Skift Take

Slim margins and complex technology have turned travel metasearch into a contact sport. Identifying the winners and losers in this space takes a keen understanding of the economics and mechanics that power these businesses. Luckily, we've produced the definitive resource for understanding and forecasting the trend lines.

Today we are launching the latest report in our Skift Trends Reports service, The State of Metasearch in Travel 2016.

This is by far the most comprehensive analysis of the current state of the global metasearch market in existence today. Weighing in at over 50,000 words, this report is as much a reference manual into the intricate mechanics of the metasearch business model, as it is a competitive and financial analysis benchmarking performance and strategy of the biggest brands in metasearch.

We found our interviews with key decision makers to be the most valuable part of the primary research process. Participants were candid with us about their companies, competition, and broad views on the future of the industry. We provide full transcripts of our interviews throughout the report.

Executives Interviewed (transcripts included):

- Kayak CEO and Co-founder Steve Hafner

- Momondo CEO Hugo Burge

- Momondo Managing Director Pia Vemmelund

- TripAdvisor VP of Global Sales Brian Schmidt

- Skyscanner GM, Americas Shane Corstorphine

- Tripping COO and Co-founder Jeffrey Manheimer

- Viajala CEO and Co-founder Thomas Allier

- Roomlr CEO and Founder Bas Lemmens

- Viceroy Hotel Group CEO Bill Walshe

- Viceroy Hotel Group VP Mary Bennett

- Standard Hotels Chief Revenue Officer Jimmy Suh

- Former Expedia CEO and Investor Erik Blachford

- SiteMinder Co-founder and CEO Mike Ford

Our team spent countless hours sifting over the latest M&A activity, company financials, web and consumer data, and transcripts of interviews with strategists and executives from meta brands, suppliers, and third-party technology platforms.

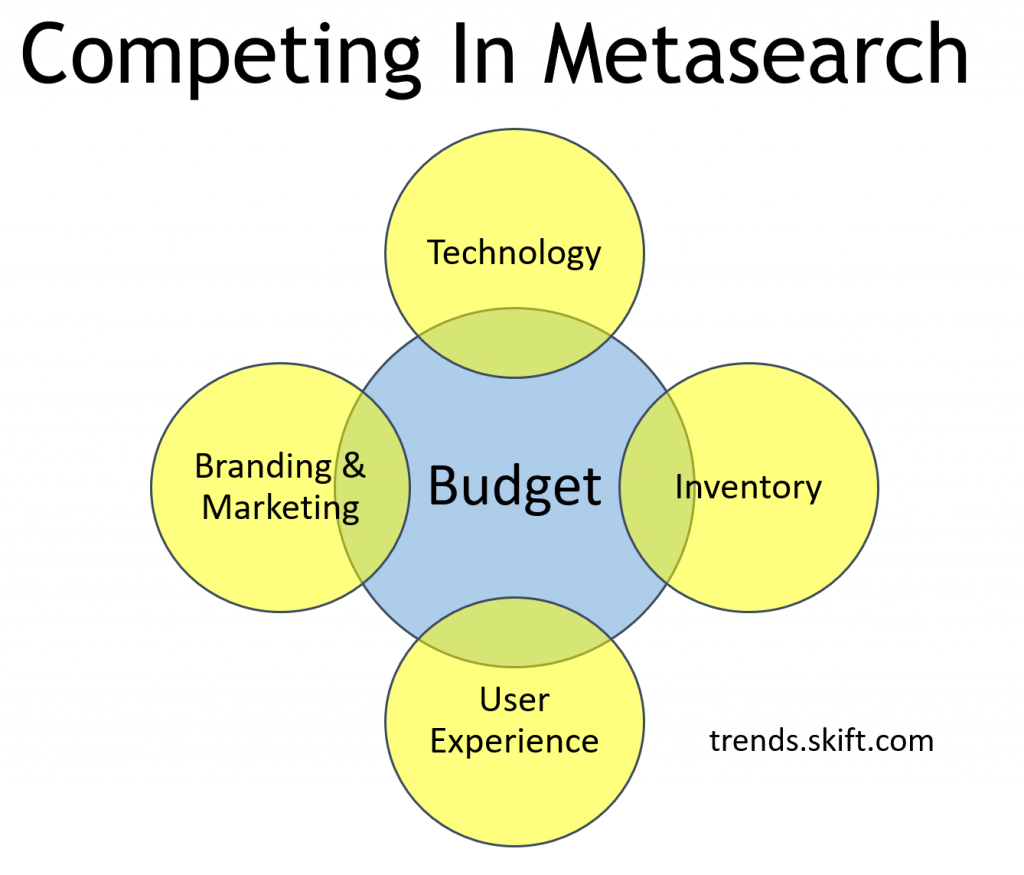

Biggest lesson: The mechanics of the metasearch business model and how travel brands use it to effectively bring attractive products to market are extremely complex. While many have tried, very few are now doing it in a meaningful way that produces attractive scale and profits. Those that succeed long term will ultimately need the right mix of technology, inventory, user experience, market strategy and budget. This definitive report outlines the competitive landscape along all five of these essential benchmarks.

From this report, you will know the following:

- Unique economics and strategies for the big four brands in meta: Trivago, Kayak, Skyscanner, Google

- Why certain metasearch brands are succeeding while others struggle to cover costs

- Listen to what the most senior thought leaders and executives are saying about the market

- How metasearch brands align technology, connectivity, user experience, marketing strategy and budget to stay ahead of the curve

- What consolidation and competition means for independent and integrated (OTA owned) meta players

- What Trivago’s recent IPO means for Expedia and for its competitors

- Foresight into the future of metasearch as a technology

- How metasearch tech plays into a growing alternative accommodations market

- Company valuations and forecasts of future M&A activity in the industry

- The impact of regulation and supplier backlash against metasearch platforms

Preview and Buy the Full Report

Airline Vs. Hotel Metasearch

Airline metasearch in the U.S. by itself is not a very attractive business from a monetization perspective compared to hotel metasearch. The airline industry is consolidated and the big carriers have a lot of power.

Based on our conversations, we believe the commission rate on a CPA basis is anywhere between zero to a few percent for the large carriers. On a CPC basis, it could be as low as $6 per booking. Internationally, there is more fragmentation so rates are likely a few percentage points higher.

Preview and Buy the Full Report

On Regulation

Revenue and channel management will become more complex as hotel managers get tasked with setting different rates across channels and markets. OTAs will keep closer watch on increasingly disparate market rates and their preferred hotel supplier partnerships, all while navigating a geographically fragmented regulatory landscape.

If price uniformity across channels widens, even marginally, consumers could feel compelled to spend more time shopping across different channels. This will usher new opportunities for brands to capture market share through unique promotions through bundling, private rates, and others.

This is the latest in a series of twice-monthly reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 100 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: digital, hipmunk, kayak, metasearch, momondo, research reports, skyscanner, travel research, Travel Trends