Skift Take

Read on for our takes on all 30 of Marriott's brands.

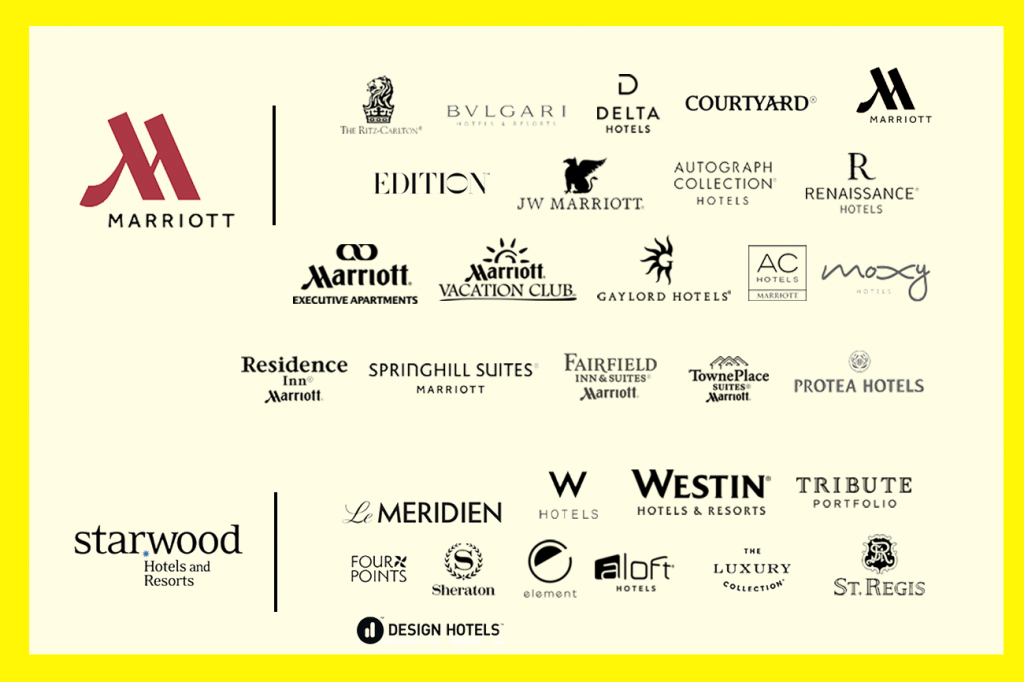

Now that Marriott International is on track to complete its acquisition of Starwood Hotels & Resorts on Sept. 23, the company will be formally inheriting 11 new brands to add to its existing 19.

Here’s a look at how Marriott and Starwood have respectively positioned each one of those 30 brands up to this point, as well as our take on how they really operate in the current hospitality landscape.

Note: Global footprint numbers and quoted takes from Marriott and Starwood come from each company’s respective 2015 annual reports, reflecting property and room numbers as of Dec. 30, 2015.

Luxury

St. Regis

Global Footprint: 36 hotels; 8,100 rooms

Starwood Take: “St. Regis is for connoisseurs who desire the finest expressions of luxury. They provide flawless and bespoke service to high-end leisure and business travelers.”

Skift Take: Marriott CEO Arne Sorenson has said both The Ritz-Carlton and St. Regis are very strong and unique verticals with enough space in the luxury segment for them to succeed, independent of each other. For that reason, it’s pretty likely this brand will remain well after the merger.

Ritz-Carlton

Global Footprint: 96 hotels; 27,131 rooms

Marriott Take: “A luxury hospitality brand where the genuine care and comfort of guests is the highest mission” and they can “enjoy a warm, relaxed, yet refined ambience.”

Skift Take: As noted above, it’s highly doubtful The Ritz-Carlton brand is going anywhere. The brand was also ranked No. 1 in J.D. Power’s annual Hotel Guest Satisfaction rankings for this year. But, as with many luxury brands, St. Regis included, it faces a challenge in breaking out of the stereotypical perceptions of old luxury and being perceived as something more modern, contemporary, and relevant to today’s luxury travelers.

Bulgari Hotels & Resorts

Global Footprint: 3 hotels; 202 rooms

Marriott Take: “Bulgari Hotels & Resorts, developed in partnership with jeweler and luxury goods designer Bulgari Spa, is a collection of sophisticated, intimate luxury properties located in exclusive destinations. With properties in London, Milan, and Bali and food and beverage outlets in Tokyo, premium individuality is the rule — no detail is too small, no experience too grand.”

Skift Take: This is still a very small luxury brand, size-wise, when you compare it to St. Regis or The Ritz-Carlton, or even Edition, for that matter. But the Bulgari name certainly has a cache that we’re pretty certain Marriott will want to keep and build upon in the future.

EDITION Hotels

Global Footprint: 4 hotels; 819 rooms

Marriott Take: “EDITION is a luxury lifestyle hotel brand that combines a personal, individualized, and unique hotel experience with the global reach and scale of Marriott International and creative vision of Ian Schrager. EDITION encompasses not only great design and true innovation, but also great personal, friendly, modern service as well as outstanding, one-of-a-kind food, beverage, and entertainment offerings.”

Skift Take: This is one of the only hospitality brands anywhere that has managed to successfully blend the luxury and lifestyle segments together, although the hotel group has been slow to scale. Each hotel is a unique and highly nuanced experience wholly local to its neighborhood, and all of them are popular with locals. This is Ian Schrager’s baby, so the brand will always be a standalone.

W Hotels

Global Footprint: 46 hotels; 13,000 rooms

Starwood Take: “W is where iconic design and cutting-edge lifestyle set the stage for exclusive and extraordinary experiences…. The beats per minute increase as the day transitions to night, amplifying the scene in every W Living Room for guests to socialize and see and be seen.”

Skift Take: Starwood, arguably, built its entire name and success on the W brand. This is Barry Sternlicht’s baby, through and through, and what really put Starwood on the map — it’s a foundational part of its legacy. We’re pretty sure Marriott is going to want to keep W around, and learn from what it’s done in terms of reinventing public spaces and bringing boutique into the mainstream.

JW Marriott Hotels & Resorts

Global Footprint: 77 hotels; 34,000 rooms

Marriott Take: “JW Marriott is a global luxury brand of beautiful hotels and resorts located in gateway cities and exotic destinations around the world. JW Marriott’s elegant yet approachable positioning provides a differentiated offering in the luxury hotel market, bridging the gap between full-service hotel brands and the super luxury brands at the top of the tier.”

Skift Take: The JW Marriott brand has a lot of opportunities globally because it’s relevant for both the leisure and business markets, and it’s very popular for meetings and events. It also sits below The Ritz-Carlton’s price point, making it aspirational and more accessible for a broader range of luxury seekers. The brand recently unveiled a global branding campaign, “The JW Treatment,” emphasizing the brand’s connection to service and its associates.

The Luxury Collection Hotels & Resorts

Global Footprint: 99 hotels; 18,900 rooms

Starwood Take: “… Unique hotels and resorts offering exceptional service to an elite clientele.” Buzz words used to describe it include “authentic” and “enriching experiences indigenous to each destination.” Hoyt Harper, senior VP and global brand leader for The Luxury Collection, has told Skift, “Each hotel is iconic, indigenous to market, and in a great location.”

Skift Take: We think there’s a 50/50 chance this brand may eventually be rolled into Marriott’s Autograph Collection. In March, Sorenson said, “We look at what’s happened at [Starwood’s] The Luxury Collection and compare that to our launch of the Autograph Collection just about five years ago — a brand which already has 100 hotels — and we think we can bring that similar kind of growth to The Luxury Collection.”

Or, perhaps, Marriott could decide to leave it as is and to operate as it is. Many of the properties in this collection are considered landmarks: The Royal Hawaiian in Honolulu and the Hotel Danieli in Venice, for example, come to mind. If Marriott can distinctively build the branding of this collection to incorporate a sense of history, that might be a way to make it stand out from the other six luxury brands that will be a part of the new company.

Upper Upscale

Le Meridien Hotels & Resorts

Global Footprint: 103 hotels; 27,000 rooms

Starwood Take: “… A Paris-born global hotel brand targeting the creative and curious-minded traveler who is eager to experience something new in every destination and discover things with a new perspective. The Le Méridien Hub is the brand’s unique lobby concept where a café inspired atmosphere, and high impact art, music, and food & beverage experiences set the scene for guests to socialize and exchange ideas in a curated environment.”

Skift Take: This is one of the most underutilized brands in hospitality today. With its Air France provenance and creative class audience, Le Meridien should have a much stronger presence among weekend bohemians and couples. Starwood seemed to focus only on artsy little social media campaigns, so hopefully Marriott can emphasize the brand’s creative mojo more.

Renaissance Hotels

Global Footprint: 160 hotels; 51,593 rooms

Marriott Take: “… A global, full-service brand in the upper-upscale tier that targets lifestyle-oriented business travelers. Each Renaissance hotel offers its own personality, local flavor, and distinctive style. Innovations include the Navigator program, which helps guests discover the soul of the neighborhood, and Evenings at Renaissance, which helps guests experience the unexpected with live music, mixology demonstrations, art exhibits, and more in the comfort of the hotel lobby bars and lounges.”

Skift Take: The Renaissance flag clashes head-to-head with Le Meridien because both target the creative professional by promoting local neighborhood arts, culture and events. This could be a chance for Marriott to fold them together under the Le Meridien marque, or vice versa. That would give the resulting group a stronger brand identity, which each side presently lacks to a degree because of their small numbers and inconsistent delivery.

Westin Hotels & Resorts

Global Footprint: 209 hotels; 78,300 rooms

Starwood Take: “Westin provides innovative programs and instinctive services designed with our guests’ well-being in mind.” This is a brand that takes wellness seriously, from its SuperFoodsRx dishes and WestinWORKOUT studios to Heavenly Beds and jogging happy hours.

Skift Take: Wellness branding is everywhere and in many ways, Westin was well ahead of the other brands in pioneering that lifestyle early on, especially when it debuted the Heavenly Bed in 1999. As far as we can tell, none of Marriott’s existing brands emphasize health and wellness to the extent that Westin does, so that bodes well for the brand’s staying power post-merger. Or it might just mean they’ll roll that into one of their own brands in the same tier. Most recently, Starwood embarked on a refreshed brand identity for Westin that transforms its former Zen-like design aesthetic into one that’s bolder, more energetic, and holistic in its approach to wellness.

Tribute Portfolio

Global Footprint: 6 hotels; 2,900 rooms

Starwood Take: “Tribute Portfolio, our newest brand, gives guests access to exceptional independent hotels around the world.” This is a soft-brand collection of independent hotels that first debuted in April 2015.

Skift Take: Even though Starwood expanded the number of hotels in Tribute Portfolio in 2016 to 20 as of April, we just don’t think this brand has had enough time to carve out its own distinct identity from Marriott’s soft-brand Autograph Collection. It’s probably only a matter of time before this brand gets rolled into its direct competitor, Autograph.

Sheraton Hotels & Resorts

Global Footprint: 446 hotels; 156,400 rooms

Starwood Take: Operating in more than 75 countries around the world, this is Starwood’s biggest brand. “Sheraton makes travel easier and more intuitive, so guests can experience more. [It] continues to establish itself as the global hospitality brand of choice.”

Skift Take: Poor Sheraton. More than any of Starwood’s brands it has the largest global reach but it’s also struggled to distinguish itself as a brand leader in its category, so much so that Starwood launched Sheraton 2020 to revive the tired brand. Has Sheraton 2020 been successful? Hard to tell. Although many speculate Sheraton, like Starwood itself, may disappear as a brand eventually, we’re not so sure we’d make that call. While Sheraton hotel consistency in the U.S. may be uneven, in Asia, the brand is, arguably, one of the No. 1 hospitality brands, and considered far more luxury than upper upscale. This is especially true in China, where Sheraton was the first international hotel brand to operate in China in 1985. Perhaps Marriott will lessen the number of Sheraton properties in the U.S. over time, but it seems doubtful and foolish for them to get rid of the brand altogether, or lose out on its incredible brand recognition in Asia.

Marriott Hotels

Global Footprint: 526 hotels; 187,277 rooms

Marriott Take: “… The company’s global flagship premium brand, primarily serving business and leisure upper-upscale travelers and meeting groups. Marriott Hotels properties deliver premium choices, sophisticated style, and well-crafted details.”

Skift Take: We can guarantee, with 100-percent certainty, that this brand is not going away after this merger for some pretty obvious reasons. But with the addition of direct competitors like Westin and Sheraton coming into the mix, the flagship Marriott brand needs to do a lot to differentiate itself, not only from its new sister brands but also from the rest of the other full-service meeting hotels out there. It’s not enough for Marriott to be the old reliable standby that it has been for so many years; it needs to reinvent itself and connect more broadly to travelers. Already there are signs that Marriott is doing just that: the brand is unveiling a new M Beta hotel in Charlotte, N.C., that will serve as a living laboratory for Marriott to test out new products and concepts in real time.

Autograph Collection

Global Footprint: 95 hotels; 22,808 rooms

Marriott Take: “Autograph Collection Hotels are high personality upper-upscale and luxury independent hotels that deliver unique experiences and design across a global portfolio. Each property has been selected for its originality, rich character, uncommon details, remarkable design, or for its best-in-class resort amenities.”

Skift Take: No doubt this is sticking around, and it’s probably going to swallow up Starwood’s Tribute Portfolio, and possibly its Luxury Collection, in the process.

Design Hotels

Global Footprint: 290 hotels worldwide; 23,000 rooms

Starwood Take: “We have a 74 percent equity interest in Design Hotels AG (Design Hotels), a company that represents and markets a distinct selection of over 300 independent hotels…. Starwood and Design Hotels entered into an agreement in 2014 that allows greater coordination and cooperation between the companies.” Design Hotels was originally founded in 1993 by Claus Sendlinger.

Skift Take: We really hope Marriott will let Design Hotels operate as it’s been operating under Starwood’s majority ownership. Design Hotels curated collection of unique hotels is differentiated enough, we think, to make it stand out from the other soft-brand collections that will come into Marriott’s ownership following the merger. But it’s clear both Marriott Rewards and Design Hotels can benefit from a mutual partnership, as Design Hotels’ partnership with SPG has shown.

Marriott Executive Apartments

Global Footprint: 28 hotels; 4,181 rooms

Marriott Take: “Marriott Executive Apartments provides international, five-star serviced apartments in emerging market gateway cities, designed for business executives who require housing outside their home country, usually for a month or longer.”

Skift Take: This is a serviced apartment brand that only exists outside of the U.S., and because there’s no other direct competitor to this within the new company, we think it’s likely this brand will remain as is. However, we do wonder if Marriott may choose to roll this brand over into Starwood’s Element extended stay brand and to transform Element into more of a serviced apartment-style model. By 2018, there will be an estimated 46 Element properties, and Sorenson has said Element could provide Marriott with a viable alternative to short-term rentals like those on Airbnb or HomeAway.

Delta Hotels & Resorts

Global Footprint: 36 hotels; 9,400 rooms

Marriott Take: “… A full-service brand, primarily serving business travelers within the upscale and upper-upscale tiers. Delta Hotels & Resorts are focused on elevating and delivering on the essentials of business travel, through pragmatic and efficient design, thoughtfully appointed guest rooms, large functional work spaces, and complimentary Wi-Fi.”

Skift Take: There is nothing exciting about this utilitarian Canadian brand, and there never has been. Marriott can go nowhere but up in terms of creating some kind of emotional resonance here, although this might be a good time to kill Delta forever and roll the properties into other inventories.

Upscale

AC Hotels by Marriott

Global Footprint: 83 hotels; 10,462 rooms

Marriott Take: “AC Hotels by Marriott is designed to attract the next generation design-conscious business traveler in the upper-moderate tier, who seeks a sleek, modern hotel with unique European touches. With hotels across Europe, and now in North America, and coming soon to South America, AC Hotels by Marriott properties are located in destination, downtown, and lifestyle centers.”

Skift Take: This Spanish take on W Hotels has yet to fully expand beyond the borders of Europe. It’s got smart design and a great, modern aesthetic, but it needs to stand out from Marriott’s other brands, like Autograph Collection, as well as the newly acquired Starwood equivalents.

Element

Global Footprint: 20 hotels; 3,000 rooms

Starwood Take: “Element first opened in 2008, providing a modern, upscale and intuitively designed hotel experience that allows travelers a place to thrive. Whether stopping by for a few days or settling in for a few weeks, Element hotels proves that time away from home doesn’t mean time away from life. All Element hotels pursue third-party sustainable certifications, furthering the green from the ground up sensibility of the brand.”

Skift Take: Element is not like Residence Inn or Fairfield Inn & Suites in any sense, so we think it has some staying power. During an investor call on March 21, Marriott CEO Arne Sorenson said, “With Element, we have a lifestyle extended stay brand which is a space where Marriott has no brands. We think that as a consequence, this will be a brand that we think will grow quite quickly post merger. We also think Element could be an interesting alternative to some of the housing rental services or shared economy platforms like Airbnrb and some others.”

Gaylord Hotels

Global Footprint: 5 hotels; 8,098 rooms

Marriott Take: “Gaylord Hotels offers guests an entertaining, upscale experience at world-class group and convention-oriented hotels…. The properties typically have between 1,400 rooms and 2,900 rooms, 400,000 to 600,000 square feet of meeting and convention space, world-class dining and entertainment offerings, and retail outlets in magnificent settings.”

Skift Take: Located in the suburbs of gateway destinations, these are massive convention properties for large association business. There’s clearly a demand for facilities of this scope, but the overall guest experience feels dated and pedestrian at times. For these hotels to thrive, large capital investments should be directed at modernizing the design, updating the technology infrastructure, and building out more sophisticated food and beverage outlets.

SpringHill Suites

Global Footprint: 336 hotels; 39,750 rooms

Marriott Take: “SpringHill Suites is the largest all-suites style hotel brand in the upscale tier that delivers industry leading service to guests who are enthusiastic about travel.” It has “proprietary West Elm furniture as a new standard” and fuses “form and function with modern décor.”

Skift Take: As much of a fan we are of West Elm furniture, Marriott’s description for the hotel is a bit of a yawn. Operating only in the U.S. and Canada, SpringHill Suites has historically performed well, and it ranks highly with consumers on J.D. Power’s annual list of hotels with the highest guest satisfaction levels. We think it’ll most likely stay as it is, but it might benefit from a more defined design identity.

Courtyard by Marriott

Global Footprint: 1,037 hotels; 153,417 rooms

Marriott Take: “Courtyard is our hotel product designed for the upscale tier, and is focused primarily on transient business travel.”

Skift Take: To us, Courtyard by Marriott is your no-frills, no-nonsense kind of hotel designed for road warriors. It’s not exactly sexy, and it doesn’t necessarily have the strongest brand identity, but it’ll do just fine urging travelers to “make room for a little fun” along the way. With such a large footprint, it’s doubtful Marriott will want to fundamentally change or alter the brand, but we hope they can give it a bit more character as they’ve tried to do with Renaissance Hotels, which is also somewhat geared toward business travelers.

Residence Inn by Marriott

Global Footprint: 697 hotels; 80,100 rooms

Marriott Take: “Residence Inn is the leading upscale extended-stay hotel brand designed for frequent and extended stay business and leisure travelers. Residence Inn provides upscale design and style with spacious suites that feature separate living, sleeping, and working areas, as well as kitchens with full-size appliances. Guests can maintain their own pace and routines through free Wi-Fi, on-site exercise rooms, and comfortable places to work and relax.”

Skift Take: Residence Inn has put out some great content lately celebrating millennial behaviors, work-life balance, lobby socializing, and the value of business mentors, among others. Marriott should keep pushing this direction and promote the updated design as well. Clearly there is huge growth opportunity here for Residence Inn, but it can only scale to a new generation of business travelers if extended-stay loses some of its reputation for loneliness and airport office parks.

Midscale

Fairfield Inn & Suites

Global Footprint: 768 hotels; 70,072 rooms

Marriott Take: “Fairfield Inn & Suites is a well-established leader in the moderate tier and targets no-nonsense travelers seeking a stress-free stay experience. Fairfield is committed to supporting guests’ desire to maintain balance and momentum by providing healthy options with our free hot breakfast, 24/7 Corner Market offerings, and on property fitness facilities. The hotels feature a multi-functional lobby and guest rooms and suite rooms that are uniquely designed for restful sleep and productivity.”

Skift Take: Positioned below Residence Inn’s price point, Fairfield Inn should be promoted more as the voice of middle America, especially for parents traveling with families. The brand potentially could promise the travel dream to everybody in the country.

Moxy Hotels

Global Footprint: 1 hotel; 162 rooms

Marriott Take: “Moxy Hotels is a design-led, lifestyle moderate tier brand with a chic, modern, and edgy personality. Moxy Hotels offers a vibrant and stylish public space and a fun, energetic, and lively social scene. The brand opened its first hotel in Italy in 2014 and is expanding to other European countries and the United States.”

Skift Take: Moxy is a smart idea to build the hotel of the future for future generations, but it might rely too much on design to the point where it becomes cloying. The brand communications are insightful, which required Marriott to move a little out of its comfort zone, but it’s a good sign if Marriott is going to capture the Millennials.

Protea Hotels by Marriott

Global Footprint: 102 hotels; 9,609 rooms

Marriott Take: “Protea Hotels is the leading hospitality brand in Africa and boasts the highest brand awareness and largest strategic footprint among all the major hospitality brands in Africa.”

Skift Take: In June, Marriott unveiled a new brand identity for Protea, which the company purchased in 2013 for $200 million. Although Protea enjoys strong brand recognition in Africa, it seems clear that with the new brand refresh, Marriott hopes to take this brand and promote it on a more global level.

TownePlace Suites

Global Footprint: 270 hotels; 27,128 rooms

Marriott Take: “… Our extended-stay hotel brand in the upper-moderate tier, designed to appeal to business and leisure travelers who stay for five nights or more. Each suite provides functional spaces for living and working, including a full kitchen and a home office. Each hotel specializes in delivering service that helps guests make the best of long trips by helping them stay productive and upbeat.”

Skift Take: Pegged as a tier just below Fairfield, TownePlace probably doesn’t get as much attention as it should. The brand’s straightforward approach to no-frills, easy extended stay vacations should be getting more marketing attention and brand differentiation.

Select Service

Aloft

Global Footprint: 104 hotels; 17,400 rooms

Starwood Take: “Designed for global travelers who love open spaces, open thinking and open expression, Aloft is where travel creates possibilities. An affordable alternative for the tech-savvy and confidently social.”

Skift Take: Borrowing its design DNA from W hotels, Aloft has always been a bolder, punchier, tech-driven brand in comparison to the others at Starwood. Now that it’s a part of Marriott, it seems likely Marriott will allow it to develop, even though it competes somewhat with Marriott’s own AC Hotels brand.

In March, Sorenson said, “Both brands [AC Hotels and Alfot] compete in the upscale space. Both we would describe as lifestyle entrants into that space. Both have meaningful momentum. But while they are positioned, in some respects, similar arrangement of the segment, they have different personalities. We tend to think of AC hotels as being a more of a European lifestyle approach, and Aloft as being a bit more of a western lifestyle approach. We think their customers that are drawn to each of the two as there will be owners and franchisers that are drawn to each of the two.”

With record numbers from Marriott’s North American Select Service Development team, which saw more than 50,000 signed rooms last year, Marriott has said it’s confident it could position Starwood’s two select-service brands, Aloft and Element, in the lifestyle sector for select-service properties.

Four Points by Sheraton

Global Footprint: 210 hotels; 36,800 rooms

Starwood’s Take: Described as being “best for business,” this brand “delights the smart traveler with what is needed on the road for greater comfort and productivity. All at the honest value our guests deserve, with perks they don’t expect. Our guests start their day feeling energized and finish up relaxed, by kicking back with one of our Best Brews (local craft beer, coffee).

Skift Take: When was the last time you stayed in a Four Points by Sheraton and felt genuinely excited to be staying in one? We are going to make an educated guess and probably guess that’s a no. But what Four Points may lack in excitement, it has plenty in terms of its global breadth, and it was also the first U.S. hotel brand to operate in Cuba after nearly 60 years. Will it be rolled into Courtyard eventually? Or will Marriott leave it alone to operate as is? Your guess here is as good as ours.

Timeshares

Marriott Vacation Club

Global Footprint: 58 properties; 12,807 rooms

Marriott Take: “Marriott’s timeshare properties are licensed by MVW under the Marriott Vacation Club, The Ritz-Carlton Destination Club, The Ritz-Carlton Residences, and Grand Residences by Marriott brand names.” You’ll find them around the world, primarily in resort destinations like Florida, Hawaii, and South Carolina, as well as internationally in the Caribbean, Spain, and Thailand.

Skift Take: The brand feels tired. The websites are terrible. It’s hard to differentiate any value propositions.

Sources: Marriott 2015 Annual Report; Starwood 2015 Annual Report

Have a confidential tip for Skift? Get in touch

Tags: brands explained, marriott, marwood, starwood