Skift Take

How do you measure the largest booking site in the world? Is it rooms sold, gross bookings, commissions earned, or profits. A look into Trip.com shows the need to be nuanced in analyzing an online travel agency's financials.

Skift Pro subscribers exclusive extract from the latest Skift Research report. Get the full report here to stay ahead of this trend.

In our latest report, Skift Research looks into Trip.com. This is a business everyone in travel needs to understand. If you haven’t bumped up against Trip.com yet, you almost certainly will at some point. it has big ambitions to expand internationally and that’s still the case even after the devastating impact of Covid-19.

The below excerpt focuses on Skift Research’s proprietary analysis of Trip.com, focusing on its financial performance and marketing spend. Get the full report here to stay ahead of this trend.

Preview and Buy the Full Report

Financial Performance

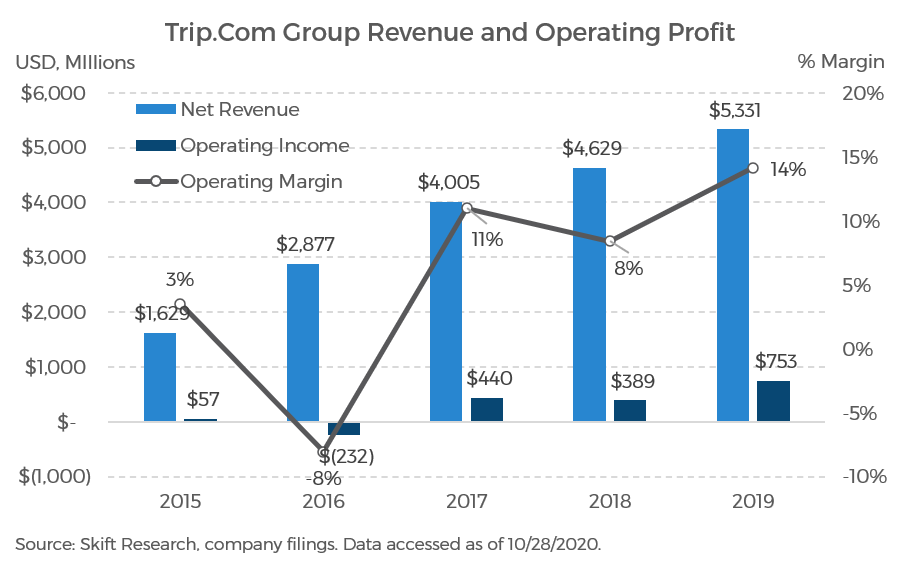

Trip.com may be the largest online booking site in the world by gross bookings, but the commissions it earns are quite small. The company has an effective take-rate of ~4 percent, leading to just $5.3 billion of revenue in 2019, not a travel industry record.

But still, that net commission revenue has been growing at a nice clip – a world-class 35 percent compound annual growth rate over the last four years. And what’s more is that Trip.com has a fairly consistent record of generating operating income and its margin was trending higher prior to Covid-19. The year 2019 was Trip.com’s best year for profitability since 2015, posting a 14 percent operating margin.

Preview and Buy the Full Report

Marketing Spend

We believe the most important expense to track at an online travel agency is its marketing spend. At most booking sites this is the largest single expense and leveraging it properly is the key to growing sustainable profits.

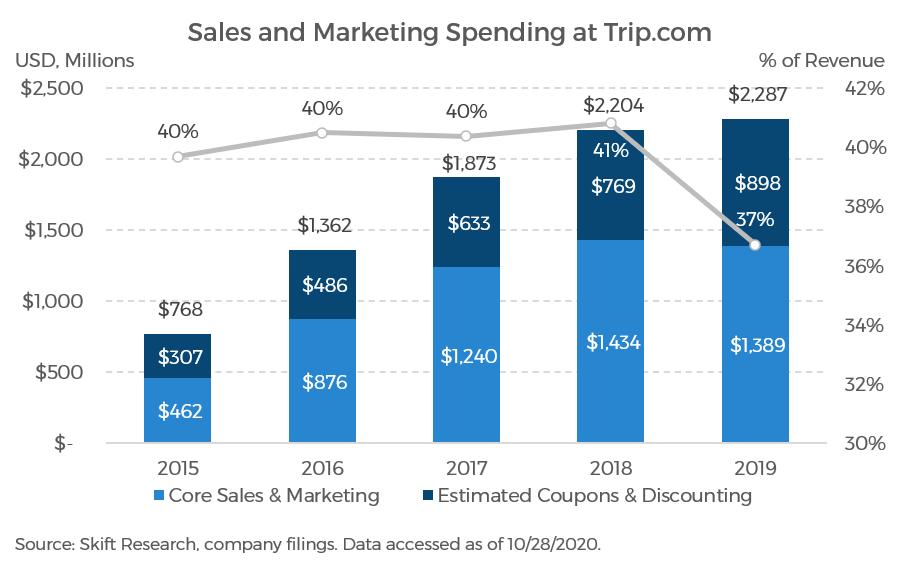

Trip.com reported ~$1.4 billion of sales and marketing expenses in 2019, down slightly from 2018. This includes $820 million of advertising spend.

In the West, most booking sites use a combination of brand advertising, metasearch, and online performance advertising campaigns to build a pipeline of shoppers at the top of the funnel. And while they have a reputation for cheap prices, these days, the largest booking sites are likely to honor rate parity clauses put in place by travel suppliers.

However, we find that Trip.com, in addition to these marketing tactics and channels, also employs extensive promotional discounting and coupon campaigns to convert lookers to bookers. This is very similar to the approach used by MakeMyTrip, which we discussed in our previous report on that company.

Coupons which reduce the purchase price are accounted for differently – as a reduction of revenue, rather than an expense. In a May 2017 earnings call, the company disclosed that its gross take rate on hotels was trending at 10–15 percent but after adjusting for coupons, the net take rate comes out closer to 8–10 percent. This is a major impact to revenue, especially when you consider that hotels are the most profitable product that Ctrip sells.

Based on these ranges, Skift Research estimates that Trip.com may have offered ~$900 million in coupons in 2019 on top of its previously discussed marketing spend. That is up from $769 million of coupons in 2018.

Before taking these promotions into account, marketing spends appeared to have declined in 2019. But we believe that there was much more of an internal shift, away from acquiring traffic and towards incentivizing purchase behavior. On an all-in basis, we believe that sales and marketing spending grew marginally in 2019 from $2.2 to $2.3 billion.

Still, the sales and marketing line item saw a favorable de-leveraging as revenue grew much faster overall. Adjusted sales and marketing as a share of revenue fell by an impressive four percentage points to 37 percent from 41 percent. Marketing has been trending at ~40 percent of revenue since 2015, so it was a positive development to see such a strong improvement last year.

Preview and Buy the Full Report

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report à la carte at a higher price.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: ctrip, online travel agencies, qunar, Skift Pro Columns, skift research, trip.com

Photo credit: A neon sign for a hotel in Hong Kong; Trip.com is the largest online travel agency in China. Aleksandar Pasaric / Pexels