Skift Take

Why doesn't Google promote Google Travel as a one-stop shop? The layoffs at Google Flights show there's too much ad revenue in play on the Google.com side of the flights business to merit such an all-in approach.

Especially heavy layoffs at Google Flights, including senior managers and engineers who joined Google with the ITA Software acquisition in 2011, could signal strategy shifts in the company’s multifaceted airline business, Skift has learned.

Any modifications to Google’s airline strategy could potentially have implications for airline partners, global distribution systems Sabre and Amadeus, metasearch rivals such as Kayak and Skyscanner, as well as travelers.

Google delivered its largest layoffs ever — about 12,000 employees, or around 6 percent of its full-time workforce — 10 days ago, and it is believed that firings at Google Flights, which had 100 or more employees on its engineering team alone, reached 10-12 percent.

The cuts at Google Flights especially impacted people who previously worked at ITA Software, which became the foundation of Google Flights, and also Google’s enterprise flights platform, which today powers e-commerce at airline websites including American, Alaska, Air Canada, China Eastern, Delta, United, Iberia, Latam, Turkish, Virgin and others.

“As I hear through social media and the grapevine about other employees who’ve been affected, I find myself amazed at how many brilliant engineers — some of whom I’ve known even before ITA became Google — are now looking for new opportunities,” wrote Stephen Peters, a Google senior software engineer, on LinkedIn. “I count myself lucky to have worked with these fantastic people and wish them the best going forward.”

In addition to Peters, among those axed from Google Flights were James Russell, senior director of engineering for Google Travel, who had 10-12 direct reports; Cynthia Towne, senior product specialist at Google Travel who, before joining ITA in 2007, had 31 years’ experience at Northwest Airlines, and Michael Reilly, who managed the airline pricing team at Google and did a decade at American Airlines before his stint at ITA.

These Google Travel employees had “big voices” on product and engineering issues, said one Google Travel veteran, who was fired with the others and declined to be identified.

Richard Holden, vice president of product management at Google Travel, remains in his leadership position. [See a video of a Skift interview with Holden about Google Travel in September 2022 embedded below.]

Skift reached out to approximately two dozen Google Travel employees, and heard back from a handful. One said many would be reluctant to speak to the press because they are still on the Google payroll through March 31, and would risk their “generous” severance packages.

One source said he was “highly confident” that Google Flights, which debuted in beta in the fall of 2011 and has become a very important source of customers for airlines, was more deeply impacted by the layoffs than the rest of Google Travel, and Google overall.

Potential Strategy Changes

The inordinately large amount of layoffs at Google Flights on a percentage basis could signal:

- A diminution of the importance of Google Flights as a standalone web destination and a tilt toward integrating flights more heavily into Google Search on Google.com where it can be monetized better. One risk in that strategy is that Google Travel becomes less cohesive as a trip-planning destination.

- Greater emphasis on hotels, vacation rentals and things to do within Google Travel because this is where the money is rather than from Google Flights.

- A further reduction in focus and investment in Google’s enterprise business for airline websites.

Asked to comment for this story, a Google spokesperson said: “Travel remains a priority for Google, including our ongoing work on flight search and airline enterprise products. Our focus has always been on helping travelers find the information they need and supporting our travel partners as they look to connect with customers online and this will not change.”

Understanding Google’s Airline Business

To understand these potential changes, one needs to understand Google’s multifaceted airline business. There are basically at least four parts:

- The currently non-revenue-producing Google Flights at flights.google.com within Google Travel at travel.google.com, with the latter offering flights, hotels, vacation rentals, things to do. The way it works is users click on an airline link in Google Flights and get directed to an airline or online travel agency website for booking.

- Flights within Google Search at Google.com, which trigger online travel agency and metasearch ad revenue.

- Google’s revenue-producing e-commerce business for airlines, and a handful of corporate travel sites and online travel agencies such as Student Universe. Google gets revenue from 5- to 7-year contracts with airlines like Delta, American, and Latam, for example, but its commitment and investments have been waning in recent years as partners fell off because they were casualties of mergers or online travel agencies like Expedia Group’s Orbitz and Hotwire, as well as Kayak, dropped out for competitive reasons.

- Among airlines, Google Cloud counts the Lufthansa Group as a customer, as well as Sabre among global distribution systems.

Google Flights in Google Travel

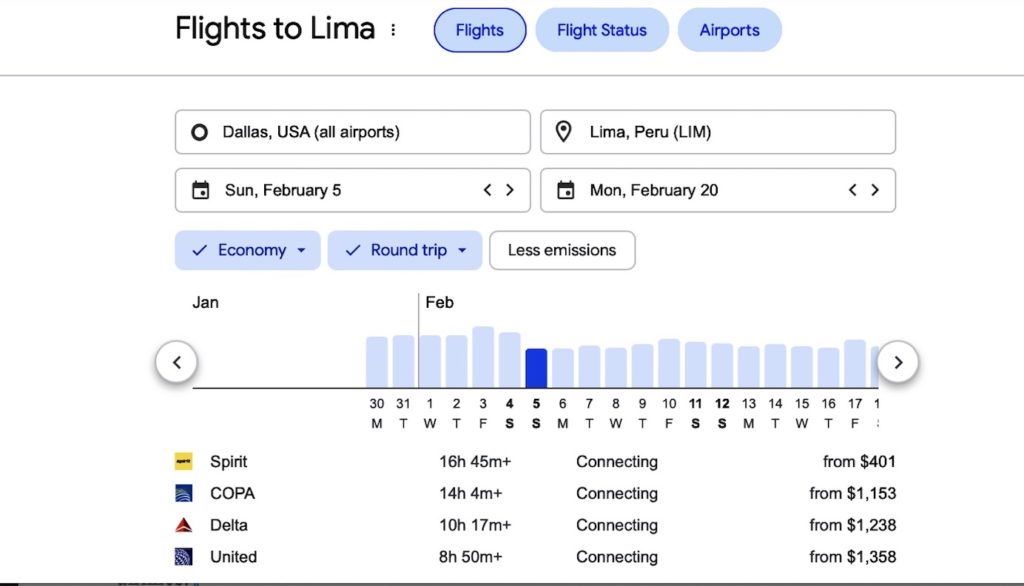

The image shows flight search results on Google Flights at flights.google.com, which is part of Google Travel. Google has struggled and tried numerous ways to monetize Google Flights over the years.

Google Flights has become for many airlines their biggest source of customers who don’t go directly to the carriers’ websites. You’ll notice in the image there are currently no advertisements within Google Flights. The feature is “free” for airlines because Google doesn’t charge them a fee when travelers click on a link and navigate to the airline website. However, airlines have their own overhead costs to keep participating in Google Flights because they are obliged to furnish Google with accurate fare and availability data.

In efforts over the years to monetize Google Flights, at the urging of Google’s product team, according to a source, Google tried to package certain services in corporate travel but that didn’t work well because businesses wanted more control over the application, and Google didn’t have the resources to handle flight changes via call center agents, for example.

Google also tried upselling airlines’ premium products within Google Flights.

Online travel agencies previously advertised in Google Flights but there are currently no ads in Google Flights.

“None of these models was big money,” the Google Travel source said.

The source said that even before the layoffs, Google has been transitioning employees out of Flights and its airline enterprise business, and into Google Travel’s hotels, vacation rentals, and things to do, as well as sustainability. In the case of hotels and things to do, at least, there is a greater revenue potential than for flights. U.S. airlines got stingy about paying flight commissions two decades ago.

Google Flights Within Google Search

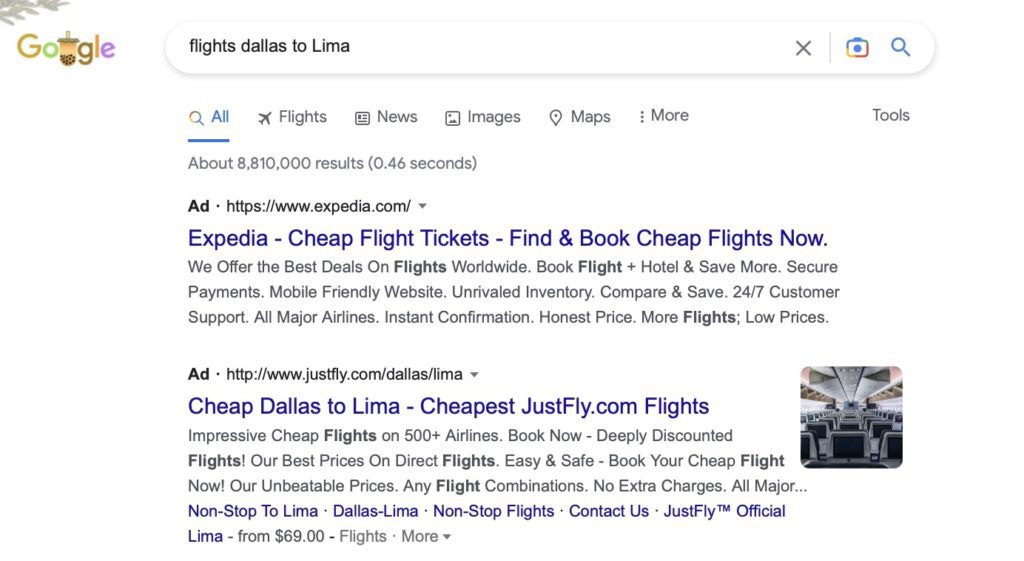

The image shows online travel agency ads and flight search results on Google.com.

There have been ongoing discussions within Google over the years about the balance of, and revenue potential for, flights within Google Travel at travel.google.com versus within Google Search on Google.com. Some observers feel the heavier proportionate layoffs of senior product managers and engineers, and more junior employees within Google Flights than elsewhere in Google Travel and Google overall mean there will likely be greater emphasis and investment to come in flights on Google.com versus flights within Google Travel.

The idea is that Google might place additional resources on developing revenue from flights in Google.com, which trigger online travel agency and tourism ads, instead of giving robust attention to developing new features for Google Flights at travel.google.com. If Google had wanted to stay laser focused on Google Flights within Google Travel would the company have cut so deeply into the ranks of its most experienced employees there?

Consumers wouldn’t necessarily notice any stronger emphasis on flights within Google.com versus at flights.google.com because Google still would likely update flyer-facing features in Google Flights, but this wouldn’t necessarily require the same amount of resources that deeper development did pre-layoffs, goes the theory.

In the run-up to the layoffs, Google had indeed been focusing on improving Google Flights. Google in May introduced new ways to track flight prices for any dates, and in September debuted a filter for flights with lower carbon emissions on Google Flights. In its business-to-business efforts, Google introduced a tool for airlines to help pinpoint new routes with potentially robust consumer demand.

But will that focus persist in the wake of the deep labor force cuts at Google Flights?

One adverse scenario for Google’s airline relationships could occur if carriers come to believe Google’s commitment to Google Flights is waning in the form of seeing Google laying off this continent of airline industry-ITA Software veterans who the airlines have dealt with over the years, or the airlines detect a lack of investment in Google Flights improvements.

Although it’s far from certain whether this will actually take place, this could conceivably lead to some airlines curtailing their commitments to Google Flights, triggering incremental reductions in the accuracy of availability and pricing data. A consumer in theory therefore might navigate from Google Flights to AA.com, and not find the flight or fare they were looking for.

“If airlines who view Goggle Flight search as a valuable source for leads, and a high percentage of leads become sales, and overhead costs within their operational budgets [are reasonable], then the airlines will make it a point to provide the necessary data to Google for availability and pricing,” the ex-Googler said. “Google management might be thinking that it’s accomplishing what we need, and we’ll not invest in further experiments for some other type of revenue.”

Google’s E-Commerce Business for Airline Websites

Although Google doesn’t collect cost per click fees on airline links within Google Flights, it indeed has revenue-producing, long-term contracts with nearly a dozen airlines, and some corporate travel businesses to power their websites with services including flight pricing and shopping, and the sale of ancillary products. Ancillaries include things such as premium seats and checked bags.

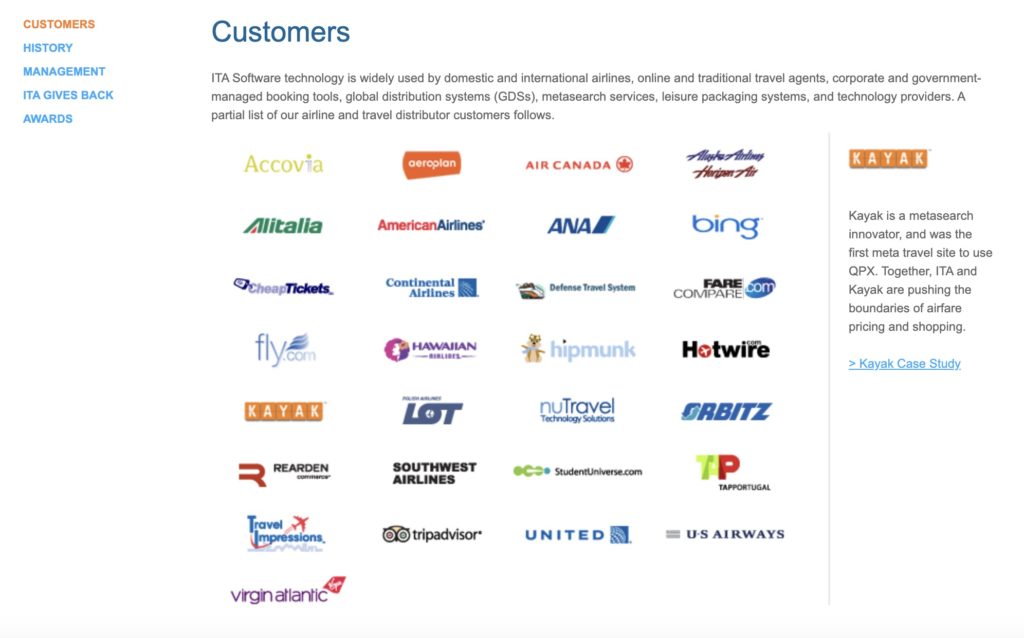

Google inherited this QPX software business, now referred to as the enterprise flights platform, from ITA Software when the acquisition closed in 2011.

“Google really cared about this business 10 years ago,” the source said, as it retained Google Flights employees who previously worked for many years at airlines, and invested in the business. The list of ITA Software by Google customers in 2012 featured around 30 partners, including airlines, online travel companies, and travel management companies.

Google/ITA Software Enterprise Partners in 2012

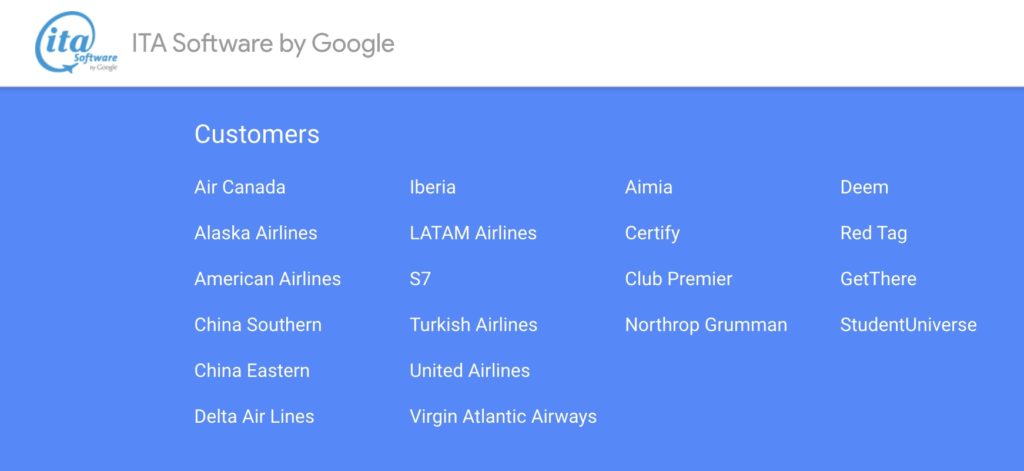

Their ranks have dwindled to around 20, as publicized on the ITA Software by Google website, with some reductions fueled by airline mergers and the emergence of Google Travel as a competitive force.

Google Enterprise Partners in Travel in 2023

The ex-Googler said the company over the last year has tamped down investment in this e-commerce and enterprise side of its airline business, and had been moving some Google Flights and enterprise platform employees before the layoffs toward Google hotels, vacation rentals, things to do, and sustainability efforts.

“Airlines will see the difference if Google doesn’t invest in enterprise software,” the ex-Googler said. “They’ve been using ITA/Google for 12 years.”

This could represent an opportunity for global distribution systems such as Sabre and Amadeus, which already power certain back-end functions of airline websites, to step in and replace Google for some of these e-commerce functions.

Is there an opportunity for metasearch sites such as Kayak and Skyscanner if Google’s flight-price accuracy slips?

Kayak co-founder and CEO Steve Hafner wouldn’t comment on internal dynamics at Google, but said: “Kayak users have always enjoyed better comprehensiveness, accuracy and availability than they could find on Google. We just couldn’t match their speed. Hopefully that will slow down, too.”

There have often been people in the travel industry wondering when will Google pull all things travel together and promote Google Travel as a primary, visit this site first travel planning destination to compete directly against Booking.com, Expedia and Airbnb.

As the ongoing deliberations about Google’s flights strategy take place, it’s clear there’s too much advertising money on the table in the Google.com side of the flights business to merit such an all-in approach.

Corrections: The Google Flights team pre-layoffs had 100 or more engineers, so that was not the size of the entire Google Flights staff, as reported. The employee roster for the entire Google Flights team was significantly larger than 100 employees. Also, Google didn’t receive a commission for Book on Google, as we initially reported.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airlines, alphabet, amadeus, b2b, gds, google, google flights, google travel, ita software, kayak, layoffs, metasearch, online travel newsletter, sabre, search

Photo credit: Layoffs at Google Flights could signal strategy changes in Google's flights business. A Royal Air Maroc 787-8 Dreamliner in OneWorld livery at JFK Airport on January 2, 2023. Mark Bess / Flickr.com