New Skift Research Report: Venture Investment Trends and Startup Opportunities in Travel 2018

Skift Take

Today we are launching our latest report, Venture Investment Trends and Startup Opportunities in Travel 2018, for our Skift Research subscribers.

Never has there been greater venture capital interest in travel startups than today. A record amount of venture capital was invested in travel startups in 2017 driven by unicorns, like Airbnb, emerging technologies, expansion outside of core geographies, and traction in new verticals.

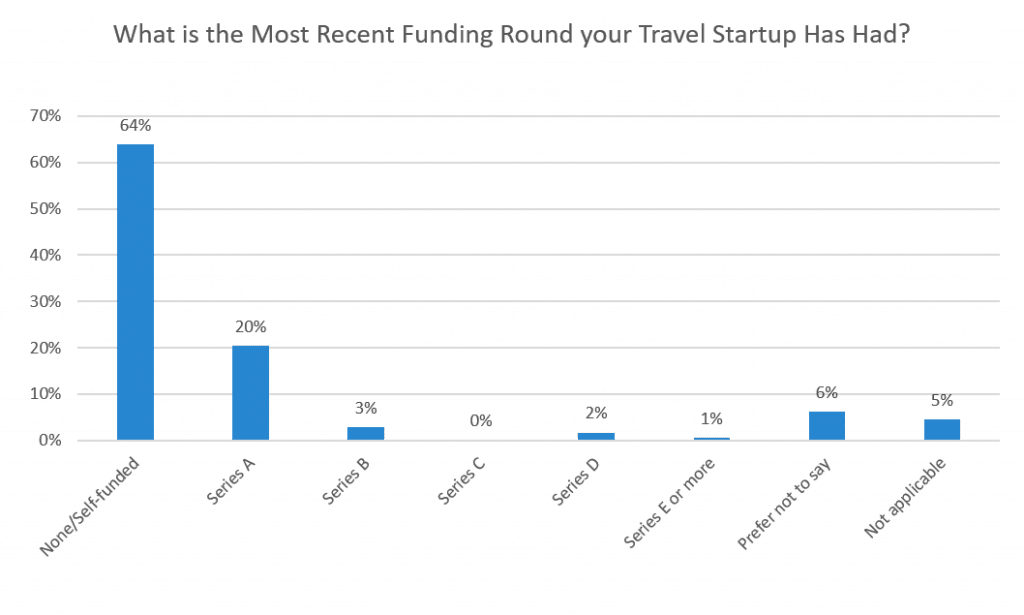

Despite the newfound attention, plenty of obstacles for would-be founders exist. For instance, early stage financings continue to decline as a share of overall deal-making because many funds now prefer bigger rounds in more mature companies. This leaves founders facing a funding gap, forcing them to bootstrap at the start.

The trend for early-stage startups is towards self-funding

Source: Skift + Amadeus State of Travel Startups Survey

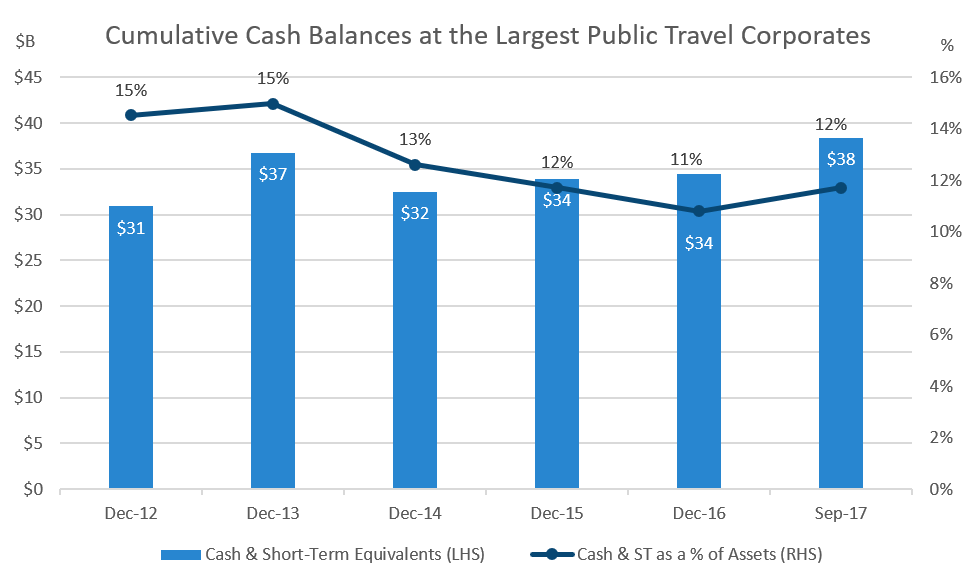

In addition to running lean business models, one strategy for startup founders to combat the funding gap is to pursue corporate partnerships. Though not without challenges, these types of deals can be especially fruitful for travel startups seeking access to well-established networks and inventory. Many large travel players have been bruised by new competitors and are eager to respond by putting their large cash balances to work through new investment.

Travel corporates hold large cash balances

Source: Skift Research, Capital IQ

Companies used: EXPE, PCLN, CTRIP, TRIP, TRVG, MAR, H, HLT, AC, WYN, IHG, CHH, DAL, AAL, UAL, LUV, JBLU. Denominated in USD

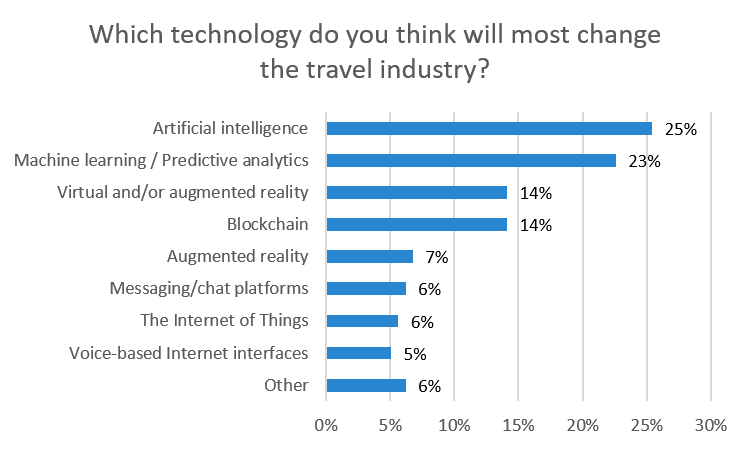

Looking ahead, breakthroughs in artificial intelligence, virtual and augmented reality, and blockchain may pressure or even unseat long-time incumbents. However, our research shows that the cutting-edge companies leveraging these emerging technologies face challenges both in commercializing their tech and in convincing an, at times, skeptical audience. It’s essential that startup founders in these emerging technology fields work on bridging the knowledge gap, ensuring that there is real value in their products and services, and then attempting to get C-Suite buy-in at larger corporations.

Going to the source: where startups see the greatest technology potential

Source: Skift + Amadeus State of Travel Startups Survey

In addition to exploring these topics more fully, the report will also cover the rapidly evolving business environments across geographies, verticals, and business models.

What you’ll learn from this report

-

- The size of the travel startup financing market

- Emerging changes in early stage investing

- A deep-dive on trends in corporate venture capital investments

- A case study of investments made by JetBlue’s venture capital arm

- An overview of travel startup exits and corporate partnerships

- How startup business models are evolving

- A look at growth in Latin America, China, and beyond

- Hot spots on the horizon for 2018

Subscribe to Skift Research Reports

This is the latest in a series of monthly reports, data sheets, and analyst calls aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report. After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.