Skift Take

Smaller independent hotels in Europe, lacking the marketing budgets and tech capabilities of branded counterparts in the U.S., are more inclined to rely on online travel agencies for distribution rather than their own sites.

In Part I of our series on Google Travel, we analyzed the hotel distribution landscape in the U.S. by web-scraping over 5,000 hotels and their respective distribution offerings across Google’s sponsored and organic auctions.

In Part II of our series, we repeat our efforts across the European hotel market. We looked at 40 European cities and again web-scraped over 5,000 hotels to compare the distribution landscape in Europe versus the U.S.

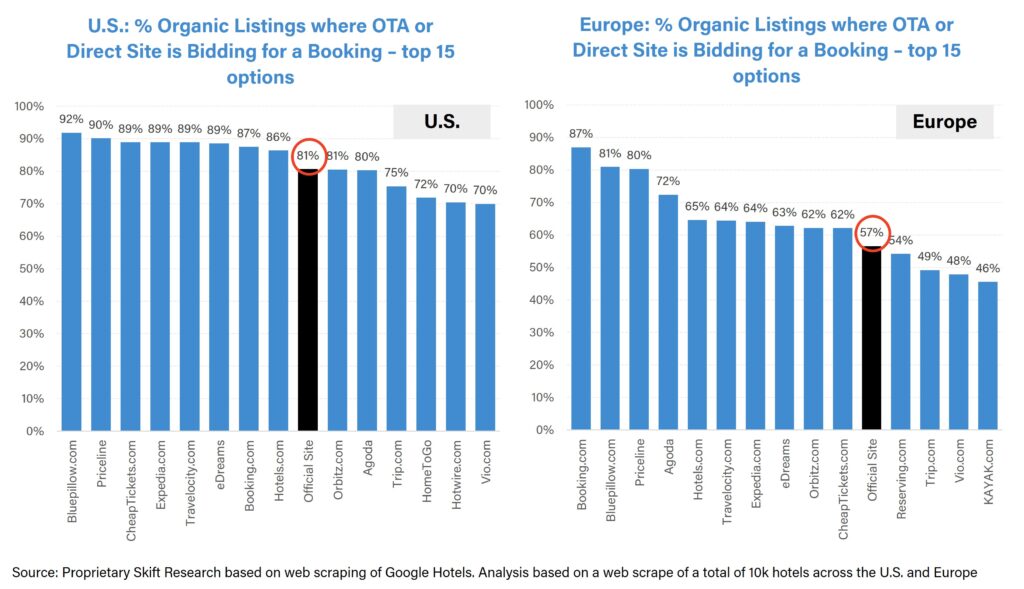

One of the key conclusions from our analysis: Direct sites compete head-on with online travel agencies (OTAs) more often in the U.S. than in Europe.

Though both markets are fairly mature with similar levels of online penetration, Europe’s hotel industry differs from the U.S. in three key ways:

- Its underlying hotel supply is far less branded than the U.S. and instead skews more towards independent hotels.

- Its OTA market is more fragmented with a longer tail of small OTAs competing directly with the likes of Booking and Expedia.

- There are stricter rules prohibiting price parity clauses in Europe than there are in the U.S.

Independent hotels – which make up the larger share of hotel rooms in Europe – are more likely to source their distribution from the OTAs vs. their direct site, usually lacking the marketing budgets, tech capabilities, and large loyalty programs of the branded hotels that are necessary to obtain direct bookings.

Even though Google’s introduction of organic listings now makes it free – and easier – for smaller independent hotels to list alongside the major brands and OTAs, there are still tech barriers in place, such as needing a connectivity partner to display real-time rates and availability.

Therefore the direct site is less likely to feature in Europe – which skews more towards independent hotels – than the more branded U.S. market.

Read the full report for more comparitive analysis of the hotel distribution landscapes of the U.S. and Europe, presented in 20 impactful and digestible charts.

What You’ll Learn From This Report

- Unique and proprietary analysis based on web scraping of over 10,000 U.S. and European hotels across Google

- Understand which OTAs are bidding for bookings on Google’s sponsored and organic results in the U.S. vs Europe

- Understand whether Google Hotels is aiding the shift to direct in Europe, as we saw in the U.S.

- Evaluating the adherence of price parity rules in Europe vs U.S.

- A framing of key conclusions by comparing the hotel distribution landscape between the U.S. and Europe – considering the mix of branded vs independent room supply in each region, the market share of OTAs vs direct site and the share of Booking and Expedia vs a long tail of smaller OTAs.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report à la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: booking, direct bookings, europe, expedia, google, hotel distribution, online travel newsletter, skift research

Photo credit: A hotel in Oia, Greece.