U.S. Legacy Carriers Vs. Low-Cost Rivals in 8 Charts

Skift Take

It is a truth universally acknowledged that a legacy airline in possession of a good market cannot handle competition.

To a degree, this notion has been validated by huge losses legacy airlines have incurred over the years, the industry’s notoriously poor margins, and market consolidation.

Some of these woes have been accredited to the rise of upstart low-cost carriers and ultra-low cost carriers taking market share away from those legacy carriers and pushing margins down through aggressive pricing.

More recently those full-service and bare bones carriers, have been joined in the market by a hybrid model, which we call low-cost lux. It is best characterized by boutique airlines which offer low-fares and up-scale service, such as JetBlue and Virgin America. Beyond different service models, these airlines have dramatically different operating models, which influence the market share they can expect to control, and the margins they can expect to make.

The perception is often that they are all competing for the same flyer, but some experts believe that the aviation market is growing in all directions. They argue that there is sufficient passenger traffic today, and more coming tomorrow, to support different types of airline operations and service models that are each designed to attract a different traveller demographic.

The people making those arguments are usually the upstart low-cost carriers, who argue that they have introduced new flyers to the market. Legacies often disagree. Though low-cost competition has been active in the airline market for nearly 50 years now, legacies continue to design aggressive Economy fare strategies hoping to push these upstarts out once and for all to secure their own Economy demand through good times and bad.

That hasn't worked in the past, but is it working now?

On December 3 of last year, in a conference call with analysts and investors organized by Credit Suisse, Ben Baldanza, then Spirit Airlines' CEO, addressed concerns about the more aggressive competition from the U.S. Big 3, and held strong to the same argument he made to us during interviews last year. He suggested that the low-cost operating model, by its nature, is resilient to pricing pressures and market changes, and that there is sufficient demand in the market, both from regular flyers and what he referred to as 'marginalized' flyers to sustain legacies, low-costs, and everyone in between.

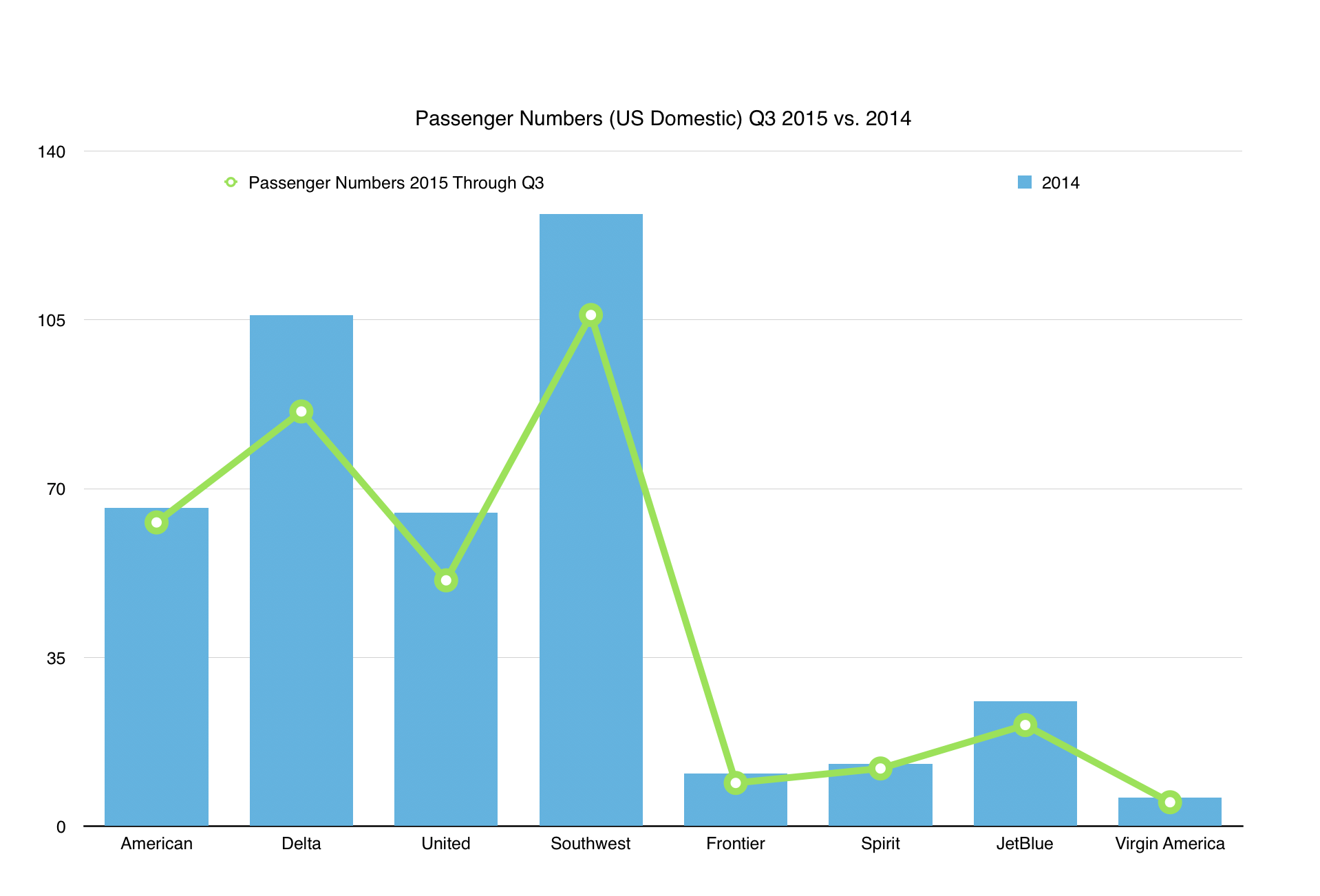

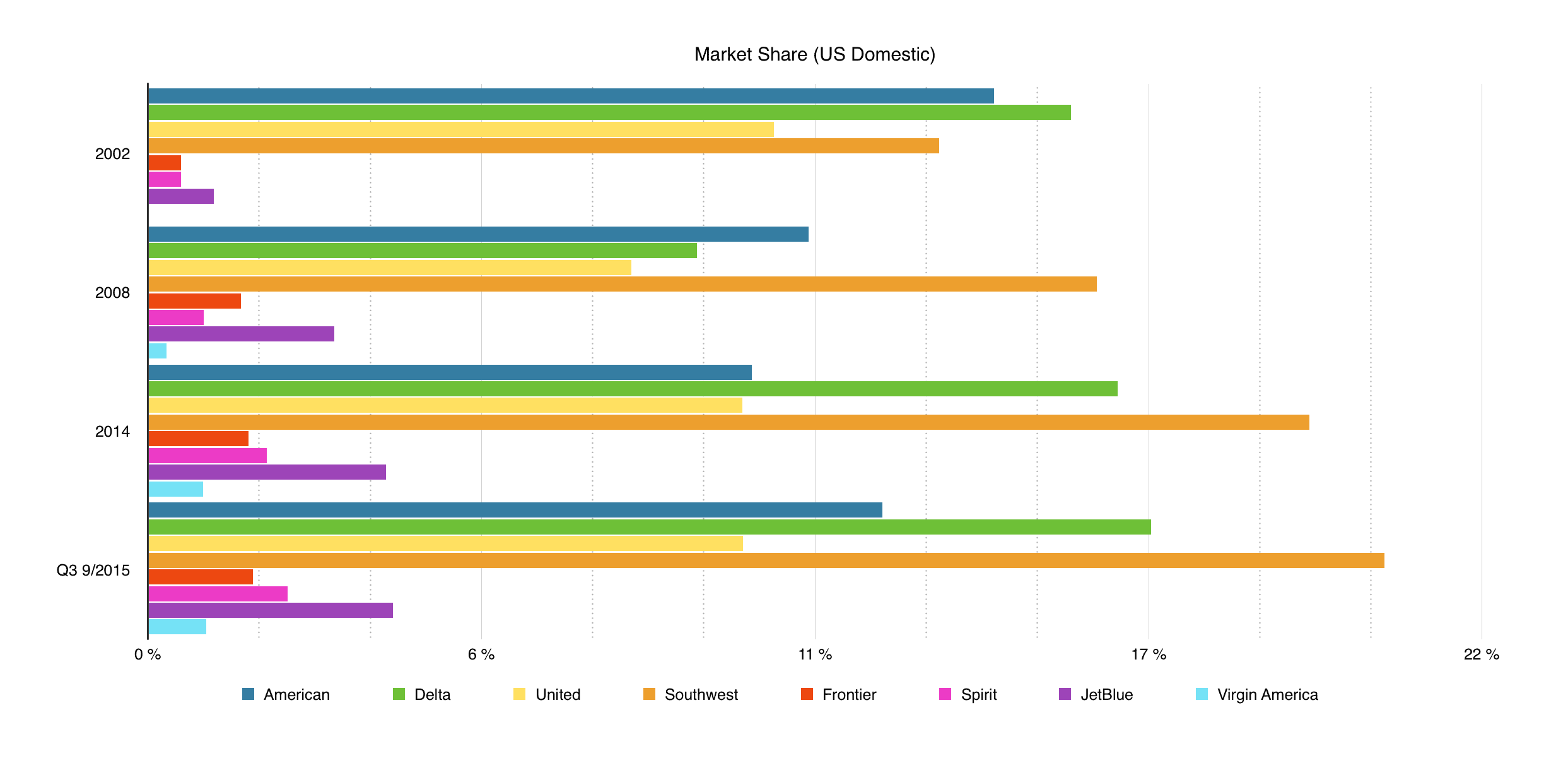

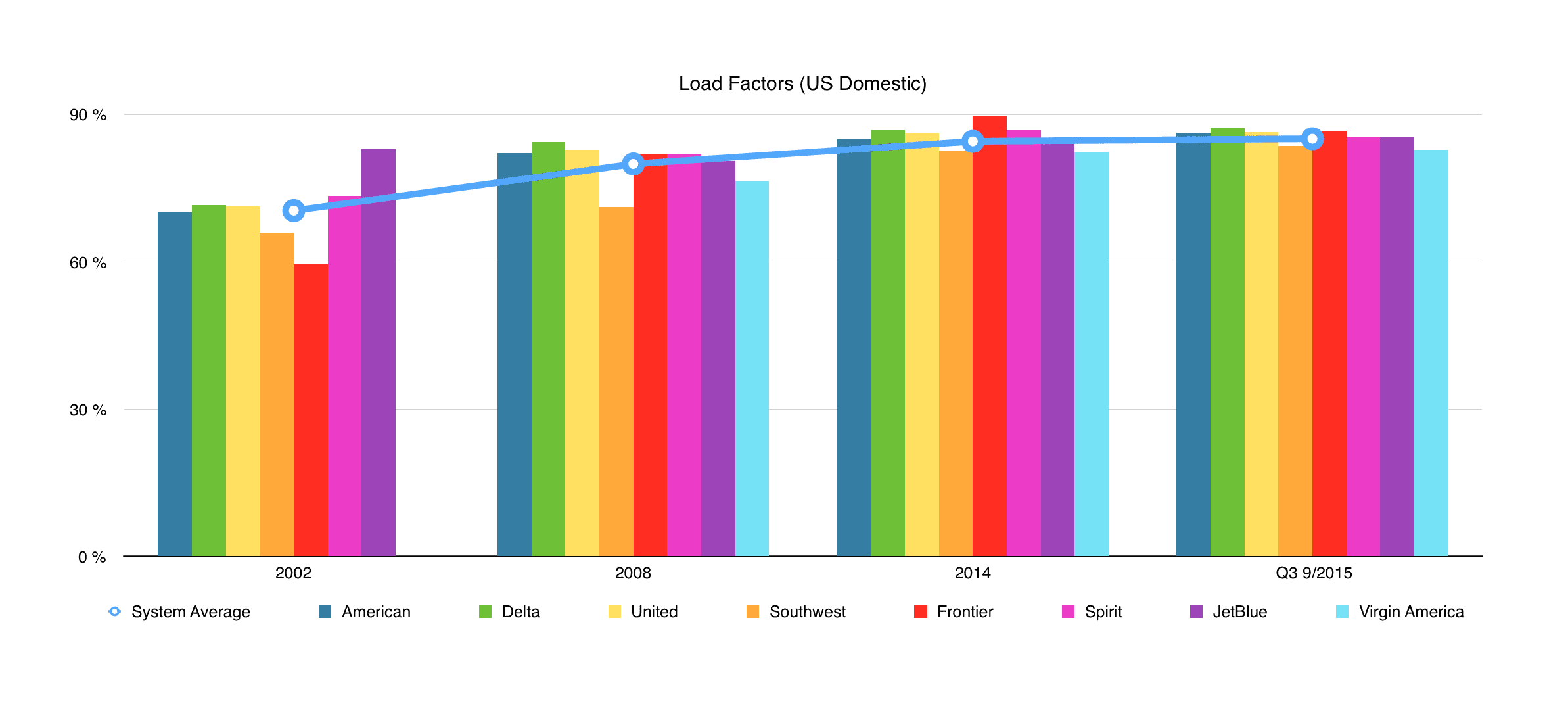

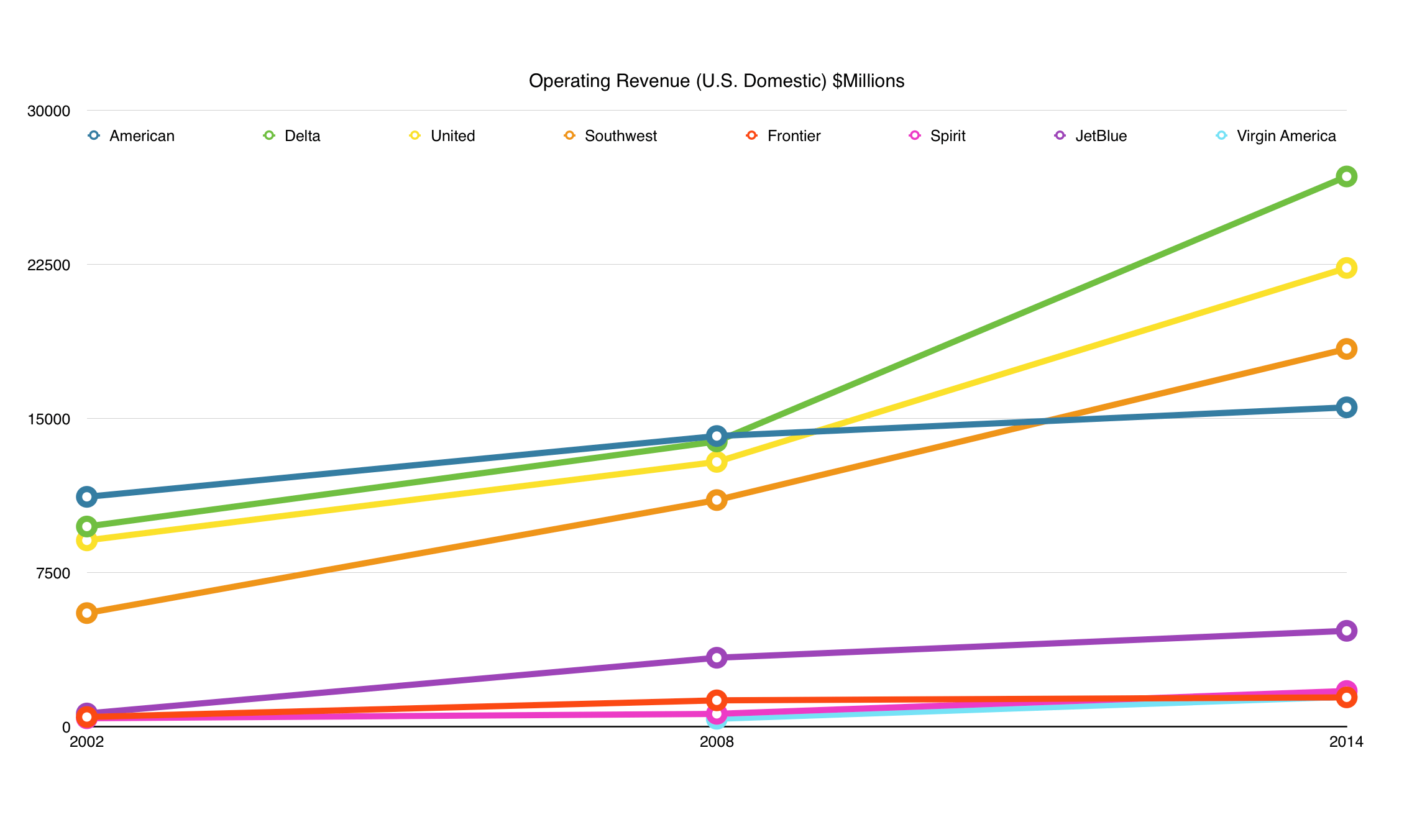

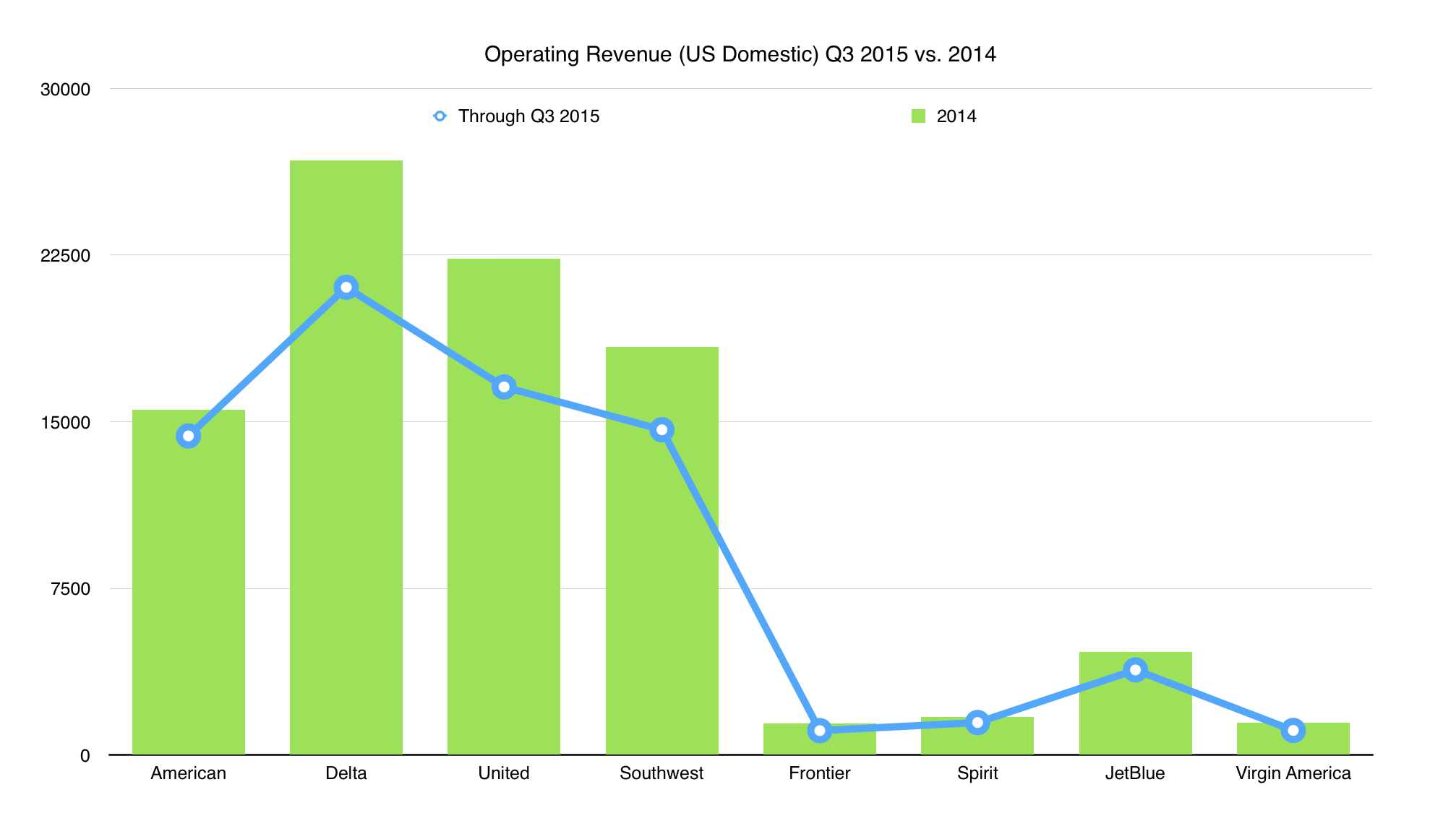

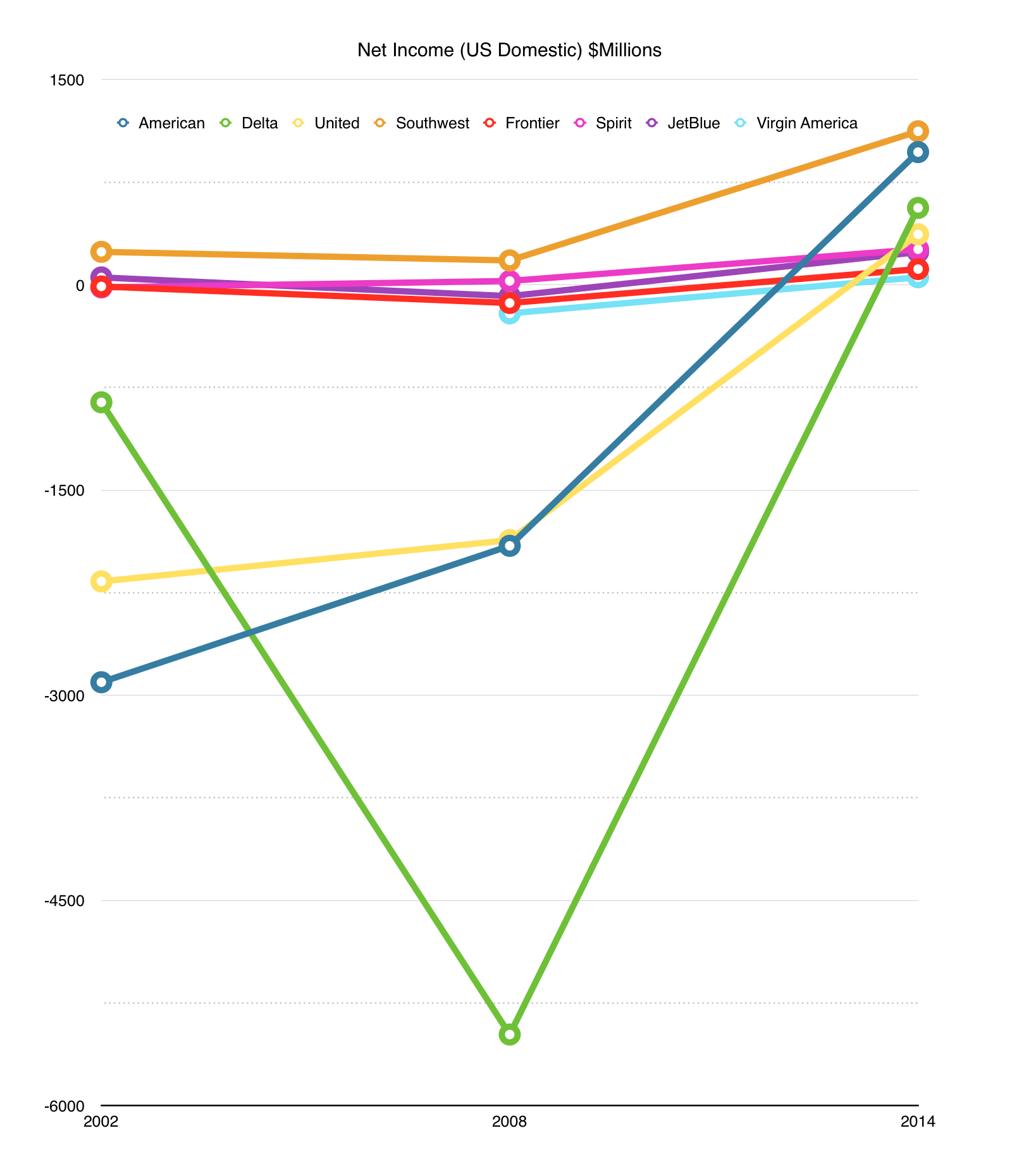

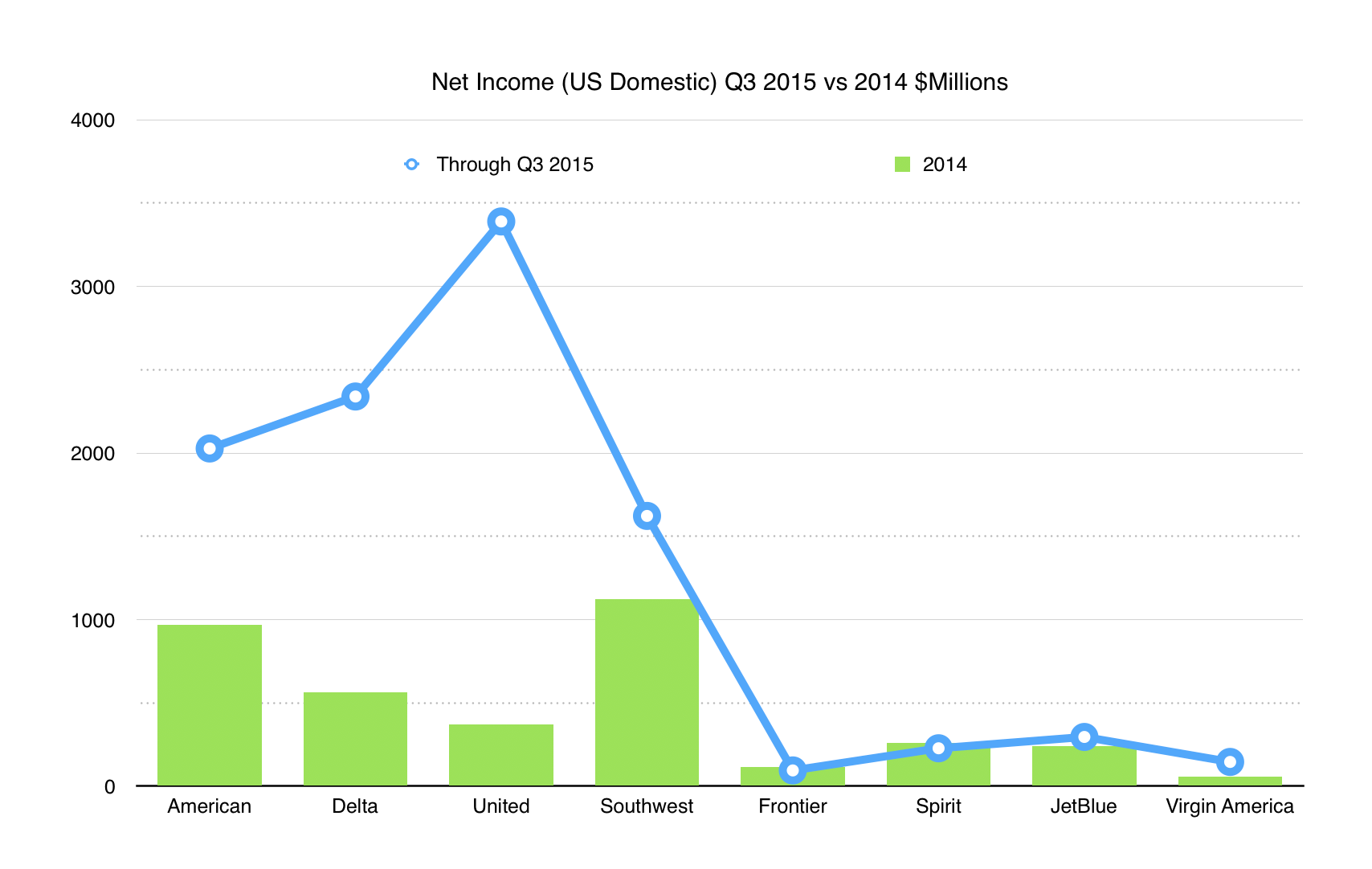

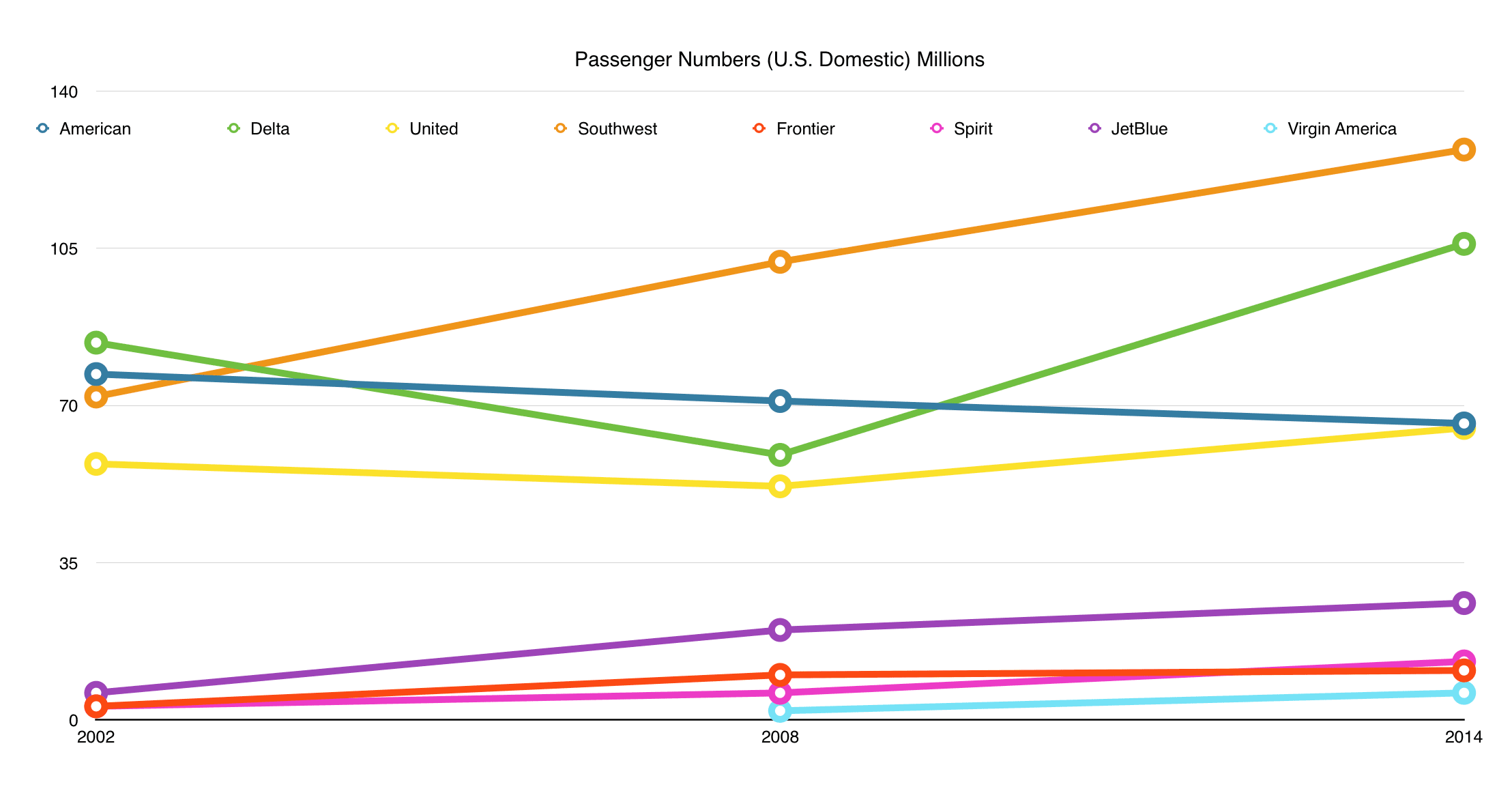

We compiled U.S. airline domestic service performance data, from the U.S. Department of Transportation, from 2002 through the third quarter of 2015, to check Baldanza’s views against market realities through good times and bad. During this period there were significant mergers and acquisitions, too: Delta bought Northwest, United and Continental merged, US Airways bought American Airlines, and Southwest bought AirTran.

We provide charts of the data retrieved, along with select quotes from Baldanza's Q&A conference call with Credit Suisse.

All figures are from the USDOT Bureau of Transport Statistics for U.S. airlines--domestic service only.

For a representative sample of the various models, we segregated the Big 3 (American, Delta, United), the classic LCC Southwest Airlines, ULCCs Frontier and Spirit, and what we would classify as a hybrid Low-Cost LUX carriers, JetBlue and Virgin America.

Baldanza: I don't think that [our growth] comes at an expense of the major carriers in a big way at all. We can show..that as we enter markets the market grows in order to give us an 85% load factor, without taking passengers from other airlines.

Baldanza: There's a conflating of issues that have happened between Spirit's share and legacies losing traffic. If a carrier carries 800 passengers a day in a market and they're the only airline that serves that market, they have 100% share. If Spirit enters the market and carries 200 people a day, but the market grows to 1,000 people, you can do the math and say Spirit now has 20% of the market and the original carriers market share has gone from 100% to 80% yet that carrier hasn't lost any traffic. Without looking at the growth in the market you can't make any assumption that share in the ULCC comes at the expense of the major carriers.

Baldanza: In some cases we have more control because we're not beholden to any certain demographic. We don't have to keep a 6:00 am flight to New York or we lose a bunch of corporate contracts. We don't have to fly to cities that don't make money. We can fly five days a week, we can fly ten times a week, we can fly double daily, we can fly once a week, to make the most money.

Baldanza: What Spirit's model does is it services demand that's not being serviced by the industry, so in a lower fuel environment that we're in now, even with more people offering low fares, the assumable market for the ULCC sector actually gets larger. The growth opportunities for the sector is bigger than it's ever been…If you look at Europe, about 20% of the market is flown by very low-cost airlines, but easyJet is pretty big and Wizz is getting bigger and growing.

Baldanza: I don't think growth in the ULCC sector, on its own, is a risk to American, United, Delta, Southwest, in terms of their own abilities..to carry much higher revenue passengers. Their willingness to invest in frequencies, in physical configuration of airplanes, in alliance networks and physical product to attract the business customer is very real. We don't have any of that opportunity.

What we're doing is carrying the traffic that the legacy industry largely is going avoid because it's economically in their industry to avoid. We built a model that can make money out of those lowest of fares and that's our bread and butter. That's what we'll do. We don't need to go out and search that higher fare average revenue customer that most of the airlines are out trying to get.

Baldanza: We're assuming diluted, depressed price environment that's in place through the second half of the year will extend through next year. We assume that there's going to be more growth in the high-cost industry next year so they'll put more seats. So we're planning our business to grow 20% and be highly profitable within that kind of environment.