incentive to adopt the new channels.

A spokesperson for American Airlines said it does not comment on fare pricing.

The airline also points out that it has not raised fares, but instead changed the technology that third parties can use to access its content, so there will be differences in pricing. In December last year it told travel retailers that enhanced, value fare categories were to be implemented from April.

"There is a misconception that only American's basic economy and certain leisure fares are impacted, but the data we've collected shows us that American New Distribution Capability has much lower fares for corporate customers on many economy and first-class bookings," said Jeff Klee, CEO of AmTrav.

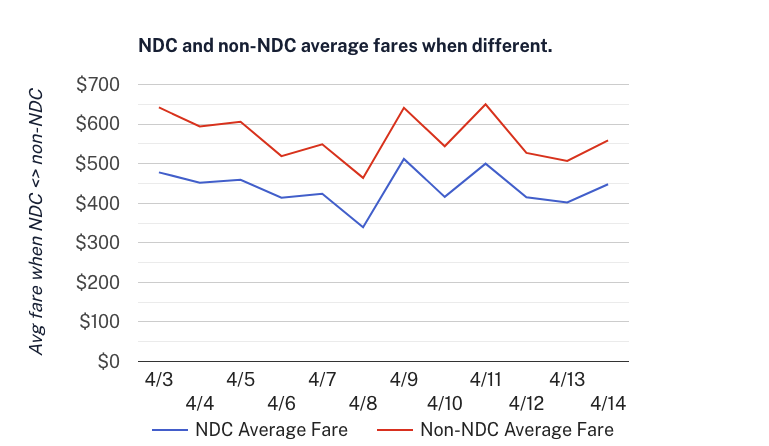

AmTrav has launched a daily fare tracker, such as shown in the accompanying chart.

“Smaller airports are showing a difference,” confirmed one travel consultant at a U.S. travel agency.

The travel consultant made this comparison: for Charleston, South Carolina to New York's LaGuardia, American’s direct price (AA.com) produced $177.81 per person. The lowest "legacy" fare through Sabre was $927.79 per person, meaning a difference of more than 400 percent.

However, the CEO of a Parsippany, New Jersey based agency told Skift it was difficult to establish a pattern.

“For corporate travelers flying during peak times, we are not seeing many lower New Distribution Capability fares at all,” said Marie Magliano of Uniglobe Travel Partners. “In some cases, yes, but, a very small percentage. In fact, in some cases, New Distribution Capability fares are higher.”

Meanwhile the American Society of Travel Advisors is continuing to protest American Airlines’ decision.

“We are disappointed that American Airlines has chosen to define transparency and competition as obscuring content from existing comparative shopping channels and preferencing its own non-comparative direct booking with lower prices for the same seats,” said president and CEO Zane Kerby. “We hope the Department of Transportation will take up this issue, but it’s more likely American Airlines’ anti-competitive behavior is an issue for the Department of Justice to investigate.”