Skift Take

Interestingly, the Starwood Preferred Guest program, beloved among frequent travelers, ranked near the bottom, and it's never fared well in past J.D. Powers' reports. So, why is it so admired, and why does Marriott want it so badly?

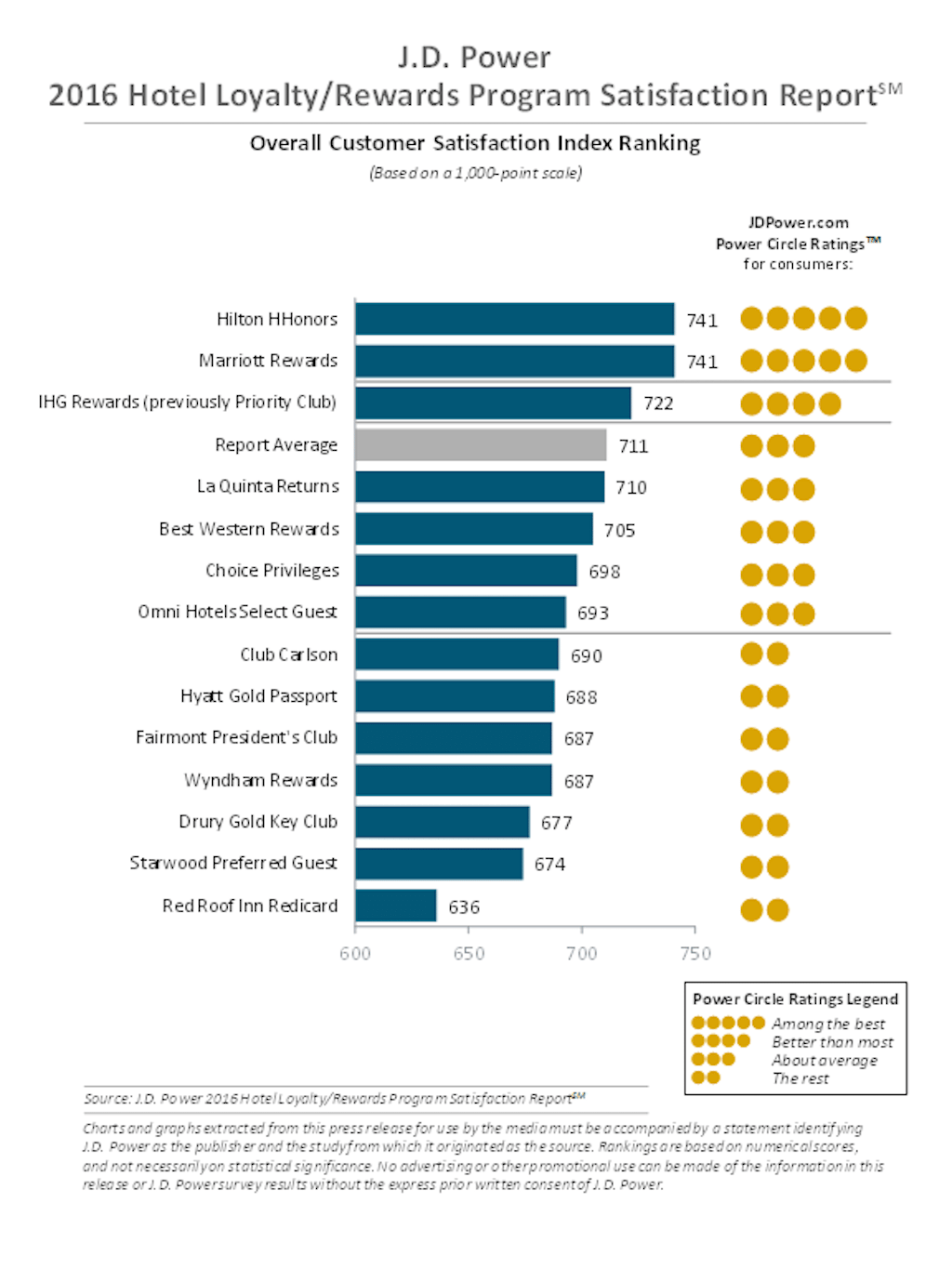

The third annual J.D. Power Hotel Loyalty/Rewards Program Satisfaction Report is out and this year, Hilton Worldwide and Marriott International took top honors, tying for first place in terms of overall customer satisfaction, followed by InterContinental Hotel Group.

The full list is included below.

Interestingly, the Starwood Preferred Guest program, which has historically never fared well in J.D. Powers’ hotel loyalty program report, ranked second to last, with an index score of 674. Last year, its score was 661 and in 2014, it was 651, ranking well below average.

One reason is that SPG caters to the most elite travelers but makes it difficult for less frequent travelers to even qualify for the lower tiers. (See more below.)

So, what made Hilton and Marriott tops? This was the second year in a row that Hilton HHonors ranked highest, and according to J.D. Power, its program scored very well in terms of account maintenance/management, as well as reward program terms and the variety of available benefits for members. Marriott, on the other hand, scored well in ease of redeeming points/miles, reward program terms, and ease of earning points/miles. Last year, Marriott ranked fifth overall.

The report drew on the responses of more than 3,096 U.S. consumers who have joined a hotel loyalty plan and answered an online survey in February 2016. The overall customer satisfaction index takes the following factors into account (and in order of importance): account maintenance/management (23 percent); ease of redeeming points/miles (22 percent); ease of earning points/miles (18 percent); variety of benefits (16 percent); reward program terms (16 percent); and customer service (5 percent). Satisfaction was measured on a 1,000-point scale, and both Marriott and Hilton earned scores of 741.

What Happened to SPG?

Hotel loyalty programs are serious business in the hospitality space. It could even be argued that some hotel loyalty programs are almost worth spending $13.6 billion for.

On April 1, Marriott CEO Arne Sorenson said, “The most important thing for us to succeed at is the loyalty program,” referring to Marriott’s pending acquisition of Starwood. “You’ve got, with SPG [Starwood Preferred Guest] and Marriott Rewards, two big groups of very loyal customers. We’ve got to make sure you’re enthusiastic about the changes. I think we can make sure the benefits stay the same, if not get better, and offer them [SPG members] a broader selection of places to stay.”

Interestingly enough, the SPG program has historically never fared well in J.D. Powers’ hotel loyalty program report. This year, it was ranked second to last, with an index score of 674. Last year, its score was 661 and in 2014, it was 651, ranking well below average.

Looking at other hotel loyalty rankings, SPG also generally ranks lower than Marriott’s. According to U.S. News & World Report’s most recent list of Best Hotel Rewards Programs, Marriott Rewards was No. 1 and SPG came in eighth (and Hilton came in at ninth). To calculate those rankings, an algorithm examines factors such as ease of earning a free night, additional benefits, geographical coverage, number of hotels in network, and property diversity. In the 2015 Freddie Awards, Marriott Rewards was named best program of the year in the Americas and SPG won for Best Redemption Ability in the Americas.

And yet, SPG members possess a reputation for their passion and program loyalty. So much so, that it was mentioned by Sorenson during Marriott and Starwood’s joint investor call on April 1. He said, “… We have been impressed by the loyalty that SPG members have for Starwood and its hotels,” later adding, “… From the moment we announced the transaction we have seen a very robust debate among SPG members about ‘What’s going to happen to our points, and is this good for me or is it bad for me?'”

The real reason SPG has historically ranked so low on J.D. Powers’ reports? It caters more to frequent business travelers and road warriors, rather than the everyday leisure traveler, said Rick Garlick, global practice lead, travel and hospitality, for J.D. Power. “Other studies that rate loyalty programs look at everything other than customer satisfaction scores. Ours only looks at the customer feedback rating, and we really look at people at all tiers and all levels of a program.”

Garlick said that J.D. Powers tries to ensure that random but representative sample of members are surveyed for each program, so there isn’t a majority of elite status members or non-elite status members, for example. Starwood, he said, rewards its elite members handsomely in comparison to Hilton and Marriott, but makes it much harder for members to achieve even the lowest tier of status in its program. For example, SPG gold status requires 25 qualifying nights; Hilton HHonors’ and Marriott Rewards’ lowest status tiers require only 10.

“If you’re higher status in Starwood’s program, you achieve more rewards and you like the status you achieve if you’re really a guest,” Garlick said. “Our report looks more at the general traveling public — not the elite travelers that Starwood’s program appeals to the most. The more engaged you are [with a program], the better you like it.”

Loyalty Leads to Profits

A recent PriceWaterhouse Coopers’ Consumer Intelligence Series report, “What’s driving customer loyalty for today’s hotel brands?” seems to echo Garlick’s assessment. It summarized that, “hotel companies will need to decide how to prioritize investments that drive brand engagement across all consumer segments, while simultaneously targeting the most profitable demographic. Ultimately, brands that drive the greatest engagement will likely accrue the highest revenue gains.”

As the J.D Power rankings show, having multiple brands, wide distribution networks, and lots of partnerships, as well as catering to a wider set of travelers, distinguishes great programs from the rest and that’s exactly what both Marriott and Hilton are attempting to do with their respective loyalty programs.

To keep guests loyal, and battle the encroachment of online travel agencies in terms of market share, both Hilton and Marriott are enticing their rewards members with the lowest guaranteed hotel rates and a variety of special perks for booking direct. And the more members they have, the better, which is why Sorenson is so keen on bringing in SPG members into the Marriott Rewards fold.

For Hilton CEO Christopher Nassetta, customer loyalty is invaluable. At the World Travel & Tourism Council in Dallas on April 6, he said having scale as one of the biggest hotel companies in the world is crucial for generating customer loyalty. “I think about scale, for us, as creating a network effect, which means we can serve any customer for any need they have, anywhere in the world they want to be,” he said. “When we have the ability to do that we drive unbelievable loyalty. And that unbelievable loyalty shows up in very high levels of market share, and those very high levels of market share drive more growth.”

Have a confidential tip for Skift? Get in touch

Tags: hilton, intercontinental hotel group, loyalty, marriott, starwood

Photo credit: The Union Station Grand Hall Lounge at the St. Louis Union Station - a DoubleTree by Hilton Hotel. Hilton Worldwide