Skift Take

Betting against China's torrid economic growth has been a fool's errand for decades. But nothing lasts forever. Foreign hotel executives shouldn't make blind assumptions about endless hotel development opportunities in the country.

U.S. hotel companies saw China’s economic rise as an engine to drive hotel development. But China’s economic turmoil may upset their plans.

U.S. hotel companies continue to have high hopes for China.

- Hilton said last week it plans to open 730 hotels in China over the next decade.

- Hyatt said this month that about 40% of its global hotel development pipeline is in China.

- Marriott has 369 projects with 95,665 rooms in China, according to a Lodging Econometrics count this week.

Skift Research Senior Analyst Pranavi Agarwal weighs in:

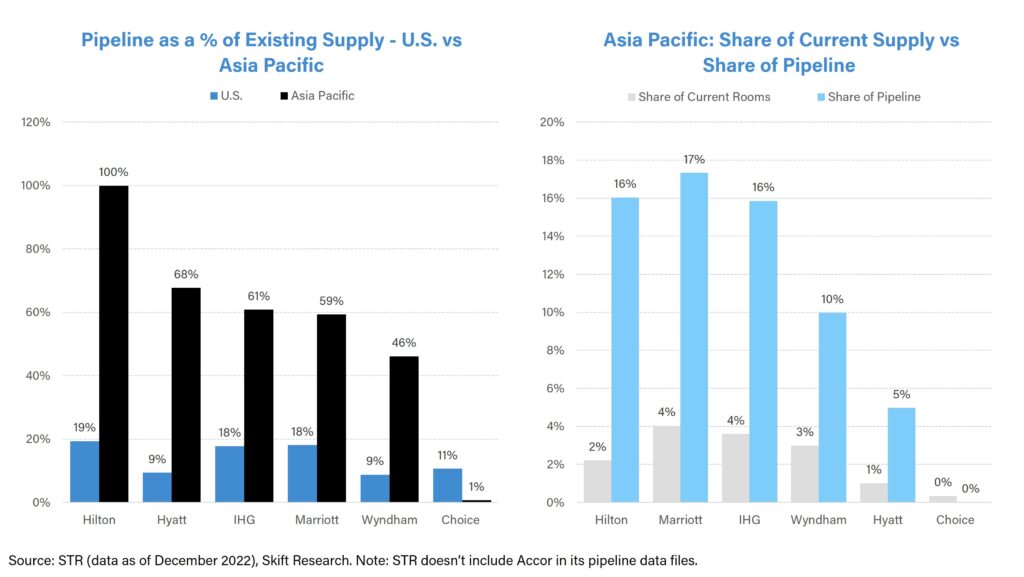

“The chart on the left above shows that the major U.S.-focused hotel groups are expanding much quicker in Asia Pacific than in the U.S.. Their pipelines as a percentage of total supply in the U.S. is around 10-20%, while across Asia Pacific this metric climbs to 50-100%. The chart on the right shows that though the major brands only have a 2-5% share of existing supply, their share of the future pipeline is considerably higher, at 10-20%.”

The New Risks

Yet China’s current economic woes throw a wrench into these growth plans. Some key points:

- Hotel development relies on local financing and real-estate construction, but the property sector sits at the heart of the current Chinese financial crisis.

- Yes, hotels may be a rare profitable business. However, problems elsewhere may overwhelm the ability of conglomerates and state banks to approve and support hotel development as rapidly as before.

- China has managed through economic crises before. But current leadership has fewer options and there’s risk that politics could override economics.

- For example, Cai Fang, a top official at China’s central bank, has called for $550 billion of helicopter money. The idea is to cheer up frightened households and help get consumer spending started. But that plan clashes with other officials’ wish to cool down the country’s economy.

China’s woes may be more than a blip. And that could curb hotel pipeline expansion.

- “China’s biggest growth challenge is that its working-age population is shrinking,” wrote Tom Orlik, chief economist for Bloomberg Economics.

- The country’s population fell last year, which wasn’t expected to happen until at least 2029.

- An aging population will create multi-year problems economically.

- “The old downside scenario has now become the base case — with expectations that by 2030 annual [economic] growth will have slowed to around 3.5%,” Bloomberg’s Orlick wrote this week.

- For context, that means China may not overtake the U.S. economy for another generation.

A Case for Optimism

The country may pull through this crisis, with side effects that support booming hotel development.

- “While local competitors tend to skew to the economy and midscale segments, international brands such as Hilton, Marriott, IHG, Hyatt, and Accor play more in the midscale and higher chain scales — meaning clear runways for growth in an under-penetrated part of the market,” said Pranavi Agarwal of Skift Research.

- Overall hotel development squeaked out a slight year-over-year rise in the second quarter — after two quarters of year-over-year declines, according to Lodging Econometrics.

- Hyatt said that the revenue per available room at its hotels in Greater China surpassed pre-pandemic levels for the first time in the second quarter, up 6% year-over-year. That was true despite the full return of foreign visitors.

- Domestic flights are at about 15% above 2019 levels (though airlines are still on a path to recovery).

- Some parts of China’s economy are roaring.

- Sales of electric vehicles are boosted by tax breaks for car buyers, and lots of money is being thrown at the development of green power and batteries. Investments in technologies like high-speed rail are also keeping things humming.

- “China has more middle- and high-income consumers than other emerging markets in the world, and the number is expected to increase sharply by 2030,” according to Bain’s 2022 China Luxury Report.

- Hotel executives have good reason to find China enticing. Its single market offers efficiencies. There’s essentially (to simplify) one language, one currency, and one legal and regulatory system.

- If you can build a successful practice there, you have the potential to scale up to hundreds of hotels quickly. That presents fewer hurdles, in theory, than an effort to grow across the rest of the world’s dozens of smaller countries.

The Nightmare Scenario

U.S. hotel execs tend to dismiss the threat China may develop a growing anti-U.S. bias. They think that hotel brands are non-political.

Yet there’s at least a small risk things might not go well for U.S. brands in China later this decade.

- If China struggles to deliver on economic stability, its leadership may be more inclined to be aggressive toward Taiwan.

- That, in turn, might lead to populist Chinese animosity against U.S. brands, including hotel brands, if the U.S. comes to Taiwan’s side.

- There are plenty of other options for Chinese investors, developers, and guests to favor, such as France-based Accor and UK-based IHG, and homegrown Chinese groups like Jin Jiang.

The lesson some U.S. hotel executives have drawn from rare out-of-the-blue calamities such as the pandemic, 9/11, and the 2008 financial crisis is that hotel demand tends to revert back to long-term growth — and supply tends to struggle to keep up. So many feel good about their bullish China projections.

Yet there does appear to be more of a risk to U.S. hotel development plans in China now than there was in the past.

Daily Lodging Report

Essential industry news for hospitality and lodging executives in North America and Asia-Pacific. Delivered daily to your inbox.

Have a confidential tip for Skift? Get in touch

Tags: china, choice hotels, future of lodging, hilton, hotel development, hyatt, marriott