Calling Booking.com a Gatekeeper Wouldn’t Have the Impact European Regulators Expect

Skift Take

Dennis' Online Travel Briefing

Editor’s Note: Every Wednesday, Executive Editor and online travel rockstar Dennis Schaal will bring readers exclusive reporting and insight into the business of online travel and digital booking, and how this sector has an impact across the travel industry.Online Travel This Week

One can make the argument that fears about the European Commission’s pending decision to designate certain companies as “gatekeeper platforms” to ensure fair competition in hotel bookings among online travel agencies, hotels, and metasearch engines could turn out years from now to be overblown.

In 2020, European Commission antitrust czar Margrethe Vestager floated the idea that Booking.com and Google might be designated as such gatekeepers, and be given certain mandates to limit their sway over European hotel bookings.

But at least in Booking.com’s case, a recent European Commission Market Study on the distribution of hotel accommodation in the EU, cast some doubt on the merits of such a designation on several levels.

The following are five takeaways from the European Commission report:

1. Booking.com Was the Dominant Online Travel Agency But It Doesn’t Have a Monopolist Grip

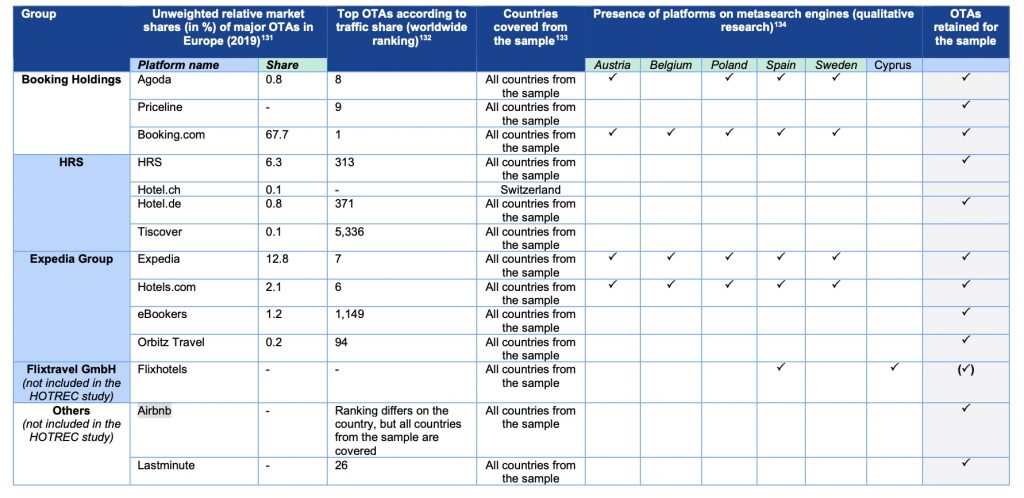

When the European Commission considers whether to designate Booking.com a gatekeeping platform, worthy of measures to ensure fair competition in European hotel sales, the commission would have to consider the question through several lenses.

Yes, according to the European Commissions’ findings, based on 2019 data, Booking.com commanded 67.7 percent of major online travel agencies’ market share of hotel bookings. That compares with just 16.3 percent for Expedia Group brands (Expedia.com was 12.8 percent), and 6.3 percent for HRS.

However, the nine properties that were affiliated with hotel chains that responded to a survey indicated that they used global distribution systems, corporate or group bookings for 58 percent of their sales in 2021, compared with just 24 percent of sales coming through online travel agencies. So Booking.com was hardly the dominant vendor for hotel chains.

However, unlike in North America, independent hotels are a much more important part of the European landscape than are hotel chains. The survey found that independent hoteliers indeed used online travel agencies for 44 percent of their sales in 2021 compared with just 18 percent of sales through chain and hotel websites. So the online travel agency channel was much more of a power broker for independent hotels than for chains. However the sample size of the survey — 15 hotels — was clearly limited.

Sales Channels Used by Hotel Chains and Independent Hotels in 2021

| Sales Channel | Hotel Chains Average | Independent Hotels Average |

|---|---|---|

| Sales through OTAs | 24% | 44% |

| Sales through travel agengies, tour operators | 1% | 6% |

| Sales through bed wholesalers | 4% | 2% |

| Sales through chain and hotel websites | 13% | 18% |

| Sales through GDS, froup bookings, corporate bookings | 58% | N/A |

Source: Survey published by the European Commission

Designating Booking.com as a gatekeeper platform could in theory have a significant impact on the brand and its parent company because the label could come require the imposition of “fair terms” in hotel contracts, and “prohibitions from using wide or narrow retail parity clauses or equivalent commercial measures,” according to the European Commission.

However, it’s impossible to know at this point what prohibitions the European Commission would ultimately level in the fine print of its order.

2. Rate Parity as a Competition Inhibitor May Be Overstated

The Digital Markets Act, which calls for the designation of gatekeeper platforms, if appropriate, would prohibit gatekeepers from forcing hotels to agree to wide and narrow rate parity clauses.

Hotels have long criticized rate parity provisions, which prevented hotels from offering lower rates on their own websites than they gave to online travel agencies, as being anticompetitive. But the commission found that when Austria and Belgium banned these two basic forms of hotel rate parity, it did not lead to significant changes in the way hotels distribute their rooms.

Wide rate parity, according to the commission, governs pricing and related provisions that the hotel offers on each sales channel, while narrow rate parity only covers room prices on the hotels’ own websites.

Despite changes in rate parity rules in Europe that have been ongoing since at least 2015, the commission found that room rate and availability differences between hotels own websites and various online travel agencies “appear to have decreased.”

This diminished differentiation in room rates and availability, for example, took place despite hotels having more freedom to discount or set lower room rates because of the decreased influence of rate parity provisions.

So if Booking.com were to be designated as a gatekeeping platform, would it really be game-changing given the European Commission’s finding that so far it hasn’t had a broad impact on online travel agency room rates versus those on hotel websites? In fact, the commission found, rate difference have diminished in countries were rate parity provisions have been banned.

3. Despite Calls to Limit Booking.com’s Influence Commission Rates Are Stable

If hotel protests about online travel agency commission rates don’t appear as bellicose as they were years ago, one reason is that the European Commission found that the rates properties pay to the online travel agencies “appear to have remained stable or slightly decreased.”

That may be a significant point of discussion when the commission is expected to name certain companies with oversized influence in hotel distribution as “gatekeeper platforms” under the Digital Markets Act sometime in the first half of 2023. The Act is slated to go into effect in Europe in the next few months, and gatekeepers would be designated perhaps six months later.

4. Google Is in the European Commission’s Crosshairs

The European Commission said survey results showed that the vast majority of hotel respondents cited Google as their largest source of their hotel bookings through metasearch. Google said that in 2020 it offered 400,000 to 600,000 hotels — and this was before Google added free links to supplement paid links from advertisers, and that boosted those property numbers starting in 2021.

The commission noted that both hotels and online travel agencies fear that Google’s status as a dominant search engine, the place to kick off travel research, and its heightened presence in hotel metasearch “could be detrimental” for booking sites and hotels.

Google’s move to add free links to supplement links from advertisers could potentially work in its favor when the European Commission decides on gatekeeper platforms.

5. Covid Didn’t Overturn Travel’s Competitive Balance in Europe

The early thinking when the pandemic began was that the strong would get stronger and the weaker players would perish. That has happened to some extent where weaker online travel companies and short-term rental businesses have fallen by the wayside.

But the report, which was conducted in 2021 and covered 2017-2021, found there wasn’t “any significant change in the competitive situation in the hotel accommodation distribution sector in the EU compared to 2016.”

In other words, the dominant player in online hotel bookings, namely Booking.com, maintained its massive market share advantage over second place Expedia, and third place HRS.

At the same time, while the significance of hotel sales channels vary by country in Europe, the commission concluded that “there appear to be no significant differences in the conditions of OTA competition” compared with 2016.

In terms of competition, according to the European Commission, the world hasn’t changed too much.