Google Flights Gets Aggressive by Intercepting Airline Trademarks

Skift Take

Google has been getting increasingly aggressive with its Google Flights product over the last year. If you talk to Google’s competitors, they’ll tell you that Google Flights, without fanfare, is taking assertive steps and is indeed making market share gains at the expense of competitors.

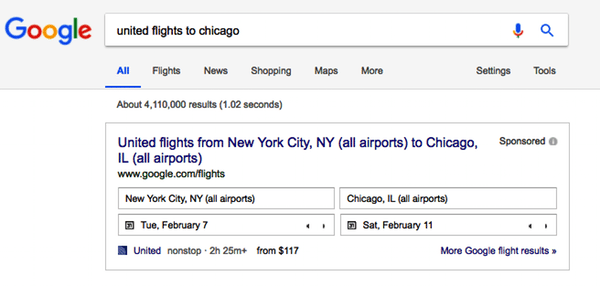

One such move is intercepting consumer searches on Google for a specific airline like “united flights to chicago” and displaying a Google Flights result at the top — or near the top — of the page instead of delivering a direct, free link to United.com or an online travel agency selling United tickets. So Google is transforming a search for a trademarked term like an airline’s name and turning it into money for Google.

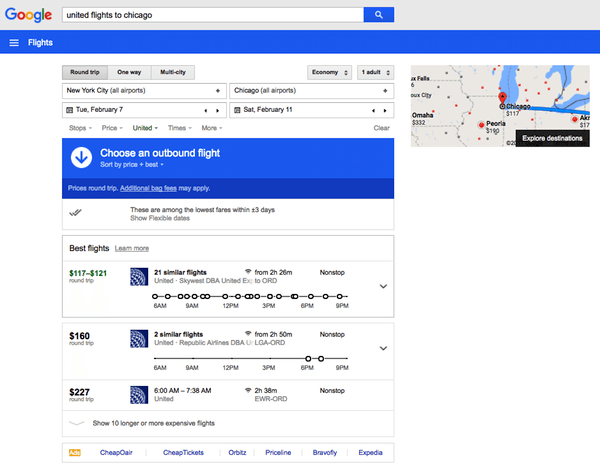

Google Flights knows the consumer’s location and closest airports, fills in dates, and presents a United nonstop fare “from $117.” When the consumer selects “More Google flight results,” the consumer navigates to Google Flights and sees a curated list of United flights, including some under the heading “Best flights.” These consider the tradeoff between “price, duration, number of stops, and sometimes other factors such as amenities and baggage fees,” Google states.

“By redirecting a branded search term to a Google-owned property, Google creates a more refined search result (a set of specific flights on specific dates) before handing the consumer over to the airline,” says Brian Clark, a partner at travel and hospitality consultancy Hudson Crossing. “Google is doing this in a bid to make more money on the more specific referral (a flight search result) which is worth more than a generic branded referral.”

These scenarios take place when a consumer search includes an airline name or both a city or airport and an airline name. Google began doing this sometime in 2015, and the thinking was that travelers searching for an airline name are more likely than others to be ready to buy a ticket. By displaying the Google Flights result from a specific airline, Google is delivering relevant results and the right moment and can potentially connect airlines with customers searching for relevant routes.

Asked about these practices, a Google spokesperson says: “We launched this experience over a year ago in order to help travelers who were comparison shopping for flights online. Through research, we saw that many people used branded airline queries multiple times — in multiple browsers and across multiple different tabs — in order to find the best flight deal. We created this experience to make this process less cumbersome for travelers, allowing them to see all of their options across different airlines at a glance.”

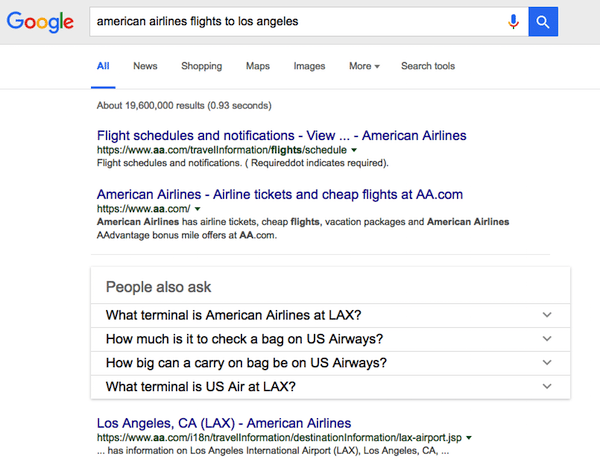

American Airlines Isn’t Playing

There is at least one notable exception to Google’s flight-search practices regarding searches for branded airline terms. A Google search for American Airlines flights does not generate a Google Flights search result but shows direct, organic links to AA.com.

American Airlines has long been extremely protective of its intellectual property and has issued scores of cease and desist letters and filed several lawsuits against metasearch and mileage-tracking sites that have use American Airlines’ trademarks without permission.

“Our flight results are in Google Flights; they just don’t automatically appear during a Web search on Google.com,” an American Airlines spokesperson says. “Other than that, I’m not going to be able to talk about it in any detail.”

Google’s practice of marketing Google Flights on Google to the detriment of competitors is a tad more aggressive than it is doing with its hotel product, Google Hotel Ads. When a consumer searches for “marriott hotels,” for example, the first result in the primary, left-hand column on desktop is an organic, unpaid Marriott.com result. The Google Hotel Ads unit is the second result. The right-hand column has a profile of Marriott International with contact information and links.

Google Flights is Different from Hotel Ads

So Google’s Hotel Ads unit usually appears as the second or third result in Google search. That’s a step less aggressive than Google’s treatment of flight searches, where there is usually no organic, or natural, result above the Google Flights widget.

“Google continues to take slow, deliberate steps to capture more and more traffic flow in travel,” Clark says. “They are keeping the frogs in the pot (airlines and hotels) and raising the temperature step by step.

“And so, what does it mean for the airlines? Their Google budgets just went up. The only escape route for the frogs is to ramp up their direct booking initiatives. We are getting an increasing number of inquiries from suppliers on how to design or improve loyalty programs and other direct-buying initiatives.”

Google and its airline partners aren’t saying how Google gets compensated from airlines in Google Flights. But we believe some airlines may pay varying rates for referrals, some don’t pay at all. Some may pay for leads on specific routes but avoid paying when the flight originates at one of their hubs because the carriers don’t believe they need much help from third-party distributors at these airports.

But when Google can take a branded search for an airline, refer consumers to a curated list of flights for that airline, and then deliver a more qualified lead when handing the customer off to the airline site, Google’s bill to paying airlines undoubtedly increases.

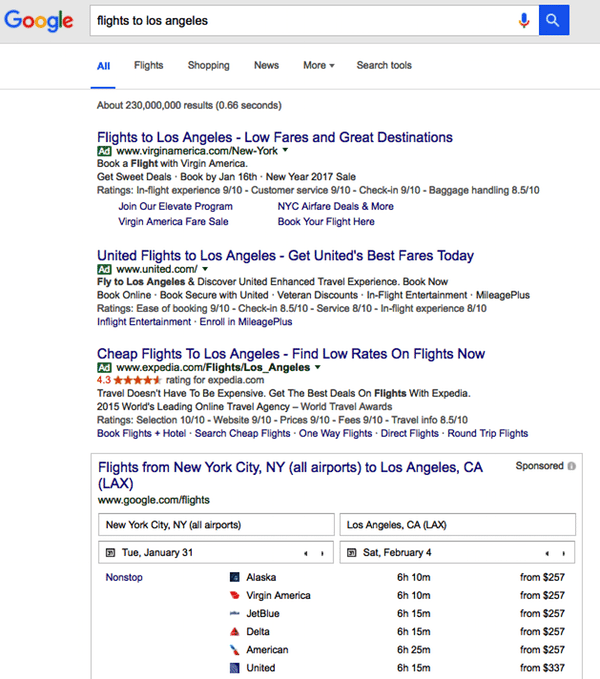

For example, the search results for the United flight above likely have a lot more chance of leading to a booking than the generic search query below for “flights to Los Angeles.” The latter search generates three paid ads and then links in the Google Flights box from a half dozen airlines all competing for the booking.

Nicholas Ward, co-founder and president of Koddi, a bid automation platform, agrees that the Google Flights results tied to searches for specific airlines lead to an enhanced return for the carriers.

“The potential benefit to the airline is less leakage in the research process, which likely comes at a higher per user cost,” Ward says. “Overall I doubt they’d participate if that cost wasn’t balanced by higher transactional efficiency.

“For the airlines it’s a shift in distribution from a text ad acquisition experience to a more dynamic one. I don’t believe Google is primarily showing this unit to push their product, but more because it’s a more efficient user and brand interaction and it takes some friction out of the experience.”

Ward acknowledges that Google Flights’ moves are going to hurt online travel agencies like Expedia or metasearch engines like Kayak. Google Flights gives primacy to airline websites, and only includes online travel agency advertisers — usually — at the bottom of the page.

“For online travel agencies and flight metas, this may create a little more pressure on their acquisition campaigns as it’s certainly more engaging than text, and they are notably absent,” Ward says.

Fragile Truce Between Airlines and Google

Al Lenza, a travel industry advisor who formerly headed distribution at Northwest Airlines, sees Google’s latest moves in context.

“No doubt Google is getting more aggressive in many fronts,” Lenza says. “They are also intercepting airline.com Gmail trip summaries and auto-populating calendars and using data for ads etc. The big airlines are getting mostly referrals to their sites for booking so I believe there is a fragile truce. We will see how it plays out.”

In other words, most airlines — with the exception of American Airlines — may be going along with Google’s move to divert consumer searches from their brands. But they’ll have to figure out if the loss of control and return on investment are all worth it.