Skift Take

There ain't no such thing as a free booking.

Last week we launched the latest report in our Skift Research service, The State of Destination Marketing 2017.

In our latest research report we dive into the direct booking wars, what is it really all about, and what does the current distribution landscape look like for hoteliers? Throughout the report we also illustrate key findings from our 2017 Direct Booking Survey powered by Skift and Trivago and totaling 370 responses from hotels worldwide.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

One would think that given all of the industry attention on direct booking, there would be a more uniform way of looking at what it actually is. The most obvious type of purchase that all hotels clearly count as direct is the booking that occurs on the brand.com website or app where there is no third party involved in facilitating the transaction.

Things become complicated within digital direct because there are paid and unpaid components. By unpaid, we do not suggest that there are not costs associated with acquiring the guest. There are advertising, technology, operational, and other expenses associated with building a brand and winning a booking. The unpaid amount is referring to third-party distribution costs.

Preview and Buy the Full Report

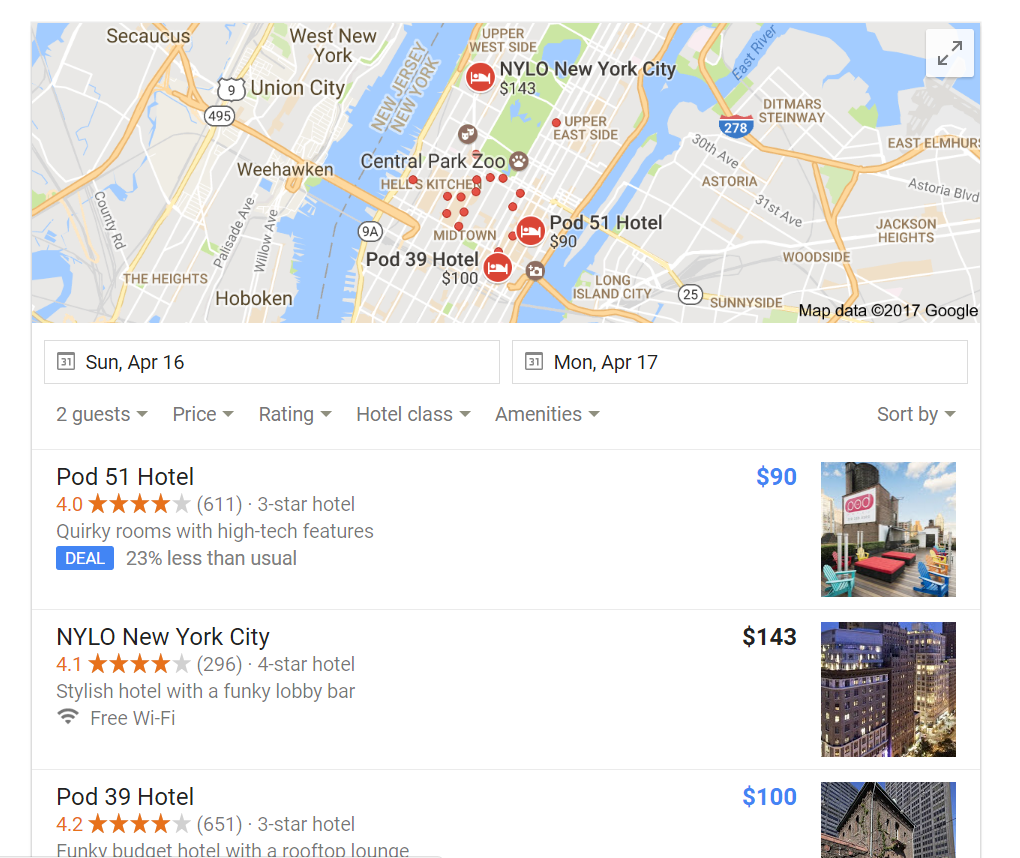

For paid digital direct bookings, hotels will have the guest book on the brand.com site or app, but pay another entity for bringing the web traffic or booking. An example would be a hotel using a traditional metasearch company like Kayak or trivago, where a consumer clicks on the meta site to then book on the brand.com site.

The hotel will typically pay the meta site on a cost per click (CPC) basis for that click, though a commission model with cost per acquisition (CPA) is possible as well. It’s debatable whether this should count as direct with marketing costs or amount to another distribution platform comparable to an online travel agency (OTA). Our view is that the CPC model would be a marketing channel while the CPA model would be “OTA-like.” Regardless, the booking is owned by the hotel and pays a third party to lead to a booking.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst calls, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst calls, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: direct booking, distribution, gds, hotel direct, metasearch, ota, research reports

Photo credit: Priceline enabled direct bookings with Hilton and other brands, while hotel's own brand.com sites have their own version of direct bookings. Hilton