Google's Critics Dismiss Move Posting Competitors' Travel Links as Window Dressing

Skift Take

Google competitors in Europe and the United States aren't putting much stock in the search engine's test in Europe where it is placing rivals links in a "carousel" above its own far-more-elaborate boxed collection of vacation rental offerings.

Michelle Schwefel, who heads the office of political communications for Deutsche Ferienhausverband (the German Holiday Home Association), told Skift that the carousel of three competitors' links that Google has been testing for several months "won't have a positive effect for competitors" because the design and user experience dramatically favor Google's own holiday homes business.

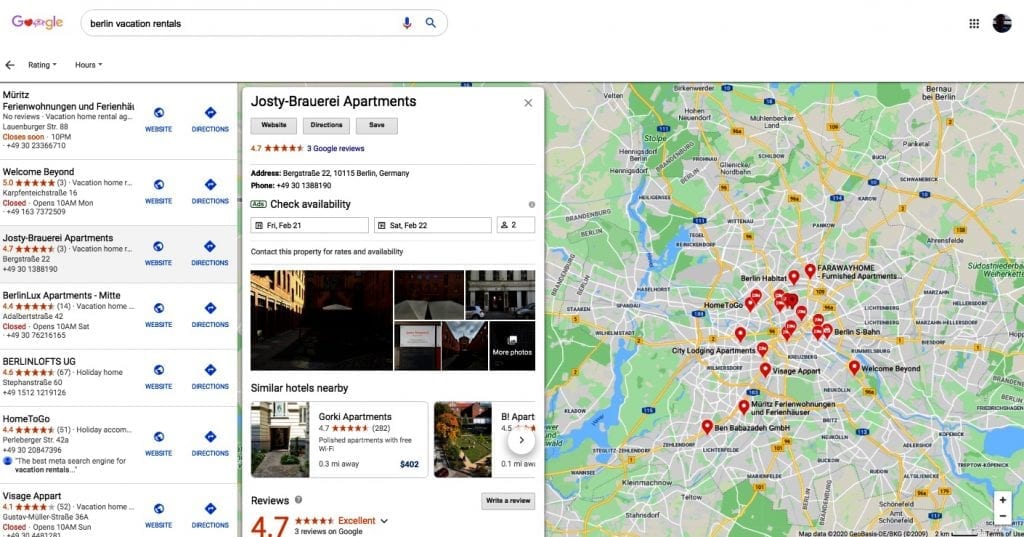

Here is an example of the Google vacation rental test; Google says it is conducting similar tests for flights, hotels, tour packages, jobs and local results although they are only visible to some users for now.

In the example shown, the Holidaylettings, HomeAway, and Cottages.com links take users directly to those sites while the Airbnb.co.uk and HomeAway.co.uk links have consumers navigating further into the Google travel universe. Once within Google's travel pages, consumers can click on free links, but most likely select advertised links from major online travel agencies and other vacation rental providers.

Schwefel pointed out that the links in the carousel (which the association highlighted in yellow) merely present three competitors' links "without context."

Google's one-box (in red), on the other hand has a map with vacation rental rates, features to input desired dates and number of guests, ratings, review numbers, and descriptions such as "lovely flat."

"The rival carousel," as Schwefel called it, "does not lead to equal treatment on Google's search results pages. In comparison to the one-box, it is hardly noticeable; the one-box from the Google service is six times larger than the carousel for all competitors."

When users enter Google's travel pages they can view "specialized vacation rentals search results with other features that allow comparison and draw user attention," Schwefel said. "The rival carousel also does not allow a comparison of different offers and therefore does not contain a comparable quality and amount of search results."

Does Google's insertion of rivals links in its one-box level the playing field?

In the retail arena in Europe, the antitrust commissioner Margarethe Vestager said competitors links in the Google's shopping box did not lead to "much traffic for viable competitors when it comes to shopping comparison."

When asked what solution the Deutsche Ferienhausverband would advocate, a spokesperson said that Google's "special placed boxes" draw attention away from other holiday home providers," and "such a distortion of competition and self-preference must be eliminated."

The German holiday home association was one of more than three dozen signatories to a letter to the European Union competition commissioner Vestager expressing concerns that Google was turning competitors into mere content providers for Google's travel services.

In the United States, both Tripadvisor and Expedia Group on Thursday called out the adverse impact that Google's biased approach to their organic links has on their respective businesses.

When asked about Google's test placing rivals' links above its own one-box of travel results, Tripadvisor CEO Steve Kaufer said during the company's earnings call: "With regard to the test that Google seems to be doing, putting an organic link above some of their placements, we'll see how it goes. (It's) far, far too early to tell whether that's a no effect or a modest positive. But (it's) a little hard for me to believe that it would be meaningful from what I've seen so far."

Expedia Group chairman and senior executive Barry Diller didn't address Google's tests of rivals' links, but called for Google to be subject to "sensible regulation."

"I told the senior management of Google exactly what we feel about this and have implored upon them to basically stop actually taking away the profits from businesses that are probably one of their main contributors to their advertising revenue," Diller told financial analysts. "And I don't know whether that will have much effect, but I've been very straightforward about it. And I think that there will be — look, when businesses get to this size, they absolutely have to have regulation, sensible regulation. I'm not talking about breakups, I'm not talking about any crazy stuff. But I do believe that will happen."

Google didn't immediately respond to a request for comment.