Skift Take

You can expect to see wider adoption of the free links in metasearch that Google started in 2021. More hotels means more site visitors, and eventually revenue.

Will Trivago, a hotel price-comparison site based in Germany, add free links from hotels and online travel agencies like Google did in 2021? CEO Axel Hefer dropped several hints that such a scenario could be looming.

In a Skift interview Wednesday, Hefer said Trivago would consider adding free links on Trivago to supplement paid links from advertisers, but he declined to comment on whether such plans were in the works. In theory, he said, the broader comprehensiveness that free links could generate would be particularly useful in Europe, where independent hotels, and not chains, dominate.

The free links might attract a larger number of travelers using Trivago to shop for deals.

Booking Holdings and Expedia Group, which is Trivago’s controlling shareholder, are Trivago’s dominant advertisers. Some 81 percent of Trivago’s referral revenue in the second quarter came from Booking Holdings brands (52 percent) and Expedia Group brands (29 percent).

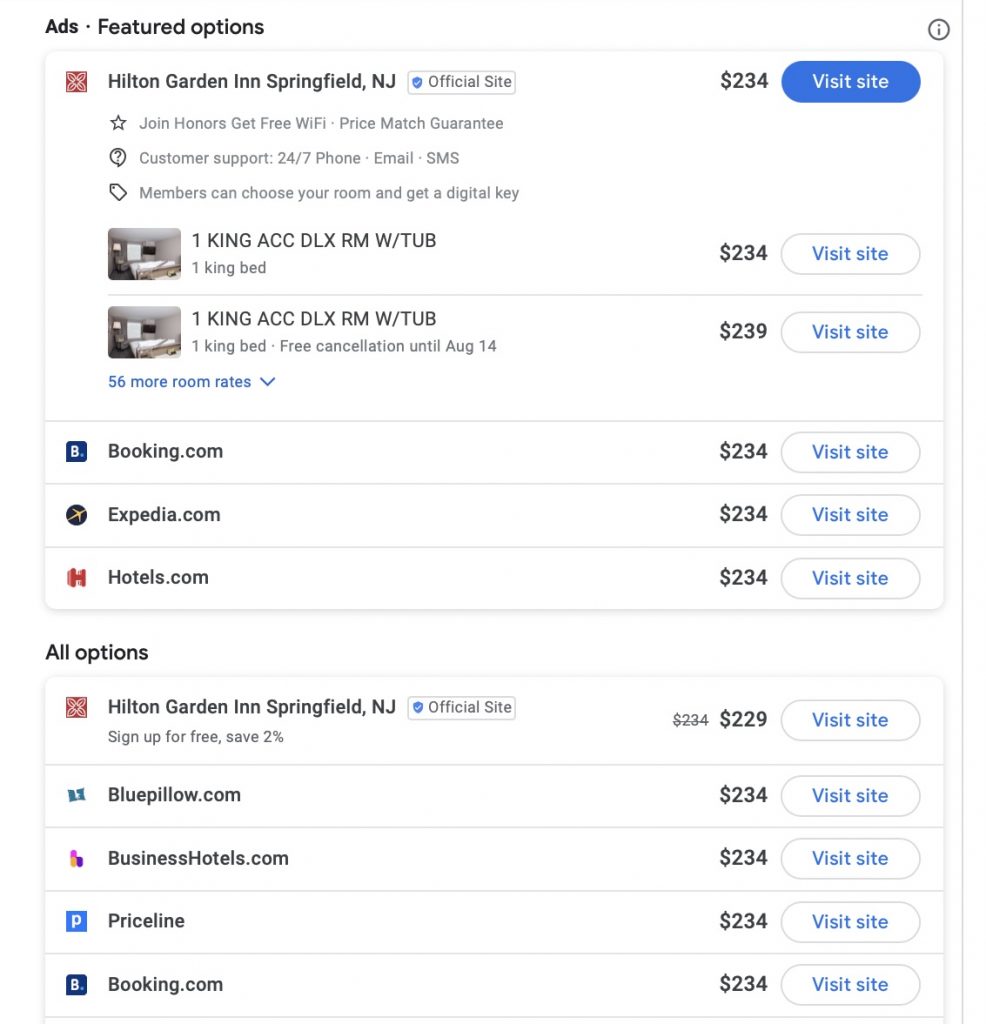

On so-called metasearch sites such as Google Hotels, Kayak and Trivago, travelers search for hotels, and click on an array of links to book their stays with an online travel agency or hotel. Metasearch sites make their money when advertisers bid in auctions to get their links placed higher or lower in a hotel listing, and they pay the metasearch site when travelers click on those links.

But Google supplemented those paid links from advertisers with free links from online travel agencies and hotels beginning in 2021 as a way to entice more booking sites and hotels to participate — and to appease antitrust watchdogs and show that its supplier participants were not just huge travel companies.

For example, in this screenshot from Google Hotels, the top box labeled “Ads/Featured options” has links from four paying advertisers (the hotel website plus Booking and Expedia brands), and the links in the lower box designated “All options” are unpaid, and include links from lesser-known companies such as Bluepillow and BusinessHotels.

In Trivago’s second quarter earnings call Wednesday, Hefer called Google’s introduction of free links “actually interesting,” adding that when Trivago has free links in Google Hotels that Trivago “actually benefits from that free traffic. So for us, it is net positive from our perspective.”

More Competitive Environment

Trivago Chief Financial Officer Matthias Tillmann said the company is seeing a more competitive environment in both Google’s hotel auction, where companies bid to place their booking links, as well as in Trivago’s own auction, leading to a higher cost-per-click for advertisers in both. That means more revenue per click for Google and Trivago, respectively.

Given the relative high costs, Trivago limited its participation in Google’s auction, Tillmann inferred.

“We decided to keep our profitability targets and maybe sacrifice a little bit of volume, but focusing on traffic that is either directly profitable for us or where we do expect long-term positive returns, but we didn’t bid for traffic where we have low conviction that it would give us a nice return over a certain period,” he said.

Trivago has summer brand campaigns running on TV and online in all of its core geographies, and Hefer said these ad blitzes are out-performing its paid digital marketing efforts (on platforms such as Google.)

Trivago Shuts Its Weekend Getaways Efforts

Officials said Trivago is seeing strong summer demand, but they argued that inflation and the consequent hits to travelers disposable income could crimp travel demand later this year and potentially beyond.

Because of that new set of circumstances, Trivago announced it would discontinue efforts to sell weekend getaways, and increase its display advertising business to focus on its core hotel price- comparison business.

Trivago acquired Weekend.com in 2021 for euro 7.4 million ($7.6 million at today’s exchange rates) in a bid to start performing its own travel transactions instead of merely referring travelers to other travel companies for bookings.

But that business model experiment is done for now.

Trivago is abandoning that effort to focus on its core price-comparison offering, which it believes will become more valuable to travelers as inflationary pressures push them to search for bargains.

Impairment Charges Drove Net Loss

Trivago recorded an impairment charge of euro 84.2 million ($86.1 million) because of the changed “macroeconomic environment,” the company said, and the impairment was the deciding factor in its second quarter net loss of euro 59.8 million ($61.1 million). Total revenue in the quarter rose 166 percent to euro 101.6 million ($104.9 million)

Trivago adjusted earnings (earnings before interest, taxes, depreciation and amortization) rose to euro 30.3 million ($31.3 million), the highest in Trivago’s history, in the second quarter. That compared with just euro 4.3 million ($4.4 million) in adjusted earnings a year earlier when Europe’s travel recovery was just beginning.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: booking holdings, booking.com, earnings, expedia, google, holidays, hotels, impairments, mergers and acquisitions, metasearch, online travel agencies, online travel newsletter, travel inspiration, trivago

Photo credit: An image from Trivago Summer Party 2022. Trivago said such brand campaigns performed better in the second quarter than its digital campaigns.