Skift Take

You can debate the degree to which cities will come back and the future grip of remote work, but it seems clear that video advertising will remain on a new perch for awhile.

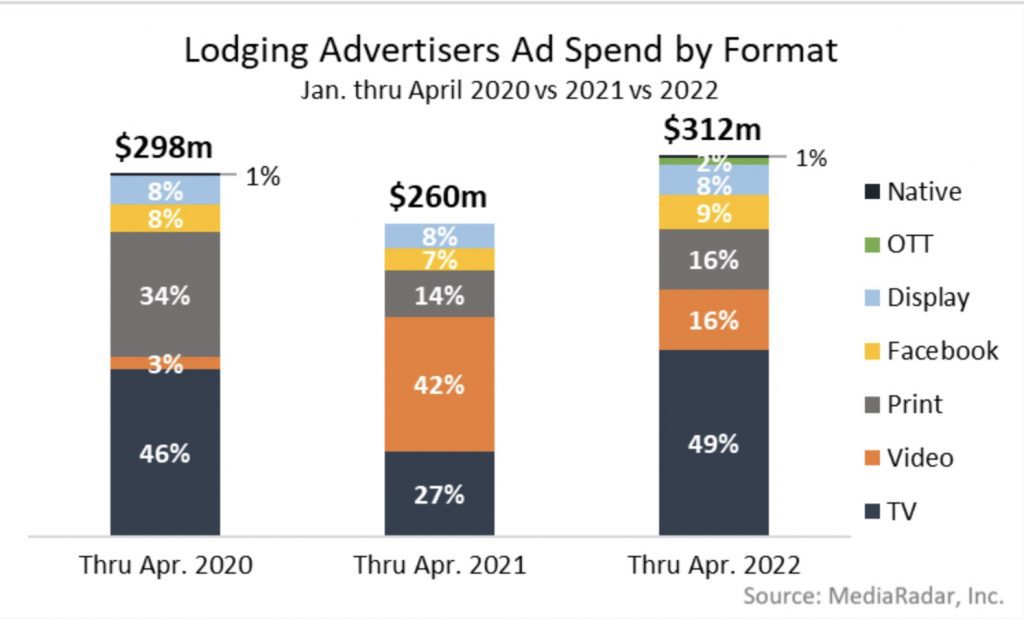

Lodging advertisers, including online travel agencies and hotel brands, dipped heavily into video advertising in the U.S. last year, and while they’ve reverted to doing a lot of TV and print so far in 2022 as the travel recovery heated up, video ads found an elevated role compared with pre-pandemic levels.

Video ads during the first four months of 2022 accounted for 16 percent of U.S. ad spend for lodging advertisers, according to a new analysis from MediaRadar. That was down from 42 percent a year earlier, but up from just 3 percent in the January through April 2020 period.

“While this may seem like a regression, if we look at traditional spending so far in 2022, we see that it’s fallen from 80 percent of total spending through April 2020 to 65 percent of total spending through April of this year,” a MediaRadar blog post stated. “The quick decrease in traditional spending [TV and print] could indicate that some of these advertisers experienced success during their brief foray into digital formats.”

MediaRadar, which offers ad tech services and could stand to gain if the grip of traditional advertising wanes, said lodging ad spend on Facebook, video and display ads could increase this year.

Still, it’s undeniable that video advertising gained new traction during the pandemic, particularly as people were stuck at home, and many kinds of digital tech saw heightened adoption.

The hotel brand spend came at a time that the vacation rental sector has gained ground, giving travelers more choice in the accommodation type for their stay.

“The vacation rental market continues to grow — revenue is expected to reach $81 billion this year and is predicted to grow at an annual rate (CAGR 2022-2026) of 7.29 percent,” MediaRadar said. “While that pales in comparison to the hotel and resort sector’s market size, which peaked at $1.5 trillion in 2019, there’s no doubt that giants like Hard Rock Entertainment, Hilton, Marriott and Unique Travel Corp. (Sandals Resorts) recognize the shifting sands.”

Here’s a Hilton video touting its sustainability attributes, for example.

During then first four months of the year, airlines ad spend increased 141 percent year over year to $141 million — around 22 percent of the total U.S. travel ad spending — but after jumping in February, airline ad spend was especially muted in March and April with the bevy of flight cancellations occurring because of staffing woes.

Delta, Southwest and Turkish Airlines were the big three U.S. ad spenders during the period, according to MediaRadar estimates.

Meanwhile, six tourism bodies, namely Visit California, the Charleston Area Convention & Visitors Bureau in South Carolina, the Monroe County Tourist Development Council in the Florida Keys, Visit Orlando, Visit Florida, and the Williamsburg Tourism Council in Virgina, combined spent more than $58 million during the first four months of 2022, according to MediaRadar. That would be about 9 percent of overall U.S. travel ad spend.

With gas prices and car rental prices soaring, car rental companies were mostly absent in U.S. travel advertising for the first four months of 2022.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: advertising, airbnb, airlines, cars, delta, digital, future of lodging, hilton, marriott, sandals, short-term rentals, southwest airlines, turkish airlines, tv, vacation rentals, videos, visit florida, visit orlando, vrbo