Skift Take

With the summer travel season in many parts of the world winding down, so is TripAdvisor's TV spend but let's see if it is starting to be a difference-maker. Meanwhile, new IHG CEO Keith Barr is conducting his first financial results call at the helm. Let's see how he does.

We should hear plenty more this week about whether TripAdvisor’s return to TV advertising and muted Instant Booking strategy is beginning to make a dent, and whether lodging-focused Booking.com’s modest introduction of flights amidst a renewed Kayak acquisition spree of flight-oriented metasearch sites represents a significant shift.

Meanwhile, SeaWorld, which is the subject of multiple federal investigations in the U.S. for allegedly fibbing about the financial impact of the scathing Blackfish documentary, may shed light this about whether it is seeking to sell Busch Gardens.

Here’s what’s going down in Travel This Week — What To Expect and, as always, you can read all of our reports here.

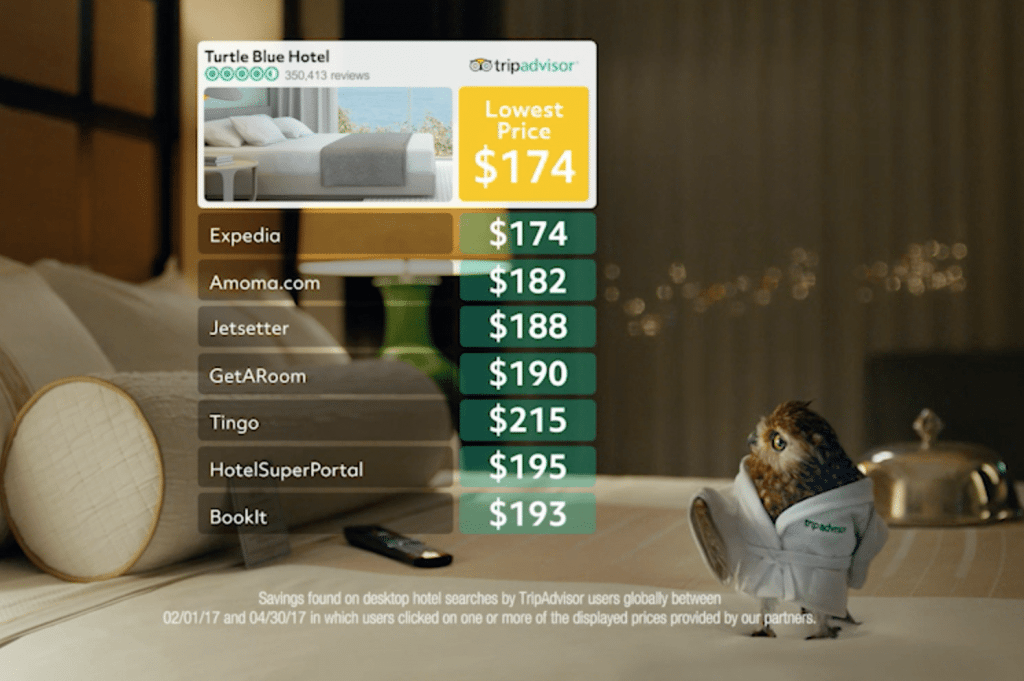

TripAdvisor Is Spending big on TV Advertising

TripAdvisor releases its second quarter financials on Tuesday and officials will chat about it the next day. They may not talk year-to-date numbers about advertising spend, but iSpot.tv estimates that TripAdvisor has shelled out about $23 million on four TV spots in the U.S. since returning to the airwaves for the first time in several years in mid-June at the very tail end of the second quarter.

That puts TripAdvisor in a distant second place in spending compared with its rival, Expedia’s Trivago ($69 million), but respectably ahead of the much-bigger Booking.com ($21.7 million), Priceline.com ($9.1 million) and Hotels.com ($8.9 million).

These are very early days for what is expected to be TripAdvisor’s multi-year TV advertising campaign. Some things to look for: Now that TripAdvisor is downplaying Instant Booking — although it is still very much an option for travelers — and re-emphasizing traditional metasearch links on its sites and app redesigns, is its number of hotel shoppers growing at an attractive clip, and is the company’s revenue per hotel shopper righting itself globally?

Another issue, too: How much will all of this necessary TV advertising spend bite into profits, and will the second quarter report do anything to warm investor’s cold should to TripAdvisor’s stock as of late?

Will the Priceline Group keep on Rolling?

The Priceline Group juggernaut continues to roll with its $2,032 per share stock price and a market cap just shy of $100 billion. Think of the coolness the somewhat-button-downed Priceline Group management would command if they were only headquartered in Silicon Valley rather than Connecticut and Amsterdam.

The Economist recently dubbed the Priceline Group the best-run Internet company after Amazon. Thankfully there is probably not an overload of Silicon Valley-like “bro culture” at Priceline, though. Gillian Tans runs its largest unit, Booking.com, and another subsidiary, OpenTable, has a female CEO, Christa Quarles, as well.

But we digress. The Priceline Group reports earnings Tuesday, and analysts expect a strong quarter. Financial firm PiperJaffray, for example, expects the Group to do fairly well in Europe, its most important region, based on strong European airline results in the second quarter and because the financial results of rival Expedia, which already reported, were fairly solid on the Continent.

It is reasonable to expect that Priceline Group officials might volunteer — or perhaps analysts will prod them — to give some early color on how Booking.com’s introduction of a flight tab on its homepage is going. While some might view the test or decision in earnest to develop a flights vertical as one of those why-didn’t-they-do-this-years-ago kind of things, it actually isn’t. Booking.com’s overarching ocus on lodging has catapulted the Priceline Group to that $100 billion market cap, and that’s not something you mess with on a whim.

We’ll also be interested to hear more on whether Kayak’s recent moves in acquiring the flight-focused Momondo Group and late last week picking up the assets of another flight-heavy metasearch site, Brazil’s Mundi. Kayak has long had a multi-brand strategy (Kayak, Momondo, Cheapflights, Swoodoo, Checkfelix and now Mundi) and building up Kayak’s flight acumen globally could be part of an effort to bolster Booking.com’s new tilt toward flights.

That begs the proverbial question: Are more acquisitions for the Priceline Group on the agenda, sooner rather than later? Ever since its problematic OpenTable acquisition, the Priceline Group’s acquisitions have been relatively modest in size.

A Theme Park Theme

Theme parks will get a moment in the spotlight on Tuesday when both SeaWorld and Disney report earnings. But the stories are likely to be worlds apart. It will be SeaWorld’s first earnings call since revealing the existence of inquiries by the U.S. Department of Justice and the Securities and Exchange Commission in June.

Authorities are looking into comments made by company executives about the impact of the critical documentary Blackfish, which hurt attendance and earnings. SeaWorld may also comment on whether it has plans to sell Busch Gardens. Merlin Entertainments has expressed interest in kicking the tires.

Disney, on the other hand, will have a new addition to one of its Orlando parks to discuss during its call, as well as several major announcements it made last month about future expansions.

TUI’s Thinking and the German Airline Market?

Will TUI Group use next week’s third quarter results’ announcement to flesh out plans for its German airline unit? The German aviation market has been plagued with overcapacity issues in recent years but a proposal to form a joint venture between TUI, Air Berlin and Etihad Airways was called off.

Nobody has yet found a solution and last month Bloomberg suggested that a deal could be back in the cards. Meanwhile, it will also be interesting to see if TUI has any more plans to develop its cruise and hotel assets, particularly as Chief Executive Fritz Joussen sees no no long-term future for intermediaries like Expedia.

We have to point out that’s the death of online travel agencies, like the demise of global distribution systems, is a very questionable viewpoint given the fact that intermediaries, like many companies, have the ability to adapt.

At any rate, we’re sure the issue of the future of online travel agencies and blockchain disruption won’t get sorted out this week.

IHG CEO’s coming out party

New InterContinental Hotels Group CEO Keith Barr’s first earnings call at the helm will take place Tuesday so it should be interesting to hear what he has to say as part his formal introduction to investors. It would be interesting to hear more about the chain’s thinking on its recently enacted 24-hour cancellation policy given the fact that some of its peers have opted for 48 hours.

Perhaps, too, IHG will provide more detail on that new midscale brand it plans to launch. The new brand’s name, for starters, would be helpful.

Ya, That Marriott-Starwood Integration is ONGOING

Now that we’ve given our take on — and explained — every one of the new Marriott’s 30 brands, the chain on Monday is likely to give an update during its earnings call on where it stands with what it admits is its complex and critical back-end integration of Starwood.

Other key issues assuredly on the agenda include progress — or lack thereof — in improving the consistency and standards of former Starwood brands, including Sheraton and W, as well as more color on Marriott’s new 48-hour cancellation policy. There might, too, be discussion about ongoing updates to the loyalty programs and integration.

La Quinta’s Spin on its Real estate Biz

With Wyndham spinning itself into a tizzy and aiming to create two public companies as a backdrop, La Quinta takes its turn in the quarterly earnings limelight on Monday and is likely to to give an update on its own spinning wheel.

La Quinta likewise intends to morph into two public companies, separating its real estate division from its hotel franchise and management business.

In all of these things, the chains believe they are creating greater transparency for investors into their disparate businesses and importantly are manufacturing additional shareholder value. In other words, in these instances, the whole is not greater than the sum of its parts.

Skift editors Hannah Sampson, Patrick Whyte and Deanna Ting contributed to this report.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: booking.com, ihg, marriott, seaworld, tripadvisor, ttw, tui

Photo credit: TripAdvisor has spent some $23 million since mid-June 2017 in U.S. TV advertising, according to iSpot.tv. Pictured is an image from one of the ads. TripAdvisor