Skift Take

As the world's fastest-growing region for tourism it's a good sign that some Asian countries can expect to see healthy travel and tourism investment during the next 10 years. But a number of factors could alter these projections, particularly the Chinese market, as more global tourism trends are tested in this region.

Asia and Southeast Asia have become the crucible of global travel during the past few years with China’s 133 million outbound travelers fanning out to destinations across the continent.

That’s one reason why Asian destinations are projected to receive $1.5 trillion in travel and tourism investment during the next decade — more than any other region — but that won’t be enough for some countries.

One in every 10 dollars spent on global travel and tourism investment will land in Asian destinations through 2026 but China will eat nearly half of that funding funding, according to a report on Asian tourism investment from the World Travel & Tourism Council (WTTC), a group backed by travel brands that promotes global tourism.

The countries with the highest demand will benefit most and those that need investment to build key and basic tourism infrastructure such as new airports and hotels could be slighted. “That’s a significant sum of money…but the smaller countries to some extent are playing catch up,” said David Scowsill, president and CEO of WTTC, speaking to CNBC this week.

The report highlights Cambodia, the Philippines, and Myanmar as countries that won’t garner enough tourism investment to keep up with growing demand while Vietnam and Laos have improved tourism infrastructure but still need more effective, targeted investments to stay on track.

China is the most significant growth story in the region, said Scowsill. The country had 58 million outbound travelers in 2010 and this year will have more than 130 million. “China itself is investing a huge amount in infrastructure as well, around $723 billion over the next three years,” he said. “They’re building 45 new airports so a lot of that outbound growth is going to come from China.”

Singapore, Thailand, Vietnam, Indonesia, and Malaysia will receive about 95 percent of the remaining $782 billion in investment and collectively account for 80 percent of the region’s international tourist arrivals. Asia and Southeast Asia have been the fastest growing regions for international tourism arrivals since last year with 8.2 percent year-over-year growth for the second quarter.

Asia’s Tourism Obstacles

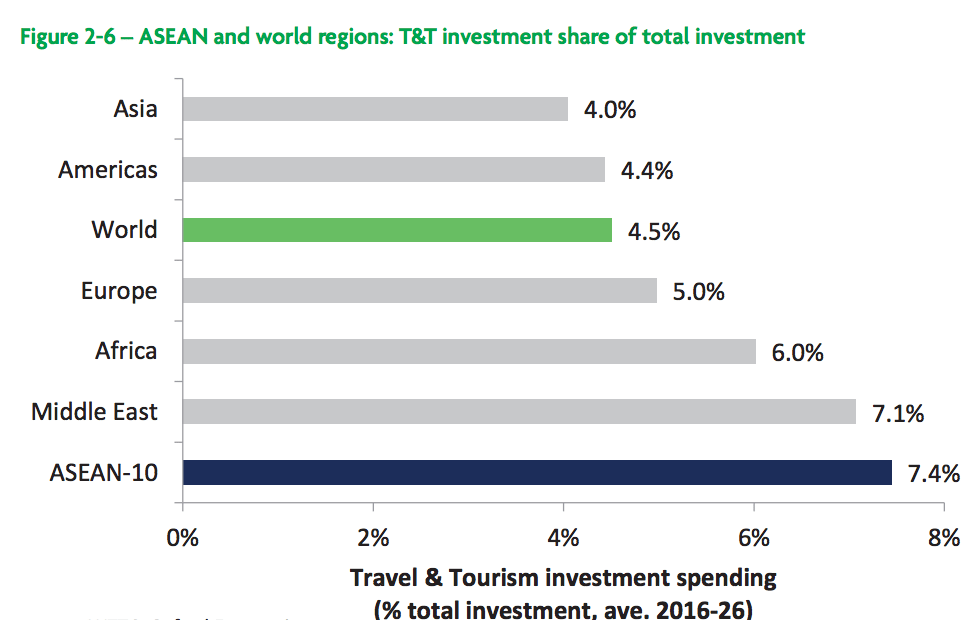

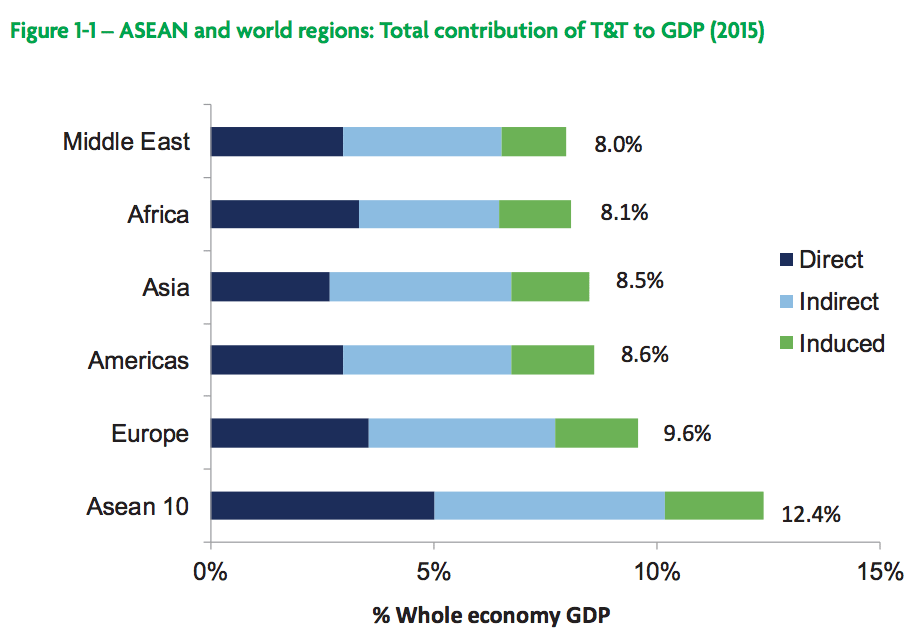

The $782 billion in tourism investment is 7.4 percent of all investment across Asia, the highest percentage of total investment for any region. Asia and Southeast Asia is also one of the world’s most tourism dependent regions with 12.4 percent of its GDP linked to travel (see second chart below).

“That money should also spread to other industries that compliment travel and make it possible,” said Scowsill. “Tourism infrastructure isn’t just airports and terminals and air traffic control systems,” he said. “It’s banking systems, mobile telephony, it’s health and hygiene. It’s a whole range of things.”

Source: World Travel & Tourism Council

Air connectivity and the proliferation of low-cost carriers across Asia in recent years have made travel more accessible, but the region also faces hurdles that could throw off these projections.

China, for example, poses as much of a threat as it does a massive opportunity. A slower Chinese economy, too much dependence on China from destinations like Thailand and the region’s general conservatism, demonstrated last week with the death of Thailand’s king and a year-long mourning period that could impact tourism, are all factors that could influence how much investment Asia’s destinations end up seeing.

Disease, security and visa fees could also deter some Chinese and and other tourists from traveling.

While tourism infrastructure has improved in several countries in the region, it only ranks higher than that of Latin America, the Caribbean, and Africa, according to the report. Chinese tourists, for example, are already one of the most valuable inbound markets for the UK and may increasingly choose long-haul destinations with sophisticated tourism infrastructure as their spending power grows.

Last year Chinese visitors accounted for more than a quarter of total international arrivals into Brunei, Malaysia, Thailand, and Vietnam and Asian destinations account for 21 percent of all Chinese outbound visitors, the report said.

Source: World Travel & Tourism Council

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: cambodia, china, hong kong, laos, myanmar, philippines, singapore, tourism, vietnam, wttc

Photo credit: One in every 10 dollars spent on global travel and tourism investment will land in Asian destinations through 2026. Pictured is the departures hall at Hong Kong International Airport. Skift