Skift Take

Beijing-based Shiji serves more than 47,000 hotels outside of China. This is the first time it has spoken candidly with independent English-language media about its acquisition strategy. This year its subsidiaries have won deals with MGM Resorts, Radisson, and other major brands. Reading between the lines, it has big plans in the works.

Shiji, the hospitality tech giant of China, has been expanding its global push since February — when it announced a $486 million investment from e-commerce powerhouse Alibaba Group.

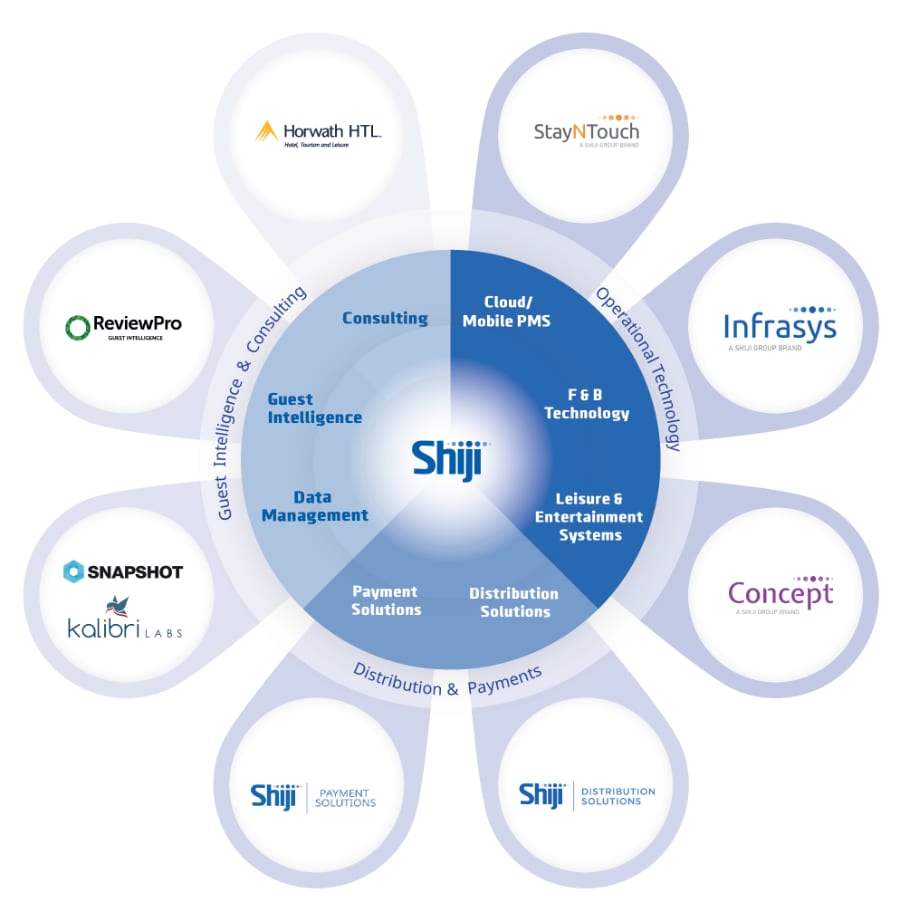

Shiji, which has 20 foreign subsidiaries, has in the past month acquired StayNTouch, a hotel tech services provider, and Concept Software Systems, a retail tech provider for golf, spa, and other activities. A few months ago, it bought out the remaining shareholders of SnapShot, an analytics dashboard.

Shiji recently disclosed its backing of Kalibri Labs, a data-based hotel revenue consultancy. It has been rumored to be bidding this month to invest in Leonardo, a company that helps hotels manage their visual assets, such as photos of rooms.

In China, Shiji is responsible for at least 60 percent of the market share for enterprise software services among upscale and international hotels and luxury retailers. About 13,000 Chinese hotels use Shiji-networked systems, including many global brands.

Outside China, about 47,000 properties use products or services from Shiji Group. More than 100,000 hotels worldwide connect to Shiji’s inventory distribution system.

The company now looks overseas for growth, with the blessing of e-commerce giant Alibaba, which has a 13.07 percent stake.

By the end of this year, Shiji expects to have more than 500 employees outside of China — a headcount that has grown from a negligible number during the past four years.

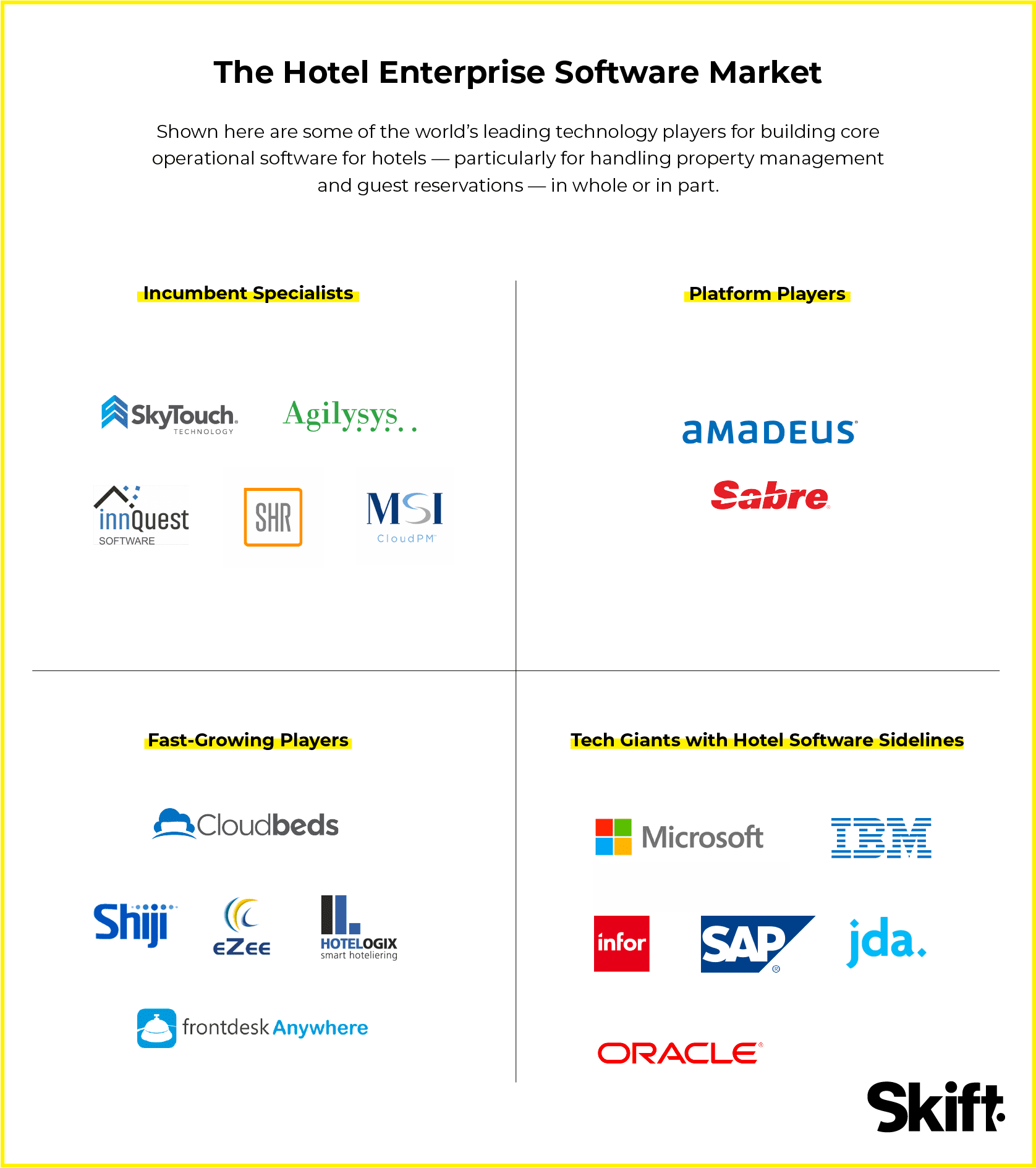

Analysts following the public company estimate that Shiji will generate about $481 million in revenue for the year through December 30, 2018. That puts it second in hospitality tech sales leadership to Oracle Hospitality, which analysts estimate generated about $1.8 billion in revenue in 2017.

By dollar volume, they are the world’s largest hospitality tech companies.

Oracle and Shiji have helped each other.

Until recently, Beijing-based Shiji had focused on China as its market. For 15 years, it has been a reseller of the Opera property management system, which fell into Oracle Hospitality’s hands when Oracle acquired Micros Systems in 2014. A few months ago Oracle renewed the resale partnership with Shiji.

On its own Shiji has provided supplementary software integrations and hardware like point-of-sale solutions to hotels in China.

Let’s cover Shiji’s recent Western acquisitions. Then we’ll explore the company’s strategy.

Acquires StayNTouch

StayNTouch, a Bethesda, Maryland-based tech company, offers a mobile property management system. Its lobby self-service kiosks and mobile check-in and check-out services aim to help hotels monetize early check-in and late check-out and push upsells and upgrades .

StayNTouch’s flagship client has been MGM Resorts. Since early 2017, all MGM hotels have been using its mobile check-in and-out services. Most recently MGM released its “m Life” mobile app which, as it relates to the hotel check-in and out, is powered by the tech company’s platform.

StayNTouch is currently in use in 15 countries by hotel groups of various sizes, such as First Hotels, a Swedish chain of 60 properties. It will introduce its solutions to China by early 2019, and will expand in Western Europe, Australia, and Southeast Asia over time. It has 80 workers and is hiring.

Expands Into Activities and Ancillaries

Another recent Shiji acquisition is Concept Software Systems, a point-of-sale solution seller whose main customer base is luxury hotels with golf and spa offerings in more than 60 countries. Concept integrates with hotel property management systems and provides expertise in managing and analyzing golf and spa guest data.

For a decade, Shiji has helped Concept grow into China. Now it’s looking to grow Concept beyond China and beyond golf and spa.

“We see a large opportunity for Concept and Shiji Distribution Solutions in distributing activities and experiences,” said Kevin King, chief operating officer of Shiji Group.

Shiji will retool Concept to help hotels, destinations, resorts, and theme parks, upsell customers effectively on activities, experiences, and other services in addition to golf and spa, King said.

Looks Inside and Outside of China

For more than five years, Shiji’s ChinaOnline service has been the largest entry point for foreign players looking for distribution to the Chinese market.

In August, the company rebranded ChinaOnline to Shiji Distribution Systems, a distribution platform for inventory management in hospitality. It also opened the portal to international markets.

Yet as of today, Shiji is approaching the China market and the rest of the world via largely separate commercial and technical paths.

While some of its services are used by clients everywhere, the group focuses some of its services on China and some on the rest of the world.

“In fact, we have set it up that way to ensure privacy and data security for all our clients,” said King. “Customer needs are quite different in different parts of the world, so we look at how we can service the market while bringing innovation at the same time. That innovation will be different in each region.”

“Our goal is to help hotel, retail, food services and entertainment businesses globally connect,” King said. “Horizontally across different industries, and vertically within industries.”

Streamlining Its Portfolio

For now, Shiji’s international approach is piecemeal. The group seems to act as an umbrella sales, marketing, and strategy organization.

That can create confusion for new customers. For example, one of its acquisitions is Hetras, which sells a next-generation property management system.

But in essence that competes with StayNTouch’s main product. While StayNTouch’s tools connect to popular property management systems such as Oracle Opera, a majority of its clients use its standalone mobile property management system, which is a replacement system.

The company’s answer to this is that it has now decided to focus on StayNTouch in its marketing. A new graphic from the company has removed mention of Hetras.

A Platform With Chinese Characteristics

“Providing a one-size-fits-all system isn’t what the industry wants,” said King.

One way to interpret that is to say Shiji is not taking the Amadeus approach of a single-sign-on for services that sit on top of a shared codebase.

While Shiji uses the word platform, “environment” might be more a more apt word, meaning a mix of cloud-based data infrastructure to support exchanging large amounts of data and an aggregation of several innovative tech companies.

Predictive analytics companies, OTAs, food services companies, hotel inventory management companies, and revenue management companies use its cloud-based environment to access data. But they don’t all log into a Shiji master account and pay a standardized fee to access the buffet of services.

“The staff who use Infrasys (a restaurant point of sale system) versus the staff who use Shiji Distribution Solutions are quite different,” said King. “So a single-sign-on wouldn’t really make sense for our markets.”

“However exchanging data from such systems into a company-wide analytics dashboard would be much more helpful for them. This is where we see the platform element in addition to the offices, sales and support,” King said.

Shiji’s environment for the international markets gathers tools for functions like distribution, payments, operations, data management, analytics, and business intelligence, and so forth. For instance, Shiji Distribution Solutions, the previously mentioned inventory management and distribution set of services for hotels, is part of Shiji’s environment.

Is Shiji aiming to be metaphorically like Salesforce, the popular customer relationship management system platform? No.

“What Salesforce has is a marketplace with applications that can be purchased off-the-shelf and which are integrated with their system since they’re built on their cloud database system,” King said. “Shiji has a-la-carte services and solutions that hotels can choose.”

“We also bring the consultative aspect to the data through our investments in Kalibri Labs,” said King.

Kalibri is used by hoteliers to evaluate and predict revenue performance. It collects daily hotel transactions from more than 31,000 hotels and it helps to calculate the cost of guest acquisition for hotel owners, operators, and brands.

Hotels aren’t the only target for Shiji. Some of Shiji’s group’s tools serve more segments than hotels. Snapshot, an analytics dashboard service it has acquired, can be used by hotels, attractions, and other vendors. It offers connectivity to application developers, consultancies, and enterprise clients.

Stitching Systems Together

The hotel industry has been following trends in other sectors by moving from buying suites of software products for specific functions to using a foundational software infrastructure that supports multiple functions and encourages third-party integrations. A platform approach allows for a smoother exchange of data.

In hotel tech, one of the purest forms of the platform approach is the decision last year by UK hotel group Premier Inn to adopt Amadeus Hospitality’s new technology platform. It will move its 765 properties onto a combined central reservation system, property management system, and payment system that can also play nicely with some third-party software.

The hotel industry could benefit from more platform adoption.

“In our view, issues of antiquated systems that don’t always communicate seamlessly with each other stems from the fact that hotel ownership remains very fragmented and service-focused as well as there is a general complacency with legacy systems that work just fine,” said Rebecca Stone, senior research analyst at Skift Research.

King said he believed that the hospitality industry is being held back in its ability to understand and serve guests because guest data is fragmented and poorly managed. Before a reservation is even booked, guest data can be processed by more than 10 different systems that are disconnected or poorly connected.

Once a guest is at a property, a guest may interact with multiple touch points at a hotel which, again, typically don’t coherently talk to one another.

Embracing Standards and Open APIs

Shiji aims to smooth out the friction points. But it can only go so far without collective industry action.

“Today guest profiles, for example, are managed with bits and pieces in multiple parts of the hotel’s IT infrastructure,” King said. “We need that single guest profile which is a challenge we want to raise awareness about.”

To help, most Shiji companies use the technical standards promoted by HTNG, or Hospitality Technology Next-Generation, a not-for-profit trade association. As more companies talk to each other using the same standards, integration will deepen.

Despite its logical appeal, seamless integrations remain a novelty. In a recent report, The State of the Hotel Tech Stack 2018, Skift Research’s technology vendor and hotelier focus groups cited a lack of integration and corresponding data fragmentation as the biggest challenges for the industry when it comes to hotel tech stacks.

Open APIs, or application programming interfaces (methods of communicating data) are endorsed by King. “Open means it is accessible without discrimination and documented so developers can access the data, get validated and use it,” King said.

“Open API doesn’t mean a free API,” King said. “Some people confuse those two. Costs need to be covered for things work well — either server fees, engineers, or quality assurance — but they need to be fair. Charging huge amounts of money to open the access to an API and to validate a developer and then charging monthly for the data being transferred is unfair.”

“Certainly one needs to consider the load on the systems, that’s a given. But, on modern SaaS architectures, like StayNTouch, hotels get access to integrations without adding large costs.”

“Some systems [in the industry] have a very closed API which requires approval and ‘lobbying’ efforts to get accepted,” said King. “This stifles innovation because the innovators are rarely the ones who have priority to get accepted and thus need to wait [because they’re starting with small client bases]. Because they don’t have the financial resources to wait, these projects die early.”

Working With Brands Like Marriott

Western brands have been announcing deals with Shiji at a seemingly more frequent pace.

“Shiji is trying to help Western hotels capture the Chinese traveler in a more effective and efficient way by providing technology solutions geared towards those travelers,” said Felix Laboy, a former head of Sabre Hospitality Solutions and an original pioneer of online marketing enterprise software for hotels.

Laboy cited Shiji’s popular tools such as integration with a WeChat booking engine for hotel websites that can handle popular payment methods Alipay and WeChat.

However, a more eye-catching example is biometrics.

In July 2018, two Marriott International properties in Hangzhou and Dadonghai Bay have been testing facial recognition for hotel check-in and payment.

Chinese guests who reserved rooms via Alibaba’s travel platform Fliggy go to a kiosk in the Marriott lobbies and scan their IDs, take a photo, and input contact details. The machine authorizes the credit card and dispenses the room key cards.

Shiji is focused on biometrics only in China because facial recognition is widely accepted there, though hotel groups like Accor have experimented with biometrics elsewhere.

“As more countries adopt it, we’ll have the system ready,” King said. “With our pilots, we’re building this technology into existing hospitality infrastructure.” Shiji is also piloting the service at about 50 hotels from other companies in Hainan Province, China.

A Light Touch to Its Acquisitions

“Shiji’s model is to acquire or invest while keeping the companies independent and letting them help us work out the best way to integrate,” King said. “Integrating cultures and technology takes time. Rushing doesn’t seem to work, not for the customers, not for the companies.”

RJ Friedlander agreed. He’s the founder and CEO of ReviewPro, a hotel reputation management and guest intelligence services company, which Shiji announced last year it had taken an 80 percent stake in.

Friedlander said Shiji’s support had helped it to speed up the velocity of its product development. ReviewPro created a three-year plan post-acquisition, and the startup is on track to double its revenue by the end of the three years, he said.

Radisson Hotel Group is its largest client. In June signed up to use the company’s full suite of services across its 1,100 properties worldwide. By using ReviewPro’s case management tool, for example, many properties among its brands cut in half their average response time to online guest reviews from six days to three.

Looking ahead, ReviewPro is building out is connectivity solutions for hotel operations, entering into a space popularized by Expedia-owned Alice, Amadeus Hospitality’s HotSos, and Quore.

Raising Its Global Profile

Shiji keeps signing deals with services while it builds its own, overlapping versions of those services. For example, it has a channel switch, meaning an outsourced partner that helps hotels distribute their inventory and process transactions across various platforms worldwide, for China that in recent months it opened to international companies.

But that didn’t stop it from earlier this year signing a deal with the Dallas-based hotel inventory distribution switch DHISCO to make about 11,000 China-based properties available for booking via online travel agencies that use it to source inventory. Shiji also introduced its online travel agency partners in China to the hoteliers who offer content via DHISCO.

Perhaps not coincidentally, Greg Berman, the former chief operating officer of DHISCO, is now the chief operating officer of the Americas unit for Shiji — a sign of how Shiji is hiring industry talent. Similarly, in July, Shiji named a 24-year Oracle vet Kyle Kurdle as vice president of global service delivery at its Americas unit.

Potential for Something Bigger

“Shiji is creating a company that will provide hotel technology solutions to Western hotels and thus competes with companies like Sabre Hospitality Solutions, Amadeus-owned TravelClick, Oracle Hospitality, and others in this space,” Laboy said.

“Based on their acquisitions, it appears that Shiji is trying to potentially build a platform that covers many of the top needs of a hotel from distribution, property management, point of sale, payment processing, customer data, etc.”

A few other hotel professionals echoed Laboy’s view. But Shiji has energetically, and plausibly, rejected any talk that it is competing with its longtime partner Oracle — especially given the size of the total addressable market for multiple players.

King talked more about Shiji rather than rivals perhaps because the industry is entering into new territory unfamiliar to everyone.

“We have a unique experience as a company of having been there from the start of hotel IT and scaled in a market that has grown exponentially over the last few years,” King said.

“We believe in observing the market and learning,” King said. “Then it is up to us to predict where we envision the market and technology will be in the next 5 to 10 years and beyond and try to push the necessary boundaries to get there. In the end, we want to make sure whatever we build is built to scale.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: Amadeus Hospitality, china, hotel tech, hotel technology, Oracle Hospitality, platforms, Sabre Hospitality, Shiji

Photo credit: Facial recognition check-in technology pilot at two Marriott International properties in China will begin from July 2018 by using technology from Alibaba and Shiji, a hotel tech company that is on a growth spurt worldwide. Marriott International