TUI Returns to Profit, Eyes Shifts From Extreme Weather

Skift Take

Tour Operator Group TUI has returned to profitability, posting its first post-pandemic net profit. However, its overall performance for the year is expected to be dampened by the impact of the extreme weather and wildfire disruptions experienced in Europe towards the end of the third quarter.

Travel demand in the three months to the end of June, had pushed TUI booking performance to a 6% gain, TUI Group CEO Sebastian Ebel said Wednesday on a conference call.

And while the company had seen a slip in bookings following recent wildfires in Greece’s Rhodes Island, Ebel stated that it had “already stabilized.” An estimated 8,000 TUI customers were impacted and the expected cost of the emergency operations is an estimated $27 million (25 million euros) for the full-year.

Ebel tried to dispel concerns that summer travel faced a climate-change problem, but laid out ways the industry and TUI could be impacted.

- The upcoming season is expected to be extended, potentially lasting until the end of the year due to strong bookings in the autumn months.

- Destinations with moderate climates, such as Cape Verde, the Canary Islands, and Portugal, will likely grow in popularity.

- There will be a focus on expanding to new destinations, including the Nordic countries, Belgium, Holland, and Poland, offering more opportunities for growth and not posing a threat to the Mediterranean business.

- TUI would continue to demonstrate flexibility in its holiday packages, allowing for cancelations and refunds and would also look to include an insurance product. The company was criticized for not allowing immediate cancellations during the wildfire crisis.

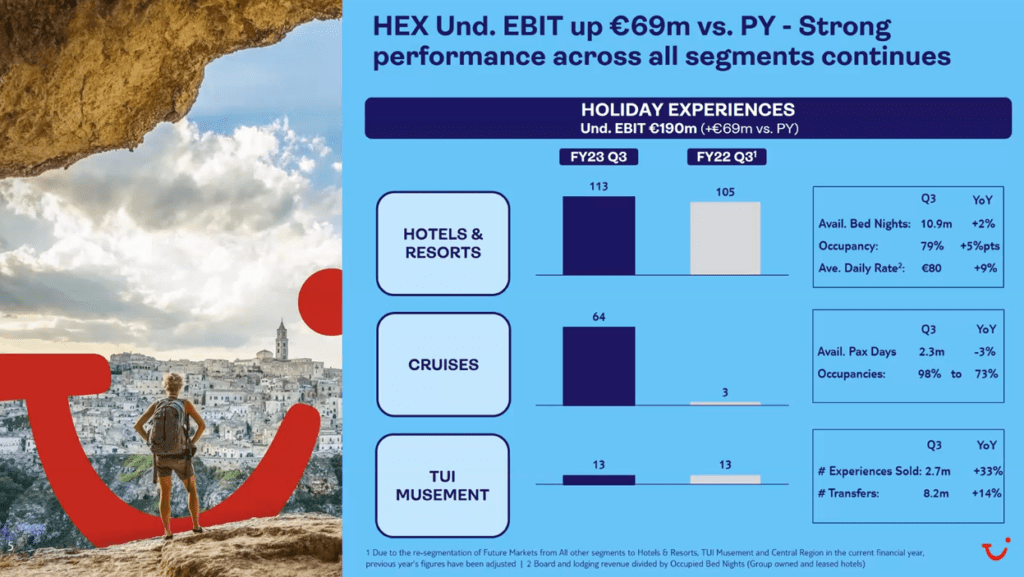

TUI reported significant improvements across various sectors, especially cruises, with TUI branded hotels growth a key focus going forward.

TUI Musement continued to see high growth, with a third more sales. The group will continue to invest in its own tours and activities branded offerings, according to Ebel.

Ebel noted that there has been a “doubling in the number of bookings” made via its App and has set a target of 50% of bookings to be made via its App in the next three years. The company did not expect this to come from retail, but instead wanted to concentrate on repeat customers and reduce reliance and what it considered the high costs of new customers via Google. It is also piloting a chatbot in its TUI app, available only in the UK for now.

Cruises

- Its cruises sector continued recovery, recording its fifth positive quarter since the start of the pandemic.

- Fleets for TUI Cruises, Hapag-Lloyd Cruises and Marella Cruises have seen improved occupancy, for the period from April to June improved to 95% (previous year: 69%).

- Underlying earnings before interest and taxes by the cruises sector climbed significantly to $70 million (64 million euros) from the previous year: $3.2 million (3 million euros).

Hotels

- TUI’s portfolio investment through its Hotel Fund has made its first acquisition in Zanzibar, with another planned in Cape Verde.

- Hotels & Resorts reported underlying earnings before interest and taxes of $124 million (113 million euros), up year-on-year $115 million (105 million euros) and above pre-crisis levels for the fifth consecutive quarter.

- The average daily rate increased by 9% year-on-year to $88 (80 euros), while occupancy improved by 5 percentage points to 79%.

TUI Musement

- Tours and activities saw 2.7 million excursions, tours and activities sold – one third more than in the same period of the previous year.

- The number of transfers rose by 14% to 8.2 million.

- TUI Musement’s underlying earnings before interest and taxes was $14 million (13 million euros).

TUI’s underlying earnings before interest and tax at $185.46 million (169 million euros) for the three months to June 30, the third quarter of its financial year, up from a loss of 27 million in the same quarter last year. The tour group reported revenue of $5.8 billion (5.3 billion euros) in revenue was up 19% from Q3 2022, and a reduced net debt by $1.2 billion (1.1 billion euros) to $2.4 billion (2.2 billion euros).