OpenAI's Travel Tool, TripAdvisor’s Machinations and American Air’s Earnings

Skift Take

Skift Daily Briefing Podcast

Listen to the day’s top travel stories in under four minutes every weekday.Good morning from Skift. It’s Friday, January 24 and here’s what you need to know about the business of travel today

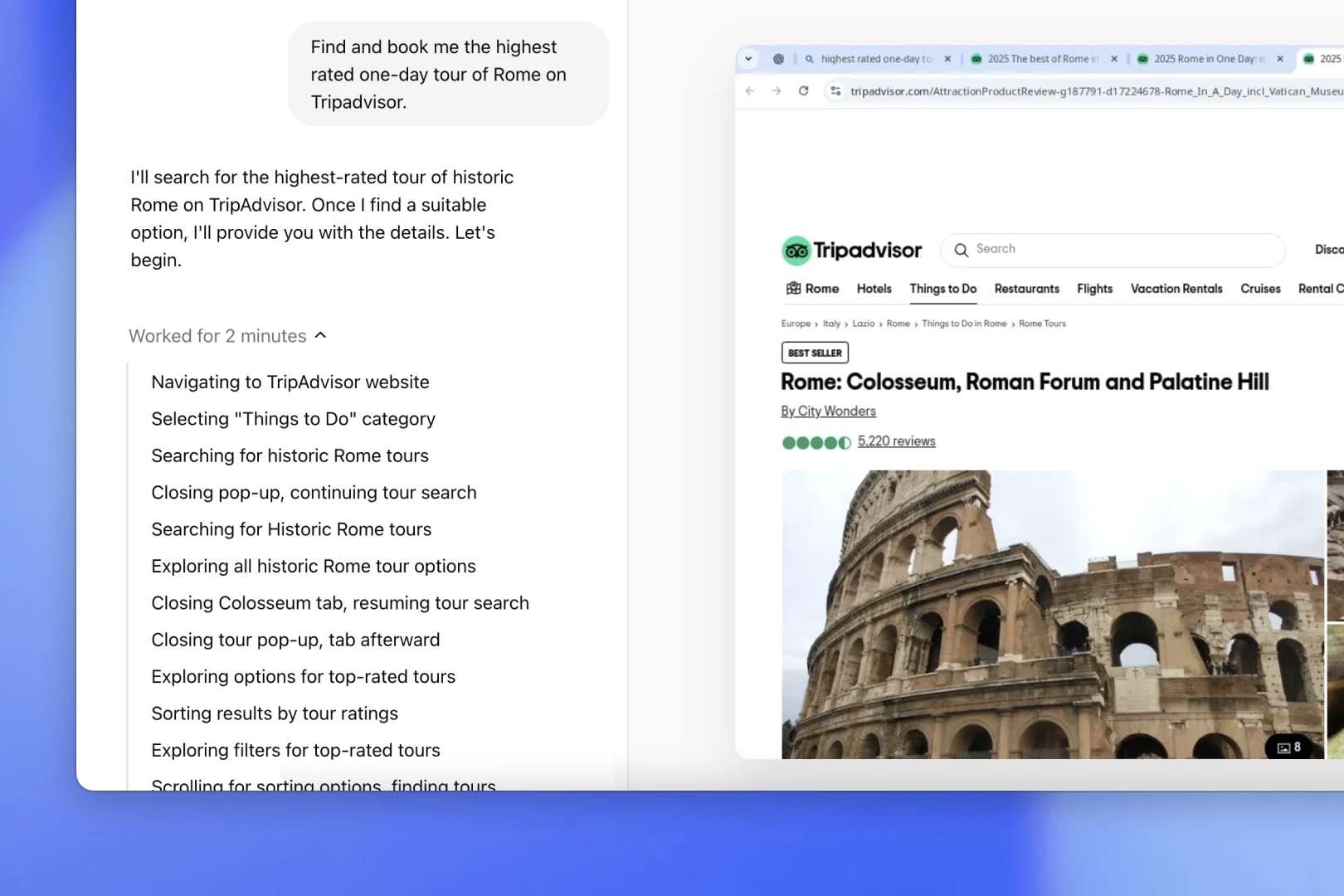

OpenAI said on Thursday it’s releasing a digital assistant that can complete online searches and purchases for travel, events and restaurants on its own, writes Travel Technology Reporter Justin Dawes. Dawes reports the new tool, called Operator, is a type of digital assistant that travel leaders have been envisioning since ChatGPT was first released. Travel executives have worried that tools like Operator could displace intermediaries and online travel agencies like Booking.com and Expedia.

OpenAI says it has partnered with a number of third-party companies to make sure Operator can access data from those websites, including travel brands Booking.com, Tripadvisor, and Priceline.

Listen to This Podcast

🎧 Subscribe

Apple Podcasts | Spotify | Youtube | RSS

Next up, Tripadvisor has been exploring strategic alternatives, engaging with 19 potential buyers and receiving six non-binding preliminary bids from both strategic parties and financial sponsors, reports Executive Editor Dennis Schaal. The most recent bid, submitted just last week, proposed acquiring all outstanding Tripadvisor shares not owned by Liberty Tripadvisor for $18 to $19 per share.

However, Tripadvisor's special committee determined that this offer was not in its best interests. In December 2024, Tripadvisor announced plans to acquire its parent company, Liberty Tripadvisor, for $435 million, aiming to simplify its complex capital structure and potentially facilitate future deals. This acquisition is expected to close by June 2025, marking a significant shift in the company's governance and strategic direction.

In the airline sector, American Airlines is facing financial challenges, reports Meghna Maharishi. The company reported record revenues of $13.66 billion and a profit of $590 million for the fourth quarter. However, it projects a loss for the first quarter of 2025, attributing this outlook to rising costs driven by reduced capacity, increased regional jet operations, and expensive labor contracts.

This contrasts with competitors Delta and United, both of which anticipate record first quarters. Additionally, American is recovering from a previous direct ticket sales strategy that strained relationships with travel agencies and impacted corporate revenues. On a positive note, the airline has secured a new credit card agreement with Citi, expected to provide substantial financial benefits moving forward.