Skift Take

To switch to revenue-based loyalty programs or not to switch? Many airlines are just doing the math, and anticipating the outcry.

Airline loyalty programs are at a crossroads as Delta, Southwest, United and Qantas have all followed the lead of hotels and other retailers, and transitioned to revenue-based loyalty programs.

Additional airlines are expected to follow along or introduce hybrid mileage- and revenue-infused programs over the next few years, according to a recent report, Revenue-Based Accrual as the New World Order, from IdeaWorks Co.

Still, American Airlines Group, is on record as saying it will stick to its mileage-based program as it works on integrating AAdvantage with US Airways’ Dividend Miles, and Lufthansa, which is spinning off its loyalty program, pledges to give more focus to non-elite flyers, a group that often gets short shrift when programs shift from miles to revenue at their core, IdeaWorks states.

“Frequent flyer program executives can certainly create strategies to woo their treasured elite members with more miles, kilometers, and points,” IdeaWorks states. “But ignoring the greater mass of members incurs great risk. These are the ‘everyday members’ who buy a few tickets each year, accrue points with program partners — and very importantly — buy goods with the carrier’s co-branded credit card. That’s the danger associated with designing a program that focuses benefits on high-value customers.”

Still, Southwest, which moved to a revenue-based program in March 2011, knew the change would create a tempest, and had a communications plan in place to influence the influencers about the merit of the changes, the report states.

Delta’s financials, with 4% of its frequent flyers accounting for 25% of revenue, underscore why the airline made the change, which was five years in the making, IdeaWorks states.

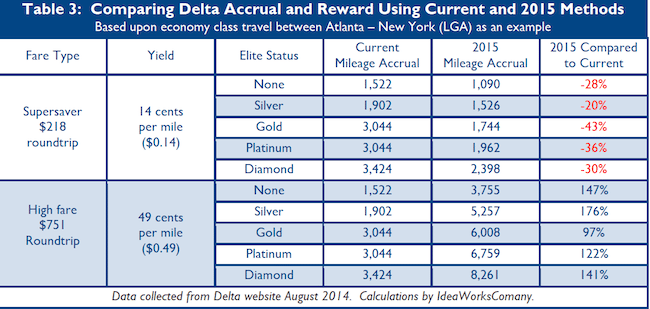

The following chart portrays changes in the Delta SkyMiles program, slated for 2015, that will skew heavily in favor of flyers purchasing higher fares and bode ill for travelers opting for discounts.

IdeaWorks offers some tips to airlines moving toward revenue-based programs:

- Consider a response that’s unique. You need not match the prevailing offer. Doing so will risk being called a follower. This will be difficult for those in an alliance or joint venture.

- Provide plenty of advance notice. This allows your program members to digest the changes, and for your airline to make corrections before implementation. Remember your key partners. They are called alliances for a good reason, it’s because the partners work toward a common economic benefit. Major accrual changes should occur after consultations and never arrive as a surprise received via press release.

- Don’t budget all your miles. Create a 10 to 15 percent reserve to provide the opportunity to launch bonus offers for reasons that were unanticipated.

- Simplicity is a virtue. Create accrual methods that a member could easily explain to a friend. To do otherwise is to risk confusing your members and penalizing the priceless benefit of word-of-mouth referrals.

- Promote accrual in the booking path. Consumers will trade up to a higher fare when made aware of the benefit of additional miles or points. Southwest Airlines provides an exceptional example of this.

- Anticipate behavior of at-risk members. Analysis should identify member groups which will lose benefits. Create bonus offers to ease their transition to the new accrual method.

- Create online comparison tools. Don’t hide the facts of before and after. Allow members to compare how their fortunes will change. Provide members with an online tool to calculate accrual.

- Don’t punish lower yield consumers. After all, they represent the majority of program membership and can someday grow into higher yield customers.

- Remember pay-with-points is the perfect complement. Switching to revenue-based accrual, while leaving the reward method untouched, represents unfinished business. Announce or implement reward improvements at the same time.

Much of the above advice is about managing expectations, and both loyalty program and airline alliance members will act as aggrieved parties unless transparency is emphasized.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: business travel, delta air lines, loyalty, southwest airlines

Photo credit: Interior cabin of a Boeing 767 showing Vantage business class seats. Delta Air Lines