Germany's Shrinking Airline Market

Skift Take

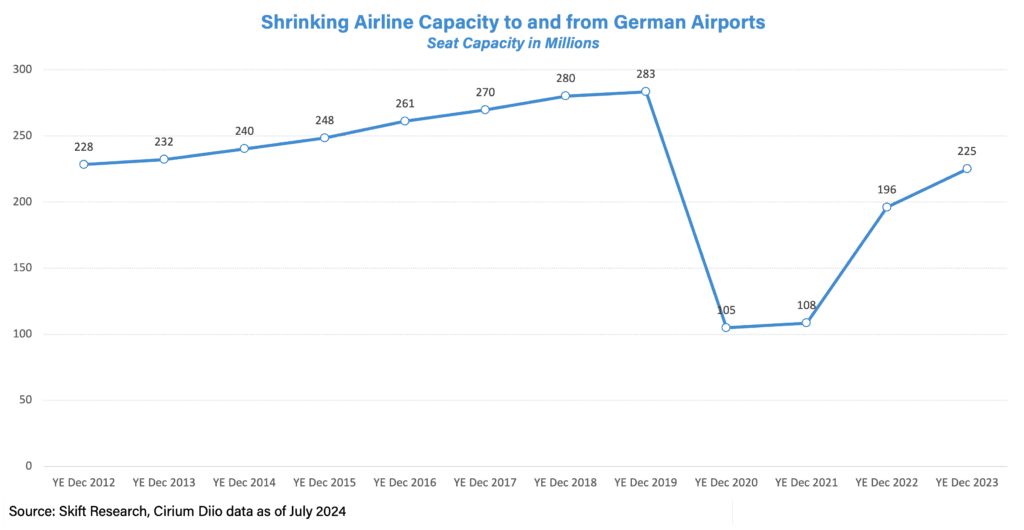

Germany has the world's third-largest economy but in terms of airline capacity, it's far from a major power. Total capacity was actually lower in 2023 than it was a decade earlier.

Here are the numbers: In 2023, the total airline capacity to and from Germany was 225 million seats, down from 232 million seats in 2012.

The German airline market was impacted by several factors:

Russia’s invasion of Ukraine and sanctions that followed was one hit. Russia accounted for just 2.2% of Germany's total outbound capacity and Ukraine was even less at 1%. But that still accounted for almost 23,000 flights in 2019, and almost 4 million airline seats.

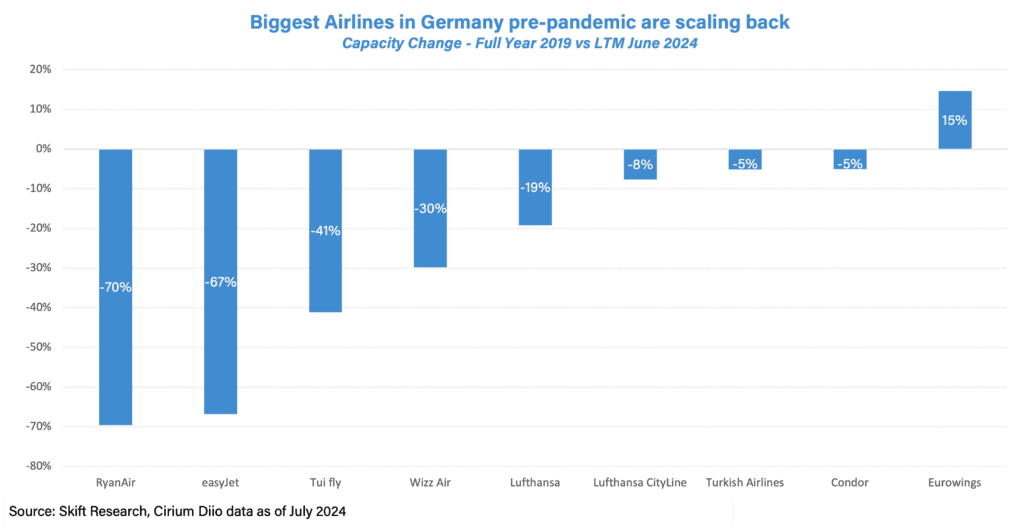

A bigger issue: Many carriers pulled out of the German market because of higher airport fees and taxes. Two of the biggest LCCs in Europe, RyanAir and EasyJet, have reduced their capacity by 70% and 67%, respectively, from Germany. Wizz Air, another giant LCC in Eastern Europe, has reduced capacity by 30%.

”German aviation taxes/charges are amongst the highest in Europe,” said Michael O’Leary, CEO at RyanAir, in an interview in early 2024.

The volume of passenger traffic at Frankfurt Airport in 2023 stood at 59 million, reflecting a 16% reduction from the peak of 70 million recorded in 2019. The total number of aircraft movements in 2023 also declined by 16%.

Germany may face challenges due to its historical reliance on corporate travel, which has been slow to recover from the pandemic. “Corporate travel in Q1 2024 was around 65% of pre-COVID level," according to Remco Steenbergen, CFO at Lufthansa.

All these factors have combined to cause a significant contraction in the German airline industry. Lufthansa Group data shows that passenger volume was down 13% in the first half of this year compared to the first half of 2019.

In the first half of 2024, Lufthansa Group's total revenue fell just short of its first-half 2019 figures by 1%. Although this may not seem significant on its own, it pales in comparison to the performance of its counterparts in North America, the Middle East, and the Asia Pacific, all of which have made substantial strides in surpassing their pre-Covid revenues in 2023.

In its second-quarter earning call, Lufthansa Group stated that it was still at 92% capacity compared to 2019 and recognized that "many of our competitors have already surpassed pre-crisis levels." It also recognized that "disproportionately high location costs in Germany, in Frankfurt and Munich particularly," have had a negative impact on earnings.