Abu Dhabi Cuts Hotel Fees, Top GCC Wealth Funds – More Middle East Travel News

Skift Take

Middle East Travel Roundup

Get the latest news from the Middle East in one easy-to-digest newsletter.Hotel stays in Abu Dhabi are now set to get cheaper as the Department of Culture and Tourism — Abu Dhabi (DCT — Abu Dhabi) announced the reduction of government fees imposed on hotels within the emirate.

What Are the Changes? The revisions to the government fees include:

- Reduction in the tourism fee for guests from 6% to 4%.

- Municipality fee of AED 15 per room per night will be eliminated

- Removal of 6% tourism fee and 4% municipality fee that were previously applied to hotel restaurants. However, the municipality fee equivalent to 4% of invoice value issued to customers will remain in place.

From When? The adjustment is scheduled to come into effect from September 1.

What Drives This Move? The goal is to further cultivate the emirate as a hub for tourism and culture, all the while providing additional support for its thriving hospitality industry.

GCC Sovereign Wealth Fund Assets Surge to $4 Trillion

What we came across while reading S&P Global Market Intelligence’s report on sovereign wealth funds in the GCC:

- Over the last few years, the assets under management of sovereign wealth funds in the GCC have experienced an average growth rate of 20% to reach a high of around $4 trillion. This is equivalent to around 37% of the total assets under management of sovereign wealth funds globally, according to statistics provided by Global Sovereign Wealth Funds (SWF).

- This size is almost equivalent to the combined assets under management of sovereign wealth funds in Asia, Latin America, and Sub-Saharan Africa.

- In 2022, state-owned investors (including SWFs and public pension funds) from the GCC region invested approximately $83 billion in new funds.

- Out of the 10 biggest global investments made by these state-owned investors in 2022, five originated from GCC sovereign investors, worth approximately $74 billion. These were divided into 62% from the UAE, 28% from Saudi Arabia, and 10% from Qatar.

- Among the 10 largest SWFs around the world, five are in the GCC region. Saudi Arabia’s PIF, the Abu Dhabi Investment Authority, the Kuwait Investment Authority, the Qatar Investment Authority, and Investment Corporation of Dubai hold combined assets under management estimated at US$3.3 trillion, according to Global SWF.

- Green investments and net zero carbon emission targets have also been on the radar screens of GCC SWFs; several have invested in renewables lately.

- GCC SWFs are currently striving to expand their global footprint by investing in various geographies and sectors. India and China — and other Asian countries — are on the radar.

Know Which is the World's Most Popular Landmark?

Dubai's Burj Khalifa has secured the title of the world's most visited landmark, drawing an impressive 17 million visitors annually, according to analytics website Switch On Business.

Burj Khalifa also rakes in $621 million each year from ticket sales alone. Moreover, it has garnered more than 22 million Google searches and boasts of over 7 million hashtags on Instagram.

The analytics company examined search volumes and average visitor figures for over 150 of the most renowned landmarks in the world.

The Top 15 Landmarks:

1. Burj Khalifa, UAE

2. Taj Mahal, India

3. Niagara Falls, U.S.

4. Golden Gate Bridge, U.S.

5. Eiffel Tower, France

6. Machu Picchu, Peru

7. Sagrada Familia, Spain

8. Statue of Liberty, U.S.

9. Big Ben, UK

10. The Great Wall of China, China

11. Stonehenge, UK

12. Buckingham Palace, UK

13. Mount Everest, Tibet/ Nepal

14. Mont Saint-Michel, France

15. Hagia Sophia, Turkey

Abu Dhabi Hotels Welcome 2.4 Million Guests

Hotels in Abu Dhabi welcomed 2.4 million guests in the first half of 2023, a 34% increase compared to the same period last year, according to data from the Department of Culture and Tourism.

The emirate’s hotels generated revenues exceeding AED3 billion during the same period, a 26% growth compared to last year. They also recorded an average occupancy rate of 70%, with the average stay in the emirate's hotels being 2.7 nights.

Airports: Abu Dhabi airports also reported a 67% rise in passenger traffic, with 10,258,653 passengers travelling through Abu Dhabi International Airport for the first six months of 2023.

The UAE Tourism Strategy 2031 includes attracting tourism investments worth AED100 billion and hosting 40 million hotel guests.

The Tourism Bit in Emaar’s Earnings Call

In the first half of 2023, Dubai-based real estate developer Emaar's hospitality, leisure, and entertainment divisions generated AED 1.6 billion ($436 million) in revenue, an 18% increase from 2022.

What Drove the Growth? The growth was driven by the steady recovery in the tourism industry and strong domestic spending.

Occupancy Rate: Emaar's UAE hotels, including those under management, reported an average occupancy rate of 70% during this period.

New Opening: Emaar also announced the opening of the 1484-key Address Jabal Omar Makkah in Saudi Arabia.

Some More Figures: The company's recurring revenue-generating portfolio, including malls, hospitality, leisure, entertainment, and commercial leasing, collectively generated AED 4.7 billion ($1.3 billion) during the first half of 2023. This revenue represents 38% of Emaar's total revenue from these businesses.

Air Arabia Reports Record Second Quarter Net Profit

As the strong demand for air travel continued, Middle Eastern low-cost carrier Air Arabia reported a record second quarter and first half of 2023.

Second Quarter Figures: The airline registered a net profit of AED 459 million during the second quarter ending June 30, an increase of 187% compared to the same period last year, while flying more than 3.8 million passengers between April and June.

First Half of 2023

Total Passengers Flown: More than 7.7 million passengers flew with Air Arabia between January and June 2023 across the carrier’s seven hubs, an increase of 47% compared to the same period last year.

Load Factor: The airline’s average seat load factor – or passengers carried as a percentage of available seats –stood at an average of 81%.

Net Profit: During the first half of 2023 (January to June), Air Arabia reported a net profit of AED 801 million, an increase of 78% compared to AED 451 million registered in first half of 2022.

Turnover: The airline posted a turnover of AED 2.82 billion, a 26% increase compared to AED 2.24 billion in the first half of last year.

During the first half of the year, Air Arabia added 3 new aircraft to its fleet bringing it to a total of 71 owned and leased Airbus A320 and A321 aircraft. The carrier also expanded its network by launching 18 new routes across its seven operating hubs in the UAE, Morocco, Egypt, Armenia, and Pakistan.

Saudi Arabia and Sports

Saudi Arabia’s newly launched airline Riyadh Air has signed a multi-year partnership as the main and official airline partner of leading Spanish football club, Atlético de Madrid.

This is the first sports sponsorship that Riyadh Air has signed since its official launch earlier this year in March.

Headquartered in Riyadh, the full-service airline is scheduled to begin operations in 2025, with an aim to connect Saudi Arabia’s capital city to more than 100 destinations by 2030.

And Then Some More…

Saudi Tourism Investment Company (ASFAR), a portfolio company of the Saudi sovereign wealth fund Public Investment Fund, has also announced a sponsorship agreement with Al-Hilal Saudi Club, one of Saudi Arabia's premier football clubs.

Timeline: The sponsorship deal will run for three seasons and ASFAR will serve as the official sponsor of the Al-Hilal Saudi Club until the end of the 2025/2026 season.

“We are keen on encouraging sports enthusiasts, supporting different age groups, and nurturing emerging talents across a variety of sports,” said Fahad Bin Mushayt, CEO of ASFAR,

More About ASFAR: Launched last month, ASFAR aims to develop and build pioneering tourism destinations and projects in the fields of hospitality, entertainment, retail, activities, and restaurants, through partnerships with the private sector.

Abu Dhabi Enhances Europe Connectivity

The Department of Culture and Tourism - Abu Dhabi (DCT Abu Dhabi) signed a Memorandum of Understanding (MoU) with Air France-KLM to enhance connectivity between Abu Dhabi and Europe.

What Does the Partnership Entail?

- Daily flights from Abu Dhabi to Paris, while reinforcing Abu Dhabi’s goal to attract more than 24 million visitors by the end of 2023.

- DCT Abu Dhabi and Air France-KLM will also implement collaborative travel trade promotions targeted towards key operators and travel agents in France and the Netherlands

“This increased connectivity not only enriches the experience for travellers but also positions Abu Dhabi as an additional access point to the East,” said Saleh Mohamed Saleh Al Geziry, director general for tourism at DCT Abu Dhabi.

Abu Dhabi’s Tourism Aspirations: Tourism continues to play a key role in the emirate's diversification strategy. The collaboration with Air France-KLM is a testament that underpins the aviation sector’s role in contributing to Abu Dhabi being a global destination and travel hub.

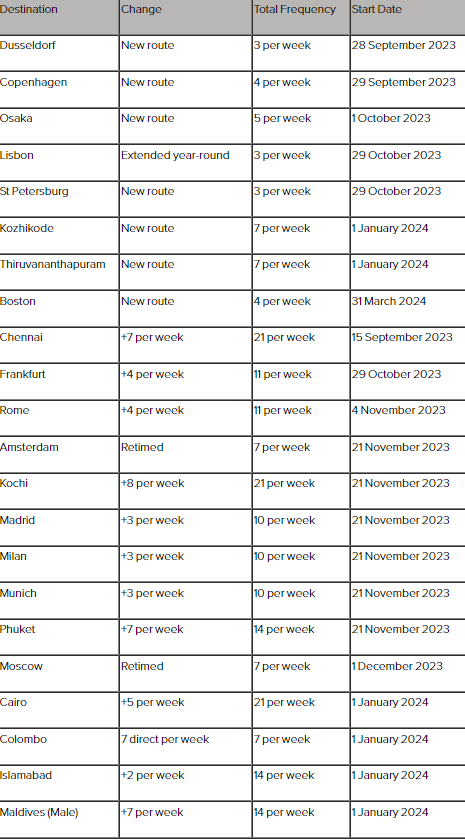

Etihad Ramps Up Winter Schedule

Etihad Airways has unveiled an ambitious network overhaul designed to support Abu Dhabi’s visitor growth and provide travelers with more options by:

- Introducing new destinations

- Providing passengers with travel flexibility

- Increasing flight frequencies to key markets

- Improving Departure Times

- Increased Frequencies to Chennai, Islamabad, Kochi, Madrid, Milan, Munich, Rome and Phuket.

Network Updates

- Launch of nine new destinations this year, including Malaga, Mykonos, Lisbon, Kolkata, St Petersburg, Dusseldorf, Copenhagen, Osaka, and Boston.

- In addition, the airline published two new routes to the Indian Subcontinent, Kozhikode and Thiruvananthapuram, to be launched in January 2024.

- An additional 5 flights per week to make triple daily operations to Cairo, effective from January 1.

- 7 direct flights per week with 3 flights to Colombo effective from December 1 and 4 flights effective from January 1.

- An additional 7 flights per week, with 3 flights effective from December 1 and 4 flights effective from January 1 to Male.

Emirates Surpasses 20,000 Cabin Crew Members

Emirates now has around 20,000 cabin crew members, as the airline continues to recruit cabin crew globally to meet its planned growth trajectory.

Since 2022, the airline has hosted recruitment events in 340 cities across 6 continents.

The airline said it now has a diverse team representing over 140 nationalities with 130 languages spoken.

New Appointments

>>Dubai-based hospitality management company, Aleph Hospitality, has appointed Ahmad Yousry El Beheiry as development director. Ahmad has 17 years of experience in hospitality and consulting, most recently at HVS Middle East & Africa and Colliers International Middle East and Africa.

>>Anantara The Palm Dubai Resort has appointed Aseel Elagib as its social media specialist. Having worked in a digital marketing position at Harbor Real Estate in April 2021 Elagib was recruited for a marketing project at Cityscape Dubai with Exalogic Consulting.

Hotel News

>>Expanding its footprint in the Gulf region, Turkish hospitality developer Continent Worldwide Hotels, has announced the signing of two hotels in Madina and another property in Al Dammam.

>>Minor Hotels’ Anantara Mina Al Arab Ras Al Khaimah Resort will open in the fourth quarter this year and will be the brand’s ninth property in the UAE.