4 Takeaways From Skift’s Online Travel and Distribution Summit

Skift Take

Many travel companies that have survived the pandemic have used the pause as an opportunity to reinvent themselves, or at least to launch new product lines that they may or may not have contemplated before masks and hand sanitizer became required accessories.

That was one of the four takeaways from Skift’s Online Travel and Distribution Summit, which took place in a virtual event on February 17.

Pandemic-Era Product Innovation

Saying Certares raised more money for investing in the last year than it has in the past eight, founder and senior managing director Greg O’Hara announced that the private equity firm, with huge investments in travel, is looking at more real estate investments.

Referring to an upcoming hotel transaction, O’Hara told Skift founder Rafat Ali: “We’ll close our first deal in the next couple of weeks.”

O’Hara made the argument that given Certares’ investments in companies including American Express Global Business Travel, Tripadvisor, Internova and AMA Waterway, the firm is one of the biggest travel sellers in the world, and case use the sometimes-contradictory data it collects to great effect.

Certares recently led a $42 million Series C investment round in cabin rental startup Getaway, and provided growth capital to small-group tour operator G Adventures.

O’Hara said investing during the pandemic is “the easiest job I’ve ever had,” but he pushed back against the notion that valuations are low. “Things are not cheap, that is a misnomer,” O’Hara said.

Kayak co-founder and CEO Steve Hafner said the company is launching a business travel solution to attract small- and medium-size businesses, and will also debut a property management system for small and independent hotels. Sister company Booking.com tried to get into the B2B side of the hotel business a few years ago but largely withdrew.

Hafner wasn’t ready to provide much detail about the property management system, which is under development.

He argued that online travel agencies will recover quicker than metasearch, or comparison shopping engines, emerging from the pandemic, but that people will still need to compare prices so that metasearch will stay relevant.

Eric Bergaglia, Booking.com’s global head of homes and apartments, said the company is developing new features and products to align with the changing nature of work, travel and living. For example, the company has introduced weekly and monthly rates, and is piloting stays of a month or more in 14 cities.

Bergaglia said, however, that he doesn’t expect longer stays to surpass the volumes of shorter reservations.

Lindsay Nelson, chief experience and brand officer at Tripadvisor, spoke about the company’s new membership program, Tripadvisor Plus, with subscriptions now available to a limited number of beta users, in the context of the travel industry’s lack of innovation over the years.

On the business side, Tripadvisor Plus will give commission relief to participating hotels that might offer perks, and will offer members discounts and assorted benefits for hotel rooms and experiences.

Discounts won’t “pull at your emotional heartstrings,” Nelson said, so Tripadvisor wants to find a way to keep members engaged.

Nelson said merchandising magic is making the retail experience more fun, and she contrasted the immersive brand experience of walking through an IKEA, versus shopping in a Bed, Bath & Beyond.

Tripadvisor Plus, Nelson said, hopes to serve both the segment of highly engaged Tripadvisor users, who the company hasn’t adequately monetized, and the “fly-by-night” visitors looking for a deal.

Alfan Hendro, Traveloka’s chief operating officer, said the Indonesia-based online travel agency used the Covid crisis, when traveling was at a standstill, to invest heavily in financial services.

“Financial services are showing very good progress,” he told Skift Editor-At-Large Raini Hamdi.

Christian Suwarna, CEO of Traveloka Experience and the company’s chief marketing officer, said the company will evolve from a traditional online travel agency into new business lines focused on consumer interest, including more local and lifestyle services.

Short-Term Rental Strength But Hotels Came On Strong

Short-term rental players from Expedia Group to Booking.com acknowledged the strength of the sector over the last year, and put forth the idea that much of that will persist.

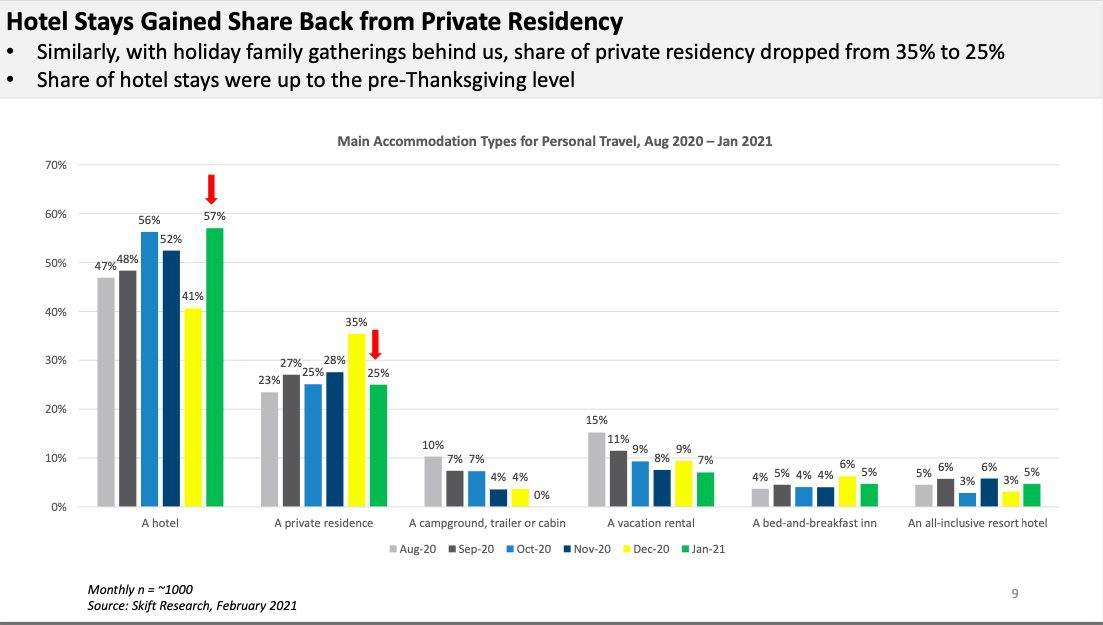

But Skift Senior Research Analyst Wouter Geerts referenced Skift’s U.S. Travel Tracker January 2021, which showed growth of hotel stays eclipsing that of private residences from August through January.

Several speakers at the summit acknowledged that the travel recovery will be uneven, and fraught.

Playing the Long Game

The pandemic gave companies with adequate resources to step back a bit from the pressure of quarterly earnings, to build their businesses for the long term.

For example, Kern of Expedia Group said the company won’t spin off a strategic asset such as Vrbo “just to get a moment of valuation upside.” He added that doing that and then screwing up the Group’s overall strategy “doesn’t make sense to us.”

Decius Valmorbida, president of Amadeus IT Group’s travel division, said the company hopes over time to become more of an integrator, helping distributors and providers, including airports, collaborate rather remain in distinct silos.

And Traveloka officials said they can invest in the growth of financial and lifestyle services, and turn to profitability when it is called for. Traveloka is mulling an initial public offering.

Awed By Airbnb But Not Distracted

It’s clear that the travel industry is fixated and awed by the trajectory of Airbnb, and its historic initial public offering.

Kern of Expedia Group claimed that Vrbo gained some share from Airbnb in markets that Vrbo is already strong, and will put resources into marketing other short-term rental brand in its portfolio, including Stayz in Australia.

He said Expedia Group will also “hard-wire” short-term rental inventory into its online travel agency brands, including Expedia.com and Hotels.com, to better compete,

Hafner of Kayak wouldn’t comment on whether Airbnb is overvalued at its $118 billion market cap — compared with $92 billion at his Booking Holdings — but added that the stock market seems to be using different criteria to evaluate Airbnb than it uses to measure others.

The travel industry, though, will clearly have to take the measure of Airbnb for years to come.