Skift Travel Health Index Shows Softening Trend

Skift Take

Skift Research's latest reading on the Skift Travel Health Index reveals a softening trend in global travel. This is due to the seasonality of demand: Our index dropped 4 percentage points to 105 in March 2024, which mirrors a slowdown we saw this time last year.

Regional performance slowed this month across all regions, matching the decline in March 2023. Asia Pacific continues to trend 12% above 2023 levels. All other regions below the 100 mark indicate that travel performance in March 2024 was below levels seen in March 2023.

Skift Travel Health Index Score by Region

| Region | 23-Feb | 23-Mar | Feb-Mar 23 | 24-Feb | 24-Mar | Feb-Mar 24 | |

|---|---|---|---|---|---|---|---|

| Asia Pacific | 165 | 163 | -2 | 114 | 112 | -2 | |

| Europe | 124 | 120 | -4 | 106 | 98 | -8 | |

| Latin America | 118 | 116 | -2 | 101 | 97 | -4 | |

| Middle East and Africa | 122 | 111 | -11 | 99 | 92 | -7 | |

| North America | 110 | 101 | -9 | 103 | 99 | -4 | |

| Global Average | 141 | 137 | -4 | 109 | 105 | -4 |

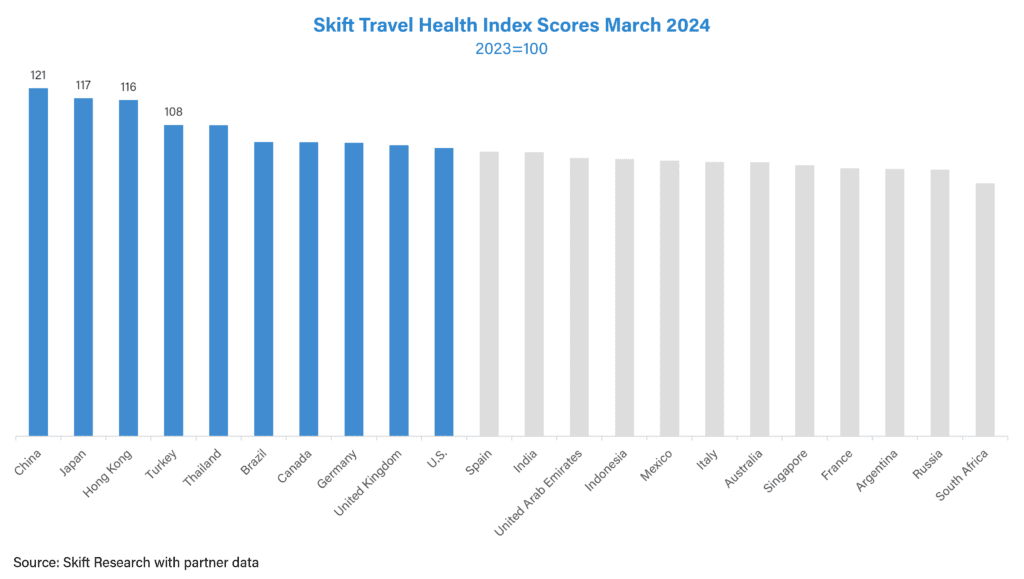

The Skift Travel Health Index in March 2024 witnessed 9 countries exhibiting growth over 2023 levels. China remains at the forefront, growing 21% year-on-year. Japan's double-digit growth during the Cherry Blossom season highlights the country's appeal to travelers, especially after many years of growing pent-up demand. A weakened currency and demand for luxurious experiences are fueling travel in Turkey.

Last year presented a mixed bag, with some countries experiencing a notable travel boom while others were still on a slow path to recovery. As a result, some countries are still witnessing double-digit, year-on-year growth numbers.

Read the March 2024 Highlights and the Travel Health Index dashboard for further insights.