Skift Take

When it comes to the potential of Southeast Asia's diverse online travel market, investors and online travel brands can no longer view what will be a gigantic market as something they can ignore for now and figure out later.

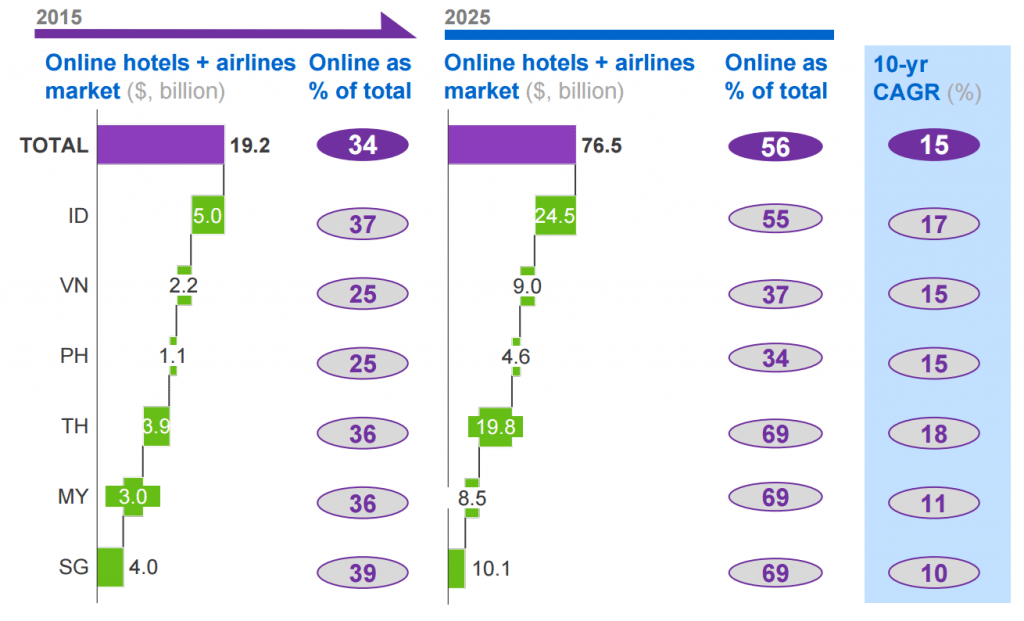

Southeast Asia’s online travel spend is expected to reach $76 billion by 2025 and Google feels that’s one of the best areas for opportunity and investment in the region.

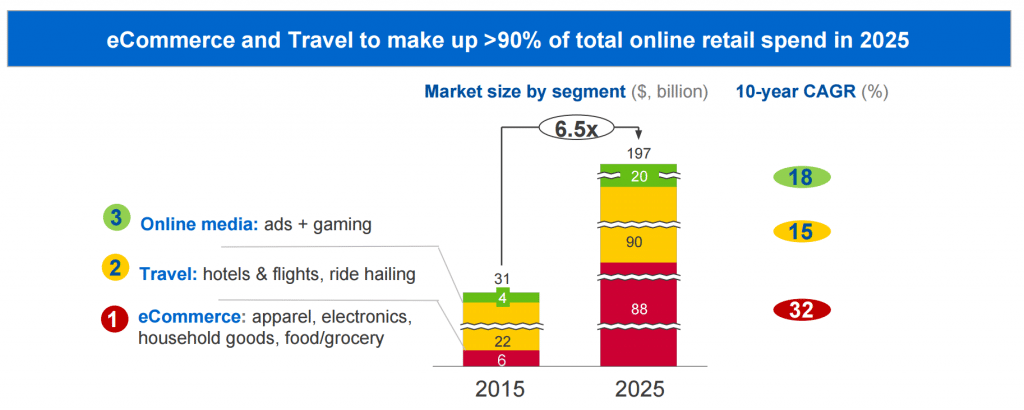

The region’s consumers will spend $200 billion online by 2025 and online travel spend will account for about about 38 percent of that amount, according to a report on e-commerce in Southeast Asia by Google and Singapore-based investment company Temasek Holdings.

Southeast Asian consumers increasingly value traveling as median incomes increase and airlift improves. Skift’s Manifesto on the Future of Travel in 2020 also holds Southeast Asia as the region where the future of travel will be tested. The region’s percentage of online travel transactions as it relates to all online transactions is only slightly less than that of the U.S., where online hotel and airline bookings account for about 42 percent, or $340 billion, of $808 billion in online purchases, according to U.S. Travel.

Google points out that more than 70 percent of Southeast Asia’s population is younger than age 40 and more technologically adept than their parents’ generation. China, in particular, has a population with 57 percent of people younger than age 40.

Winnie Tan, founder and CEO of TripZilla, a Singapore-based travel planning and media company founded six years ago, said faster Internet speeds and greater Internet penetration are also enabling growth in online travel bookings.

Tan said low-cost carriers across Asia are driving up demand and giving startups a strong niche to target. “They’ve showed us where the money is so we just need to bear that in mind when we are designing our monetary model. It’s a good time to be a travel startup in Asia and if the big travel brands have yet to build their presence here, these numbers should get their attention now.”

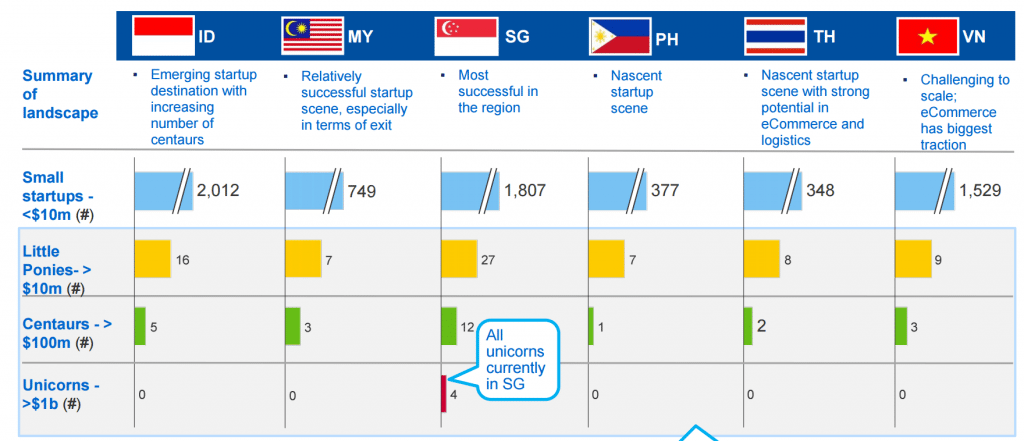

The report identifies startups focused on online hotel and airline bookings as one of the top three sectors for entrepreneurs in Southeast Asia. As Google points out, venture capitalists still overwhelmingly favor companies in China, India and the U.S. as their investment targets. Investment in Southeast Asia’s travel startups would need to increase by billions of dollars by 2025 if they want to compete with overseas travel startups also vying to break into that region. (see Chart 4).

Chart 1: E-commerce (clothing, electronics, household goods, etc) and travel will together make up more than 90 percent of total online retail spend in 2025 in Southeast Asia.

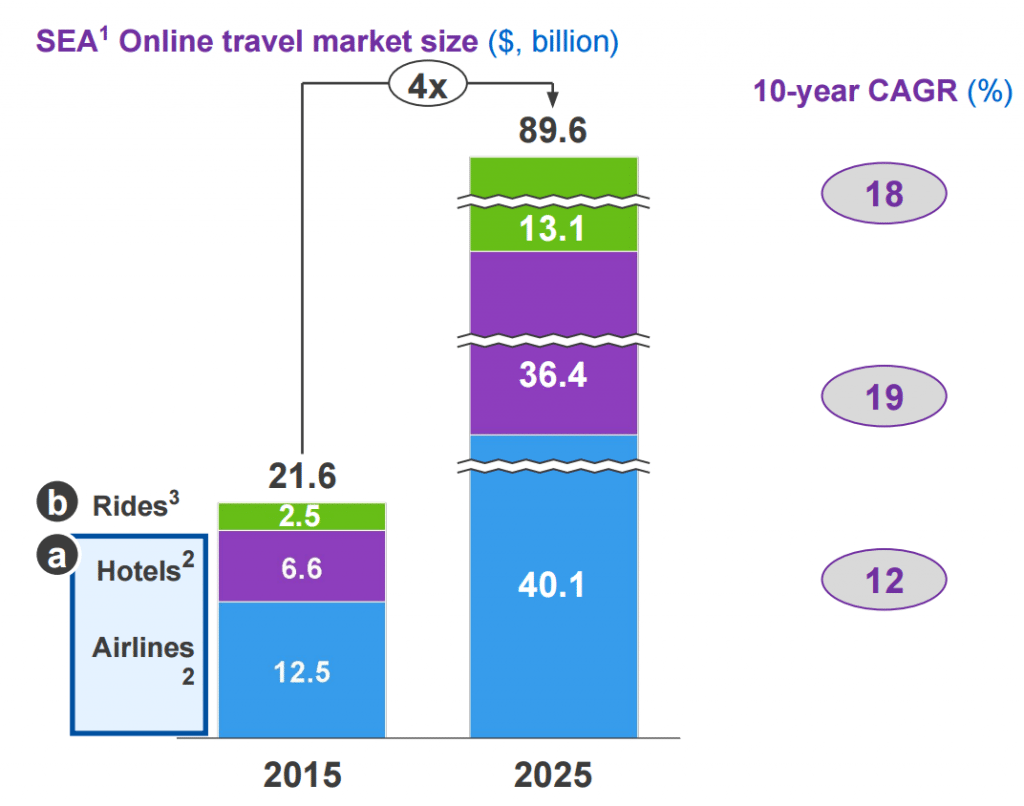

Chart 2: Southeast Asia’s market size for online hotel bookings will increase from $6.6 billion last year to $36.4 billion by 2025 with a 19 percent compound annual growth. Online airfare bookings will be even bigger by 2025, growing from $12.5 billion in 2015 to more than $40 billion in 2025.

Chart 3: From the chart above, this means online hotel and airline bookings will total $76 billion in 2025 in Southeast Asia and online travel bookings will account for more than half of all travel transactions in the region.

Chart 4: But, despite all the upbeat projections for Southeast Asia’s online travel market growth, venture capital is so far not matching up. Looking at all Southeast Asian startups, including travel, the region still received only 20 percent of the investment that Indian companies alone received in 2014. Most companies in Southeast Asia still have valuations of less than $10 million.

The report estimates that Southeast Asia must receive between $40 to 50 billion in investments during the next 10 years to make the region a $200 billion internet economy in

2025. Singapore, Indonesia and Vietnam have the densest concentrations of the region’s 7,000 startups and nearly 90 percent of all funding deals went to startups based in either Singapore or Indonesia.

Source: Google and Temasek

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: google, online travel, southeast asia

Photo credit: The iconic Marina Bay Sands resort with downtown Singapore behind it. Singapore is one of the biggest hotbeds for travel startups and investment in Southeast Asia. Dan Peltier / Skift