Skift Take

Expedia Group's Peter Kern may or may not be correct in his claim that the trend toward long-term stays will eventually weaken to a considerable degree. On the other hand, his Vrbo vacation rental brand probably could have done more to capitalize on the trend.

Dennis' Online Travel Briefing

Editor’s Note: Every Wednesday, Executive Editor and online travel rockstar Dennis Schaal will bring readers exclusive reporting and insight into the business of online travel and digital booking, and how this sector has an impact across the travel industry.

Online Travel This Week

Expedia Group CEO Peter Kern conceded that its Vrbo vacation rental brand has seen its stays trending longer during the pandemic, but the trend has not been as “pronounced” as with Airbnb, adding “that swing is going to go back.”

In a Skift interview after Expedia’s fourth quarter earnings call last week, Kern took a not-so-veiled shot at Airbnb CEO Brian Chesky — although Kern didn’t utter Chesky’s name — and the notion that the travel and living dynamic is subject to enduring change because of digital nomads and the work from anywhere phenomenon.

Where’s Waldo?

“Frankly, I think, despite everything my friend says, that swing’s going to go back,” Kern said. “I’m glad he can work from anywhere, and Where’s Waldo? or whatever. It’s a fun game, but I don’t know.”

Kern’s mention of “Where’s Waldo?,” or as it was initially known, “Where’s Wally?” in the UK, referenced Chesky’s decision to live mostly in properties listed on Airbnb, changing locations periodically, throughout 2022.

“Where’s Wally?” aka “Where’s Waldo?” started out as a series of puzzle books which saw characters doing comical things at a variety of destinations, and readers had to pick Waldo/Wally out of a group.

Chesky has argued that “travel as we know it is never coming back and there’s a whole new game.”

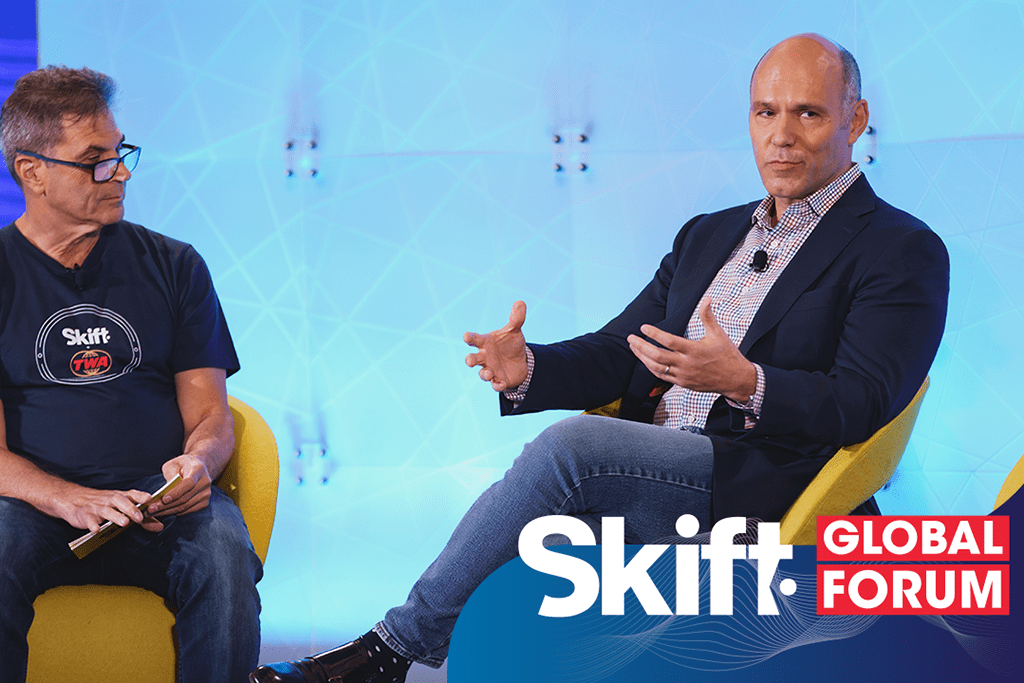

“Imagine hundreds of millions of people now flexible,” Chesky said at Skift Global Forum in September. “They don’t have to go back to the office five days a week. Most bosses aren’t going to force you to come back five days a week. If you’re one of the CEOs that forces people to come back five days a week, you’re probably going to struggle to compete with talent because I think mobility and flexibility will be number two to compensation as a benefit.”

In the Skift interview last week, Kern referenced an Expedia corporate communications employee who was listening to the interview.

“Dave’s got kids,” Kern said. “Those kids go to school eventually. Are you just going to live in Costa Rica and homeschool everybody? What are we doing? Everyone’s going to go back to work.”

Did Vrbo Fall Short?

One can make the argument that Vrbo failed to take greater advantage of a trend toward longer stays. “Yes, people in general, if you look at the trends, the stays have gotten longer. But we have not seen this giant swing from one end of the continuum to the other.”

Cities are not Vrbo’s strength. If you are a digital nomad looking for a month-long stay in Barcelona or Boston, you are going to gravitate toward Airbnb because of its ample supply of properties, and because their prices tend to be cheaper.

Kern alleged that Airbnb pre-pandemic was used to having one- or two-night stays in urban areas as a certain percentage of its business, and then saw a big jump when Covid-19 struck.

Although that indeed was true, Airbnb said in 2019 that 39 percent of its stays were for seven nights or more, and 14 percent of stays were for at least 28 nights. Airbnb was to report fourth quarter earnings Tuesday night, but in the third quarter Airbnb stated that stays of 28 days or longer were still its fastest-growing trip type at 20 percent However, that percentage declined from 24 percent in the first quarter, potentially giving credence to Kern’s prediction that the pendulum will eventually swing back.

Kern said one- or two-night stays in cities has never been a mainstay of Vrbo’s business. ” It’s not a thing for us,” he said. “It’s not as big a part of our business. Nor have we had this big swing to be like all the people who used to do two nights are now taking a month in Costa Rica and working from there. We see a lot of family or group travel to resort destinations for vacations.”

But how big a trend is long-term stays? Not huge, according to Kern.

“There’s a sliver of well-educated, highly paid young people who don’t have any roots, who don’t mind living all over the place,” Kern said. “OK, yes. I don’t know how many people that is, but it doesn’t feel like it’s the market.”

To be fair, although Chesky has talked plenty about a travel “revolution,” with millions of people changing their travel and living patterns because of a pandemic-driven new sense of flexibility, he’s never cited that trend as being appropriate for everyone. Perhaps it won’t apply to many people at all, and for others it might be a new inclination to tack on a day or two to a weekend getaway.

Kern has contended throughout the pandemic that cities and the hotel industry will make comebacks.

For anyone looking to Vrbo as being a big challenge to Airbnb, especially in urban areas, that’s not on the agenda.

In Expedia’s earnings announcement last week, Kern said that unlike other platforms, his company is not trying to replace hotels.

“But Vrbo is not in the same way like some of the other choices focused on being a replacement for hotels in cities,” Kern told financial analysts last week. “We have a lot of great hotel partners in all the major cities of the world, and we see them coming back more strongly, and we think that’s where the business is going to be for now. Of course, we want to continue to expand Vrbo wherever it makes sense and that we’ll certainly look at cities where it makes sense.”

Expedia Group did try to tap into the work from anywhere trend, launching a website, Work From Here, in December 2020 that touted taking “your laptop on the road and upgrade your home office outlook,” but it was mostly oriented toward working from hotels, probably not the most-sought-after option.

Airbnb was in a quiet period because its earnings announcement Tuesday afternoon, and decline to comment on Kern’s comments.

In Brief

Booking.com to Eliminate 2,700 Customer Service Jobs

Booking.com said it will eliminate 2,700 customer service jobs from its books in various regions, although these positions will be outsourced to a Luxembourg company. Majorel will also inherit a dozen Booking.com call centers. The online travel agency said it needed more flexibility to cut costs during periods of reduced demand as one of its motivating factors. Skift

Luxury Hospitality Brand Inspirato Goes Public

Inspirato, which offers luxury hotel stays to members for $2,500-per-month subscriptions, went public on Nasdaq in a special purpose acquisition company deal Monday. CEO Brent Handler said the priority is to sign up new properties. Unlike several recent SPAC debuts, Inspirato’s stock price rose in the first couple of days of training.

HotelPlanner-Reservations.com SPAC Deal Falls Through

HotelPlanner, Reservations.com and a special purpose acquisition company called off their merger $688 milliion merger deal. The companies provide no reason for the blow-up other than calling off the transaction was the optimum way forward. Skift

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, booking.com, brian chesky, Dennis' Online Travel Briefing, digital nomads, expedia, hotelplanner, inspirato, peter kern, remote work, Skift Pro Columns, vrbo, work from anywhere, work from home