Strategies for Hospitality Recovery: Spotlight on Europe

Skift Take

This sponsored content was created in collaboration with a Skift partner.

After last year’s dramatic shock to the hospitality ecosystem, the industry is welcoming growing signs of recovery in 2021. But as hotels and operators try to capitalize on the awakening demand, they’re also acknowledging that new efforts need to be made if they’re to stay relevant and profitable in the transformed landscape.

What lessons were learned over the past year? What does the consumer experience demand in today’s market? And amidst fierce competition, how can hotels evolve, adjust, and re-prioritize for greater efficiency and profit — and what changes are the most crucial?

To answer these questions, Skift and Oracle collaborated on a global research study during spring 2021 focusing on the current thinking from hoteliers and guests on the post-Covid hotel experience, the results of which are published in a new report: Back to Hospitality: Getting Smarter and More Profitable in a Post-Covid World.

To help further explore geographic differences in the recovery, and better understand the needs of hoteliers and guests in key regions, Skift and Oracle are also releasing three regional spotlights. In this spotlight, we examine key industry and consumer trends from the hospitality recovery in Europe.

Overview

Travel demand in the greater European hotel market has not recovered as quickly as in the United States and United Kingdom. However with the summer vacation season underway, executives in the region are seeing positive signs that recovery in certain markets is making progress.

“We will pick up late this year, like Q4,” said Florian Daniel, CIO of Deutsche Hospitality. “That’s the current situation here in Germany, but also in Europe too. Some countries may try out different opening strategies, so our outlook is to stay cautiously optimistic.”

Other executives in the region back up this assessment. “As markets begin to reopen and travel restrictions begin to ease, we are starting to see some pent-up demand, especially for properties located in restriction-light destinations,” said Dimitris Manikis, president Europe, Middle East, Eurasia and Africa for Wyndham Hotels & Resorts. “In June, we saw a robust increase in bookings in several European markets, particularly driven by demand in Southeast Europe.”

Here are some key highlights from European hotel executives and guests from this year’s Skift and Oracle research.

Non-Room Revenue Opportunities

The business environment of 2020 created new momentum among hotel executives to rethink their notions of profitability and seek new sources of revenue diversification. As hotels looked for ways to make up lost room revenue during the pandemic, many discovered an emerging strategy focused on exploring new ways to monetize and market existing hotel products and services.

This year’s survey responses suggest hoteliers in Europe are already exploring how to expand their revenue streams beyond the overnight stay. For instance, 64 percent of European hotel respondents either started offering extended hotel stays of seven days or more in 2020 or offered this pre-pandemic — 14 percentage points higher than the responses from global survey participants.

Sixty percent also said they either started offering package deals, or offered this beforehand, a full 10 percentage points higher than global respondents.

European consumers, meanwhile, did not seem as enthusiastic about being offered more upsells or non-room products during their hotel stay, at least when compared with their global peers. When asking travelers about the importance of an upgrade or special offer at check-in, only 41 percent of European guests definitively said “yes” — nine percentage points lower than guests worldwide.

Still, it’s important to recognize that this lower traveler interest could be a by-product of the strict travel lockdowns that have impacted the region for much of the past year.

“We’ve been tightly regulated in the last 10, 11 months,” said Daniel. “So there was really not much room to have any travelers at all here, or to try that sort of business [model] out.”

Now, with the summer travel season showing greater signs of flexibility, there is hope that more clarity around border crossings will yield to more promising upward trends within the European region.

Competing With Short-Term Rentals

As the hospitality industry navigates out of the pandemic, they’ll also need to look for opportunities to differentiate themselves from competitive threats like short-term rentals. Thanks to the growth of short-term rental demand in 2020, the urgency of a response has increased considerably.

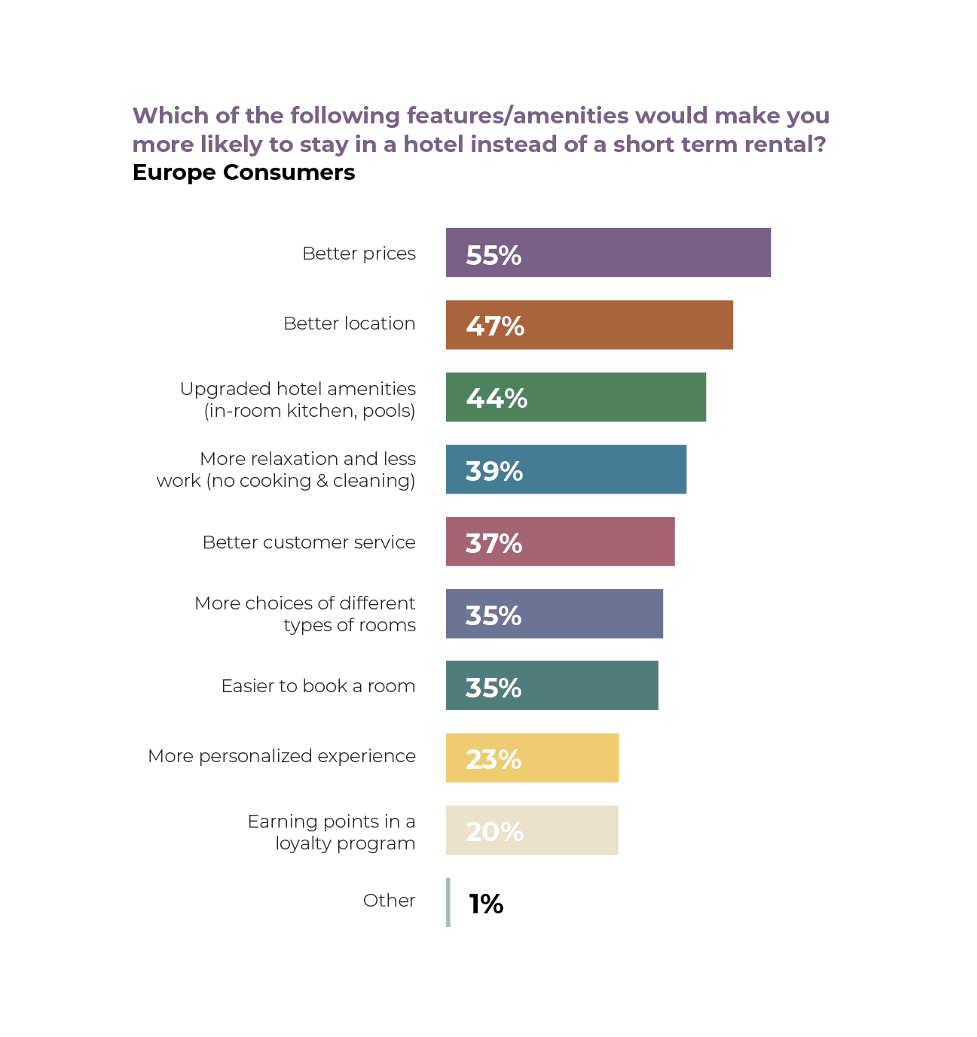

This year’s research confirms that European hotel operators overwhelmingly believe “they will need to develop products and services to better compete with short-term rentals in the future.” Seventy-seven percent of executives in the region agreed with this sentiment, as compared to 80 percent globally. But the question remains as to what types of products or services they should consider developing, something that is answered by the survey responses of European guests.

Reasons why European consumers are currently opting for short-term rentals over hotels were more or less similar with global attitudes. Short-term rentals provided them with increased privacy, access to kitchen facilities, and perceived protection from Covid-19 exposure. Similarly, European guest responses matched the global narrative regarding the benefits of hotels: on-site restaurants, pool and leisure facilities, and upgraded amenities — as well as location and price — were all seen as better attributes of hotels.

Still, there were points of difference that may help hotels better position themselves when appealing to future guests curious about short-term rental options. One example is hygiene and cleaning procedures.

“[Pre-pandemic] There was a lot of, ‘I would like to be in the middle of the city and see how people live there’,” said Daniel. “And what changed is, ‘I don't know if they have the proper hygiene in place, so I’d rather stay at a hotel’.”

European hotels are thus more likely to support new products highlighting rigorous cleanliness protocols as a means of differentiating their offering.

It’s worth highlighting that only 38 percent of consumers reported a clear preference for short-term rentals over a hotel — in line with the global response overall (37 percent). Nonetheless, there’s likely to be growing focus on competing with and positioning against short-term rentals as the industry recovers further.

Technology Upgrades

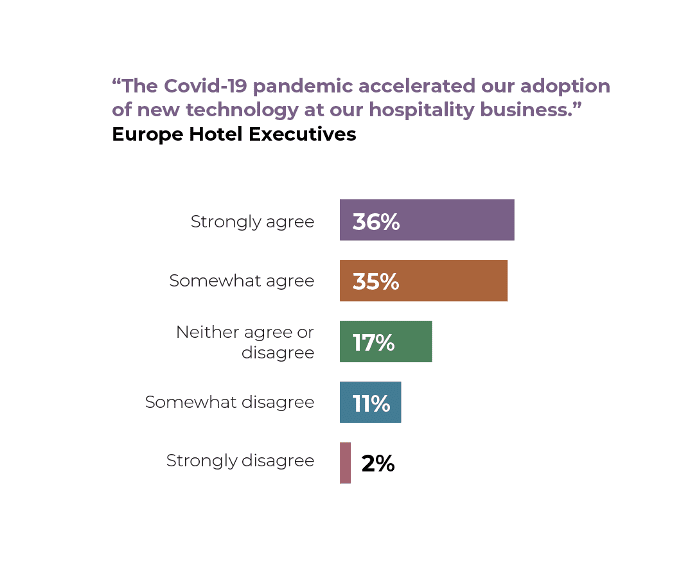

For hotels, the pandemic reinforced the importance of using downtime in 2020 to revitalize their technology systems, prepare for new consumer expectations, and upgrade their business for the future.

“Technology was already playing a key role in our industry, but Covid-19 has further accelerated the pace of digital adoption, with travelers expecting more digital and low-contact experiences,” said Wyndham’s Manikis. “Our focus on digital has become even more important in this context.”

On the topic of technology upgrades, European hotels ranked their progress as lagging behind that of their hospitality colleagues globally, suggesting an opportunity to further accelerate future adoption of technology in the region.

Seventy one percent of European executives said the pandemic accelerated their adoption of hotel technology — five percentage points lower than respondents globally (Asia-Pacific and Latin America, by contrast, showed very high appetite for updating systems).

Interestingly, this trend was very much in keeping with European consumer attitudes — European travelers seemed far less enthused about contactless, self-service, or messaging technology as part of their stay, as compared to their global peers.

However, as other regions invest more in new technologies — and show their capabilities around efficiency — there’s good reason to believe that European providers, and consumer demand, will follow suit.

For example, though slower to embrace, European executive attitudes around cloud-based computing solutions appears to be shifting — while only 68 percent reported shifting towards cloud-based technology in the past year (8 percentage points lower than the global average), these executives also reported that they were exploring cloud-based options for the future (70 percent, next to 72 percent globally).

Rethinking Operations

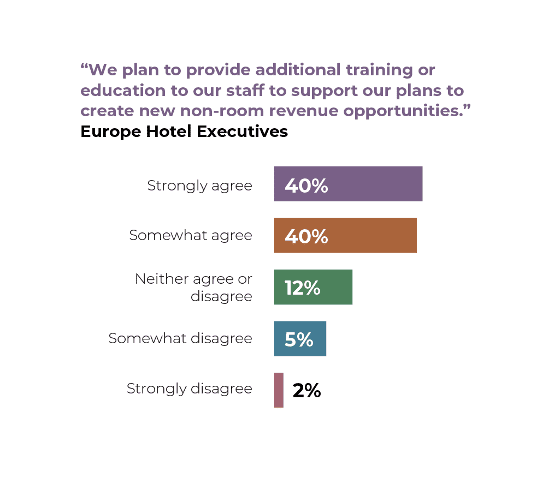

The previous sections describe hotel strategies for boosting revenue, repositioning against short-term rentals, and investing in technology. But for hotels to implement these strategies, they will also need to take a closer look at how to run their properties more efficiently and profitably.

That’s why many hotels used 2020 and the early months of 2021 to focus on streamlining their business operations to prepare for recovery.

Overall, European hotels seemed enthusiastic about overhauling operational platforms and procedures. Eighty percent of the executives said that they planned to provide additional training or education to staff to support plans to create new non-room revenue, a trend in line with the global norm.

“We've equipped our hotel staff with operational technologies,” said Daniel. “And also that they can operate more contactless. So there's also that aspect, but there's also efficiency as a driver. So we've used this time to introduce new distribution tools. We've used this to introduce new housekeeping tools and new employee communication platforms.”

While other regions reported a focus on attracting new types of guests, this appeared to be less of a priority for European hotels, with only 48 percent of executives focusing on new business: six percentage points lower than their global peers.

Again, depending on how member states’ border policies within the EU align and transform over the summer months, the recovery overall will likely remain in flux, as travelers internally, and potentially overseas, seek more green lights to proceed with travel plans.

To learn more about how hotels are evolving their recovery strategies in 2021 and beyond, make sure to download the full Skift and Oracle report.

This content was created collaboratively by Oracle Hospitality and Skift’s branded content studio SkiftX.