Choice-Wyndham Faces Long Odds. The Skift Travel 200 May Reveal Choice’s Thinking

Skift Take

Choice Hotels dropped a bombshell earlier this week when it went public with a hostile takeover bid for Wyndham Hotels & Resorts. Clearly Choice likes the deal while Wyndham thinks it can do better on its own (or with someone else).

What does the market think? We can assess the current consensus with some back-of-the-envelope math and by using the Skift Travel 200 stock index.

What Are the Odds Choice-Wyndham Will Happen?

Even when both sides are gung-ho to get a deal done, large mergers are rarely a slam dunk. There are pesky issues of regulatory and shareholder approval that can kill them. Add in a hostile management team and a Choice-Wyndham deal looks like an uphill battle.

Skift Research calculates that the stock market assigns Choice a 20% to 30% probability of success with its current offer, based on current stock and option prices.

While Wyndham's stock shot up this week, it still sits far below the fair value price of the Choice offer. As of October 20th, Choice's terms are worth around $86, but Wyndham shares trade near $74.

Given that wide gap, the wisdom of the crowd is telling us that a) this deal is likely to fail or b) that Choice will need to sweeten its offer.

Why Would Choice Make This Choice?

Why would Choice choose to pursue a difficult merger that faces large obstacles? It lays out several reasons in its pitch to Wyndham investors, primarily around scale advantages.

Skift Research Senior Analyst Pranavi Agarwal has built a case for the midscale hotel market segment in Battle of the Midscales: Wyndham vs Choice in 20 Charts.

Agarwal writes: “Opportunities for growth in the U.S. lie in the midscale and economy segments, where Wyndham and Choice are current market leaders but face competition from Hilton, Marriott and IHG as they look to expand into the space.”

Stock market performance might also be a reason. The Skift Travel 200, brings together the diverse travel industry into a single stock index. It also allows us to track the performance of travel sectors and sub-sectors and it helps us guess what Choice’s management team is thinking.

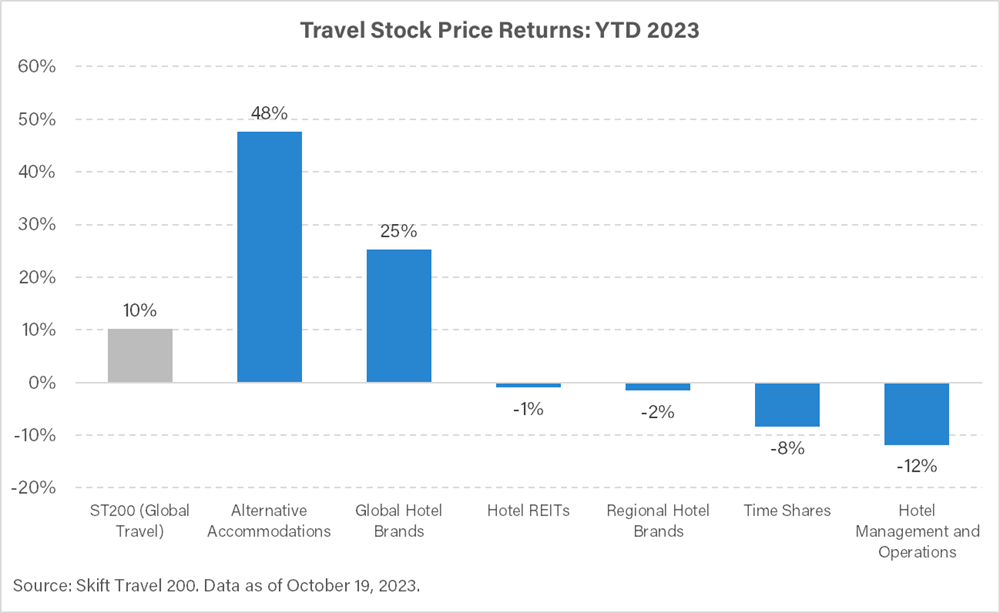

Skift Research divides accommodation stocks into six sub-sectors. Looking at returns this year reveals a dramatic dispersion in returns across sub-sectors. Management companies and time shares have declined by 12% and 8% respectively. On the other side of the spectrum, alternative accommodations have soared 48%.

Global hotel brands have also done well, returning more than twice that of the broad travel sector measured in the ST200. This sub-sector, which includes Marriott, Hilton, Hyatt, and others, is up 25% this year.

Tale of the Hotel Tape

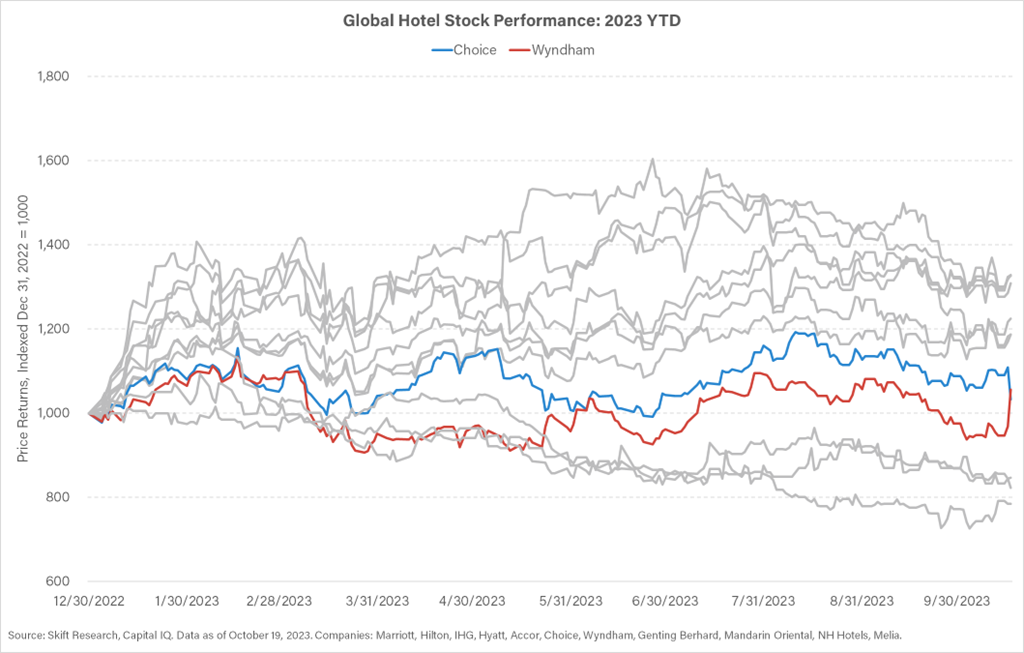

Against this backdrop, Choice and Wyndham both stand out as laggards. Over the past 10 months, they have been some of the worst-performing stocks in the global hotel sector. Marriott, IHG, and Accor and other large names have been the primary drivers of performance.

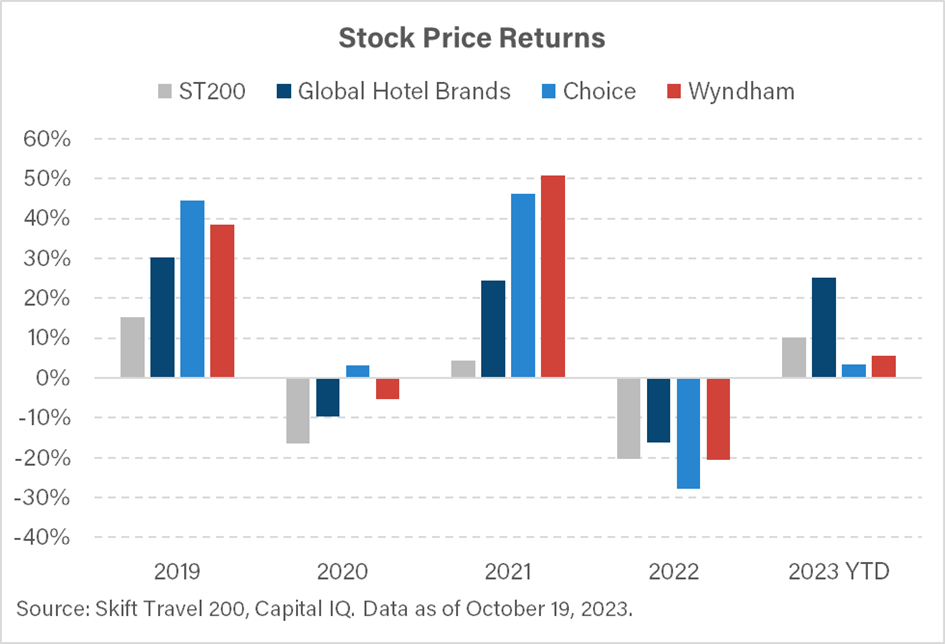

It wasn’t always this way. Midscale brands like Choice and Wyndham outperformed both broad travel stocks and global hotel brands from 2019 to 2022. It’s only this year that the trend has reversed.

Why the change in fortune for Choice and Wyndham? It could just be a simple reversion to the mean. After years of strong returns, it’s only natural for a stock to take a breather. But investors may also have taken notice of increased competition in the economy and midscale hotel market. Marriott, Hilton, and IHG have all launched new brands this year aimed squarely at Choice and Wyndham’s core market.

Choice management no doubt has many reasons behind pursuing a hostile takeover of Wyndham. There’s never just one reason behind this complex of a deal but stock prices likely were top of mind.