Where Are Travel Prices Headed? Get Ready for Twists and Turns

Skift Take

If you think that airfare and hotel rate trends will be uniformly characterized by steep discounting as travel reopens unevenly across the globe, then guess again.

Travel businesses have pent-up demand in their favor, to be sure, but how hotels and airlines price their services in coming months will play a crucial role in travel’s recovery, especially as the global economy teeters toward recession and consumer spending pulls back.

Take a look at the airlines. Yes, the airline trade group IATA reported that domestic airfares around the globe fell 23 percent year-over-year in May as airlines try to stimulate demand. But investment bank UBS found that while forward airfares in the next few weeks and months are weak in the United States, they were getting higher in Asia, and flat to heading upwards in Europe.

So regional airfare disparities are very much in play.

On the hotel front, STR data found that average daily rates in the United States fell nearly 40 percent for the week ending May 23, but the analytics firm forecasts rates to rebound nearly 2 percent in 2021.

Referring to global airfare trends, Jay Shabat, senior analyst at Skift Airline Weekly, said there are so many variables at play, including capacity cuts, blocked middle seats, historically low fuel prices, travel restrictions, government subsidies, the extent of a business travel rebound, and the timing of a coronavirus vaccine, that there’s no one-size-fits-all narrative about airfare fluctuations.

“There’s not a dominant trend out there right now with everything really expensive or everything really cheap,” said Shabat, who conceded that one common theme is the global airline industry is getting smaller.

Hotel rates in the United States are way down on average, and there is a discounting frenzy in destinations that are reopening such as Las Vegas, for example, where a luxury king suite at the 5-star Venetian was available Wednesday on its own website and on Expedia for $127.

But Caren Kabot, founder and CEO of Solo Escapes, said rates for this summer at four- and five-star properties in places such as Cape Cod in Massachusetts and Newport, Rhode Island are similar to last year’s because many properties are sticking to 30 percent maximum occupancy for social distancing purposes.

Another factor, she said, is that Maine and Vermont still have mandatory 14-day quarantines for tourists.

“These rates are not coming down,” Kabot said, referring to luxury properties. “People think there will be discounts. There really aren’t any.”

For example, the Wequassett Resort and Golf Club in Harwich, Massachusetts on Cape Cod was offering a garden view room with two queen beds for a July 21 stay at $725 per night.

Kabot said she expects luxury hotel rates to remain at a premium level because few clients are ready to get on planes unless they are flying in private jets. “I think the rates will stay very competitive in the U.S.,” Kabot said.

The Skift team dug into airline and hotel pricing trends, and the following is what we found:

Airlines Are Discounting Domestically But Trends Uneven

As mentioned, IATA found that airlines are discounting in their domestic markets with airfares falling around 23 percent on average year-over year in May.

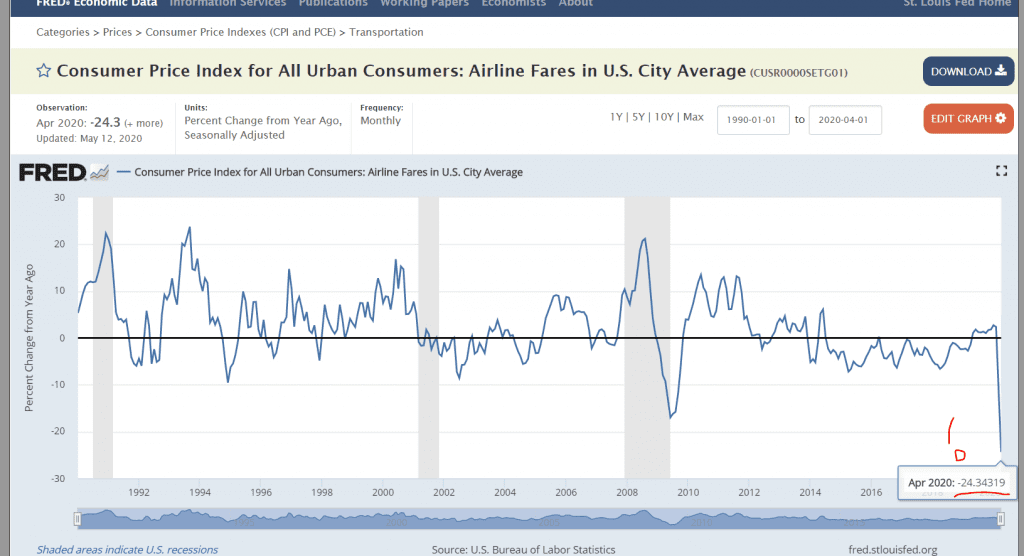

In April in the United States, airfares declined 24.3 percent on average in U.S. cities, according to the U.S. Bureau of Labor Statistics. These were the latest statistics available from the bureau.

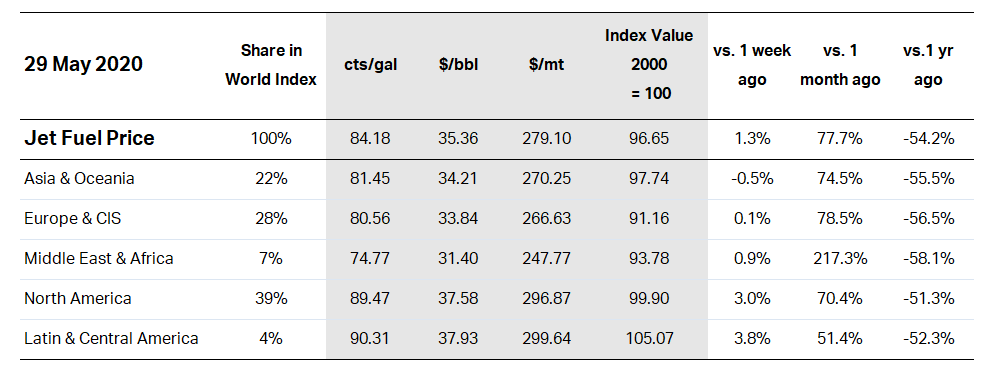

One factor that could enable airlines to keep airfares low is that jet fuel prices are at historically low levels, Shabat of Skift Airline Weekly pointed out.

Jet fuel prices were up 1.3 percent to $35.40 per barrel for the week ending May 29 compared with the previous week, according to IATA. But that price was 54.2 percent lower than a year ago.

With airlines removing capacity, which tends to keep airfares higher, they are not ready to cut rates to “next to nothing,” Shabat said. But they could get “super-aggressive” about discounting once people feel more comfortable about flying. Low-cost carriers, he said, could emerge from the crisis “not too badly damaged” because they can profit despite low fares because they have a lower cost base than the network airlines.

One temporary factor keeping airfares higher and available seats lower is some airlines blocking middle seats for social distancing purposes, Shabat said.

But he feels that middle seat blocking will disappear before long.

“There is no airline industry if you block the middle seat,” Shabat said. “There is no economic model that works.”

The UBS Evidence Lab tracks 17 million flight departures annually at 2,000 airports and found divergent airfare pricing trends around the world.

Jeremy Ridder Brunelli, managing director of the UBS Evidence Lab, talked to clients in a webcast Tuesday about divergent airfare trends across the world.

Citing the UBS yield management tracker, Ridder Brunelli said he’s seeing “weaker forward curves” for U.S. airlines than for Asian carriers, where “the forward curve has actually turned positive, and Europe, which is more neutral to positive over the next few weeks and months.”

Regarding individual airlines, British Airways’ pricing is “deteriorating but EasyJet inflected higher in recent weeks,” Ridder Brunelli said. He added that “the price trend is deteriorating for Delta and it’s kind of weak-ish for United.”

Stella Penso, senior director of pricing at flight and hotel metasearch firm Skyscanner, said early signs of discounting by Europe’s low-cost carriers is not a sustainable model because fuel prices won’t stay as cheap as they are forever.

“Longer term, we expect the focus to shift towards more value-based pricing where power will come from flexibility, safety and trust,” Penso said. “In the absence of a Covid-19 vaccine, these factors will become increasingly important for travelers and may allow travel providers to charge more of a premium.”

In Latin America, airfares fell around 35 percent on average compared with last year, according to Despegar CEO Damián Scokin. Discounting, he said, was particularly sharp in Brazil, with airfares plummeting 40 percent on average.

Fareportal, with its Travelong corporate travel business and consumer brands, including CheapOair and OneTravel, analyzed its 10,000 top origin and destination combinations and found that airline tickets are $66 cheaper on average than they were pre-coronavirus. New York City to Miami is most-frequently searched route for people seeking to travel in June while it was third prior to the pandemic.

“We observe airlines are increasing capacity, which is a signal of growing consumer demand,” Fareportal CEO Sam Jain and Co-CEO Werner Kunz-Cho said in a statement. “We believe leisure travel will rebound more quickly than business, as customers take advantage of lower prices and better deals for travel, and we are anticipating an ongoing increase in numbers of people traveling in 2021.”

Hotels

The hotel sector entered the coronavirus downturn with analysts cautioning to not cut rates too deeply or quickly, as there was too much uncertainty surrounding the pandemic. Given the cratering of travel demand and rise of travel restrictions, many hotels opted to temporarily suspend operations rather than stay open and bother with setting rates.

Industry experts argued it was impossible to induce demand by lowering rates due to health fears and government orders to stay at home.

But of the hotels that remain open, rates have tumbled significantly; however, they have not dropped at the same pace as occupancy. U.S. hotel occupancy rates ended the week of May 23 down 50 percent compared with the same point in 2019, STR reported. But average daily rates, while still significantly down, declined at a slightly slower clip, nearly 40 percent.

STR expects average daily rates to drop nearly 22 percent in 2020 before increasing by nearly 2 percent in 2021.

Update: STR provided Skift with an update about the upward trajectory over the last few weeks about average daily rates in the United States, China, and Australia. See the following chart:

Average Daily Rates in Select Countries ($US)

| Country | 4/6 – 4/12/2020 | 5/25-5/31/2020 | Percent Change |

|---|---|---|---|

| United States | $73.08 | $82.59 | 11.9 percent |

| 3/23 – 3/29/2020 | 5/25-5/31/2020 | ||

| China | $51.15 | $58.40 | 14.17 percent |

| 4/20 – 4/26/2020 | 5/25-5/31/2020 | ||

| Australia | $77.10 | $81.10 | 5.18 percent |

Source: STR

“The gradual relaxation of social distancing in the second half of this year will primarily benefit regional leisure travel with the business and group travel recovery lagging,” Tourism Economics President Adam Sacks said in a statement. “We anticipate it may take until 2023 to recover to 2019 peak demand levels.”

Nicholas Ward, co-founder and president of metasearch marketing platform Koddi,

said the company saw hotel rates decline around 24 percent in May.

“This only tells part of the story,” Ward said. “In addition to average rates being down, we’re also seeing stays shift into shorter and nearer-term windows, which creates even more pressure on top line revenue and metrics like RevPar (Revenue per Available Room).”

As Kabot of Solo Escapes found, Ward said higher-end properties have maintained their pricing, but they suffer from falling occupancy rates.

“The hotels we see doing the best right now are taking advantage of short-term stays and short booking windows, and even though we are seeing a faster than expected pickup in many markets, it remains a tough time for the space,” Ward said.

In Latin America, online travel agency Despegar found the plunge in hotel rates seems to be less severe —15 percent on average — than in some other regions of the world.

“We foresee lower hotel rates levels for several months in Latin America given the supply-demand imbalance is very large and we do not consider that there will be an adjustment of supply in the next 6 to 12 months,” said Despegar CEO Scokin.

Gino Engels, co-founder and chief commercial officer at OTA Insight, said hotel markets that are more dependent on domestic travel have an advantage over those more reliant on international visitation, which have “lost a large amount of feeder business that has not returned yet.”

Hotels that opt for steep discounting will trigger “a race to the bottom,” Engels said.

“It will only take a short time before the rest of the market will need to follow to compete, which will have a negative impact for everyone,” Engels said. “With demand down and supply remaining the same, businesses may now need to shift gears and focus more on domestic business travel and compete with hotels outside of their typical comp set.”

Mike Chuma, vice president of marketing for IDeaS, which provides revenue management to hotels, said the company is seeing spikes in demand nearing 2019 numbers in drivable resort areas in Florida, for example.

“Location and proximity to major metro areas are driving rates more so that segment type at this point,” Chuma said.

On a segment basis, though IDeaS is seeing extended stay properties with rates down 10-20 percent year over year.

Select service and extended-stay properties “weathered the storm better and are performing more strongly than upper scale and luxury properties,” Chuma said.

Skift staff members Jay Shabat, Cameron Sperance, and Sean O’Neill contributed to this report.

Note: This story has been updated with average daily rates in the United States, China and Australia.