Marriott Edges Out Hyatt for Top Honors in J.D. Power's Hotel Loyalty Survey

Skift Take

When it comes to hotel loyalty program satisfaction, Marriott Rewards has come out on top once more in J.D. Power's new 2017 Hotel Loyalty Program Satisfaction Study.

But, it was almost a dead heat.

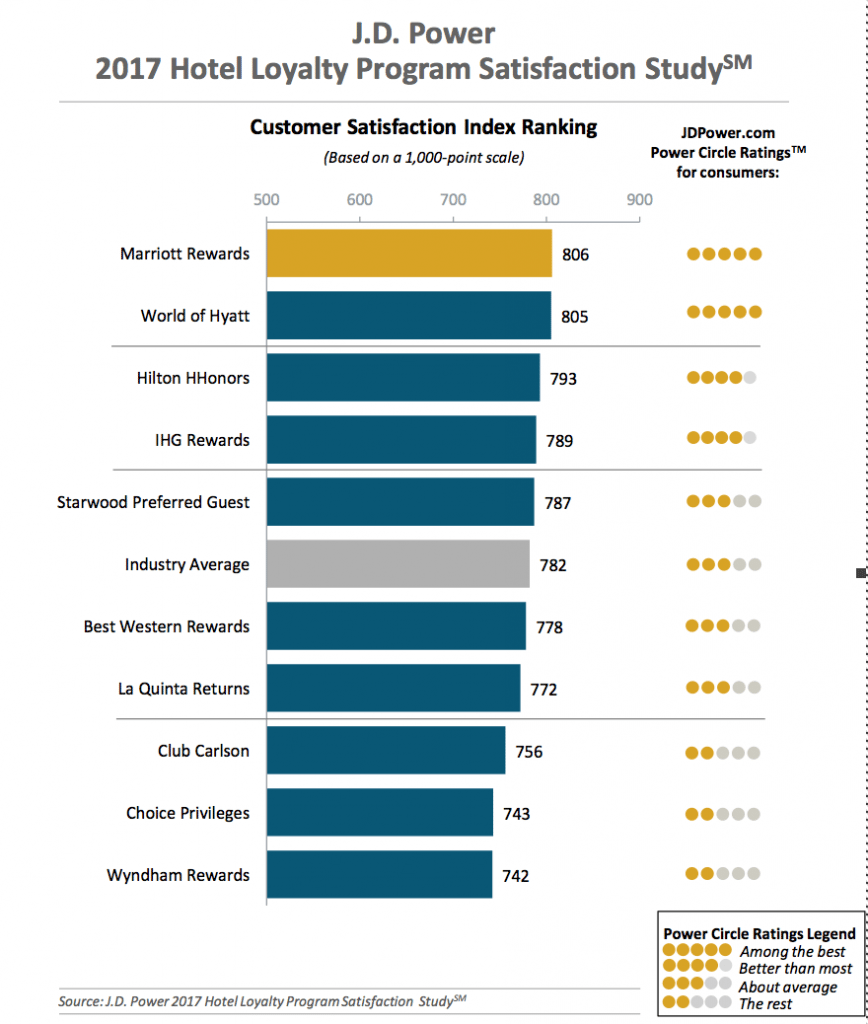

Marriott Rewards ranked highest with a score of 806 on a 1,000-point scale, and was followed very closely by World of Hyatt with a score of 805. Hilton Honors, which tied with Marriott last year for the top ranking, had a score of 793. Last year, Marriott and Hilton tied for first place with scores of 741 each.

Satisfaction took into account the following four factors: ease of earning and redeeming rewards (35 percent of score); program benefits (27 percent of score); account management (22 percent of score); and member communication (16 percent of score).

The study measured responses from 4,682 hotel rewards program members who took five or more trips in the past 12 months. The survey was conducted from September to October 2017. See below for the full rankings.

The criteria for this year's study was different from last year's, said Rick Garlick, global practice lead, travel and hospitality, for J.D. Power, so "it's not an apples-to-apples comparison between this year and last year."

What changed? The number of minimum hotel stays that respondents had to have within the past year. This year's survey required at least five hotel stays. Last year's study only required that respondents have joined a hotel loyalty program in the past year.

"We asked them to rate their more preferred program — not just any random program," Garlick said, "so, we had more engaged respondents and not just casual members."

He said that the average number of years that respondents had been in their preferred programs was nine to 10 years. "They had a significant level of engagement, and that caused our ratings to be impacted positively," he said.

A Closer Look at the Top Three Programs

Marriott Rewards ranked first, Garlick noted, primarily because of it's program's redemption options. "It's everywhere you want to be," he said.

Marriott Rewards also has partnership agreements that enable its members to redeem for things that aren't just limited to hotel stays.

"The more redemption opportunities, the more value you have and it drives up member satisfaction. Free hotel stays alone are not really what's driving member satisfaction anymore," Garlick said.

Marriott is preparing to merge its Marriott Rewards program with Starwood Preferred Guest (SPG) and Ritz-Carlton Rewards by 2019. New reports suggest the programs will remain separate throughout 2018, and giving customers the same amount of choice will remain crucial to guest satisfaction, according to J.D. Power's findings.

When it comes to travelers with elite status, Garlick said, "Based on the data, you have to rate Marriott at the top."

World of Hyatt, which debuted in March, was only one point shy of the top spot in the survey.

J.D. Power didn't cite any reasons why the program ranked so highly. "I think it's one of the more unique programs that I see in the industry today. I think it has really resonated with the members of the program," Garlick said,

Hyatt configured World of Hyatt to appeal to "the high-end traveler," Hyatt CEO Mark Hoplamazian has explained to Skift, and in doing so, it adopted a more revenue-based approach. Hyatt recently hired two former SPG veterans to run the program.

However, not much has fundamentally changed with the Hyatt program, said travel loyalty expert Gary Leff, who writes the blog View From the Wing.

"With respect to Hyatt in particular, last year it was in the bottom of J.D. Power's rankings. The only thing that's changed about Hyatt year over year is in their elite program, and it's a change that most members think is marginally worse if not the same as before," Leff said. "J.D Power surveys, in the past, didn't factor elite treatment at all. They were looking at earn and burn, but not elite benefits. Elite benefits have changed and Hyatt's performance in the survey has changed markedly, but J.D. Power doesn't give you enough information to know what's going on."

Hilton made some changes to its loyalty program earlier this year, borrowing some its tactics from airline loyalty programs.

"I wouldn't say that Hilton dropped this year," Garlick said, "It's just that the other programs improved."

What About SPG and Wyndham Rewards?

SPG has never ranked highly in J.D. Power's hotel loyalty program surveys and this year was no different. However, it did move up slightly in the rankings this year, primarily because of the inclusion of more engaged and frequent travelers, said Garlick.

"SPG was always known as the gold standard in hotel loyalty," Garlick said. "But every year of our study — for three years — they never ranked much higher than the bottom. Our belief was they were low because you basically had a lot of elites not counted in the data as much. Not that many people get elite status or elite status with SPG. But once you had it, you were really happy with the benefits."

Leff has doubts about how J.D. Power conducts its survey and determines its rankings; he pointed to SPG as an example. "There's nothing fundamentally different about the SPG program from last year to this year," he said. "There's no change in the program driving the results in this survey. When the programs themselves haven't changed in terms of things measured by the survey, I treat the survey results as pure noise."

U.S. News & World Report ranked Wyndham Rewards as the No. 1 hotel loyalty program in 2016. An IdeaWorks survey founded that Wyndham Rewards had the most payback on guest spending. The program, however, ranked at the very bottom of J.D. Power's rankings.

Garlick thinks this may have to do with the fact that many Wyndham Rewards members are casual leisure travelers as opposed to seasoned business travelers.

"They have a lot of leisure hotel stays," he said. "U.S. News and World Report evaluates loyalty programs based on a completely different set of criteria, and put them right at the top. In this particular case [our study], people who said Wyndham was their first program rated them not as highly."

Lessons for Hotel Loyalty

If there's one thing to be gleaned from the J.D. Power study, it's a seeming no-brainer: The happier guests are with their hotel loyalty program, the more brand loyal they are, and the more money hotel companies can make.

Of the hotel stays booked by respondents in the last year, 47 percent were booked with a brand affiliated with a member's loyalty program. That percentage grew to 52 percent among members who say they are delighted with their loyalty programs.

However, happiness isn't always so easy for loyalty programs to deliver: Nearly half of all loyalty program members surveyed said they have a less-than-clear understanding of how to earn their points and only 50 percent know how to redeem them. When members fully understand how to redeem points in their loyalty programs, their overall satisfaction is 147 points higher than those who say they do not fully understand the process.

"There's a simple solution for this," said Garlick. "Provide more education to your customer base to teach them how to earn and redeem rewards, and you'll drive up your share of wallet."

Leff said it's not just about providing education but meeting customers where they are. "Is it true that people don't understand these programs? Sure, especially among the least- engaged members. You want them to be more engaged but you don't get them more engaged by trying to teach them more about your program. You need to meet them where they are. I wouldn't have too much consternation about less-engaged members not having program details top of mind."

And when redeeming points, loyalty program members are increasingly looking for more than just a hotel stay, according to J.D. Power. It noted that overall satisfaction is 138 points higher among hotel loyalty program members who redeem rewards for retail products.

Satisfaction was also higher for redemptions involving special events (+124 points); car rentals (+103 points), and dining (+86 points). Redeeming for hotel stays added only 4 points, on average, to loyalty members' overall satisfaction with a particular program.

Leff thinks this takeaway might be a bit misleading. "In a vacuum, that always polls well: Would you like a hotel or a hotel and a pony? People will say, 'Give me a hotel and a pony.' But when it comes to actual consumer behavior, you have to take into account price and value, and you always get a better deal for redeeming for a hotel stay than having to use those points to buy other things.

"In the abstract, of course, people want a lot of things. But when you look at how they actually behave and what drives loyalty, you have to think about that value. In practice, those non-travel redemptions don't work nearly as well as they do in generic polling."