Hopper’s ‘Rise in Travel’ Comes Without Playing the Search Engine Marketing Game

Skift Take

As we have written about in our deep dive on “Hopper’s Rise in Travel,” much of the company’s growth can be attributed to its expansion into fintech products, which has not only helped boost take rates and revenue gains, but has also allowed Hopper to be differentiated from the legacy players. Another way Hopper is distinct is its unique strategy around marketing and user acquisition – namely, how it avoids spending marketing dollars on Search Engine Marketing and instead focuses on product-led growth.

Along with Hopper’s ambitions of becoming a social-commerce platform, these are all means to increase lifetime value and retention of consumers, rather than spending marketing budget on acquiring each booking, as is largely the model used by Booking and Expedia. We do note that despite Hopper’s rapid growth and its differentiated business strategies, it is still unprofitable, with its focus on market share gains rather than the bottom line.

Below we offer a short excerpt on Hopper’s marketing strategy taken from our report. We interviewed Makoto Rheault-Kihara, Head of Hopper User Acquisition, to inform our research.

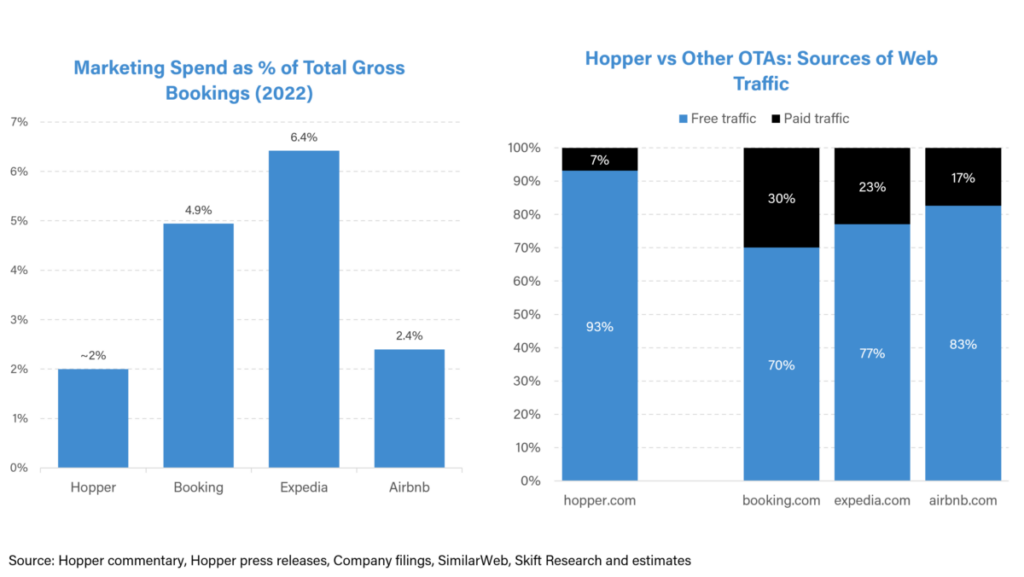

Hopper spends much less on marketing than peers Booking and Expedia despite being much younger and not yet fully at scale – in 2022, we estimate that Hopper’s marketing spend was under 2% of its total gross booking, versus 5-6% at Booking and Expedia respectively. This is largely due to Hopper spending none of its marketing dollars on Google advertising or metasearch services, which at Booking and Expedia makes up an estimated 60-70% of their marketing budgets. As a result, Hopper receives more of its web traffic organically, and is further helped by the fact that it is an app-only booking platform, receiving 100% of its B2C bookings on the app, versus roughly 45-50% of bookings coming from app at Booking and Expedia.

We spoke with Makoto Rheault-Kihara, Head of User Acquisition at Hopper, who explained that “One of the reasons we’ve been able to keep our costs a lot lower than our competitors is that we don’t compete at all on search engine marketing (SEM). The traditional travel companies’ growth models are based on bidding on Google for really high intent keywords, trying to convert them on the spot and extract as much revenue from that transaction and then the next time around go through the process again. At Hopper we decided not to compete in that game at all. Instead Hopper has a lot of features like price freeze and flight watches that are meant more for users that are a little bit lower intent but higher in the funnel. We also acquire all of our app installs on channels like Facebook, TikTok, Snapchat, and YouTube, as well as through partnerships with influencers, which are channels that are much lower cost than a pay per click on traditional SEM.”

Hopper was already ahead of peers in terms of marketing efficiency in 2021 – and it continues to innovate, moving away from social media advertising and instead investing its marketing dollars towards product-led growth and the development of a social commerce platform and super app.

Whilst paid marketing channels through social media allowed Hopper to quickly grow its app downloads, the focus is now on retaining those customers rather than continuing to attract more downloads. Hopper’s app has been downloaded more than a 100 million times, with Hopper being the most downloaded travel app in 2021, growing app installs near 200% year-on-year from 2020. However it will be difficult to keep up this growth momentum – the U.S has a population of about 330 million, meaning that at 100 million app downloads, a certain saturation level gets hit. Continued paid marketing will not see the same level of returns as before.

Rheault-Kihara explains that “In 2021 we got a really good amount of installs and we lead travel pretty consistently in terms of the number of app installs that we get. [However], now it’s less of growing installs because we’re up there with Uber and Amazon in terms of total install volume. The next opportunity isn’t in increasing installs by 2x or 3x every year. So we started to look a lot more inwards towards product led growth.”

According to Rheault-Kihara, marketing spend on paid marketing external to the app (i.e. through social media channels) was 80% of Hopper’s marketing spend in 2021, and has today dropped to 25%.

Read the full report to learn more about where Hopper does spend its marketing dollars – specifically its investment into product-led growth such as social commerce mechanisms as inspired by Chinese app Pinduoduo.