Google Expands Its Things to Do Feature Deeper Into Maps

Skift Take

Dennis' Online Travel Briefing

Editor’s Note: Every Wednesday, Executive Editor and online travel rockstar Dennis Schaal will bring readers exclusive reporting and insight into the business of online travel and digital booking, and how this sector has an impact across the travel industry.Online Travel This Week

The typical Google Maps use case doesn't entail people planning their entire vacations in the app, but they can selectively find flight information, compare hotel prices and — Google announced Tuesday — mix and match prices of attractions tickets.

No, Google Maps isn't a superapp yet but it's edging in that direction, and touts 1 billion people monthly using the feature. Search "New York" in Google Maps and you'll find restaurants, hotels, museums, transit options, pharmacies, ATMs, and now things to do.

In a blog post, Richard Holden, Google's vice president of travel products, wrote: "Last year, we began showing ticket booking links on Search when people look for attractions, like the Boston Tea Party Museum, to help them quickly compare admissions prices across different partners. Now, this ticket information is available on Google Maps as well, where travelers often plan their itinerary for the day."

In other changes announced Tuesday, Google is in the initial stages of introducing in Google search booking links for tours that are connected to attractions, such as a combination Vatican and Colosseum tour in Italy. Previously, Google had booking links to attractions tickets, such as for the Vatican, and some related tours were mixed in.

With the tweaks in Google search, the attractions tickets' booking links and related tours are separated into distinct modules so they aren't competing for attention, and users can readily make tour to tour comparisons. Google plans to introduce this functionality into Maps, as well.

Google currently only offers these booking links when they are connected to attractions, and doesn't provide them for "food tours in Rome," for example, but you can bet that will be coming.

Google Upped Its Ad Game for Things to Do

Importantly, Google announced that it expanded the reach and format of text ads for things to do that it launched initially in 32 cities in September 2021.

With the expansion, more graphical tours and activities ads get triggered with appropriate queries in 24 countries, which would be a greater revenue opportunity for Google.

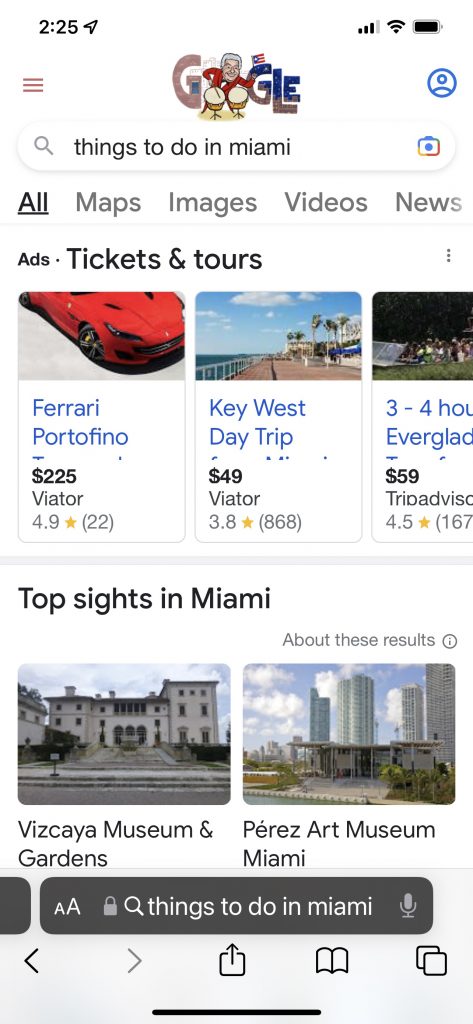

Pictured is an image of Google ads from Viator and Tripadvisor (both are Tripadvisor brands), triggered on mobile by a query for "things to do in Miami."

Parallels to Google's Hotel Playbook

Google dropped its Reserve with Google feature for tours and activities in August 2021, and one month later transitioned to a system of paid advertisements and free booking links for attractions, aggregators and operators.

That combination of advertisements plus free links is similar to the way it changed Google Hotels in March 2021, supplementing its years-long paid booking links from online travel agencies and hotels with free links for a sometimes long-tail array of providers.

In another parallel move, Holden detailed how attractions operators can now update their own ticket prices through their own Google business profile. Previously pricing updates could only be made on Google via a feed with a tie-in to a connectivity partner, so the do-it-yourself feature is likely most relevant for smaller operators. Holden wrote that these business profile updates would soon be available for tours and activity operators, and not just for the attractions themselves.

Again, this is what Google previously did for hotels, enabling them to manually update their rates in their Google business profiles if that's the way they wanted to do them.

Google has lots of time and money to develop robust features for things to do, making itself an essential part of the sector's fabric through its grip on search, knowledge about user behavior, and talent. Google over the years edged its way into the travel ecosystem for flights and hotels, and is patiently building out vacation rentals (although Airbnb doesn't participate), things to do, and newly, trains in Europe.

Google has all the time in the world to consolidate its position in tours and activities — unless regulators say otherwise.

A spokesperson for Germany-based GetYourGuide said the potential impact of Google's latest moves isn't yet known.

"Of course, Google remains a relevant and strategically important partner for GetYourGuide and we will continue to monitor these developments," the GetYourGuide spokesperson said. "However, it will take time to finalize the assessment of the potential of this feature and its impact on the customer experience."

The GetYourGuide spokesperson saw it as a positive development that new players are joining the sector. "We are convinced, a deep understanding of customer needs and the optimized experience in the booking process are the most essential factors to success," the spokesperson said.

Note: This story has been updated to add GetYourGuide's reaction to Google's recent moves in tours and activities.

In Brief

Traveloka Leans Into Its Travel Core Products

During the initial stages of the pandemic, Traveloka officials emphasized that the company was much more than a travel firm, but it has now shuttered its various delivery services. However, Traveloka still has a menu of non-travel fintech offerings. Skift

Airbnb's Chesky Wants to Clean Up the Cleaning Fee Albatros

Airbnb hasn't been in much of a hurry over the years to mute the outcry over host's cleaning fees, but 17 months ago it began probing the overall fee issue, and this week CEO Brian Chesky said changing displays of fees and pricing are among his top priorities. A scathing Wall Street Journal article about the issue last month didn't go unnoticed at Airbnb, for sure. Skift

Sister Companies Booking.com and Priceline Add Attractions Partners

Booking.com and Priceline, sister brands within Booking Holdings, separately added partners to source tours and activities for their respective businesses. Booking.com added Klook, and Priceline brought on Musement. Booking CEO Glenn Fogel recently said that tours and activities are must-haves to service travelers, but they aren't nearly as lucrative for the company as hotels. Skift