Skift Take

What's keeping hotel executives up at night these days? For some, it's looming reporting requirements for sustainability.

Early Check-In

Editor’s Note: Skift Senior Hospitality Editor Sean O’Neill brings readers exclusive reporting and insights into hotel deals and development, and how those trends are making an impact across the travel industry.

What’s worrying hotel executives these days? Jeanelle Johnson is one of the people well-placed to know. She’s a principal at PwC, one of the “Big Four” accounting firms and consultancies. She’s PwC’s lead contact with the hotel sector’s topmost execs.

Johnson’s answer? Execs are worried about environmental reporting, which is becoming increasingly complex.

- In a chat near her Washington, D.C., office, Johnson recently told me that European Union regulators are looking to require companies that operate in their countries to make more sustainability-related disclosures under the Corporate Sustainability Reporting Directive, or CSRD, enacted in January.

- For the hotel sector, the new requirements mean that companies doing business in Europe will likely have to generate reports about the impact of their businesses on the environment.

- Large companies may have to publish the reports starting as soon as 2025.

The problem for hotel companies is that environmental reporting requirements are getting more complex.

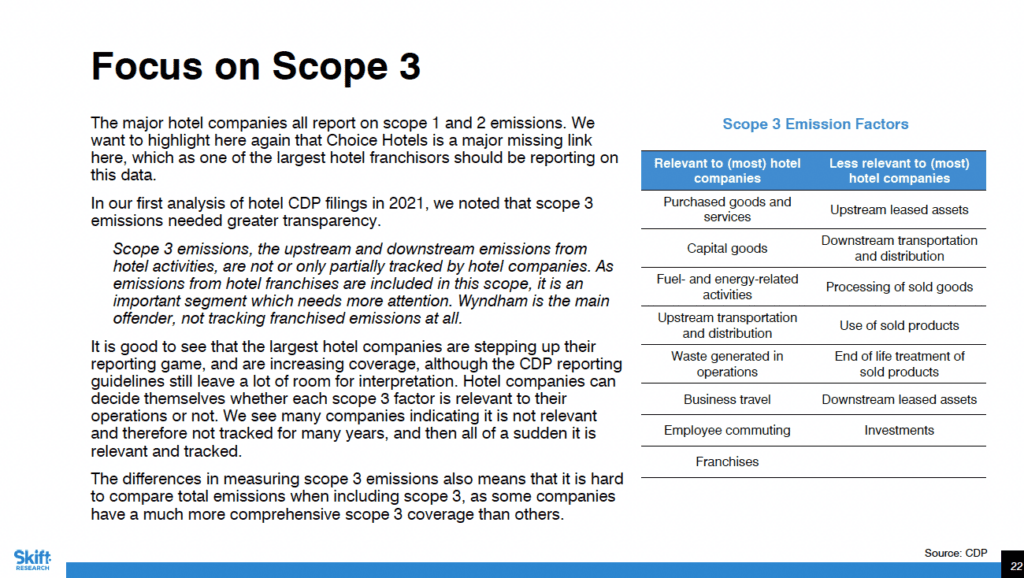

- As many hotel companies expand the detail of their carbon emissions reporting, the next frontier is to disclose so-called Scope 3 emissions — or ones from their franchisees, suppliers, and guests.

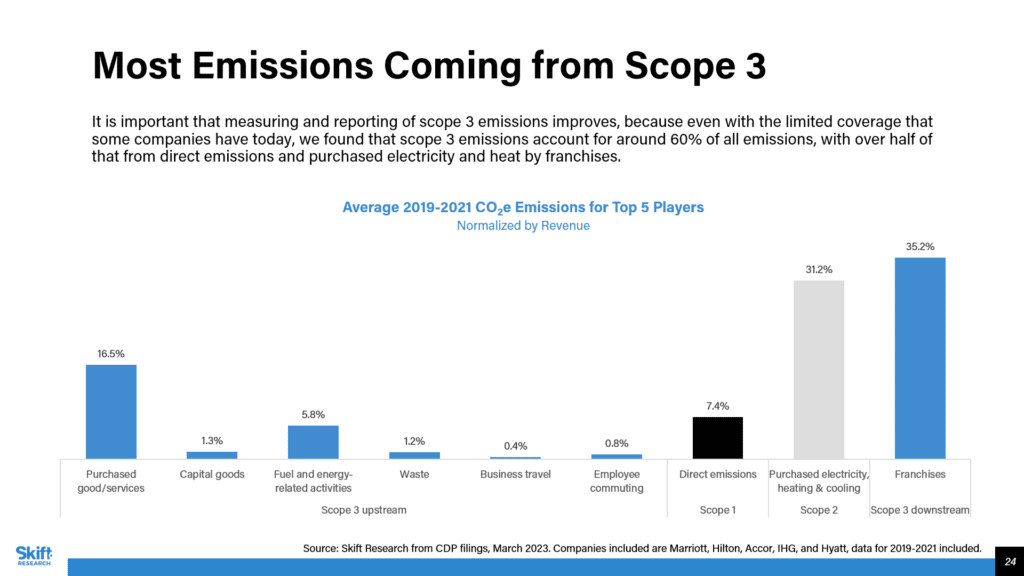

- Most hotel company emissions come from Scope 3, as Skift Research noted in March. See this chart below from the report Progress in Sustainability: Hotel Company Analysis 2023.

The new requirements will require a daunting reporting effort.

- Hotel companies must overcome shortcomings in measurement, data collection, and reporting, Johnson said. But one problem is that a lot of the required data has to come from their partners, such as franchisees.

- “Scope 3 emissions are the hardest to measure and track because it requires you to have your suppliers provide accurate and comparable statistics,” Johnson said. “In the hotel sector, something like 70% of the emissions probably falls under Scope 3, given how much related to emissions is done outside hotel companies’ direct control framework.”

Pressures for more detailed emissions reporting seem more likely to grow than not.

- Demands to increase such reporting are coming from investors — “Investors Prod Hotel Leaders on Climate Promises” — and, to a lesser extent, from employees.

- In the U.S., some lobbyists are pressuring politicians to frustrate the practice by some investors of pushing for tougher sustainability-related targets. But over time, climate risks — such as exposure to hard-to-insure resorts in areas exposed to extreme weather, fires, and floods — will become unavoidable inputs into calculations about the risks and costs potentially facing companies. So sustainability reporting seems more likely than not to continue its march toward greater complexity, broadly speaking.

- “To get access to certain types of capital, I do believe there will be increasingly some question by some institutional investors of ‘What are your sustainable practices?'” Johnson said. “The institutional investors often have to report on these metrics as well.”

So what’s Johnson’s advice to hotel leaders?

- “There are a lot of vendors pouring into the sustainability technology space,” Johnson said. “If you have the data, you need to put the data into trackable and auditable formats. You want dashboards where you can track your KPIs [key performance indicators] effectively.”

- “There are several questions hospitality decision-makers should be asking,” Johnson said. “From the strategy perspective, what’s your problem statement, or what do you need? What’s the universe of relevant vendors? How do you determine the true cost, considering implementation costs, operational costs, and costs of adding any enhancements if your reporting needs change? What processes will you need to change internally?”

- But her biggest advice is to start collecting the data. That means incentivizing franchisees, suppliers, and other partners to provide data. It also means providing tools to make it as easy and consistent as possible for third parties to provide accurate data.

To be sure, Johnson is “talking her book” to a certain extent. PwC is all about selling audit-style projects and tech implementations to companies.

- Johnson is the lead client partner and travel, transportation, and hospitality sector co-leader at PwC.

- “I spend most of my time in the hospitality space,” she said.

- For those needing a refresher, PwC has two broad wings. One offers “trust solutions,” helping clients with tax compliance or environmental reporting. The other acts like a traditional consultancy.

- PwC works with several software companies to implement cloud migration projects for clients, and it has some staff to aim to be experts in planning such migrations for hotel companies.

Johnson co-authored a report with other industry thought leaders that PwC and New York University published in late June. “Hotel industry digital transformation: The current state of play.” A few points from it below — which reflect my paraphrases and interpretations — are relevant here.

- There’s an efficiency gain to be had for the hotel sector by adopting better sustainability reporting. Too many parts of hotel procurement and franchise operations including labor aren’t yet monitored via automation. By mapping the supply chain to track carbon emission targets, hotel owners and asset managers have a parallel opportunity to gain insight into business processes they currently have only a foggy view of.

- Today, the headquarters of hotel owners, global brands, and asset managers don’t have a clear view of cost trends and trade-offs in the far reaches of supply chains. An enhanced reporting process could give a hotel company or asset manager valuable insight into managing costs and incentivizing better behavior from partners such as franchisees.

- Owners prioritize revenue growth. Brands need to ensure they align with owners on long-term value to get buy-in.

- One way to get buy-in: The sustainability mapping process requires a digital transformation that will ultimately lead to more revenue and margin for owners and franchisees if done well.

- Why? Artificial intelligence will help reduce the need for specialized data analysis skills at each property, centralizing specialist decision-making higher up the organizational chain. This could help reduce labor costs, boosting revenue goals for owners.

- The reasoning? Data analytics offers powerful revenue opportunities but requires quality data and analytical talent. But a data-driven culture isn’t practical to expect in many tight labor markets. It’s hard to find and pay for well-educated hospitality workers.

- Building trust in technology automation, data accuracy, AI, and governance for data privacy and security is also critical and easier said than done.

- An ideal process would drive efficiency by replacing routine data collection with automated back-office workflows. Integration via APIs [application programming interfaces, or a method of exchanging data] is key to connecting disparate legacy systems. The carbon reporting push gives global brands another tool to prod franchisees and owners to update legacy property management systems and related software.

The hotel sector has a long way to go, and standards around environmental reporting continue to shift in frustrating ways. But climate change isn’t going away, and the expectation for emissions reporting is only likely to grow.

I always read tips and feedback. Contact me at [email protected] or through my LinkedIn profile.

Have a confidential tip for Skift? Get in touch

Tags: carbon emissions, carbon footprint, climate change, Early Check-In, environment, ESG, future of lodging, Skift Pro Columns