The Emergence of a New Chinese Traveler: A Skift Deep Dive

Skift Take

For more than two decades, outbound travel from China was a major rising catalyst for global travel, an economic engine spurred by the emerging middle class in the country of 1.4 billion people. Chinese travel could be felt from Vancouver to Dubai to Singapore with destinations becoming reliant on the steady stream of easily spending tourists.

Accounting for almost one-fifth of global tourism spending, Chinese tourists spent $255 billion overseas and made 166 million overseas trips in 2019, according to the United Nations' World Tourism Organization.

Between 2009 and 2019, the number of outbound Chinese tourists rose 12.8 percent a year on an average, compared to the global average of 5.1 percent.

Nothing seemed it could be a threat to that vibrant trend. That is, until the pandemic.

For three years, this drive force was eliminated from the global stage as China enforced strict, zero-Covid policies that put the country into lockdown.

China registered an average of around 12 million outbound air passengers per month in 2019, those numbers fell 95 percent during the Covid years.

Today, as China has opened up its borders finally, the world must prepare itself for a new kind of Chinese traveler, one that is more reticent and guarded, and certainly one that may not be as willing to hop on a plane and fly across the world as readily as in 2019.

Remember the archetypal Chinese tourists trooping behind a flag-wielding tour director at some world heritage site? Well, in 2023, they are an outdated cliché at best.

Like most of the travel industry being forced to adapt to new norms after the pandemic, so too will it have to figure out ways to serve a new Chinese traveler.

First things first, to attract Chinese tourists, destinations need to be more welcoming and should have easier entry rules for Chinese travelers, according to Steve Saxon, partner in McKinsey Shenzhen and leader of Asia travel practice.

“Thailand now offers straightforward e-visas for Chinese. Middle East and Singapore are also performing strongly,” Saxon said.

China's largest online travel agency Trip.com Group’s leading Chinese language platform Ctrip’s data revealed the release of pent-up demand as the Lunar New Year holiday marked the first major holiday following the removal of mainland China’s border restrictions.

Overall outbound (non-mainland China) travel bookings on the platform grew by 640 percent compared to the 2022 Lunar New Year period, with outbound air ticket and overseas hotel bookings both increasing by over 400 percent.

Fliggy, Alibaba Group’s online travel platform, saw the number of outbound and inbound flight bookings increase more than 4.5 times year-on-year in the first two months of 2023, according to Simeon Shi, chief strategy officer and head of corporate development.

The platform also noted a 190 percent year-on-year increase in orders for outbound tour products, including overseas local rides, scenic spot tickets, and online visa processing services during the same period, Shi said while speaking at ITB Berlin.

With China's outbound tourism industry witnessing a firm trajectory of quick recovery, the country last week announced a list of 40 more countries, after the initial list of 20 countries for its pilot program for outbound group tours.

However, tourism destinations and businesses would be amiss to imagine that there is just one type of Chinese traveler, warned Sienna Parulis-Cook, director of marketing and communications of Chinese marketing solutions firm Dragon Trail International.

“The Chinese outbound tourism market should not be seen as a monolith,” Cook observed.

Professor Wolfgang Arlt, CEO of Chinese Outbound Tourism Research Institute, too agreed that any answer to questions about defining “the” Chinese traveller would be wrong.

The key point, according to Arlt, is to understand that there are various types of travelers with different demands and behavior patterns.

How different? Arlt explained, “The 28-year-old foodie from Hangzhou may want to eat local food and do a cooking class, the couple with a 10-year-old kid from Shanghai may want educational activities, the affluent elderly couple from Beijing may opt for a wine tasting tour.”

A lot to decipher for destinations keen to tap into the once-largest outbound market in the world.

At the Skift Global Forum East in Dubai last year, Schubert Lou, chief operating officer of Trip.com had aptly said that earlier ways of marketing to Chinese travelers won’t work as well today as their preferences have changed during the pandemic.

Just how different would these be?

How Destinations Can Approach The Change

According to Dragon Trail’s Cook, destinations that want to market themselves to Chinese tourists, need to understand the market segments they appeal to the most and the ones that they most want to attract.

“Being clear about both of these things will guide a successful marketing and product development strategy,” she said.

Travel service providers need to spend more time researching consumer behavior changes and ways to efficiently meet diverse needs, according to Fliggy's Shi.

From a content perspective, destinations should also have a good idea of prevalent travel trends and how they are a good fit for these trends.

If trends are dictated by the information people have at hand, then it makes sense to understand how information-gathering has changed.

Citing China i2i Group’s survey results, CEO Alexander Glos said Chinese messaging platform WeChat is overwhelmingly the number one information source today, while earlier surveys would have typically showcased web and online travel agencies or just travel agents as being the single most important source.

Explaining how travelers are using WeChat and other social media platforms, Glos said consumers are not just getting information directly from travel suppliers, but also from platforms that share information from travelers who have been there, done that.

Arlt echoed the sentiment as he said people would rather prefer reviews from regular customers than from influencers.

“Spend more money on wow quality for your customers, so you can save money on marketing, as the satisfied customers will become your brand ambassador,” he explained.

And if wow quality is what destinations are looking for to attract Chinese tourists, Trip.com Group suggests putting more focus on visual content to inspire travelers.

While Dragon Trail noted that the approach towards marketing probably hasn’t changed substantially since the pandemic, Cook observed that a major development over the last three years has been the emergence of social media platform Xiaohongshu (aka Little Red Book aka Red) for travel inspiration and research.

Psyche of The Chinese Traveler

To understand the demand for travel coming from China, Glos said it also important to understand the Chinese traveler’s psyche.

“Travel is not just about exploring a particular place, but about living a lifestyle that is reflective of one’s financial success and maintaining the outward appearance of a successful lifestyle,” according to Glos.

With travel being symbolic of one’s professional and financial success, it is only logical that, as Glos predicts, high-end travelers are the likeliest candidates to return faster.

Trip.com Group too noted that the new Chinese traveler would like prefer customized travel products and experiences, as well as high-quality products that provide added value.

A sentiment echoed in Skift Research’s latest report, which states that luxury will be the key differentiator when comparing a potential 2023 recession to previous downturns.

“You can expect a segment that has very strong pent-up demand, spending power, but is also quite savvy in distinguishing what’s quality and good in travel choices,” said Jackey Yu, partner in McKinsey Hong Kong.

Yu’s prediction is based on the behavior of Chinese travelers who she said didn’t stop traveling in the last three years. “They had just stopped international travel. Domestically, consumers experienced new diversified tourism products emerging.”

Talking about a significant pent-up demand in China's domestic travel market, a Trip.com Group spokesperson said, “Cross-provincial hotel bookings accounted for almost 70 percent of total domestic hotel bookings made on Ctrip over the lunar holiday period.”

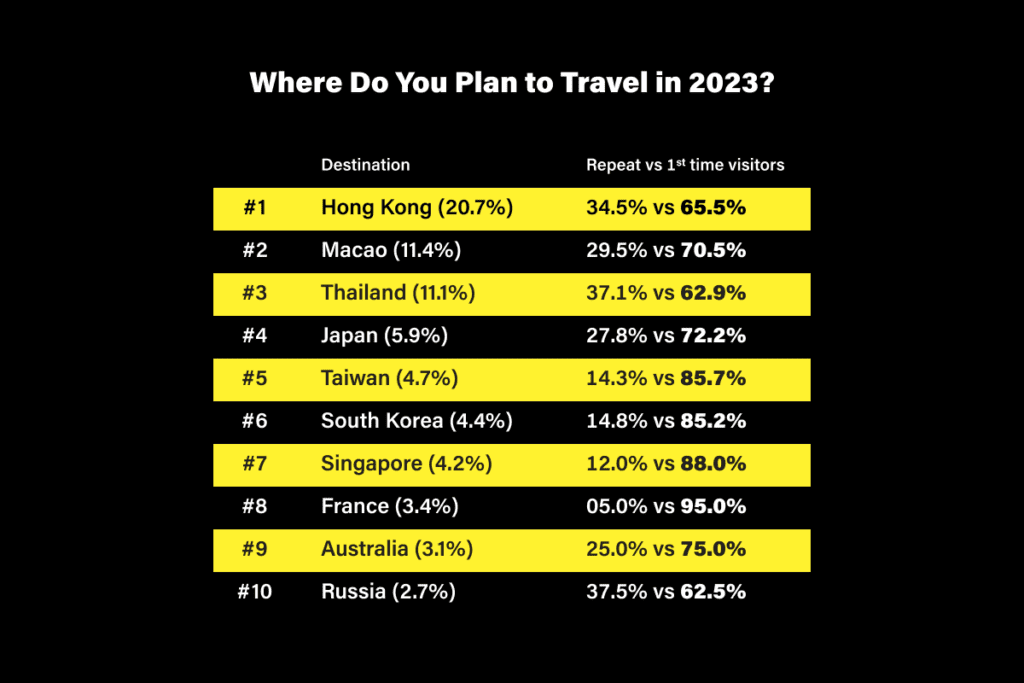

Most Chinese would continue to travel within the region for reasons best known to all — faster, cheaper and more familiar, according to Arlt. “Long-haul travel would start around April-May depending on visa availability and affordable air tickets.”

Travel analytics firm ForwardKeys too noted that China’s intra-regional neighbors in Asia will reap the most significant benefits with the easing of travel restrictions, while it noticed a sharp upswing in bookings for domestic flights.

While Glos said there is enough pent-up demand in the China market to overcome any sensitivity to price increases, he also shared that the Chinese are smart travel consumers, who will look for value for money while spending.

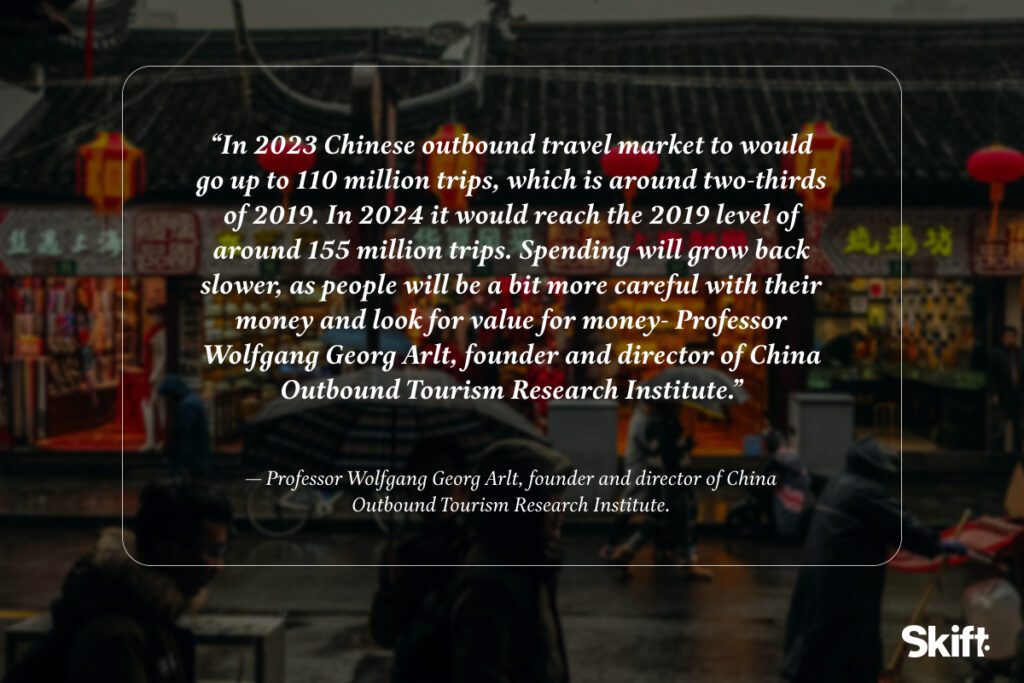

An idea shared by Arlt, who expects spending to grow back slower, as people will be a bit more careful with their money.

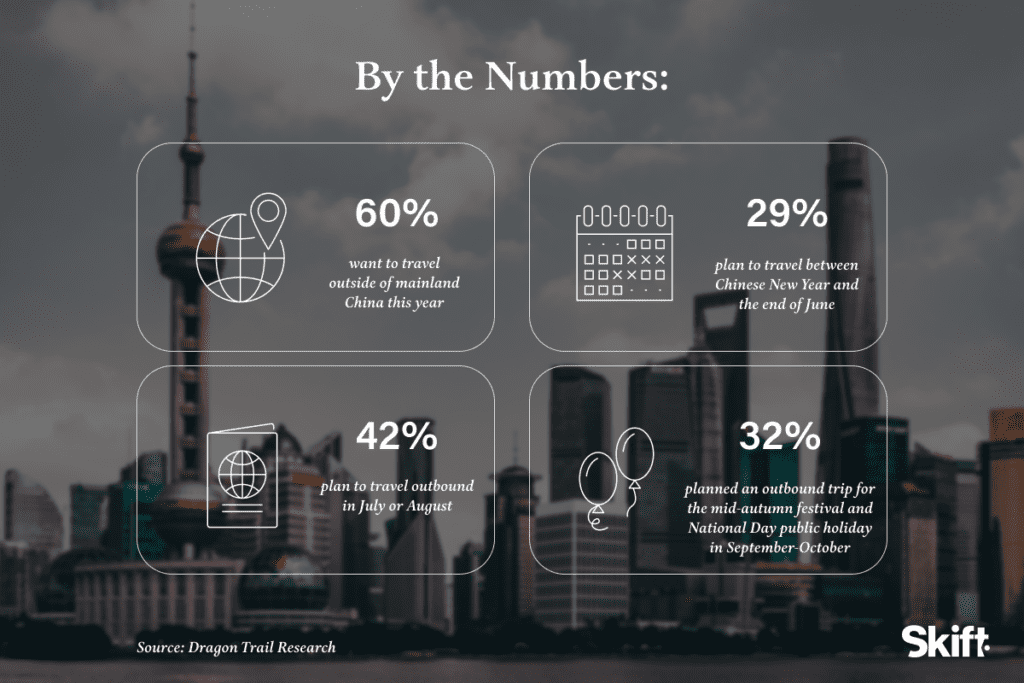

Arlt expects Chinese outbound trips to hit 110 million by 2023, almost two-thirds of 2019’s 155 million trips. Next year is when he forecasts Chinese outbound trips to hit the 155 million-mark.

Travel Consumption Is More Experience-Oriented

While they look for more bang for their buck, many Chinese tourists are looking at relaxation as a goal of travel, particularly in Southeast Asian destinations with beaches and resorts. Family travel is also picking up, including traveling with young children and older parents.

Fliggy’s Shi also emphasized that China’s travel consumption trend has shifted from destination-focused to experience-oriented and interest-driven, fragmenting demand significantly.

According to Trip.com Group, the younger generation of travelers is showing interest in small group tours, with more flexible arrangements, high-quality services and varied experiences.

And even as Glos noted that the periodic international traveler, going abroad once every two or three years, is the least likely to return in the coming 12 months, Dragon Trail’s Cook said that tour groups keen to check off bucket-list destinations with packed travel itineraries are here to stay.

Cook also noted that there has been strong growth in outdoor activities, particularly camping, hiking, and water sports such as surfing.

However, she is quick to observe that a lot of the top “new” trends are things that had already started before Covid, and have perhaps been accelerated by the pandemic with its impact on travel plans and preferences.

With the inspiration and marketing taken care of, what are the challenges for destinations wanting to attract Chinese tourists?

And Now the Challenges ...

While inflation and the cost-of-living crisis have been cited by many destinations, many believe these aren’t impediments for Chinese tourists.

As Arlt explained, “Many Chinese have a travel budget. If the prices are higher, they cut short the trip by a day or two or end up eating cup noodles instead of dinner to stay within the budget.”

Cook noted that China is not experiencing the same inflation and cost-of-living crisis that many western countries are now facing.

That said, three years of strict zero Covid policies have had a significant impact on people and businesses in China. No wonder then that financial constraints was the number one reason that respondents of a Dragon Trail survey conducted earlier this year cited for not planning an outbound trip in 2023.

But as Cook observed, while some Chinese consumers may be low on money for travel now, others would have saved up during this period, resulting in the so-called “revenge spending” on outbound travel.

Glos too opined that the significant pent-up demand in the China market will overcome any sensitivity to price increases.

The pricing of travel in China over the last couple of years has increased significantly, according to Glos. He noted that hoteliers indicate that room rates in China have increased anywhere from 20 percent to 35 percent, compared to 2020 and certainly 2019.

It's important to remember that with significantly lower cost of living, Chinese travelers typically have a higher level of disposable income compared to north American and European travelers.

Trip.com Group observed that China’s inflation rate is set to stay below other major economies in 2023 amidst reopening and could be a boon for outbound travel.

“Lower inflation benefits travellers as their money will retain its purchasing power over time, enabling them to take advantage of competitive prices and make their money go further. The high-end earners and booming middle-class travellers are looking to spend on travel,” said a Trip.com group spokesperson.

However, Cook observed that there is no way for the market to recover with flight capacity as low and prices as high as they currently are.

A sentiment echoed by Trip.com Group executives while announcing their fourth quarterly results. For a faster recovery of the outbound market, Trip.com Group said the aviation sector will have to ramp up flight capacity from the current 15-20 percent of pre-Covid level.

McKinsey’s Saxon too noted that while travel recovery is taking place, leisure travel is still dogged by frictions such as thin airline schedules, high airfares, passport availability, slow visa renewals, outbound licences and approved-destination status that needs to be reactivated.

The constant announcements of countries dropping entry requirements for Chinese tourists and routes being resumed or increased from China are now facilitating increase in flight capacity, which would eventually lead to lower airfares.

“In fact, prices have already dropped very significantly since last year,” noted Cook, adding that the extraordinarily high airfares in January and early February were a big deterrent for people to consider travel.

However, he was optimistic about flights and prices rectifying themselves quickly as more airlines add capacity.

“We are seeing it already, certainly to markets in Southeast Asia, the Middle East and even Europe. Between expedited visa processing and realistic air ticket prices, we think the summer is going to be very strong,” Glos said.

Though Cook expects Chinese outbound travel to recover by the end of 2023 within Asia, and some time next year for other destinations, she said that Chinese outbound tourism to Europe cannot reach pre-pandemic levels without the group tourism sector.

In a rapidly improving travel environment, the evolved Chinese tourist is ready to hit the road with updated expectations from destinations and experiences and if service providers don’t catch up, there is bound to be many a slip between the chopstick and the lip.