How China, Japan and India Are Shaping the Asian Hotel Market

Skift Take

This year is shaping up to be a “year of contrasts” for the Asia Pacific hotel market, according to real estate services company JLL.

Big ticket events like Taylor Swift’s concerts in Melbourne, Singapore, Sydney and Tokyo, and travel during Lunar New Year have helped improve occupancy rates. But business travel budgets have tightened and leisure travelers are spending more cautiously.

The drivers of growth? Chinese demand, which has not fully recovered yet, and the strong potential of India’s outbound travel demand driven by its rising middle class.

JLL estimates that increased investor interest and improved market fundamentals could lead hotel transaction volumes in Asia Pacific to reach around $12.2 billion this year.

Monetary policies and investor optimism, especially in core markets like Japan, are some of the main drivers of this growth.

The Numbers Say it All

“The region’s strong tourism fundamentals, more pronounced since the reopening of borders, will continue driving investor interest into the region,” Nihat Ercan, CEO, JLL Hotels & Hospitality Group, Asia Pacific, told Skift. He also noted that currencies in the region are weaker against the U.S. dollar, which helps drive investment.

Ercan expects this travel momentum to continue through 2025, driven by favorable macroeconomic environment in Japan and Korea, and emerging and safe haven markets.

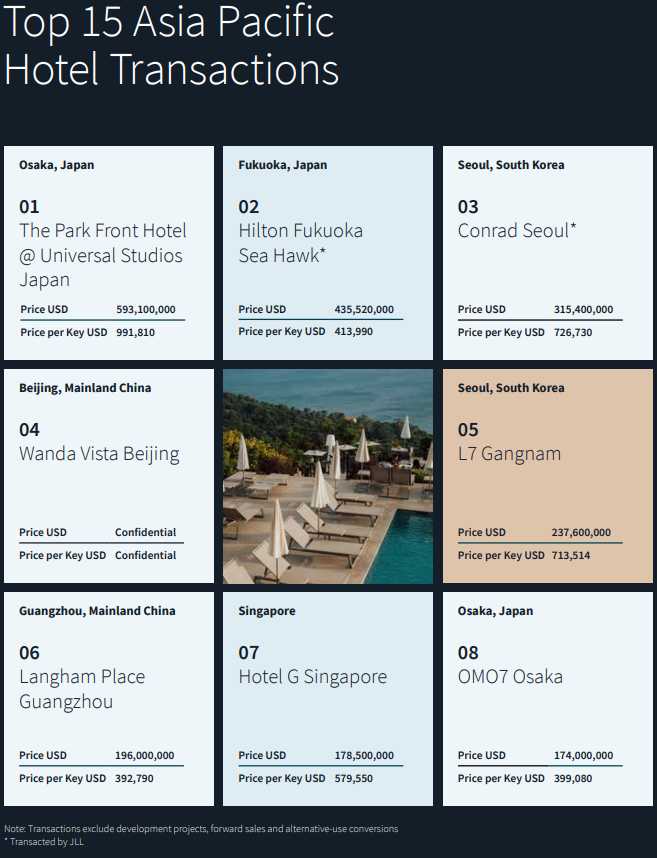

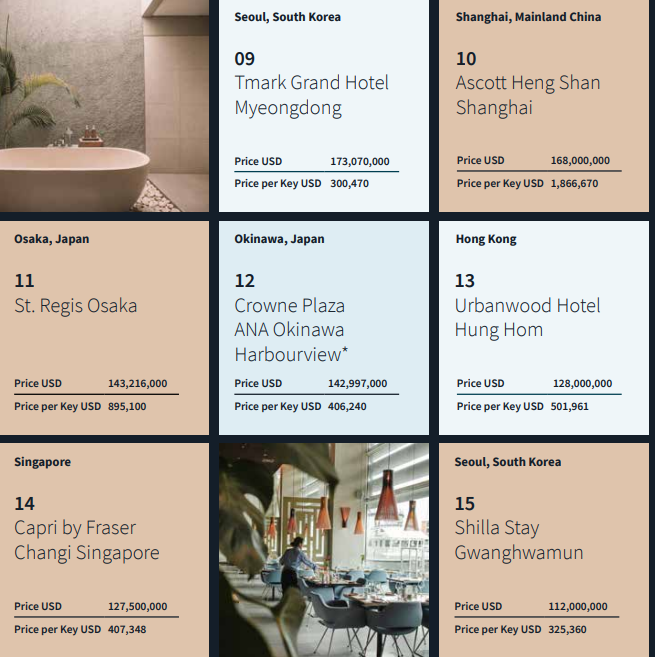

Upscale to luxury full-service assets remain in favor representing 45% of the total investment volume in the region. Investor interest in upscale to luxury full-service products in resort destinations increased by 4% from last year.

As opposed to this time last year, inflation is in a more manageable and stable position, Ercan said. “Countries that saw inflation surge are quickly regaining control and as a result, medium-term inflation pressures are expected to be low.”

Japan: The Most Active Market

Despite a recent interest rate hike, Japan will continue to be a top investment destination, projected to record $4.7 billion in hotel transactions this year driven by the weak yen and strong tourism fundamentals.

Japan has been the most active market regionally and will remain so for the coming 12-18 months. JLL expects larger full-service hotels to trade in late 2024.

Most investors continue to focus on popular cities like Tokyo, Osaka and Kyoto. Emerging cities for hospitality investment include Fukuoka and Sapporo. JLL said it expects opportunities to be in midscale / limited-service products.

With year-to-date September sales volumes at $3.8 billion, JLL forecasts total sales of $4.7 billion for this year for Japan, and an increase of 4% in 2025 at $4.9 billion.

According to Ercan, the strengthening of the yen could impact investors’ decision as a higher local currency will likely impact asset prices in the USD base. “A stronger yen could also slow down the surge in inbound travelers in the country as it will be more expensive to travel to Japan. Ultimately, this will influence Japan’s hotel revenue per available room (RevPAR) on average, tapering the year-on-year growth in trading performance,” he said.

The Return of Mainland China

For Mainland China, hotel RevPAR has recovered to 2019 levels in the first half of 2024. Leisure destinations like Sanya and business/leisure destinations such as Chongqing, Chengdu and Xi’an have led the recovery.

Investment in Mainland China’s hotel space totaled $1.8 billion as of September 2024, 6.4% growth from the previous year. More than half of these investments are in Shanghai and Beijing. Hotel transaction volumes would reach $2.1 billion for the full year. However, the report noted that transaction volumes may flatten out next year as a result of uncertainties around the overall market sentiment.

“In Mainland China, there has been a slowdown in domestic tourism given the current economic situation and a slower-than-expected inbound tourism despite numerous visa facilitations are amongst the main risks. These factors will influence the market at least in the short-term,” Ercan told Skift.

According to Ercan, Chinese tourists may not fully return if the local economic environment persists and geopolitical challenges and trade issues may further provide some level of influence to the market.

The India Opportunity

JLL forecasts hotel trade in India will reach $440 million this year, marked by balanced activity between Tier-1 and Tier-2 and 3 cities, with a strong pipeline of new rooms

The hotel sector in India has experienced solid growth over the past 3 to 5 years, with major international brands expanding their footprint in the country, Ercan pointed out.

Ercan attributed the sustained momentum in hotel transactions throughout 2024 to the rising domestic tourism in the country. This boost has strengthened room rates, revenue, and occupancy levels, leading to higher yields and improved EBITDAs.

“In the year ahead, Tier-1 cities will continue to raise interest, especially from cross-border investors, whilst investors will increasingly look at Tier-2 cities given the strong growth in domestic tourism,” he noted.